Summary:

- I reiterate a ‘Buy’ rating on Applied Materials with a one-year target price of $225 per share, driven by strong growth in AI and energy-efficient computing markets.

- Applied Materials reported 4.8% revenue growth and 7.3% net income growth, with significant advancements in HBM, DRAM, and advanced packaging.

- The company is expected to double its advanced packaging business in the coming years, bolstered by leadership in micro-bump and through-silicon via technologies.

- Despite weak growth in China, Applied Materials is well-positioned in the AI and HBM markets, projecting 8% overall revenue growth and 20bps margin expansion.

Monty Rakusen

I initiated a ‘buy’ rating on Applied Materials (NASDAQ:AMAT) in August 2024, highlighting its potential growth from HBM, DRAM and advanced packaging. Applied Materials delivered a 4.8% revenue growth and 7.3% net income growth in Q4 FY24. While the market is not satisfied with their China growth during the quarter, I believe the company’s business is well positioned in the AI and energy-efficient computing market. I reiterate a ‘Buy’ rating with a one-year target price of $225 per share.

Growing Advanced Packaging Business

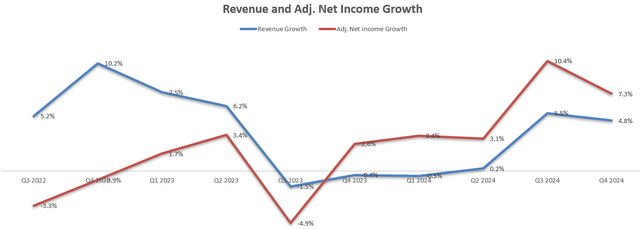

Applied Materials reported its Q4 FY24 on November 14th, reporting a 4.8% revenue growth and 7.3% net income growth in, as shown in the chart below.

Applied Materials Quarterly Earnings

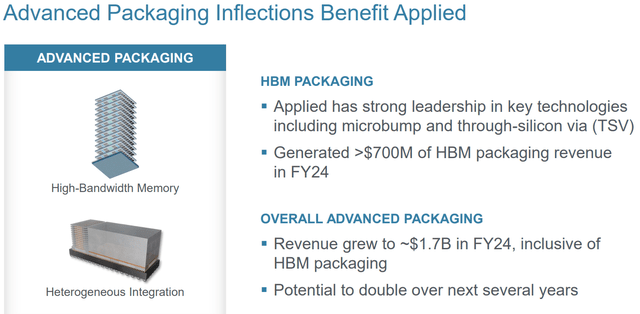

My key takeaway is their strong growth in advanced packaging, where it holds leadership positions in micro-bump and through-silicon via.

As advanced nodes allow semiconductor fabs to pack more transistors onto a single chip. Therefore, with the rapid growth of high-performance computing and AI, advanced packaging technology is crucial for manufacturing advanced nodes.

Applied Materials exited FY24 with close to $1.7 billion in revenue, a threefold increase over the last four years. During the earnings call, the management anticipates their advanced packaging business will double in the coming years. In addition, Applied Materials generated $700 million in revenue from HBM packaging business driven by the rapid growth in AI computing. As indicated in my previous article, I anticipate HBM will experience strong growth in the near future as high-performance GPUs require more HBMs for memory storage.

Notably, the company has leading positions in the advanced packaging markets for high-bandwidth memory and heterogeneous integrations. Heterogeneous integrations could integrate separately manufactured components into a higher level assembly like System-in-Package, which could improve packaging process.

Applied Materials Investor Presentation

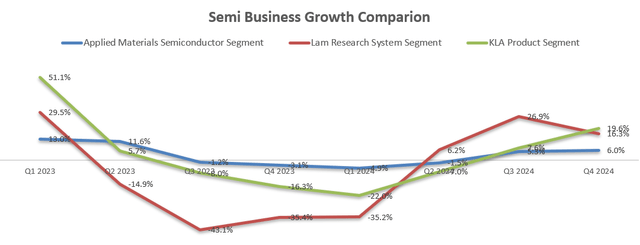

The following chart compares the semiconductor business growth of Applied Materials, Lam Research (LRCX) and KLA (KLAC). Please note that I have aligned the quarterly earnings periods with Applied Materials’ fiscal quarter-end dates. While all three companies exhibit some cyclicality in the growth rate, Applied Materials demonstrates less earnings volatility compared to its two competitors. Applied Materials has higher business exposures to the semiconductor packing markets, which is more closely tied to overall chip productions, and less sensitive to fluctuations in fab capital expenditures, in my view.

Applied Materials, Lam Research and KLA Quarterly Earnings

Outlook and Valuation

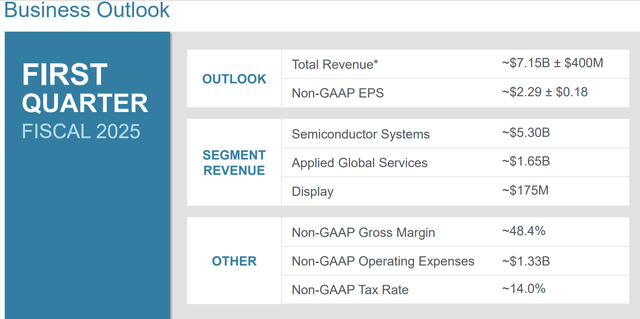

The company is guiding for around 6.6% revenue growth for Q1 FY25 at the mid-point, as detailed in the slide below.

Applied Materials Investor Presentation

I estimate the segment growth as follows:

- Semiconductor Systems: The segment represents more than 73% of total revenue, I continue to believe AI and energy-efficient computing will become the primary growth drivers for Applied Materials. Advanced packaging represents close to 10% of segment revenue. Mordor Intelligence predicts the high bandwidth memory market (HBM) will grow at a CAGR of 25.86% from 2024 to 2029. As such, I anticipate the advanced packaging will grow by 30% annually, contributing around 3% of growth to the segment. The growth rate incorporates 25% market growth and 5% growth from market share gains. I project the segment will grow by 8% annually, comprising 3% growth from advanced packaging and 5% from traditional semiconductor businesses.

- Applied Global Services: Applied Materials has done a great job to grow its service and parts businesses in recent years. I expect this growth momentum to continue, projecting 9% year-over-year growth.

- Display and Adjacent Market: As indicated in my previous article, the segment is a legacy business for the company, growing at a very low rate. I anticipate the business will grow by 3%, aligned with the industry volume growth.

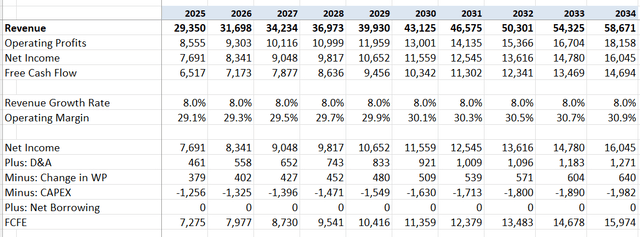

- In total, the overall revenue growth is forecasted to be 8% organically by multiplying the growth rates of the three segments by their respective revenue mixes. I continue to project 20bps margin expansion driven by 10bps from gross profits and 10bps from reduction in SG&A. I continue to forecast the company will allocate close to 12% of revenue to R&D, supporting their advanced packaging businesses.

- The cost of equity is calculated to be 16.2% assuming: risk-free rate 3.6%; beta 1.8; equity risk premium 7%.

I calculate the free cash flow from equity (FCFE) by adding net income, depreciation/amortization, and net borrowings, then subtracting change in working capital and capital expenditures.

Discounting all the future FCFE at the rate of 16.2% to the year of FY26, the one-year target price is calculated to be $225 per share, as per my estimates. I am using 4% as the terminal growth rate, as the overall semiconductor market is more likely to outgrow the global GDP growth. I believe the potential downside for the valuation lies in the normalized revenue growth, as Applied Materials offers semiconductor equipment for fabs, a business that can be highly cyclical. Their revenue growth is closely tied to semiconductor capacity investment cycles, in my view.

Key Risk

The market has expressed concern over weak growth in China, where revenue declined by 28% during the quarter. Following this decline, China represents around 30% of total revenue. During the earnings call, the management indicates that the Chinese market is normalizing now and expects the China mix will maintain at 30% in Q1 FY25. Applied Materials’ main business in China comprises IoT, Communications, Automotive, Power and Sensors (ICAPS), which are highly cyclical sectors in China.

Applied Materials’ China business declined by 3.7% in FY22 and 0.1% in FY23, followed by a 39.6% year-over-year growth in FY24. Tech Insights predicts China’s semiconductor production capacity will grow by 40% over the next five years, driven by rapid equipment purchases and strategic investments in semiconductor fabrication facilities. Applied Materials’ equipment is highly relevant to China’s fab capacity expansion. While I am confident in the long-term growth potential in China, Applied Materials is more likely to face strong comparable for FY25 due to the significant 39.6% growth in China revenue in FY24.

Conclusion

Applied Materials is well positioned in the advanced packaging markets, driven by rapid growth in AI and HBM end-markets. I reiterate a ‘Buy’ rating with a one-year target price of $225 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.