Summary:

- Applied Materials posted Q2 results that were slightly better than expected, but the revenue growth is not impressive.

- The company is heavily reliant on China for sales, as revenue in the U.S. and the rest of the world continues to decline.

- AMAT stock’s valuation is high, and there is uncertainty surrounding the guidance for Q3, making Applied Materials unattractive for investors.

Monty Rakusen

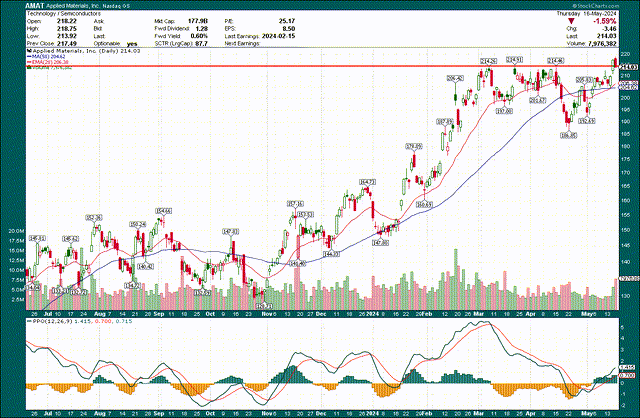

Semiconductor giant Applied Materials, Inc. (NASDAQ:AMAT) posted second quarter earnings last night, and shares are fractionally off in the early trade following the report. The stock went on an epic heater to the upside from the November low into the February release of Q1 results, prompting me to place a Hold rating on the stock at that time. In the three months since, the stock has basically kept pace with the S&P 500 (SP500), rising in the mid-single digits over the three-month period.

With Q2 results now known, I don’t see enough to like here to move from my Hold rating. There’s enough strength here to warrant a hold, but at the same time, if it’s a semiconductor stock you’re after, you can do much better. Let’s dig in.

Strong Q2 results and good guidance from Applied Materials, but is it enough?

That’s the question with any earnings report for any company; is it enough? In this case, given the valuation of Applied Materials – which was my principal concern back in February as well – I don’t think it is.

Applied Materials has traded with an extremely high valuation (in my opinion) for several months now, so in order for the stock to continue rallying, it either needs an even higher multiple, or it needs earnings estimates to rise very sharply to reduce the valuation. Given results in Q2 and guidance for Q3, I’m not seeing it.

Revenue came in at $6.65 billion for Q2, which was ~$110 million ahead of estimates, or about 1.7% better than expected. The company noted they feel strongly about their portfolio of materials engineering technologies for chips that can support megatrends like AI, EVs, and clean energy, but at the same time, for me, the revenue growth we’re seeing simply isn’t good enough.

Revenue in the U.S. fell 23% YoY in Q2 after falling 28% YoY in Q1. The story is the same in the rest of the world, with the notable exception of China, which is seeing sales absolutely flying higher. There are brewing tensions between the U.S. and China (again) with one of the hot items being chips and chip equipment. Does that eventually impact Applied Materials? Time will tell, but this company is wholly reliant upon China currently, as it struggles just about everywhere else in the world to grow the top line.

The largest segment – Semiconductor Systems – posted a net sales decline of just under 2% YoY in Q2. DRAM made up 32% of the segment’s revenue against just 11% a year ago as the company continues to see more and more of its demand shift away from Foundry and Logic, and as Flash Memory becomes more and more irrelevant.

This doesn’t seem to have helped with margins, however, which is again problematic for the valuation. We know revenue growth was weak at best, so we’d want to see margin expansion driving earnings, but operating margin in the company’s largest segment was basically flat year-over-year at 34.9% of revenue on an adjusted basis. There’s nothing wrong with that level, but the fact that Applied Materials cannot seem to move the needle on margins is concerning to me, and helps reiterate this is not a stock I want to buy.

In total for Q2, the company earned $2.09 per share, which was admittedly a dime better than expected, or about 5%. That’s a good result, but as I mentioned in my Q1 recap, the stock was really pricing this kind of performance in already.

For Q3, management guided for $1.83 to $2.19 in EPS on revenue of $6.65 billion, but with a margin of $400 million either side. That’s a huge range and while the midpoint of $2.01 is better than the expected $1.97, as well as the $6.65 billion being better than $6.58 billion expected for Q3, the sheer uncertainty of these guidance numbers is enough to keep investors on the sidelines. In other words, yes this is technically a guidance raise, but with so much uncertainty around revenue and earnings visibility for Q3, it’s simply unattractive. Investors really hate any sort of uncertainty, and in my view, Applied Materials’ guidance offers up plenty of uncertainty.

Let’s now take a look at the technical picture, as well as some other considerations for the stock and why I’m sticking to my hold/avoid rating on Applied Materials after Q2.

AMAT stock – Will the breakout stick?

I mentioned the stock absolutely flew higher from the November low, and I wasn’t kidding. The stock rallied from the low around $130 to $214 in a nearly straight line, and that of course took the valuation higher with it. The Street has taken notice, and the stock hasn’t budged since hitting that high of $214 in March. More importantly for the short term, the breakout we saw earlier this week appears to have failed, which means the bulls are up against it now unless there’s a rapid rally.

I’ve noted clear resistance at the $214 level, which was the top three different times in the past few months. The stock did indeed break out two days ago, but is trading back inside the prior highs as of this writing. Whether it stays that way or not is critical for the technical picture because above $214, Applied Materials is a buy on a technical basis. Above that level, it’s a breakout candidate.

Below that, however, I’m not interested from a technical perspective because that implies the consolidation is likely to continue for some time, meaning no new highs. Friday’s action and into next week will be critical in terms of the bulls or bears taking control of this stock that has been in limbo for the better part of three months. If I had to take a guess right now, I’d say the odds of more consolidation are higher than that of a sustained breakout, the reasons for which we’ll get into now.

One reason is that on a relative basis, Applied Materials stock has been quite weak. Below, we have the stock’s performance against the semiconductor segment, as well as the semiconductor segment’s performance relative to the S&P 500 (SP500).

Applied Materials has underperformed its peers by about 10% since the November low, although to be fair, its peers have outperformed the broader market by a staggering 45% since then. Of course that means Applied Materials has done very well on an absolute basis, but we want leading stocks in leading industries; Applied Materials is only one of those things, not both.

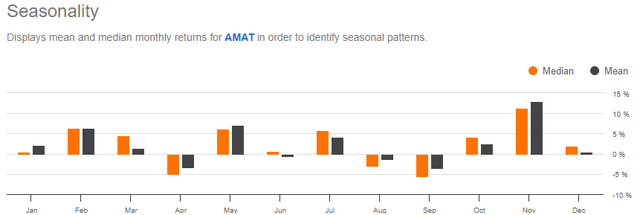

Second, seasonality is quite weak for this particular stock in June.

We can see May is one of the best months for Applied Materials historically – because that month contains the Q2 report – but June is a period of consolidation, typically. Seasonality is by no means a guarantee, but these patterns exist for a reason, and ignoring them is done at one’s own peril. There’s no reason to expect a strong performance in June, meaning that the odds from a seasonality perspective do not favor a sustained breakout at this time.

I keep mentioning the valuation, so let’s dig into that now, as I believe it’s a critical component of the analysis of this stock.

Seeking Alpha

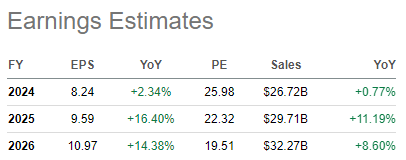

EPS estimates may rise very slightly after Q3 guidance, but I’d suspect if they do, it’s by a few pennies. Guidance for Q3 was far from overwhelmingly positive, so I don’t see cause for big moves here. That leaves the company’s EPS growth at maybe 3% year-over-year barring a massive shift, on sales that are only slightly better than flat. Ho-hum.

Of course, next year and 2026 look much better, but those are priced into the stock already. In other words, the only thing that can drive the stock higher right now, in my view, is an even higher earnings multiple. It’s clear to me with Q3 guidance that a big move up in revenue/margins/earnings is not in the cards for the foreseeable future, so the only other option is the multiple. That’s problematic, as I shall now demonstrate.

Shares are going for ~26X forward earnings, which, as we can see, is far and above anything we’ve seen for the past five years. When the valuation was ~10X forward earnings late last year, it was a screaming buy. Today, we’re at the opposite extreme, and I simply don’t want anything to do with it.

This company has essentially flat revenue this year, and meager EPS growth, so paying a nosebleed multiple for it is out of line with how I view the company’s prospects.

There’s enough strength among the semiconductors as a group that we may see Applied Materials, Inc. shares stay afloat simply by association. However, this stock is nowhere near “Buy” territory, so I’m sticking with my hold/avoid rating on Applied Materials. There are numerous better options within the segment, and Q2 results reinforce that for me.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.