Summary:

- Applied Materials stock is up sharply after posting strong Q1 earnings and Q2 guidance.

- The stock has been on an eye-popping rally, but the pace of gains is unsustainable.

- The company’s fundamentals are strong, but the valuation is becoming less attractive after the big rally.

Sundry Photography

Semiconductor giant Applied Materials (NASDAQ:AMAT) posted Q1 earnings last night, and the stock is exploding higher. We’ve seen the semis as a group relentlessly powering higher this year, and Applied Materials is no different. The stock, with the pre-market move this morning, is up something like 30% and we’re only halfway through February.

I’ve been bullish on Applied Materials for a long time, with the two most recent examples here and here. I’ve liked the stock’s valuation, its entrenched market position, and its growth prospects over time, but I’ll admit at least the valuation has become less attractive with the big rally we’ve seen. I don’t think anything but positive changes have taken place in the fundamentals, but of course, valuation is important, with more on that below.

After the report, I still like Applied Materials a great deal, but given the run we’ve had, I’m growing a bit more cautious. Let’s dig in, beginning with the price chart.

An eye-popping rally

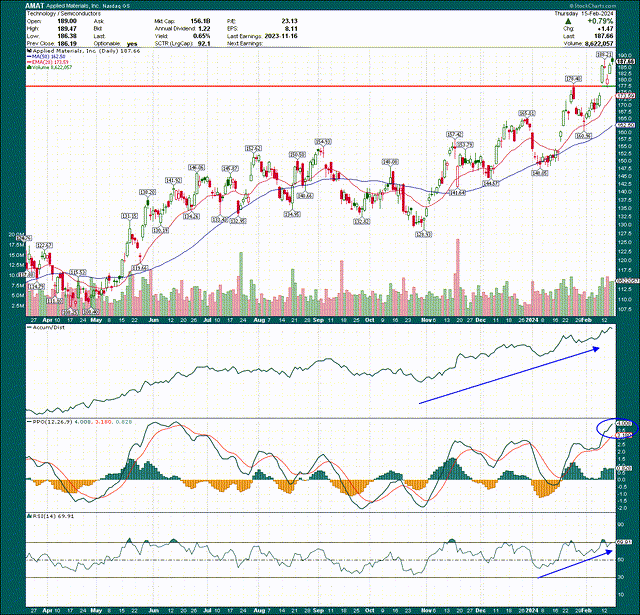

Applied Materials formed a base between roughly $130 and $150 for most of last year, so when it broke out of that, the move was extremely powerful. Long basing formations like what we saw in this stock last year generally produce powerful and swift moves in whatever direction the breakouts are in, and in this case, it was decidedly higher.

With the move off of Q1 earnings, the stock is now well into the $200s and making new all-time highs. The question then becomes, what do we do now?

StockCharts

I don’t generally like to chase strength on the scale that we’ve seen from Applied Materials in recent weeks, just given that the pace of gains the stock is putting in is completely unsustainable. However, for the long-term bullish case, the action we’ve seen is quite supportive. In short, buyers are showing up in huge numbers and overwhelming sellers, and that’s what you need for a stock to go higher over time.

The breakout and gap level of about $178 is the line in the sand for the bulls on any pullbacks, although with the stock indicated at $212 pre-market, that seems a long way down. I think a more likely test is the 20-day exponential moving average, which is in red above. That line is rapidly moving higher and will soon crest the $178 level, so my first support on any selling would be that.

The accumulation/distribution line is absolutely flying and making new highs, which simply means that there’s more volume intraday for buyers than sellers. This is a great indicator of the long-term health of a rally, and this one really couldn’t look better.

My one concern is that the PPO already was unsustainably overbought before the move to $212 after earnings, so it will only become more so. The PPO is about measuring the pace of a trend, and as I said earlier, the pace of this trend move is not something that can be maintained.

StockCharts

This is a zoomed in look at the same chart, but with a channel drawn in that frames the current rally. We saw the stock close at the top of the channel yesterday, and is now up $24 pre-market to blast over and above that channel. Again, that’s bullish long term, but the pace of this rally has me worried for the short term. One way to play this is to wait for a pullback that tests the top of this channel, for instance. That will, undoubtedly, happen at some point because it cannot go up forever.

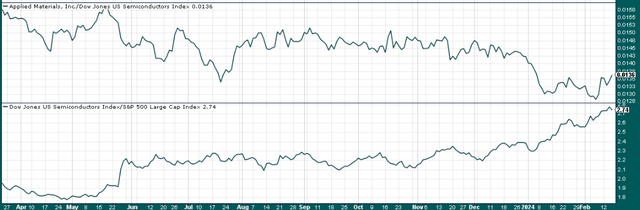

I’ve been extremely bullish on semiconductors as a group, having made a buy call on the group in early January using the SOXL ETF, which is up about 50% in the past six weeks. Why was I so bullish? Relative strength in the semis really couldn’t be better.

StockCharts

Applied Materials (top panel) has been underperforming the group, although that should be largely rectified on the post-earnings move, assuming it sticks. The semis as a group have been outrageously good, and we want to own strong stocks in strong sectors. Check, and check.

Let’s now turn our attention to the fundamentals after Applied Materials put in a very strong showing for Q1 results and Q2 guidance.

Manna from heaven for the bulls

Applied Materials posted EPS of $2.13 on $6.71 billion in revenue in Q1, handily beating estimates on both accounts. Management noted that its customers are ramping investments in next-gen chip technologies, which the company believes will drive more outperformance in the years to come.

There’s an interesting shift going on with Applied Materials’ core Semiconductor Systems revenue mix, as Foundry and Flash Memory revenue are both taking a back seat to DRAM on a relative basis, and in a big way. DRAM was 13% of total revenue a year ago, but was 34% in this quarter. The 21% gain in mix for DRAM came from a 6% reduction in Flash Memory and a 15% reduction in Foundry, although the latter still comprises 62% of the total for the segment.

Applied Materials is a market leader in DRAM, growing its share in recent years, and continuing to do so recently. The company believes it’s No. 1 in DRAM process equipment, and with DRAM’s total addressable market continuing to grow, there is a huge opportunity for Applied Materials in the years to come. Given it’s already dominant here, that bodes extremely well for future top line and margin growth.

Gross margin came to 47.9% on an adjusted basis, while operating income neared 30% of revenue at $1.98 billion. Those margin numbers are slight improvements on recent quarters, although they’re incremental steps rather than leaps and bounds. Still, as the company drives revenue higher, I expect to continue to see some operating leverage push operating margins further towards – and eventually past – 30% of revenue.

In addition, margins in both Applied Global Services and Display & Adjacent Markets are materially worse than Semiconductor Systems. As DRAM and the rest of Semiconductor Systems continue to grow, the mix of higher margin revenue should help drive margins higher over time.

Cash from operations was $2.33 billion during the quarter, and the company spent $700 million repurchasing shares, as well as $266 million on common stock dividends. Given where Applied Materials is in its growth cycle, I’d much prefer it stop paying a pointless dividend that yields half a percent and instead buy back more shares, but that’s a discussion for another day.

Management guided for $1.79 to $2.15 per share in Q2 earnings, as well as $6.1 billion to $6.9 billion in revenue. Analysts were expecting $1.80 and $6.34 billion, respectively, so there’s substantial upside potential here.

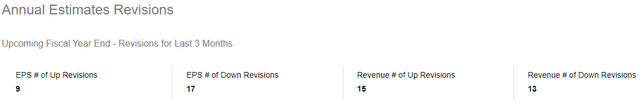

What’s driving the move in the stock post-earnings, in my view, is that analysts have just been wrong and the company has surprised massively to the upside.

Seeking Alpha

Recent revisions have been quite negative, particularly with EPS, so for Applied Materials to blow right past guidance for Q2, I think we’ll see price target and EPS upgrades come thick and fast in the next several trading days. That’s a perfect storm for the bulls, and it also means that valuation metrics will be reset.

Why I’m moving from buy to hold

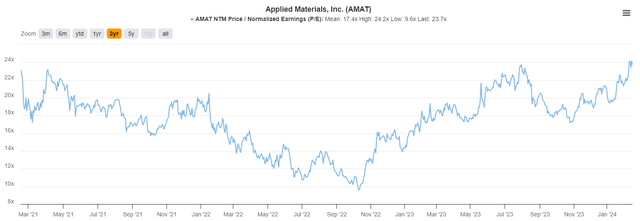

Speaking of the valuation metrics, let’s take a look at the forward P/E ratio to get a sense of how cheap (or not) the stock is now post-earnings.

TIKR

Shares have traded in the past three years between 10X and 24X earnings, which is a sizable range. The average in that time has been ~17X times forward earnings, and we ended yesterday at 24X. The stock is up 12% from that level right now, however, keep in mind that EPS estimates will be rising after blowout guidance for Q2.

The company’s guidance suggests up to 35 cents of upside in Q2 EPS, so current estimates of $7.70 in full-year EPS will turn into something more like $8.00+ at a minimum. If we assume shares at $212, and $8 in EPS, we’re still looking at a valuation of ~26.5 times forward earnings, so the stock is not cheap. In fact, in order to get the stock to be at 24X forward earnings, we’d need $8.83 in EPS estimates, which is too high at the moment. In other words, the stock is being re-rated at much higher multiples, so that’s something you’d need to be comfortable with if you jump in now.

Part of the reason why I was so bullish on Applied Materials in the past was that it traded for stupid valuations; that’s simply no longer the case. This stock is a market leader with strong growth prospects, but it’s also now priced like one.

Given all of this, while Applied Materials’ Q1 report and Q2 guidance were strong, I cannot help but think a lot of growth is now priced in. I’ve had a buy rating on the stock for a long time, but this move is causing me to move from buy to hold. I love the fundamentals, but the valuation is too much for me to stomach at a buy rating. This report and guidance were great, but the stock is now too rich for me.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.