Summary:

- The third quarter results were not that bad. Compared to 3Q23, Ardmore realized higher revenue, EBITDA, and EPS.

- According to the company’s estimates, an additional $10,000 per day equals an annual increase of about $2.25 in EPS increase and nearly $100 million in FCF growth.

- As of November 06, Ardmore holds $47.6 million cash and owes $30.0 million total debt. Its Total Debt-to-Equity ratio is 8.1%.

- Ardmore is a good deal at 57% PNAV and 9.0% dividend yield. Dividend safety is insured by a low break even and deleveraged balance sheet.

rgaydos

Note: I previously covered Ardmore Shipping (NYSE:ASC) in October. In my last note, I discussed the company’s fleet, product tanker market, and financials. I was not excited about average dividends and a lack of buybacks. At that time, Ardmore traded at 73% PNAV. Despite the discount to NAV, I gave it a Hold rating.

Today, I reviewed 3Q24 report, the product tanker market, and the company’s rating.

Introduction

In my previous take on Ardmore, I shared my expectations for 3Q24 figures. Here is a quote from my article on 2Q24.

That said, I anticipate declining revenue and profit for 3Q24. The next earnings report will be published on November 06. I expect EPS in the $0.50/$0.55 range. The analyst’s consensus is for $0.61 adjusted EPS. If my expectations become fact, the ASC share price may fall further.

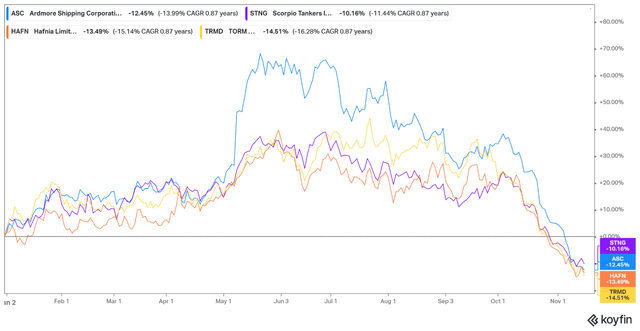

ASC reported 3Q24 EPS, aligned with my expectations, at $0.55/share. For the second quarter of 2024, the company reported $1.47 adjusted EPS. The company’s shares follow up on the declining EPS. Nevertheless, all tanker stocks suffered in the last few months.

Koyfin

Clean tanker erased double-digit YTD gains in a matter of weeks. So, is it time to enter the market?

Ardmore seems like an attractive way to bet on rising tonne mile demand for product tankers at a 45% discount to NAV.

Ardmore fleet

Ardmore remains the only tanker enterprise focused on MR tankers. It owns 16 MRS and 6 Chemical tankers; its average fleet age is 10.1 years. In the last few quarters, the company took active measures to upgrade its fleet. Now, nearly 50% of its MR fleet has scrubbers. Besides that, in 2Q24, ASC reported the delivery of a 2017 Korean-built MR tanker, Ardmore Gibraltar.

The main driver of EPS contraction was the seasonally weaker day rates. QoQ fleet-wide TCE dropped from $37,762/day to $26,471/day in 3Q24. For the last quarter of 2024, 50% of its MR fleet was booked at $25,000/day, and 55% of its chemical fleet was employed at $25,150/day.

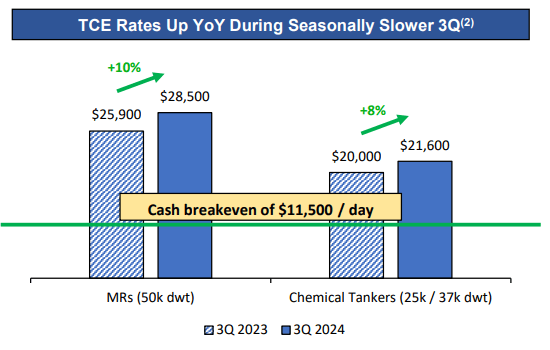

Two positives are worth mentioning: YoY growth in day rates and declining breakeven cost. The image below from 3Q24 presentation shows TCE for 3Q23 and 3Q24.

ASC 3Q24 presentation

Compared to 3Q23, ASC reported 10% MR TCE growth and 8% TCE growth for chemical tankers. These figures imply that a long-term bull trend is intact. ASC reported an $11,500/day breakeven. Since 2019, it has reduced its breakeven by 30%.

FY25 the company scheduled its chemical fleet for 5Y regular docking. In its 3Q24 call transcript, Ardmore shared its intentions to upgrade the tank coating of its chemical tankers. The goal is to improve flexibility in choosing the cargo.

During 2Q24 and 3Q24, the company completed all scheduled dry docking for 2024. Scrubber installations have been a priority. As part of its $26 million program, ASC spent $15 million on CAPEX.

3Q24 review

The third quarter results were not that bad. Compared to 3Q23, Ardmore realized higher revenue, EBITDA, and EPS. The QoQ decline is driven by seasonal weakness, not a long-term bear trend.

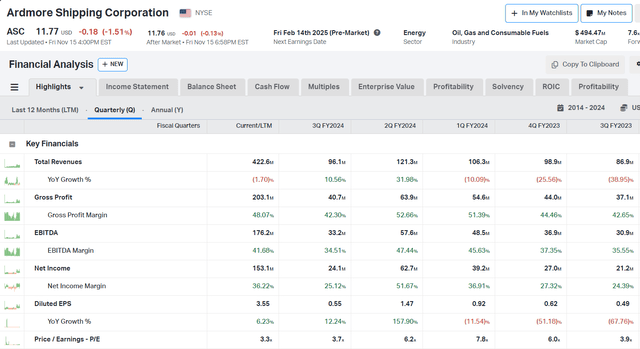

Let’s look at ASC highlights for 3Q24.

Koyfin

YoY revenue increased by 11% and EBITDA by 7%. Operating expenses remained stable YoY. For 3Q24, ASC reported $14.0 million, and $14.4 million was spent on 3Q23. EPS increased by 12.2% YoY to $0.55/share in 3Q24.

Ardmore reported growing FCF compared to 3Q23. For 3Q23, it declared $35.8 million vs. $38.6 million for 3Q24. According to the company’s estimates, an additional $10,000 per day equals an annual increase of about $2.25 in EPS increase and nearly $100 million in FCF growth.

The tanker market is entering a seasonally strong period. I anticipate improved day rates for the next two quarters. MR tanker rates may increase to $35,000-$40,000/day.

As of November 06, Ardmore holds $47.6 million cash and owes $30.0 million total debt. Compared to its peers, the company has the most deleveraged balance sheet. Its Total Debt to Equity ratio is 8.1%.

Ardmore distributes nearly 30% of its EPS in quarterly dividends. For 3Q24, it announced $0.18 distribution per share. Following the latest price decline, the yield approaches 9.0%.

I miss an attractive buy-back program. Ardmore’s price drop is an excellent opportunity to purchase some shares. ASC trades at 57% PNAV. Given the company’s low debt levels, strong cash position, and attractive valuation, a buyback program should be on the agenda for the following quarters.

Valuation

Tanker stocks are, again, cheap. All product tanker owners trade at a >30% discount to NAV. Based on PNAV, ASC is cheap, too.

Inputs for the NAV equation are:

- Fleet replacement value: $815 million

- Current assets: $132.8 million

- Total Liabilities: $58.8 million

- Total Debt: $30.0 million

- Market Cap: $502 million

- Total Outstanding Shares: 42.0 million

ASC’s NAV per share is $21.16. The current stock price of $12.03 results in 57% PNAV. This valuation is comparable to Scorpio Tankers. STNG trades at 54% PNAV. The Dividend Kings, TORM plc (TRMD), and Hafnia (HAFN) command higher multiples, 74% PNAV and 62% respectively.

In summary, all product tanker stocks are a good buy. Of course, a further decline in those prices is not impossible. That said, do not go “all-in;” instead, build a position gradually.

Product tanker market review

MR tanker market is still attractive. The percentage of aging ships is higher than the order book. Below is a quote for Ardmore’s latest call about product tanker market fundamentals:

In contrast, the current order book delivering over the same time period represents only 15% of the fleet. So, the aging fleet is more than 3x of the current order book. For the product tanker order book overall, it’s important to reemphasize the lack of Aframax crude tanker newbuildings as well as the fact that LR2s are coated tankers of the same size and can operate in the same trades. That means that as the Aframax fleet shrinks, a portion of these LR2s will operate in crude trades to make up the shortfall.

The supply dynamics support a long-term bull trend in MR day rates. Refining capacity is the prime driver of clean tanker day rates. The capacity East of Suez is growing, while in the West, it is declining.

Geopolitics also play an essential role. The ongoing conflict between Russia and Ukraine, coupled with the EU embargo on refined products, has reshuffled the supply chains for refined products.

Recent TCE weakness was not propped only by refinery maintenance. Due to declining dirty day rates, crude tankers were cleaned up and used to transport clean products. VLCC and Suezmax tankers absorbed part of the tonne miles demand for product transportation.

In the long term, swing costs between dirty and clean are not economically viable. So, I expect dirty tanker owners to return to their regular operations, thus reducing the supply of available tankers.

Restarting refining capacity will also positively impact tonne-mile demand. That said, I anticipate higher day rates for clean tankers in the coming quarters.

Risks

As discussed, I anticipate robust rates in the first half of 2025. Nevertheless, I could be wrong. In the case of the Chinese recession, tonne mile demand for clean tankers will suffer for longer. Another adverse scenario is a global economic crisis. Even then, Ardmore’s financial risk is at a minimum. Given the company’s break-even below $12,000/day, ASC can weather a decline in day rates below $15,000/day. The $47.6 million cash is an additional buffer for rainy days.

Investors Takeaway

Last time, I gave Ardmore a Hold rating. The reason is the opportunity cost. The pullback in tanker stocks made the segment cheap again. In other words, there are many opportunities to choose from.

A month ago, Ardmore was not the most appealing. Since then, its price has dropped by another 20%, resulting in higher yields and cheaper valuation. Therefore, I give ASC a Buy rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.