Summary:

- Applied Materials, Inc. is poised for growth amid strong semiconductor demand, despite geopolitical risks and regulatory headwinds, warranting a cautious Buy rating.

- The company benefits from increased CAPEX by major customers like Taiwan Semiconductor, driving revenue growth in advanced process technologies and GAA transistor technology.

- Geopolitical tensions, particularly US-China relations, pose significant risks, but Applied Materials is diversifying its supply chain to mitigate these challenges.

- Q4 earnings are expected to surpass targets, with positive outlooks for 2025, suggesting undervaluation and potential for margin expansion and earnings growth.

branislav_bubanja

Investment Thesis

American semiconductor WFE (wafer fabrication equipment) supplier Applied Materials, Inc. (NASDAQ:AMAT) is set to close out its fiscal 2024 this week as it reports its last quarterly earnings results of its financial year on Thursday, November 14th.

There is no doubt that Applied Materials operates its business at a time when the outlook for the entire semiconductor value chain is at perhaps its strongest ever in decades. Many of Applied Materials direct customers and end-market beneficiaries are still looking at strong double-digit compounded growth rates in their businesses over the coming years, which bodes well for Applied Materials’ capital-intensive business.

Yet, rising global tensions are the single reason that could limit any further in Applied Materials’ case, as geopolitical trust settles on thinner ice with every passing year. These issues are likely to get further exacerbated as the incoming White House administration is expected to ramp up the regulation narrative with its tariff-based policies.

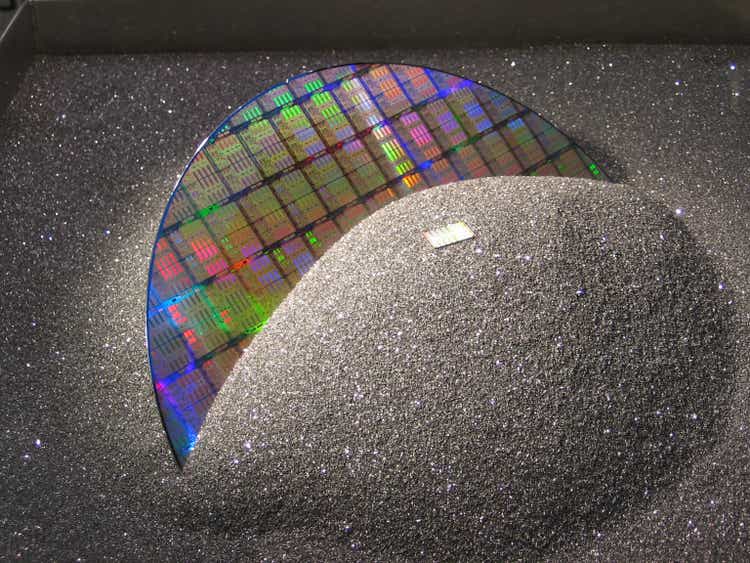

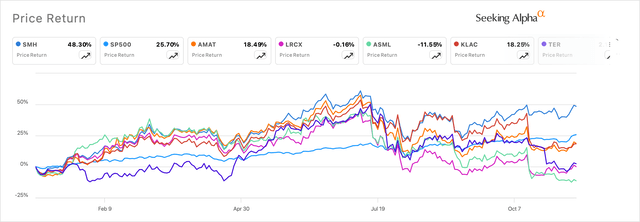

After delivering an outsized 2023 for its investors, the tension is palpable in Applied Materials’ stock heading into Q4, with the stock underperforming markets year-to-date but still better off than some of its peers in the space.

Exhibit A: Applied Materials underperforms the markets year-to-date but still better off than its peers. (Seeking Alpha)

While the business appears to be on the edge of another cyclical upswing, I’m not fully confident of the regulatory headwinds that loom and will be looking for direction from management.

For now, I cautiously recommend a Buy rating on Applied Materials heading into earnings.

Delivering Growth In a Geopolitically Challenged Environment

The operating environment for the entire semiconductor value chain is strong given the strong growth that many major players in the larger semiconductor industry are still poised to show.

Many major fabless behemoths ranging from Nvidia (NASDAQ:NVDA) to Broadcom (NASDAQ:AVGO) project strong future growth in the midterm and continue to see strong demand for their semiconductor chips, networking, and other components. The strength in their businesses is pushing the management of the companies I highlighted to buy more manufacturing capacity from their fab companies, suppliers, and vendors further upstream, which I highlighted in a previous post on the former.

Management of Taiwan Semiconductor aka TSMC (NASDAQ:TSM), the largest fab company on this planet that innovates at the leading edge of semiconductor chip manufacturing, echoes the bullish sentiment expressed by its customers, such as Nvidia and Broadcom. Anticipating this growth, Taiwan Semi’s management expects their own CAPEX to be slightly over $30 billion while also adding, “between 70% and 80% of the capital budget will be allocated for advanced process technologies,” according to their earnings call discussion last month.

This is good news for Applied Materials because the additional manufacturing capacity that Taiwan Semiconductor plans to build, especially in the advanced process technologies category, for their 2nm node technologies will be deployed using additional WFE equipment purchased from Applied Materials. Taiwan Semi’s management expects at least 30 billion of capital investments this year, indicating a strong ramp up in their fourth quarter, while some expect management will guide to ~$34 billion in capex next year. Taiwan Semi is the largest customer of Applied Materials’ Foundry Semiconductor Systems.

On the other hand, Samsung Electronics (OTCPK:SSNLF), another large customer for Applied Materials, disclosed last month that they were guiding down their CAPEX for the year by expecting “the amount of CapEx executed this year to decrease.” Samsung is seeing troubles in its TAM, and so is Intel (NASDAQ:INTC), another Applied Materials customer that has also forecast sluggish growth in its capex.

Exhibit B: CAPEX Growth trends of Taiwan Semiconductor, Samsung and Intel, all customers of Applied Materials (Company filings)

Still, Applied Materials’ revenue continues to grow, defying concerns seen by some of its top customers. In the previous quarter, Applied Materials posted impressive revenue growth of 5.5% y/y which pointed to Q3 revenues totaling $6.78 billion and indicating some inflection. With management’s Q4 guidance, the company should easily surpass their 2024 projections of ~$27.06 billion. The company’s semiconductor systems revenue segment, which accounts for almost three quarters of the company’s total revenues, continues to be pulling all the weight with growth in its foundry systems. In Q3, management mentioned how semiconductor architectures had reached an inflection point with more focus on intensity and efficiency in chips and components by saying, “reducing power-per-operation is now more important than increasing operations-per-second.”

At the Communacopia conference in September, management reiterated those thoughts. It further added that these new architectural inflections will require more capital from its customers since they are capital intensive, so I expect Applied Materials to be a big beneficiary of that coming CAPEX wave when that comes.

The company has already talked about how GAA (Gate-All-Around) transistor technology, a leg up from the FinFET architecture, is driving revenue growth because of the technology’s promise to deliver high-performance but low-power consumption in semiconductor applications. The company has already posted $2.5 billion in revenues from GAA this year and is expected to at least double in 2025. Management also revealed at the Communacopia conference how they’re already working on BPSDN (Backside Power Delivery Network), a new paradigm in leading-edge logic.

Exhibit C: Applied Materials revenues by revenue segment (stockanlaysis)

So far, Applied Materials’ customers are not broadly alluding to any capex expansion plans yet, apart from Taiwan Semi. But I expect to hear from management soon on their views about next year.

Applied Materials Still Has Room For Premium Expansion Despite Risks

I expect the company to achieve its ~$27.06 billion target of 2024 revenues, which should be seen in the upcoming Q4 report. But looking ahead, Applied Materials should be able to post at least low-teen top-line growth next year with the growth inflections that are falling in place for the company.

Exhibit D: Applied Materials revenue growth rates versus margins (yCharts)

With the uptick in revenues expected in 2025, I also expect earnings to start moving higher, which should allow the company to expand its margins through the course of next year. The single-digit margin expansion should allow Applied Materials to post earnings growth of ~12% next, which should outpace top-line growth.

This growth rate warrants a forward earnings premium that should be ~23x 2025 earnings. Currently, that premium indicates ~20x forward earnings, pointing to some pessimism.

Despite the risks that I highlight below, I think Applied Materials is marginally undervalued here, with scope for some more expansion in its valuation premium.

Risks & Other Factors To Look For

As I mentioned earlier, geopolitical risks remain the single largest headwind for Applied Materials.

The US government keeps a watchful eye on equipment shipments and forms regulations to curb shipments of leading technology to China. Recently, some lawmakers sent more requests to Applied Materials and their peers about their revenue exposure to China. Note that a big chunk of Applied Materials revenue comes from China, as per Exhibit E below.

Exhibit E: Applied Materials revenues by region shows big exposure to China. (Company filings)

Applied Materials and its peers say that is due to past growth in backlog and previous commitments. ASML Holding (NASDAQ:ASML) recently said their China sales were due to “backlog build-up in the past.” Applied Materials themselves guide towards a 30% contribution from China sales. Now, whether this includes leading technology shipments or not depends on how regulation views it, which is uncertain.

With an incoming president, talk about these pressures is expected to intensify, and management should explain how they are trying to diversify from those risks. This recent article from WSJ explains how Applied Materials is trying to diversify its supply chain away from any Chinese partners or even Chinese investors. More importantly, the margin headwind that it sees from these efforts might also be talked about by management.

I expect to hear more from management on the recent communication received from lawmakers and how they plan to operate their business within the regulatory framework being set for companies such as Applied Materials.

For Q4: Applied Materials is expected to earn $2.2 per share on revenues worth $6.96 billion, growing ~3.5% y/y. Note that these expectations are above the $2.18 earnings per share on revenues worth $6.93 billion that management themselves had projected for Q4, indicating markets are optimistic.

For Q1 of next year: Applied Materials is expected to still showcase range bound sequential growth, guiding towards $2.27 EPS on revenues growing 7.7% y/y to $7.23 billion. But I expect the company to talk about positive strength in the back half of next year.

Applied Materials will report Q4 earnings on Thursday, November 14th, after markets close.

Takeaway

I expect Applied Materials to outperform its targets and estimates in the upcoming Q4 report this week, as the larger discussions about leading edge technologies dominate the earnings call discussion about how the company stands to gain market share.

The risk from the diversification away from Chinese suppliers and partners as Applied Materials tries to balance regulatory compliance with forward growth will be front and center in this report.

However, I still believe Applied Materials is undervalued given the pessimism in face of risks, and I rate Applied Materials a cautious Buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.