Summary:

- Applied Materials is the most balanced WFE player.

- AMAT is the leader in leading-edge logic and advanced packaging.

- China’s ICAPS and HBM markets are near-term concerns for AMAT.

Monty Rakusen

Applied Materials (NASDAQ:AMAT) is one of the largest WFE (wafer fabrication equipment) suppliers in the world. In 2023, while most WFE suppliers experienced revenue declines due to a combination of weakness in leading-edge logic and the NAND market, AMAT has avoided revenue decline as the company benefited from the strong growth of the ICAPS (IoT, communications, auto, power, sensors) market, particularly in China, as well as the strong growth of HBM market. In 2024 and 2025, there might be some weakness in the ICAPS market. However, growth in leading-edge logic and advanced packaging (excluding China’s HBM market), and the recovery of the NAND market, is likely to more than offset the weakness in ICAPS market. I believe AMAT is the most balanced WFE supplier and will continue to benefit from the increasing worldwide demand for semiconductor products. At the same time, AMAT’s stock looks fairly valued at this price. Therefore, I am giving AMAT a long term “hold” rating.

AMAT is the most balanced WFE player

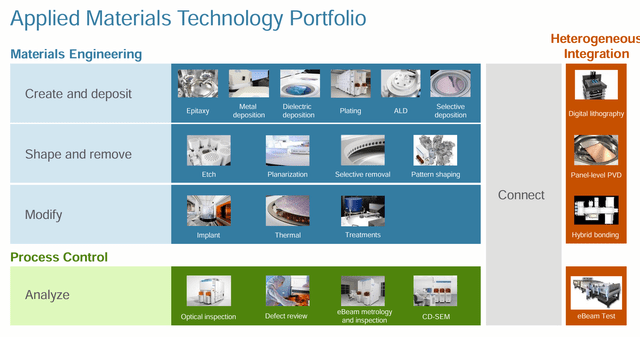

Among all the major WFE players, I think AMAT is the most balanced one. For instance, from a technology portfolio standpoint, ASML is concentrated on lithography systems. KLA Corporation (KLAC) is focused on inspection and metrology equipment. AMAT, however, has a product portfolio that spans across the entire wafer fabrication process, including Epitaxy, etching, deposition, ion implant, inspection and metrology, and hybrid bonding.

Applied Materials IR Deck

In terms of logic/memory mix, as I explained in my previous article, AMAT’s biggest competitor Lam Research (LRCX) is heavily dependent on the memory market, especially the NAND market. AMAT is well-balanced between logic and memory. While AMAT doesn’t break out its revenues in details, AMAT’s management hinted that memory accounted for only about 1/3 of total revenue during Q4 2023 earnings call.

AMAT is leading in leading-edge technology and AI chips

For me, what’s exciting about AMAT is its leading position in leading-edge logic and AI chips. In leading-edge, AMAT’s management has always talked about AMAT’s almost 50% position in gate-all-around transistors (mostly used in 3nm and below nodes), which recently just entered the high-volume manufacturing phase. Management estimated that the shift from FinFET to gate-all-around will expand AMAT’s market for the “from around $6 billion to approximately $7 billion for every 100,000 wafer starts per month of capacity”. The advancement in gate-all-around also expands AMAT’s addressable market for interconnect wiring used to transmit data at high-speed and low power. During the Q2 2024 call, management expected to “generate more than $2.5 billion of revenue from gate-all-around nodes this year and potentially more than double that in 2025”.

Advanced packaging is another exciting area which is guaranteed to grow with leading-edge logic and HBM memory chips. It is widely known that AI chips use a lot more DRAMs to improve performance and power consumption, especially for HBMs. During the 2024 Morgan Stanley Technology, Media & Telecom Conference, AMAT’s CFO Brice Hill estimated that “only about 6% or so of wafer starts are actually today directed towards AI in the WFE. But it’s going to grow at a 30% plus CAGR”, and “DRAM has been underloaded lower utilization, there’s probably only about 5% of DRAM starts that are allocated towards HBM memories by customers who have said that that’s growing at 50% to 60%”.

Hill also shared that AMAT has greater than 50% share in HBM. And AMAT expected that its HBM packaging revenue could be 6 times higher in 2024, “growing to more than $600 million”. Including HBM, AMAT expected that advanced packaging product portfolio to grow to approximately $1.7 billion in 2024.

Near-team China headwinds and competitive risks

For most of the major WFE players, China has been an important market for revenue growth. Like its peers, AMAT also benefited from strong China demand during the past two years. However, it looks like China will be a near-term drag for AMAT’s revenue for two major reasons.

First of all, AMAT’s management had explained multiple times that AMAT’s DRAM revenue in China was about $500 million higher than normal in the past few quarters as major Chinese DRAM manufacturers ramped up orders in preparation for the U.S. export restrictions. This $500 million of incremental revenue would likely drop to almost 0 in the next few quarters.

Secondly, there’s growing concern over slowdown of China’s ICAPS market as China’s AMAT’s largest ICAPS market. In June of 2024, during the BofA Securities Global Technology Conference, AMAT’s CFO told BoA’s analyst Vivek Arya that the utilization rate for China’s ICAPS market was “in the mid-70s” and he is expecting “some digestion that has to happen.”

Thirdly, the competitive landscape in China has changed as the U.S. export controls. According to J.P. Morgan’s analyst Harlan Sur, “within the deposition and etch segments of the market, China domestic competitors have been making some relatively strong progress on share gains, in deposition, the China domestic competitor moved to the number five share position last year from number eight in etch, the two China competitors move to the number four and number five position of share respectively.”

The competitors mentioned by Sur are Naura (deposition and etching) and AMEC (etching). As I’ve addressed in my LRCX article, AMEC’s 2023 annual report reveals that AMEC’s revenue from sales of etching equipment increased 49% in 2023 and its backlog for etching equipment increased 60% to almost $ 1 billion. Naura doesn’t disclose its backlog for etching and exposition business separately. According to Naura’s 2023 annual report, Naura’s revenue increased by 50% in 2023 and its backlog has increased to almost $4.2 billion. With AMEC and Naura’s massive amount of backlog, I think it’s almost guaranteed that AMAT’s market share in China will decline considerable in the next 2-3 years.

Financial projections and valuation

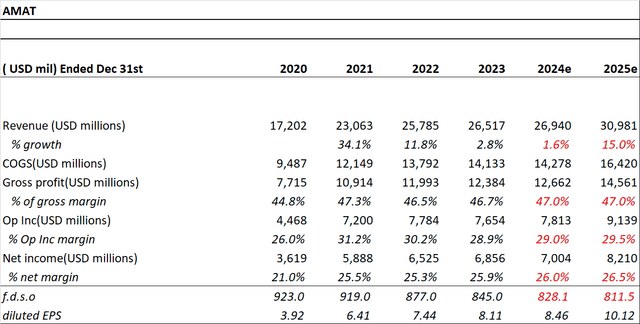

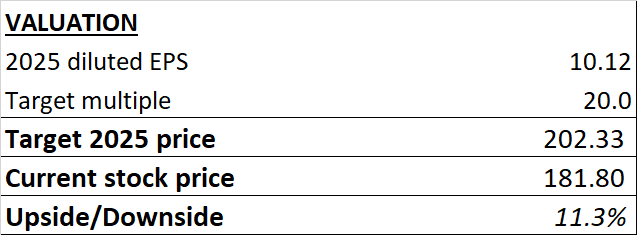

In my model, I have assumed AMAT’s revenue to grow only 1.6% in FY 2024 and 11.6% in 2025, which is in line with consensus estimates by analysts. I’m using management’s latest guidance for gross margin and operating margin.

On the valuation side, I applied 20 times TTM P/E multiple, which is AMAT’s five-year average. As a comparison, LRCX trades at 26 times TTM P/E and Naura trades at 44 times TTM P/E.

author’s estimate

Based on my financial projections and valuation, AMAT appears to be fairly valued.

Conclusion

I think AMAT is the most balanced and one of the best-managed WFE suppliers in the world. While facing some near term headwinds, mostly related to China’s HBM and ICAPS market, AMAT will still continue to benefit from the accelerated development of leading-edge and AI-related chips. It looks like the market has fairly priced in both the positives and near-term negatives. Therefore, I am giving AMAT a “hold” rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.