Summary:

- My thesis for Microsoft is centered on its unstated but evident strategy akin to the Trojan Horse method of incursion into the Enterprise segment.

- From the advent of the PC to the ongoing AI narrative, Microsoft’s footprint reveals recurring revenues as its primary focus.

- In terms of valuation, this cannot be called an expensive stock by any measure.

- The best part is that these recurring revenues mitigate a lot of the risk of owning the stock for generations.

4×6/E+ via Getty Images

Not too many years ago, equities of the largest companies in the world were considered to be neither value stocks nor growth stocks. You couldn’t get them cheap, and you couldn’t really get phenomenal growth, either. They were stable blue chips that typically paid a nice dividend, and were stocks that you could pass on to your kids and grandkids. If you owned Procter & Gamble (PG), Coca-Cola (KO), or any of these granddaddies of yore that kept your capital safe, grew it patiently, and paid you reasonable and growing dividends, you were an astute investor with a multigenerational investment horizon. The case today is a far cry from what it was then. Today, the largest companies in the world are also the movers and shakers of the broad market, with a combined capitalization in the double-digit trillions of dollars that would put every country’s but the United States’ and China’s economies to shame. At an estimated $14 trillion, The Magnificent 7’s combined market value alone is nearly half the GDP of the United States at $28.8 trillion and hot on the heels of China at $18.5 trillion. In other words, Mag 7 is the third-largest economy in the world. Let that sink in.

Of that, a hefty $3.2 trillion, more than 22%, comes from Microsoft Corporation (NASDAQ:MSFT). My thesis is that Microsoft has its fingers in so many stable and/or fast-growing subsegments of technology that it will be hard for investors to see it any other way than as a lucrative long-term investment that you can leave as a legacy for the next couple of generations, at least. In a sense, this new generation of blue chip companies comprise growth stocks that also offer value to those keen enough to realize it.

The difference between my bullish thesis and those of most other analysts is not the growth of its revenue streams themselves, but the quality of that growth. A lot of analysts have contributed to the growth discussion around Microsoft, but few seem to recognize the inherent position of strength from which this growth has come. It’s not a new phenomenon. It began with the goal of putting a PC in every home, it continues with the goal of putting AI in everything we touch, and I believe that as long as its leadership is strong, it will continue with the goal of being the support structure on top of which other companies will flourish.

So, let’s pull on a few logical threads to unveil the real secret behind Microsoft’s success over the decades. I’ll try to keep things relatively brief, but in a nutshell, Microsoft gets a Strong Buy recommendation from me, not necessarily just for its growing revenues, as I said, but more importantly, for the quality of those revenues.

The Trojan Horse Principle, as Executed by Microsoft

The personal computer’s success was not in its ability to enter every home, but what it could actually do, and that’s where I’d like to introduce the company’s ‘Trojan Horse Principle’, as I call it. The real power of a PC was not its form factor or the novelty or convenience of product itself, but in its software capabilities – the word processor that replaced the age-old typewriter and revolutionized everything from book-writing to journalism to publishing, the spreadsheet that replaced actual, physical spreadsheets and revolutionized the accounting industry, and, indeed, the computer’s operating system itself, which was essentially Microsoft creating that first Trojan Horse shell and stuffing it full of goodies that changed the face of multiple industries. That shell was created by OEMs, who leveraged Microsoft’s products to produce compelling products that the market lapped up.

Indeed, PC shipments grew at an amazing pace between 1990 and the end of the last millennium, growing nearly four-fold from 24 million to over 113 million units. The following decade saw that growth streak continue until the second half of the 2000s and into the following decade, when smartphones and tablets made their appearance.

During this rapid growth in the PC market, relatively unseen was the growth of Microsoft’s products, mainly because they shipped with these PCs by default. But what most people don’t realize is that during this time, its software products changed the face of several major disciplines.

In a very interesting article from 1997 that was published in the Journal of Accounting and aptly titled, The Power of Spreadsheets, the author, John Lacher, says this:

CPAs who want to use their spreadsheet programs as report writers can apply the new software’s easy-to-use advanced features such as outlining, versions, forecasting, data analysis, importing data and charting to enhance budgeting, business modeling and analysis. And they can program complete applications to improve workflow and workgroup productivity. A controller, for example, can automate a business planning spreadsheet so an assistant with little knowledge of a spreadsheet program can input data and print reports.

Accountants today can’t imagine not having access to Excel, and that’s where Microsoft’s power lies – in slowly becoming the irreplaceable, and then continuing to improve on that until it becomes virtually indispensable to the end user.

Likewise, another article from 2012 about Word, called Has Microsoft Word affected the way we work?, begins with this:

Thirty years after Word was invented, we are no nearer to understanding the impact it has had on writing.

So, did Microsoft actually invent these technologies? Heck, no! They weren’t the first movers on practically anything they did. They always piggybacked or purchased their way into these technology areas, but then they worked on them intensely until they became appealing and highly marketable products.

However, they didn’t stop there. Early on, Microsoft realized that legacy products would soon be phased out by more globally accessible utilities, so their focus shifted to porting their best products to the cloud in the form of SaaS equivalents of the Microsoft Office suite and other business tools.

Importantly, the focal shift from the consumer to enterprise companies was an important milestone in Microsoft’s success story. Without that, they couldn’t have achieved the kind of penetration that their legacy products in their new avatar continue to enjoy.

And it shows in their revenues as well as their profitability, as we’ll see further down this article.

From Then to Now

After Microsoft revolutionized multiple industries, their products became essentials rather than luxuries that only a few could afford. And they rinsed and repeated their formula over and over until their revenue segments started growing in a sustainable way. Although Microsoft couldn’t achieve that kind of dominance in the mobile or smartphone segment, they certainly did it in cloud computing, and they’re now doing it in AI. I’ll discuss an interesting tangential benefit of Microsoft’s failure in the hardware space later on. Surface products are great, but I think they detract from the core growth story.

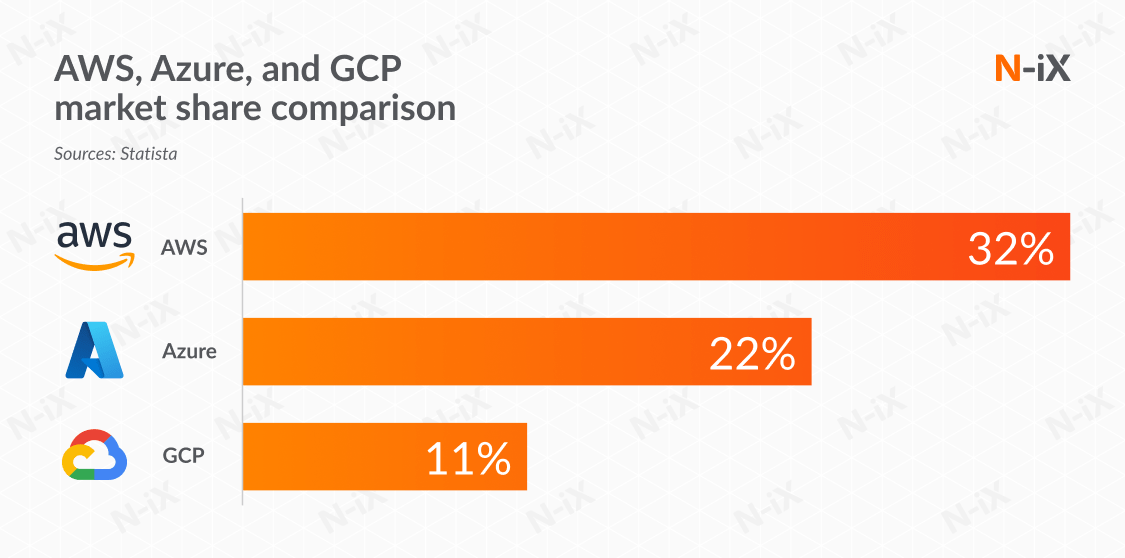

In cloud, Microsoft’s biggest achievement is not just cloud infrastructure but how its developer services appealed to the broad enterprise segment. That’s why it quickly gained more than a fifth of the market and is still considered to be a top-three player in cloud computing.

N-iX

In fact, due to Microsoft’s advantage in terms of migrating legacy Windows, Office, and Outlook, and other products, its enterprise adoption rate matched that of Amazon’s (AMZN) AWS at 75% in 2023 (source linked above image). I believe one of the few reasons AWS’s adoption in the enterprise segment is that high is due to its greater focus on compliance tools. That worked well for Alphabet’s (GOOG) GCP as well, but even Microsoft’s disadvantage there doesn’t seem to have impacted its adoption rate across the enterprise market.

Once again, we see that ‘shell’ or the cloud infrastructure itself has played the role of the Trojan Horse that delivered the company’s core products to the enterprise world. The only difference in this case is that Microsoft owns the Trojan Horse as well as its insides.

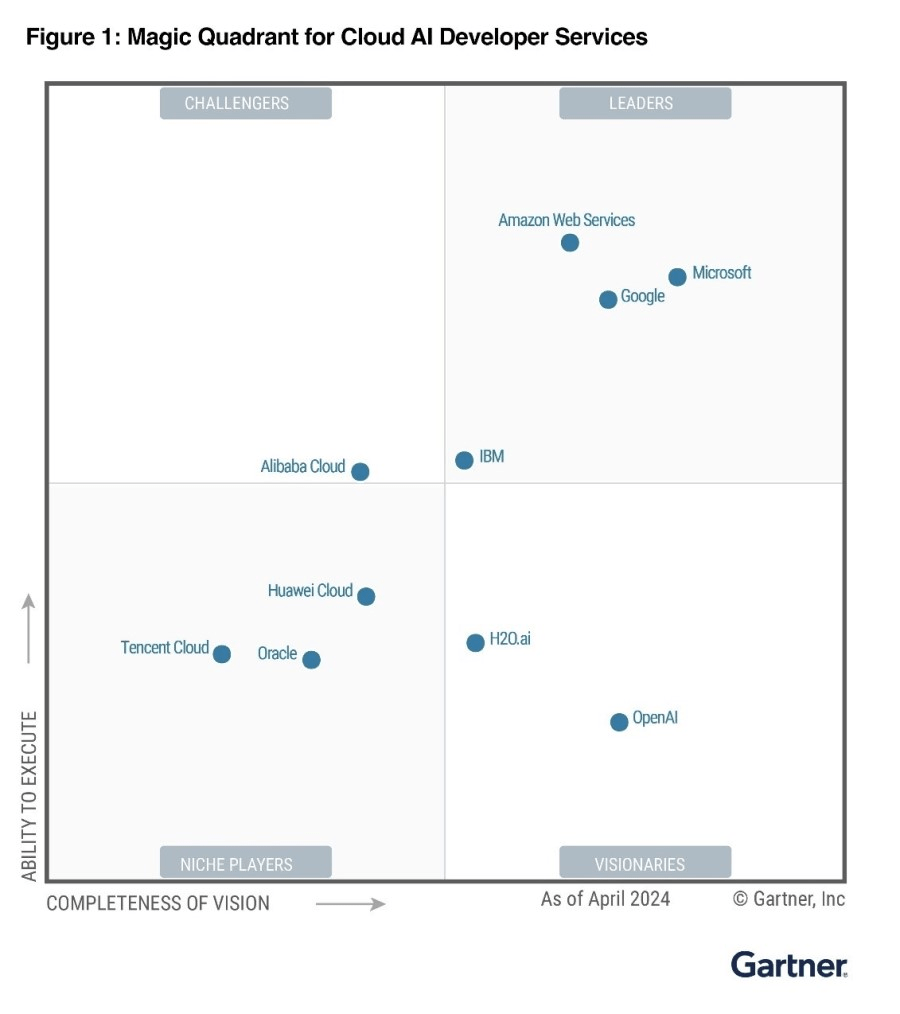

Today, Microsoft’s investments in AI are only starting to pay off, but these revenue streams will continue to grow, in my opinion. According to Gartner’s April 2024 Magic Quadrant for Cloud AI Developer Services, Microsoft is clearly pegged as the leader with the most complete vision for enterprise.

Gartner

Microsoft’s strategic investment in OpenAI, among other investments and acquisitions targeting enterprise users, was an astute move to gain first-mover advantage, and that’s showing up in terms of growth. On the Q3 earnings call in April 2024, the word “copilot” was used more than 40 times and “AI” nearly 80 times! Microsoft Cloud was the biggest beneficiary of that development with an important milestone of hitting $35 billion in revenues for the quarter, with an impressive 23% growth rate.

Of course, not all of that can be attributed to AI-related revenues, but it’s clear that what the company revealed on its earnings call point to future revenue growth in AI-based revenues – again, the inside of the Trojan Horse that is its Azure Cloud infrastructure. Here’s a quick rundown of revenue growth opportunities and data points that support this (directly quoted from the Q324 call):

Microsoft Copilot and Copilot stack, spanning everyday productivity, business process, and developer services, to models, data, and infrastructure, are orchestrating a new era of AI transformation, driving better business outcomes across every role and industry.

More than 65% of the Fortune 500 now use Azure OpenAI Service.

All-up, the number of Azure AI customers continues to grow and average spend continues to increase.

We also saw an acceleration of revenue from migrations to Azure.

Arc now has 33,000 customers, up over 2X year-over-year.

That’s just from their Intelligent Cloud segment. The discussion around AI-based revenues practically dominates the entire call, and I urge you to please read the earnings transcript that I’ve linked above. It’s an eye-opener for anyone invested in or looking to invest in Microsoft.

As for historical data, we now need to prove beyond reasonable doubt that Microsoft’s revenues from these Trojan Horse initiatives have been ‘sticky’, and that’s not too hard, in my opinion.

Is There Evidence of ‘Sticky’ Revenues to Validate This Thesis?

Yes, absolutely! I dug up Microsoft’s 1996 Annual Report’s financial highlights, and I found these nuggets:

This was a defining year for Microsoft, and our 21st consecutive year of growth in both revenues and profit.

For the fiscal year ended June 30, 1996, revenues totaled $8.67 billion, a 46% increase over the $5.94 billion reported last year.

The OEM channel closed the year at a record $2.5 billion, an increase of 52% over the previous year.

While this doesn’t specifically reveal recurring revenues, we can logically glean that a chunk of revenues were from license renewals and upgrades to newer versions of Windows, Office, and other standalone products like Excel, Word, etc.

Microsoft used the time-tested strategy that Apple (AAPL) also follows to this day, but in a slightly different form. Essentially, the approach involves stopping key support and security updates for legacy products so users are incentivized to upgrade to the latest version, which of course entails a license renewal or upgrade fee. Apple does that with iOS versions to push newer hardware out the door. Anecdotally speaking, I still have the original iPad, but it won’t let me get past iOS 5.1.1. That forced me to upgrade to newer and newer versions of the tablet just to make sure I can get the most up-to-date apps that I regularly use. And what are those apps? Outlook, Excel, Word… you get the picture.

With the advent of SaaS and Microsoft’s migration to cloud products and services, those recurring revenues took on the new avatar of subscriptions. Even better! Users were now locked in to products and services that they automatically renewed just to maintain continuity in their operations, and since most of Microsoft’s offerings were mission-critical to these enterprise users, those recurring revenues only became stronger with time.

More than 20 years after that 1996 earnings report, Microsoft was openly touting its focus on recurring revenues. Here’s an excerpt from the 2018 10-K filing:

We are focused on improving our financial performance by executing upon identified strategic initiatives and further evolving our business toward recurring revenue models, which are positioning us for increased future revenue and profitability growth. Recurring revenue represented 71.4% , 72.5% and 69.6% of total revenue in fiscal years 2018 , 2017 and 2016, respectively.

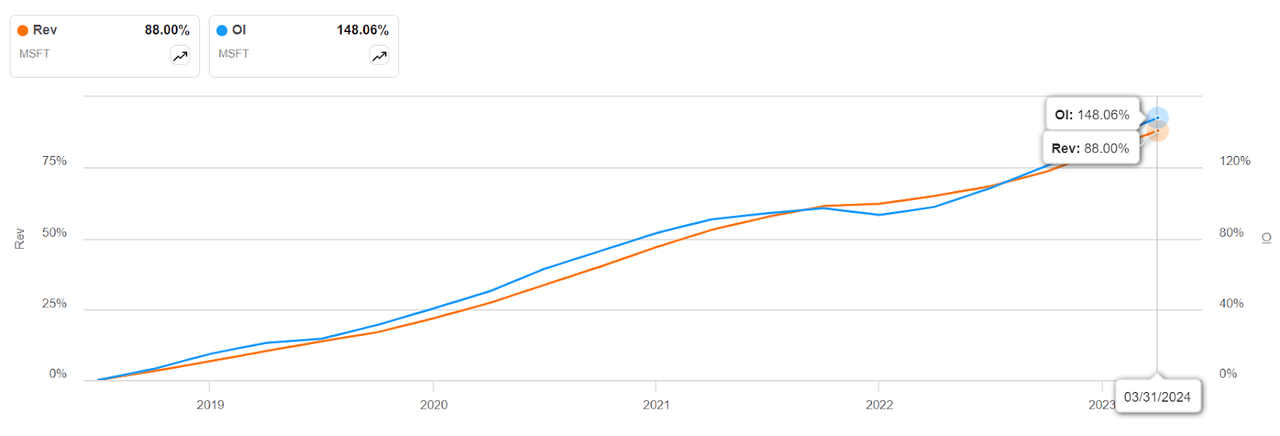

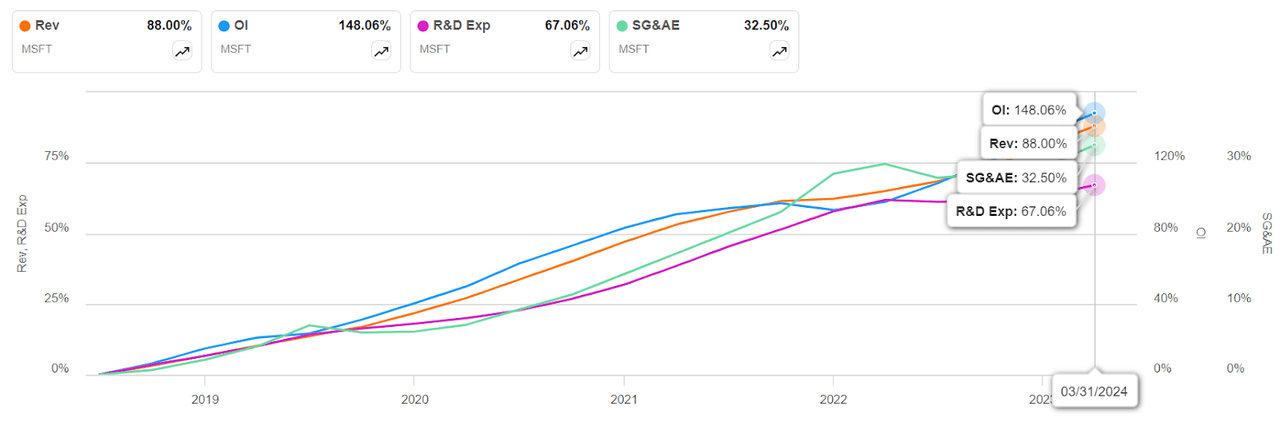

Interestingly, the use of the word “recurring” tapers off in Microsoft’s 10-K filings as you get into 2019 and beyond. Nevertheless, we can see from the rapid growth in operating income vs net revenue since that time that there’s significant leverage coming from recurring – and growing – revenues, because cloud-based products and services typically cost much less to deploy on a per user basis as your top line grows. That’s SaaS 101, and Microsoft is clearly a master of recurring revenues, even though they don’t report that metric anymore.

SA

What to Expect in the Next Decades?

That’s my proof that the Trojan Horse strategy has worked exceedingly well for Microsoft over decades, and it will continue to grow now that the key focal point is on revenues that are repeatable in nature, quarter after quarter, year after year.

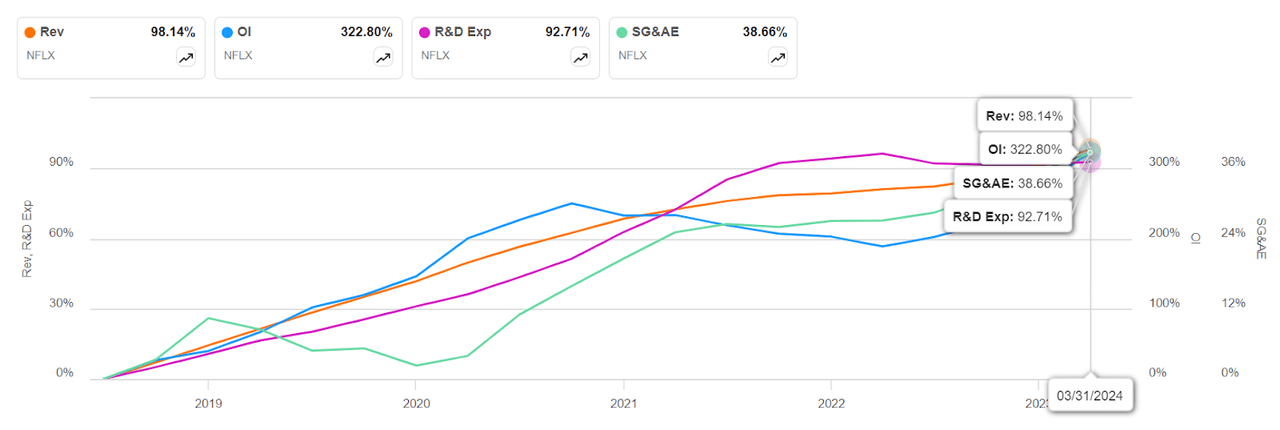

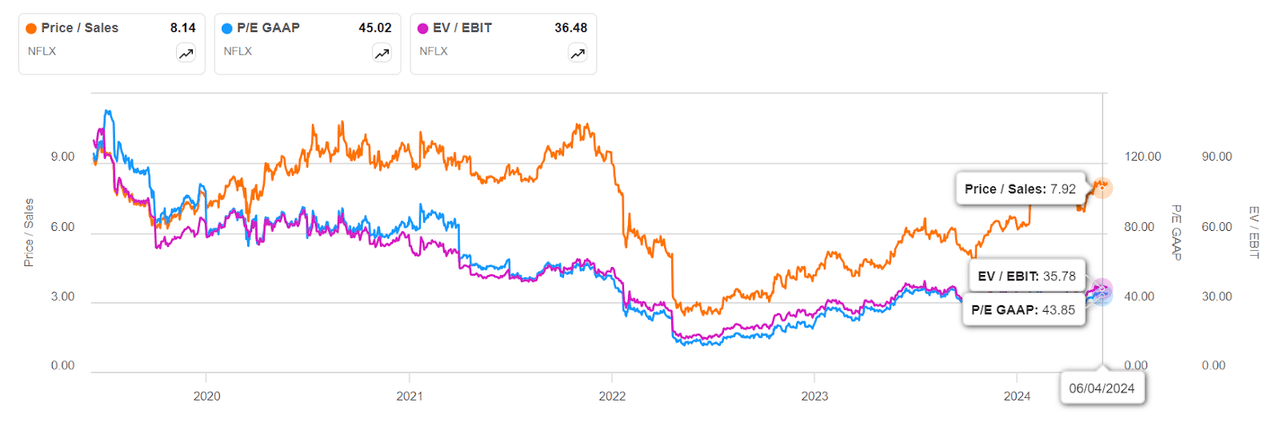

Many investors have slammed Microsoft for not successfully penetrating the hardware space like Apple did, but consider this: the absence of non-sticky hardware revenues has been a blessing for Microsoft and a curse for Apple. That’s why Apple is now aggressively trying to build its Services revenues – they offer higher ops margins because it costs increasingly less to distribute a service to more numbers of users. Look at how Netflix (NFLX) enjoys this operating leverage. For that reason alone, I see Surface products and their success as blocking the path to true, profitable growth.

SA

Luckily, Microsoft doesn’t have Apple’s problem in any area other than cloud infrastructure, where it has to make hard opex and capex investments; and, perhaps, Surface. Nevertheless, that’s fully diluted by the quality of its revenues, which is why I said before that this is the crucial consideration for an investment case, as far as I’m concerned.

To drive that point home, here’s a look at how Microsoft’s R&D and SG&A expenses have grown over the last five years. You’d expect them to stay in tandem with revenue growth, but they’re actually growing at a much slower pace. That’s where that operational leverage is coming from.

SA

In summary, investments like Microsoft can’t be seen as short-term or even medium-term plays. This is a generational investment that can be part of your legacy. That’s not to say it doesn’t come with associated risks. For instance, the constant high valuation; but, even there, you can see that the stock is very reasonably priced compared to its pre-2022 historical levels.

SA

To me, that minimizes the risk even further, but only if you look at its future business prospects from the perspective of the lens I’ve shown today. From that perspective, the current price is a steal, because the numerator on those multiples are only going to go up, and because revenues and earnings are also growing, that translates to higher stock prices. Worst-case, even if these multiples remain at these levels, the denominator of MSFT’s enterprise and equity multiples is going to continue to increase, offering greater value and thereby, once again, pushing the stock price up as investors rush in to fill that gap.

As AI translates into real-world revenues, Microsoft, with its Trojan Horse strategy where the insides are more valuable, will march on regardless of whether or not AI companies actually bring cash down to their respective bottom lines. I love the fact that its current revenues are largely immune to that element. Even if companies start spending less on AI initiatives over time, which I highly doubt, Microsoft will still be holding on to significant recurring cash flows.

I’ll say it again. We have to recognize that this AI frenzy will eventually find an equilibrium and Microsoft’s tremendous growth from these initiatives is likely to slow down, but remember what Microsoft will be left with – recurring revenues!

That’s my investment case for Microsoft, and anyone who has the vision to acknowledge the ‘hidden in plain sight’ / ‘Trojan Horse’ evidence I’ve shown today will be all the richer for it, as will their kids and grandkids.

The risk here is as minimal as it gets. Unless there’s a major pivot away from AI in the far future, which I see as an extremely remote possibility, Microsoft’s recurring revenues and the growth they’re currently experiencing that keeps adding to those recurring figures mitigate nearly all the risk of owning MSFT stock.

And I haven’t even touched on the growing dividends; perhaps in a future article on this tremendous force that is Microsoft.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.