Summary:

- The semiconductor boom in the stock market continues, with a rising tide lifting nearly all boats.

- Applied Materials is a leading company in the semiconductor equipment industry, but current valuation suggests downside risk.

- AMAT is very high quality, and ticks all of the boxes for investment.

- Despite strong financials and market position, caution is advised due to the high valuation.

SweetBunFactory

Semiconductors will power the future. This truth is ubiquitous. It’s discussed in politics, the news trumpets Nvidia’s (NYSE:NVDA) stock performance, and nearly every megatrend, from car electrification to crypto to AI will require additional and more complex chips.

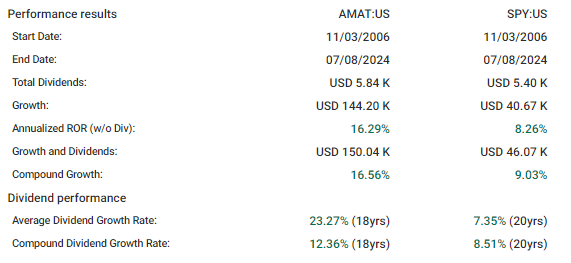

It’s been tough to lose in the stock market buying these companies. Looking at the company I want to highlight below, Applied Materials (NASDAQ:AMAT), it has handily beaten the market over about 20 years.

FAST Graphs

Thesis

There are several high quality companies in the space I’d very much like to own. But today represents an exercise in restraint. FOMO is a hell of a drug, and buying the best company in the world at the wrong time is still a losing proposition. I won’t sit here and trumpet strict adherence to rigid valuation metrics, but AMAT is overextended, with significant downside risk today. I’ll be waiting once the sector cools to scoop up shares.

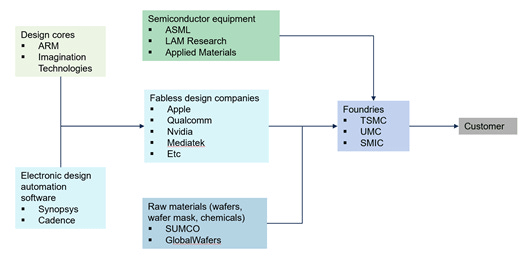

Fabricated Knowledge Substack

Within the supply chain for semiconductors, a few companies form somewhat of an oligopoly and carry significant barriers to entry. I’ve written on ASML (NYSE:ASML) in the past, and own it in more than one account. Many of the same virtues are evident in AMAT, which is a picks and shovels play on the semiconductor industry. The company is effectively a jack of all trades, with a leading market position in several facets of semiconductor equipment with the notable exception of lithography.

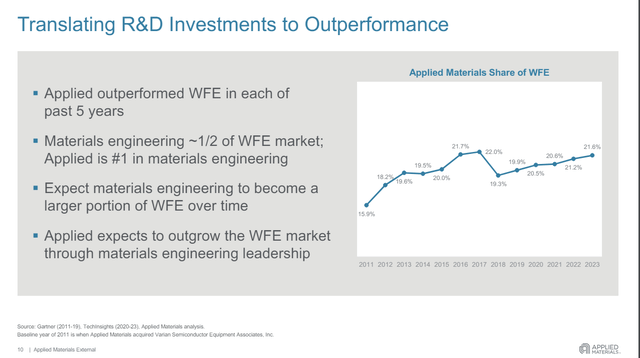

Company Presentation

This market position has been maintained over time via disciplined investment in research and development. Management allocates ~$3B a year to maintain the company’s competitive position, which has been effective enough Tech Insights showed AMAT has outpaced the wafer fab equipment space growth rate five consecutive years.

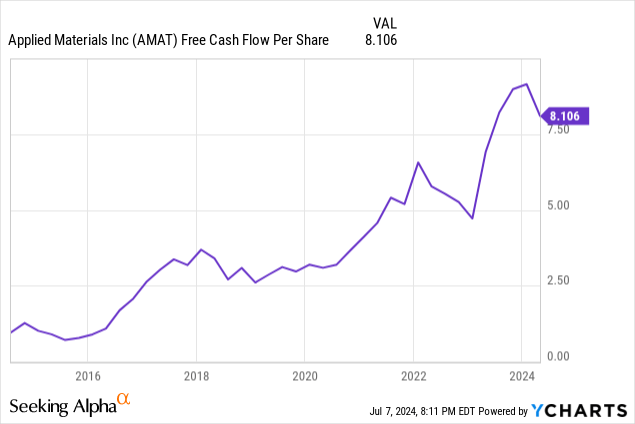

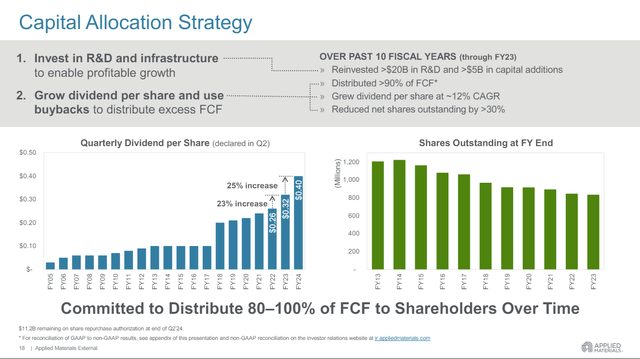

Despite the investments into research and development, the company has been an absolute share cannibal. FCF/share, one of my preferred metrics for business quality, is on an excellent trajectory, as the share count drops and the company generates more and more free cash flow.

So, ultimately, the company is generating tons of cash, and has historically returned over 90% of it to shareholders via either dividends or buybacks. This is the recipe for a consistent outperformer.

Company Presentation

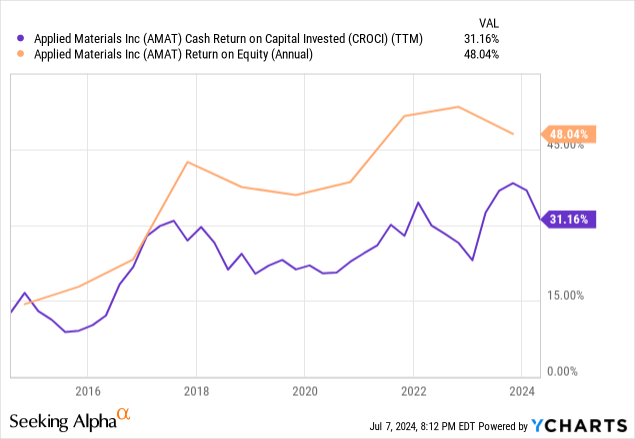

This has been made possible by consistent improvement in profitability and strong return on invested capital. Smart investment in R&D and sound capital allocation has made shareholders of AMAT very happy over time.

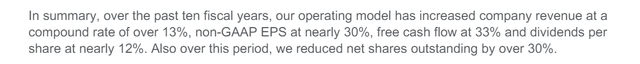

The most recent earnings call sums it up well:

Earnings Call

The last thing I want to highlight is the semiconductor space is cyclical. However, AMAT has long-term service contracts with companies it sells equipment to. With a 90% renewal rate, this revenue helps even out cyclicality elsewhere in the business. Additionally, the gross profit from this segment alone is sufficient to cover the dividend.

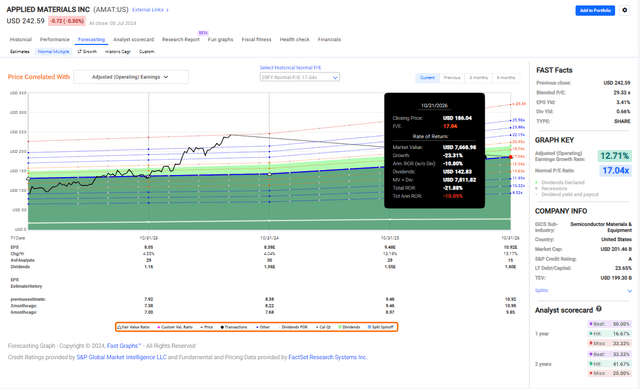

FAST Graphs

So, all of that sounds pretty great. However, investors are paying up for this quality. Despite how incredible the future appears for semiconductors, earnings estimates hold for pretty consistent growth. The most recent quarter saw a 2% drop in revenues in semiconductor systems with a 7% growth in AGS (services revenue). The company’s consistent strong profitability and share buybacks have translated reasonable revenue growth to impressive EPS growth.

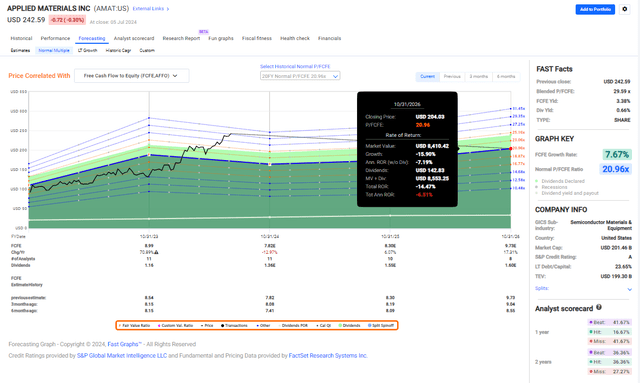

Based on current estimates, a return to the 20-year average valuation from a purchase today would lead to a decline of around 20% in the share price by the end of 2026.

Nothing guarantees this outcome. The company could shoot up another 50%. However, it seems much more likely the stock is out over its skis today. This could mean going sideways for awhile while the company grows into today’s valuation. Ultimately, the downside outweighs the upside to me.

FAST Graphs

Shown here against free cash flow, the picture is similar. The company would return around -7% annualized from a purchase today.

Now, all that being said, I could totally be wrong. AMAT is a great company, and I’m almost certain I’ll own shares at some point. However, taking swings at companies after this kind of run-up at peak enthusiasm is bad process, in my view. It’s definitely a hold for me.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ASML either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.