Summary:

- I believe revenue and EPS growth estimates over the next year are too conservative, making AMAT stock a strong buy.

- Applied Materials has shown strong revenue and EPS growth over the past 10 years, with revenue increasing by 353% from 2014 to 2024.

- Consensus revenue estimates suggest continued growth, with revenue projected to increase from $26.94 billion in fiscal 2024 to $37.36 billion in fiscal 2028.

- Despite concerns about semiconductor stocks being cyclical, Applied Materials has demonstrated consistent revenue and EPS growth, with potential for further acceleration due to the AI revolution.

Sundry Photography

Investment Thesis

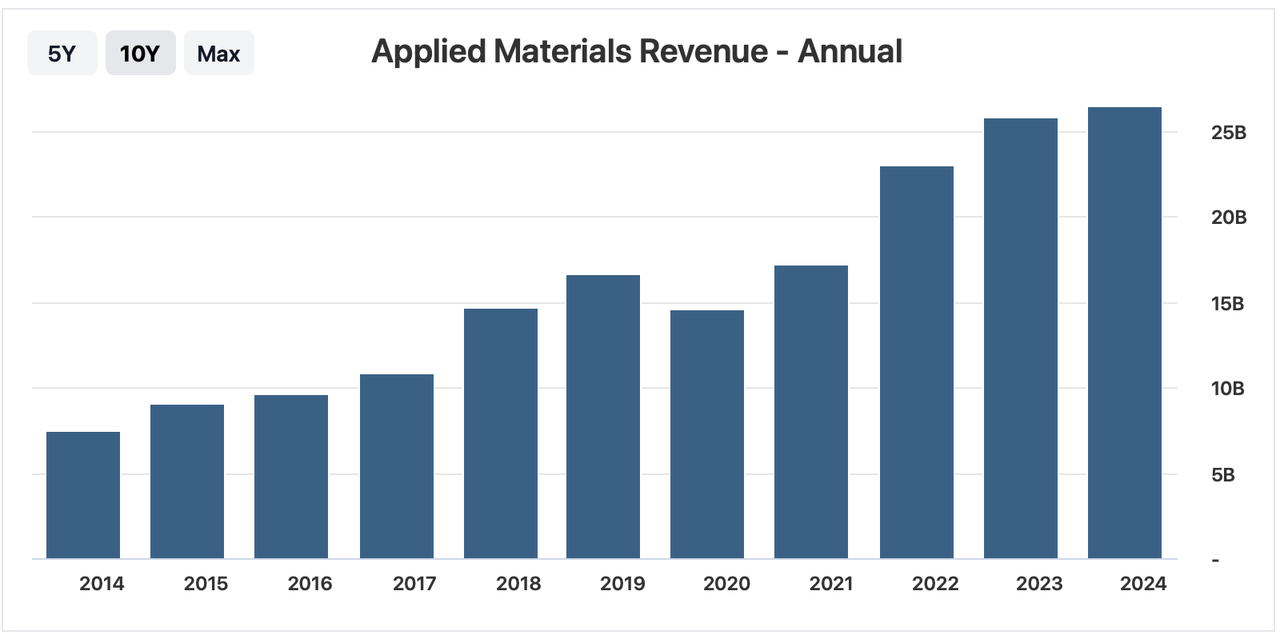

I believe Applied Materials (NASDAQ:AMAT) has demonstrated strong revenue and EPS growth and this is set to continue. Over the last 10 years, Applied Materials has seen strong revenue growth. In 2014, revenue totaled $7.51 billion; 2024 revenue is equal to $26.52 billion, a 353% increase.

Looking forward, consensus revenue estimates have shown this compounding continuing, with revenue projected to increase from $26.94 billion in fiscal 2024 to $37.36 billion in fiscal 2028.

One of the biggest concerns about semiconductor stocks is their cyclical nature, leading some investors to believe semiconductors deserve to trade at a lower price-to-earnings (P/E) multiple.

However, I believe that some semiconductor companies, like Applied Materials, do not follow this cyclical nature. I think that the market’s opinion on the industry (and Applied Materials) is beginning to change as semiconductor volume accelerates, driven by advancements in technology and increasing demand driven by the AI revolution.

Adding to this, Applied Materials has showcased consistent revenue and earnings per share (EPS) growth even before the AI boom. In the last 10 fiscal years, their revenue compounded annual growth rate (CAGR) was over 13%, and their Non-GAAP earnings per share grew at roughly 30%.

With the growth of AI, I believe Applied Materials will benefit significantly. As a company, they already have a strong history of executing excellent revenue and EPS growth. With increasing demand for AI applications, I expect Applied Materials’ revenue and EPS growth to accelerate further. Given the conservative growth estimates (below these current growth rate estimates), which I believe are likely to be revised upward, Applied Materials represents a compelling strong buy.

Background: Strong Compounder

Applied Materials has shown to be a consistent compounder of earnings per share (EPS) and revenue. Contributing to this are their three key operating segments— semiconductor systems, applied global services, and display and adjacent markets.

Zooming out to the past 10 years, Applied Materials has seen steady revenue and EPS growth, as displayed in the charts below.

AMAT Annual Revenue (Stockanalysis)

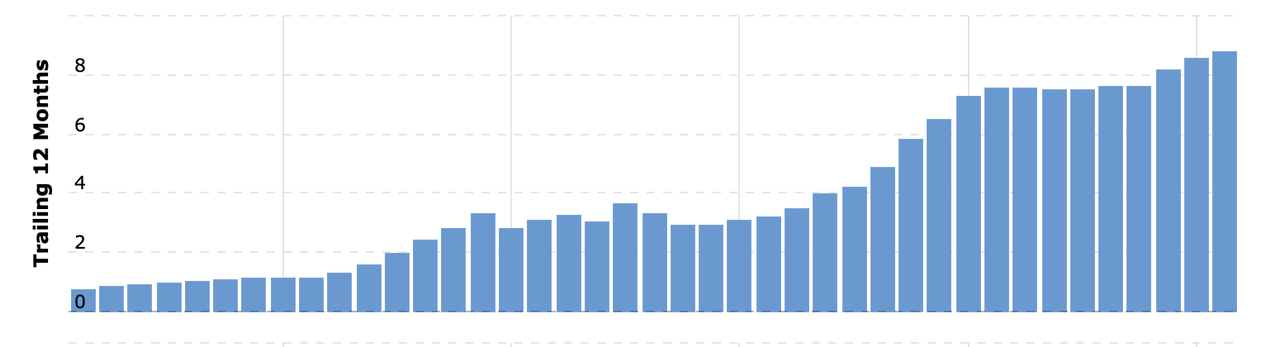

EPS has seen this even stronger compounding, which has been even more impressive. On almost all of the rolling 12-month periods over the last 10 years, EPS continued to compound higher. In fact, EPS has increased by over 8x in this time frame. That’s powerful.

This graph shows the EPS of Applied Materials, displaying an EPS of $.88 in October 2014, and an EPS of $8.77 as of May 2024. This equals an increase of 996%. This is where management gets their 30% CAGR of EPS they reference in their most recent earnings call.

Looking Forward: Growth Appears Understated

I believe we are in the midst of a massive AI transformation, yet the growth estimates for Applied Materials (Applied Materials) seem conservative. Despite the rapid advancements and increasing demand for semiconductor technology driven by AI, with Applied materials playing a key role in retooling facilities that make DRAM (like Micron (MU) which is seeing strong order bookings on their own), revenue and EPS growth projections for Applied Materials remain below the industry average. For instance, Applied Materials’ estimated forward revenue growth rate is set far below their 10-year personal CAGR of 13%, projected at 5.25%.

This is also below the sector median of 6.64%, indicating a 20.95% difference. In the event of a massive AI revolution, I believe their actualized revenue should not only exceed predictions and the sector median, but also their personal average of 13%. Similarly, the forward EBITDA growth rate is projected at 4.43%, also below the sector median of 6.38%. I think what we are seeing here is a similar setup to Micron a few months ago. Applied Materials is a key part of the new AI future, helping supply tools to DRAM makers like Micron. Once Micron’s order book necessitates new fab retooling, I expect orders to pick up in a manner stronger than what estimates are penciling in.

As highlighted in my recent analysis on ASML (ASML), the semiconductor industry is undergoing a significant retooling to accommodate the needs of AI applications. As an example, ASML’s advanced lithography machines are in high demand, and this demand is expected to drive substantial growth across the entire semiconductor supply chain. Applied Materials, being a critical player in semiconductor equipment, stands to benefit immensely from this same industry-wide upgrade cycle. What I am saying here is we are seeing the downstream effect on other companies that retool fabs. I have no reason to believe we will not see this same uptick in growth with Applied Materials.

I believe analysts are beginning to recognize the growth potential of this company. Applied Materials’ consensus revenue and EPS estimates have shown consistent upward revisions. For the upcoming fiscal year, the number of upward revisions for EPS in the last 3 months stands at 21, compared to 7 downward revisions. For revenue, there are 21 upward revisions against 8 downward revisions.

In fact, we have seen EPS estimates for just this year increase by 8.86% for the fiscal year ending October 2024. This has taken EPS estimates from a decrease to a now 3.97% year-over-year growth estimate. I still think these estimates could turn out to be too conservative, especially given how fast AI DRAM orders are ramping up at Micron.

The need for substantial semiconductor retooling for AI will be a major growth driver for Applied Materials. As the entire semiconductor industry gears up for AI retooling, the demand for Applied Materials’ equipment is expected to jump. As mentioned in their Q2 2024 earnings call,

…the advanced chips that power AI datacenters are enabled by four key semiconductor technologies: leading-edge logic; compute memory or high-performance DRAM; DRAM stacking technology, referred to as high-bandwidth memory, or HBM; and advanced packaging to connect the logic and memory chips together and create a ‘system in a package’.

Applied has process technology leadership in all four of these areas, and we have made significant investments in next-generation solutions to make possible the key device architecture inflections that are essential for our customers’ future roadmaps. – Q2 2024 earnings call

I believe this statement solidifies my thesis. As companies retool Applied leads in these key areas; they will look towards Applied Materials to provide the needed technology.

Valuation

Looking at Applied Materials’ valuation metrics, I believe the market is underestimating their potential for growth. For example, their forward P/E (GAAP) ratio is 28.71, which is below the sector median of 29.67, representing a 3.24% discount.

During the earnings call, CEO Gary Dickerson mentioned multiple avenues of growth, one being the spending on process equipment for transistor steps. Dickerson stated:

With the gate-all-around transition, we are also gaining share, and we’re on track to capture over 50% of the process equipment spending for transistor steps. – Q2 2024 earnings call

Adding onto this, Dickerson also stated during the call

We also have very strong market share in interconnect or the wiring used to transmit data at high speed and low power. Our available market for the wiring steps is approximately $6 billion for each 100,000 wafer starts per month, and we expect it to grow by $1 billion when backside power delivery is introduced into volume manufacturing. Overall, we expect to generate more than $2.5 billion of revenue from gate-all-around nodes this year and potentially more than double that in 2025.

– Q2 2024 earnings call

He just said some parts of their business will double in 2025 (a $2.5 billion division will double in 2025). The rest of the company would severely have to underperform in order to have revenue growth of 5.25% like what is projected.

Shifting to their high bandwidth memory (HBM) sector, Dickerson mentioned:

[we] have recently seen customers accelerate their capacity plans for HBM, we now believe that our revenue could be 6x higher this year, growing to more than $600 million. Across all device types, we now expect revenue from our advanced packaging product portfolio to grow to approximately $1.7 billion this year. – Q2 2024 earnings call

As demonstrated by these quotes from Applied Materials’ most recent earnings call, the company is expected to see exponential growth across multiple sectors, but the market doesn’t seem to agree.

However, even with these conservative estimates, Applied Materials’ FWD (GAAP) EPS growth is projected to be 22.85% above the sector median over the next 12 months.

We are currently paying a 3.24% to sector median GAAP P/E ratios to access a compounder that is estimated to grow (in what is likely conservative estimates) 22.85% above the sector median. I think this is a great deal.

If we saw their forward P/E (GAAP) ratio gain a 22.85% premium above the sector median, this would then equal a forward P/E of 36.45. This forward P/E would result in 26.96% upside in shares if the forward P/E were to converge on this growth premium.

Risks

Despite the strong growth potential and attractive valuation of Applied Materials, there are several risks that investors should consider. The most significant risk is the geopolitical tension surrounding China. The U.S. government is considering additional restrictions on China’s access to advanced semiconductor technology, which could impact Applied Materials’ business. Specifically, the U.S. is looking to curb China’s ability to use advanced chip architectures like gate all-around (GAA) technology, which is crucial for AI applications.

Any severe restrictions could lead to a significant drop in Applied Materials’ revenue from the Chinese market. However, it’s important to note that many of the latest AI chips cannot be manufactured in China due to existing bottlenecks and restrictions on critical technologies like those provided by ASML. This limitation partially mitigates the impact on Applied Materials, as the demand for their advanced manufacturing equipment remains high in other regions. On top of this, any equipment Applied Materials ships to China is likely not their most advanced equipment, since other parts of the AI chip making process in China are bottle-necked by the lack of advanced technology from ASML.

As mentioned previously, the AI world is due for a retooling. In China, Applied Materials could help with this retooling. In the earnings call, Gary Dickerson mentioned:

So, as that DRAM business falls off, our ICAPS business and our leading-edge logic business does increase to fill that in. And so, that’s consistent with continued strength in ICAPS, which the rest of the market for us in China would be ICAPS-related. – Q2 2024 earnings call

This indicates that although Applied Materials may lose parts of their DRAM business in China, there are other avenues that will continue to drive growth. For example, as of 2022, the CHIPS Act was passed aiming to make the United States a main producer of semiconductor chips. Because of this, companies like Micron are looking to build new facilities in the U.S., which will need to be filled with Applied Materials machines. As more companies prioritize U.S. manufacturing, I believe more companies will look towards Applied Materials for machinery.

Bottom Line

I believe Applied Materials presents a strong buy, driven by their consistent revenue and earnings per share (EPS) growth. Despite historical concerns on the cyclical nature of semiconductors, Applied Materials’ long-standing ability to compound revenue and EPS, with projections indicating significant growth ahead, mitigate these concerns.

While conservative growth estimates have kept their valuation below sector median, the ongoing AI revolution and the necessary retooling across the semiconductor industry present substantial upside potential. Although geopolitical risks in China are a concern to some investors, I believe with the growing demand for AI, the rest of the world will make up for any downturn in revenue from China.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AMAT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.