Summary:

- ASML Holding N.V. surpasses Applied Materials, Inc. as the leading supplier in the Wafer Front End, WFE, Semiconductor Equipment market in 2023.

- Strong sales to China lift the WFE market, and in particular Applied Materials, as imports of equipment into China rose by 14% in 2023.

- Applied Materials has been issued subpoenas by U.S. Securities and Exchange Commission, U.S. Attorney’s Office for the District of Mass., and U.S. Commerce Department’s Bureau of Industry and Security.

Klaus Vedfelt

In my previous analysis of WFE (wafer front end) semiconductor equipment, Applied Materials, Inc. (NASDAQ:AMAT) had lost its market share dominance to ASML Holding N.V. (ASML) in 2023. Now, AMAT has announced its latest earnings. At the time of my December 5, 2023, Seeking Alpha article entitled “Applied Materials: Weak Earnings Means ASML Takes Over The #1 Equipment Spot In 2023,” AMAT had only reported earnings through Q3 2023. This article presents semiconductor equipment sales for all companies in this analysis for the entire year, which incidentally does not include service or spare parts.

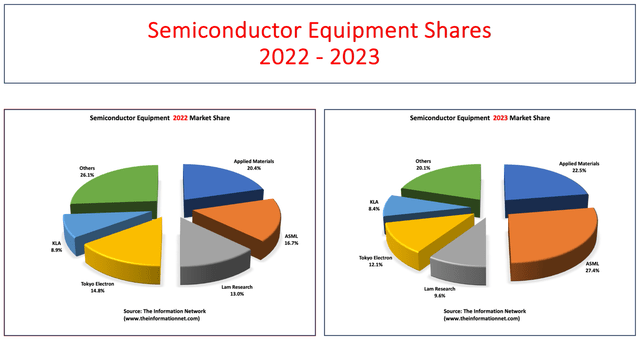

As shown in Chart 1, according to The Information Network’s report entitled “Global Semiconductor Equipment: Markets, Market Shares and Market Forecasts,” AMAT relinquishment of its top position—a status it maintained for two decades, with the exception of 2019 when ASML previously claimed the lead.

I believe that 2024 will be a challenging year for AMAT, tied to ASML’s sanctioned high-end DUV lithography systems to China, which would have required AMAT’s etch and deposition equipment for multi-patterning, and ASML’s High-NA EUV lithography equipment, which doesn’t require AMATs equipment.

These financial factors are combined with AMAT’s significant legal problems, in which it has been receiving subpoenas from the U.S. Securities and Exchange Commission and from the U.S. Attorney’s Office for the District of Massachusetts in February 2024, and from the U.S. Attorney’s Office for the District of Massachusetts in August 2022 and February 2024, and the U.S. Commerce Department’s Bureau of Industry and Security in November 2023. As a result, I rate this company a Sell and caution investors of the implications for AMAT management.

Top 5 Companies

In the midst of China sanctions throughout 2022 and 2023, ASML ascended to the pinnacle of the Wafer Front End Semiconductor Equipment market in 2023, surpassing Applied Materials to become the leading supplier. ASML’s share rocketed to 27.4% from 16.7% in 2022.

According to ASML’s Q4 2023 earnings call, CFO Roger Dassen reported:

“Looking at the full year, net sales grew 30% to €27.6 billion, with a gross margin of 51.3%. EUV system sales grew 30% to €9.1 billion, realized from 53 systems while a total, we shipped 42 EUV systems in 2023. DUV system sales grew 60% to €12.3 billion.”

Chart 1

AMAT’s semiconductor revenues grew by just $26 million QoQ in the latest quarter despite strong revenue from China, which I discuss below. For 2023, revenue dropped $253 million YoY. This compares to ASML, which grew $345 million QoQ and $7.9 billion YoY for the calendar year.

Tokyo Electron Limited (OTCPK:TOELF) (OTCPK:TOELY), hailing from Japan, found itself in third place following a significant following a market share drop from 14.8% in 2022 to 12.1%. Tokyo Electron and other Japanese firms such as Hitachi High-Tech, Screen, and Kokusai, were adversely affected by the strong U.S. dollar in the second half of 2023, which led to a 2% reduction in their revenues (when measured in U.S. dollars) in the fourth quarter of 2023.

This downturn mirrored the challenges faced by Lam Research (LRCX), which also saw a considerable market share decrease from 13.0% to 9.6%.

KLA Corporation (KLAC) rounded out the Top 5 companies as its share dropped slightly from 8.9% to 8.4%.

Catalysts for 2023 Market Share Changes

There were several factors impacting market share changes in 2023.

Negative Factors

On the negative side, a strong U.S. dollar against the Japanese Yen affected sales by -2% for Tokyo Electron and other Japanese companies.

The memory market was mired by a downturn through all of 2023, as I discussed in my July 24, 2023, Seeking Alpha article “Lam Research Earnings: All Eyes On Memory Chip Recovery.” This sector’s vulnerability, exacerbated by diminished demands for end products such as PCs and smartphones, directly impacted companies with a high exposure to the memory market, including Lam and Tokyo Electron.

Positive Factors

On a positive note, strong sales to China lifted the WFE market, primarily for mid-critical and mature nodes in China. Imports of equipment needed to produce semiconductors rose by 14% in 2023 to $40 billion.

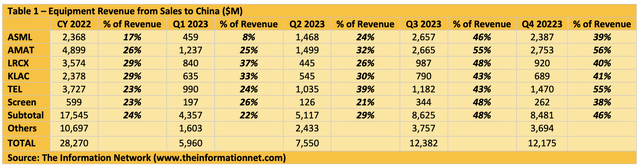

In Table 2, I show the Top 6 Semiconductor equipment companies and their China revenues and percentage of revenues generated from China for CY 2022 and Q1-Q4 2023. In Q3, the % of revenue was nearly the same for each company but elevated, indicating that Chinese semiconductor companies are importing equipment irrespective of process equipment type.

In CY2022, shown to the left of the table, revenues from China were 22%. This is similar to the 22% and 29% in Q1 2023 and Q2 2023, respectively.

But in Q3 and Q4 2023, we see an explosive growth in revenues, from pull-ins of equipment slated for 2024 as well as a hoarding of equipment by Chinese companies prior to anticipation of further, more deeply impacting sanctions.

Also noted in Table 1 is the large percentage of revenues from China by AMAT. This 55% and 56%, higher than competitors, helped AMAT gain 2% of market share in 2023.

Investor Takeaway

Impact of China Sanctions

Looking back at Table 1, in Q4 2024 ASML generated 39% of revenues from China. While still significantly larger than the 17% in 2022, it slowed in Q4 2023. An important consideration for the other companies in 2024 is that DUV lithography sales, even though in 2023, semiconductor equipment was imported for the processing of mature and mid-critical nodes to China, as vendors complied with export control regulations.

Why? Because DUV lithography on its own only works up to the 39nm technology node. Lower than that, multi-patterning processes need to be used, and these processes use deposition and etch equipment from AMAT. Limiting DUV sales to China for mature and mid-critical nodes will significantly impact AMAT’s sales of etch and deposition equipment, which I discuss below.

- At the 28nm node, no EUV systems are required anyway, and 10 DUV immersion systems are required for the 50,000 wafers per month (wpm). At 7nm, normally 15 DUV systems and 5 EUV systems are demanded, depending on chip type and company. However, since Chinese fabs such as SMIC are not permitted to use EUV by U.S. sanctions, then they will be substituted by DUV, and 20 DUV systems will be used.

- In both cases, multiple patterning is done to delineate that pattern, whether it is 28nm or 7nm. This multiple patterning process is more or less a trick to reach even the 28nm dimensions. The multiple patterning is typically a combination of deposition, etch, and lithography steps.

- For a fab making 50,000 wpm at 28nm, in addition to the 10 DUV immersion systems, multiple patterning will demand 125 etchers and 200 CVD systems. At 7nm, in addition to the 20 DUV immersion systems, multiple patterning will demand 350 etchers and 175 CVD systems. Clearly, non-lithography equipment suppliers benefit from the sale of DUV systems.

As for the impact of U.S. sanctions on China, in October 2023, the U.S. government published updated export control regulations, according to ASML. The regulations consist of both an update from the October communication of the previous year and the implementation of U.S. regulations within the trilateral agreement involving the Dutch, Japanese, and U.S. governments.

On October 17, 2023, the US Department of Commerce’s Bureau of Industry and Security (BIS) declared that lithography machines with a maximum “dedicated chuck overlay (DCO)” value between 1.5nm and 2.4nm are prohibited from being shipped from the U.S. to China. The DCO value serves as an indicator of imaging performance, with smaller values indicating higher accuracy.

Under these new rules, the BIS has imposed a ban on shipments of ASML’s NXT:1980Di and NXT:1970Ci machines, which have maximum DCO values of 1.6nm and 2nm, respectively, from the U.S. to China. As of now, there is no indication that the Dutch government will follow suit.

ASML expects that these sanctions will impact its sales to China by -10 to -15%. And that would mean lower sales from AMAT, LRCX, and TEL.

Financial Metrics

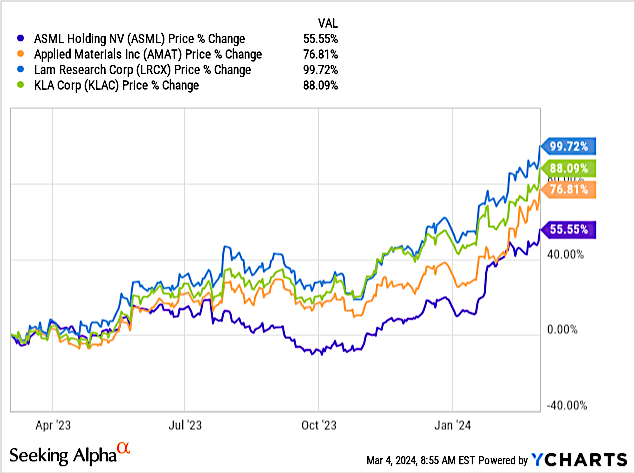

Chart 2 shows the share price for ASML, AMAT, LRCX, and KLAC over a 1-year period. ASML’s performance is worse than its competitors despite the strong top-end revenue growth in 2023. LRCX, which fared worse, shows the strongest growth.

YCharts

Chart 2

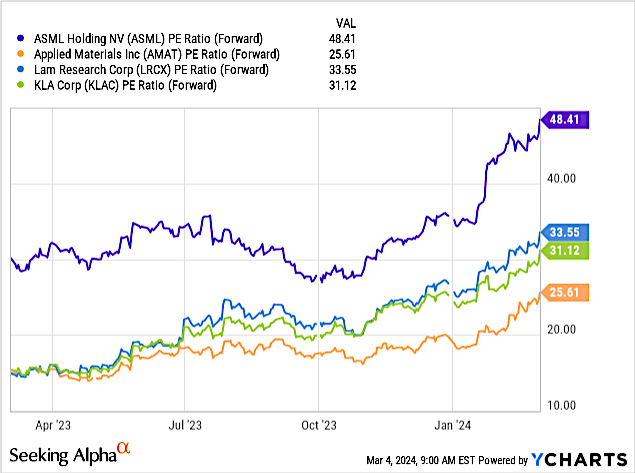

Chart 3 shows the Forward P/E ratio of the four companies indicating ASML is overbought at 48.41x and AMAT at the lowest at 25.61x. Note that AMAT has an attractive forward P/E ratio despite revenues that dropped $253 million YoY in 2023.

I also suggest that AMAT’s gain of 2 percentage points in market share is a result of a significant drop of 6 percentage points by the “other” equipment companies indicated in Chart 1 above. As Chinese companies began hoarding Western Equipment in 2H 2023, as shown in Table 1, they were primarily buying from the top equipment manufacturers analyzed in this article. Thus, smaller companies outside the Top 5 in this article, were passed over for equipment purchases.

YCharts

Chart 3

For 2024, I see a recovery of WFE revenues, which dropped double digits in 2023, but because of pull-ins from 2024, primarily by Chinese semiconductor companies, this recovery won’t happen until 2H 2024.

Restrictions on ASML shipping advanced DUV systems (and of course EUV systems) will have limited impact on ASML, but a much larger impact on companies selling deposition and etch systems for multi-patterning.

Based on forward P/E ratios in Chart 3, AMAT has the lowest forward P/E ratio and makes the company attractive. However, I have great concerns about the company’s business strategy.

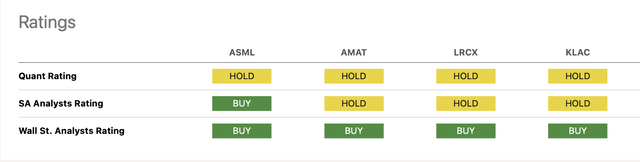

Chart 4 shows the Ratings of the four companies. Seeking Alpha’s Quant Rating is a Hold for all four companies, although all have a Buy rating from Wall St. Analysts.

Chart 4

Legal Implications

I already reported that AMAT managed to move $331 million in revenues in three tranches from 2018 revenues into 2019 to improve market share. It didn’t work, as ASML took over the #1 spot from AMAT for the first time in 20 years. Curiously, not one analyst reported these antics.

Now we learn of another head fake from AMAT – allegations that the company has shipped sanctioned equipment to China in violation of U.S. sanction laws. According to Seeking Alpha news, AMAT received multiple subpoenas from U.S. government authorities seeking information pertaining to its China shipments:

The semiconductor firm received subpoenas from the U.S. Securities and Exchange Commission in February 2024. It also received a subpoena from the U.S. Attorney’s Office for the District of Massachusetts in the same month requesting information related to certain federal award applications.

The recent subpoenas are in addition to ones received from the U.S. Attorney’s Office for the District of Massachusetts in August 2022 and February 2024, as well as from the U.S. Commerce Department’s Bureau of Industry and Security in November 2023.

Sales of its deposition and etch systems, which normally complement lithography DUV systems from ASML will be impacted by China sanctions and by advanced High-NA EUV. While sales for AMAT were strong in China in 2023 without U.S. sanctions, this growth will not be mirrored in 2024.

I also caution investors that several different government departments have issued subpoenas against AMAT. This is serious, and could ultimately lead to implications for AMAT’s management, raising the question “Where does the buck stop?”

In conclusion, I rate this company a Sell.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This free article presents my analysis of this semiconductor equipment sector. A more detailed analysis is available on my Marketplace newsletter site Semiconductor Deep Dive. You can learn more about it here and start a risk free 2 week trial now.