Summary:

- Applied Materials is a strong “picks and shovels” play in the AI-driven semiconductor boom, benefiting from rising demand for advanced, energy-efficient chips.

- AMAT’s robust fundamentals, including revenue growth and improved operating margins, make it an attractive investment despite trading above its historical P/E.

- The company’s strategic growth initiatives, strong balance sheet, and shareholder-friendly capital returns through buybacks and dividends enhance its long-term investment appeal.

BlackJack3D

Picks and shovels plays can be great ideas to ride the AI-boom that we are in now, especially if they’re reasonably priced. This brings me to Applied Materials (NASDAQ:AMAT), which appears to be one such example, with market exuberance wearing off since it hit a high of $256 back in July of this year. As shown below, AMAT currently sits in the bottom half of its trading range over the past 52 weeks.

Getting a decent starting valuation is key for value investors, as it reduces the risk of overpaying for stock and saves time by allowing the stock to begin compounding from a better starting point. I last covered AMAT back in January of last year, highlighting its moat-worthy presence, strong growth and undervaluation.

It appears the market has rewarded the stock in a big way, giving AMAT an 89% total return since my last piece, far outpacing the 52% rise in the S&P 500 (SPY). In this article, I revisit AMAT including recent business results, and discuss why the dip in price over the past 3 months opens up another solid entry point on the stock, so let’s get started!

Why AMAT?

Applied Materials is a leading global player in the semiconductor industry. It’s what I would consider a picks and shovels company, given that its advanced materials engineering solutions drive the creation of high-performance chips used in a wide range of applications. AMAT’s innovations in materials engineering are essential in the development of next-generation chips that power data centers, AI applications, autonomous vehicles, and clean energy technologies.

Notable customers of AMAT include a who’s who of the global chip industry, including TSMC (TSM), Nvidia (NVDA), Intel (INTC), and Samsung (OTCPK:SSNLF), among others. Growth in the chip industry due in large part to AI and data centers and has given AMAT an outsized opportunity to help its customers meet in recent years have propelled AMAT’s operating fundamentals.

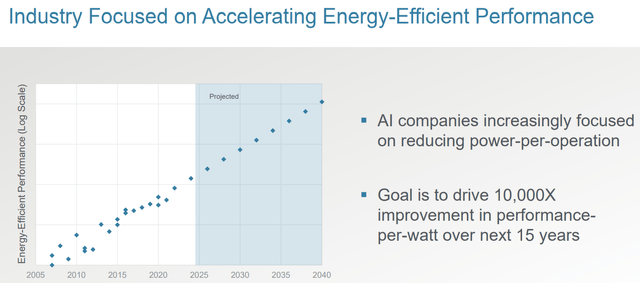

As shown below, demand for energy-efficient performance has followed a logarithmic scale (i.e. exponential growth) with the goal of driving 10,000x improvement in performance per-watt by 2040.

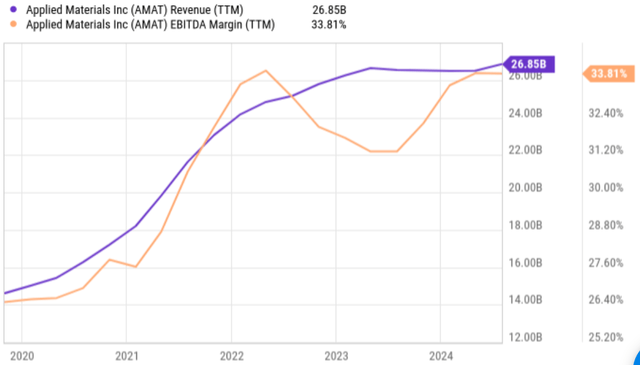

Growth in demand for AI and data center solutions has been a boon for AMAT, as reflected by revenue growing from ~$14 billion to nearly $27 billion over the past 5 years. AMAT has also seen increased operating leverage with EBITDA margin growing materially by 8 percentage points, from 26% to 34% over the past 5 years, as shown below.

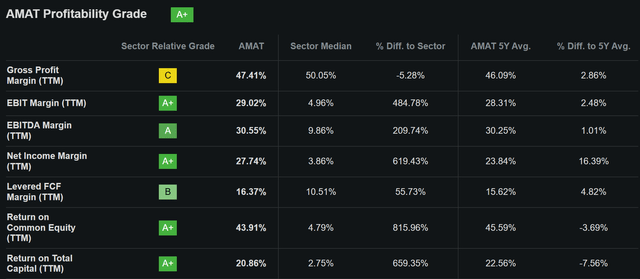

Meanwhile, AMAT continues to produce robust results, with revenue growing by 5% YoY to hit a company record $6.8 billion during fiscal Q3 2024 (ended on July 28th). Adjusted gross margin improved by 100 basis points YoY to 47.4% and this helped to drive robust adjusted EPS growth of 12% YoY to 2.12. As shown below, AMAT scores an A+ grade for profitability for having well above sector-average margins and a high return on equity (due in part to share buybacks).

AMAT’s growth during the third quarter was driven by increased demand for energy efficiency as companies that buy from Nvidia (an AMAT customer) like Meta Platforms (META), Microsoft (MSFT), and Google (GOOG) seek to reduce carbon footprints from AI-driven data center proliferation. Growth was also driven by momentum in advanced packaging solutions, including high-bandwidth memory technologies, with management expecting packaging-related revenue to reach $1.7 billion in 2024, up from $1.1 billion in 2023.

Looking ahead, AMAT should continue to see strong growth tailwinds from the aforementioned drivers for energy-efficient chips. This includes DRAM, which poses as a material opportunity for AMAT, with it having established a leading position in process equipment. This is reflected by AMAT having grown its market share in DRAM over the past decade. Management expects its market opportunity to grow in this space by 10% in the near term, as noted during the recent conference call:

As DRAM plays a critical role in energy-efficient computing performance, there is a huge focus on advancing the roadmap. The next major DRAM inflection, from 6F-squared to 4F-squared, or vertical transistor architectures, is materials-enabled, and we expect our market opportunity to grow by approximately 10% to around $6.5 billion for each 100,000 wafer-starts-per-month of capacity. We also expect to increase our share based on our position to enable the 4F-squared inflection. In addition, we believe the subsequent transition to 3D DRAM will grow our addressable market by an incremental 15%, further compounding Applied’s opportunity.

Importantly, AMAT maintains a strong balance sheet with an ‘A’ credit rating from the S&P. This is supported by a negative net debt balance of $2.4 billion due to higher current assets than long-term liabilities. This includes $9.1 billion of cash and short-term investments and another $5 billion in accounts receivable.

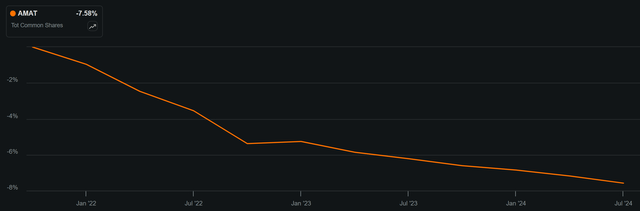

While AMAT’s dividend isn’t high at 0.9%, it’s very well-covered at a 17% payout ratio and comes with a 12% 5-year CAGR. AMAT should also be recognized as a total return stock, given material share repurchases as another form of capital returns. Share repurchases have accelerated in recent years and as shown below, AMAT has retired 7.6% of the outstanding float over the past 3 years.

Lastly, I continue to see value in AMAT at the current price of $186.52 with a forward PE of 21.9. While this does sit above AMAT’s historical PE of around 16x, I believe the current growth tailwinds as noted earlier supports this valuation. Sell side analysts who follow the company estimate 10% to 14% annual growth over the next 3 years, which, I believe, is reasonable for the aforementioned reasons.

AMAT carries a ‘Strong Buy’ Quant Rating, and sell side analysts who follow the company have a consensus ‘Buy’ rating with an average price target of $230, implying a potential 12-month total return of 24%.

Risks to the thesis include the potential for export restrictions and tariffs between the U.S. and China, which could impact AMAT’s market opportunity in China. In addition, the semiconductor industry is generally cyclical, and it’s difficult to predict how long the current bull cycle in the industry will last, as a pullback in spend by end-user companies could negatively impact the industry. Moreover, AMAT’s industry is capital intensive and competitive forces require that it continually invest in R&D to maintain its leadership advantage.

Investor Takeaway

Applied Materials presents an attractive “picks and shovels” play in the ongoing AI-driven semiconductor boom, backed by robust fundamentals, a strong market position, and strategic growth initiatives. The company benefits from rising demand for advanced, energy-efficient chips required in AI, data centers, and clean energy, which have propelled its revenue and operating margins significantly over recent years.

Despite trading above its historical P/E, the stock’s reasonable valuation relative to growth projections and shareholder friendly capital returns through buybacks and dividends make it a compelling long-term investment opportunity at its current price.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMAT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

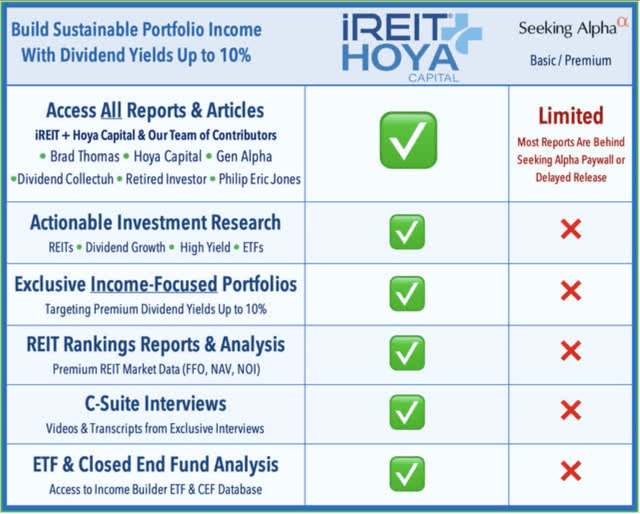

Read The Full Report on iREIT+Hoya

iREIT+HOYA Capital is the premier income-focused investing service on Seeking Alpha. Our focus is on income-producing asset classes that offer the opportunity for sustainable portfolio income, diversification, and inflation hedging. Get started with a Free Two-Week Trial and take a look at our top ideas across our exclusive income-focused portfolios.

With a focus on REITs, ETFs, Preferreds, and ‘Dividend Champions’ across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.

With a focus on REITs, ETFs, Preferreds, and ‘Dividend Champions’ across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.