Summary:

- Ardmore Shipping’s stock is fairly valued at around $17-18, with no strong potential for long or short positions at current levels.

- ASC’s solid financial position and zero debt strategy are notable, but poor capital allocation and modest shareholder returns are concerns.

- Increased product tanker orderbook and grimmer demand outlook make me less optimistic about future rates, despite a potential near-term spike.

Bjoern Wylezich/iStock Editorial via Getty Images

Ardmore Shipping (NYSE:ASC) is a product and chemical shipping company specializing in the ownership and operation of small vessels. The ASC fleet consists of 22 owned tankers (18 MR and 4 handy size) and 4 operated vessels through charter agreements.

I have covered Ardmore Shipping previously, issuing an initial buy rating at $13.68 until $22.22 with a short recommendation. Investors should view this as an update to my previous articles on the company, where I provided an extensive business overview. I concluded the last article with this prediction:

Moreover, last year there was a very profitable similar setup when Ardmore Shipping briefly traded above NAV, but in the following months, it lost more than 30%. While I’m not expecting such a decline, I wouldn’t go long at this valuation. I could consider initiating a short position to hedge other tanker positions, such as Okeanis (ECO) or Tsakos Energy Navigation (TNP).

Indeed, the company followed the same pattern as last year and since then, the stock has fallen around 25%. As we approach the tankers’ strong season, I believe it is time to review Ardmore Shipping again. I still wouldn’t consider a long position; however, I believe that a short position is no longer prudent.

Another important factor is that, on July 8, the company announced that the CEO Anthony Gurnee will retire and Gernot Ruppelt, the CCO, will succeed him. It is too early to assess whether this will have positive changes in the future, such as improved shareholder returns.

Product Tanker Overview

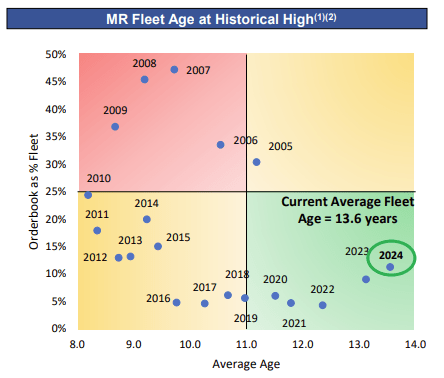

As mentioned in previous articles, the product tanker order book has been increasing and currently represents 17.5% of the total fleet. For comparison, one year ago was 9% of the fleet. Despite there being an important need for fleet renewal due to the aging vessels, this huge increase will impact future earnings.

Q2 presentation

Moreover, in the last few months many crude tankers have shifted to the clean trade, increasing supply and suppressing rates.

On the demand side, product tankers experienced an important boost due to Red Sea disruption. While I don’t expect a near term resolution, it will be difficult to see further benefits from this front. Moreover, recently refinery margins have been under pressure leading to Chinese refinery bankruptcies.

Despite expecting that most of the crude tankers transporting clean products will shift back to crude shipments in the coming months, increasing rates during the strong season. The increased order book along with the grimmer demand picture, makes me much less optimistic regarding future rates than a few months ago.

Financial Position & Stock Valuation

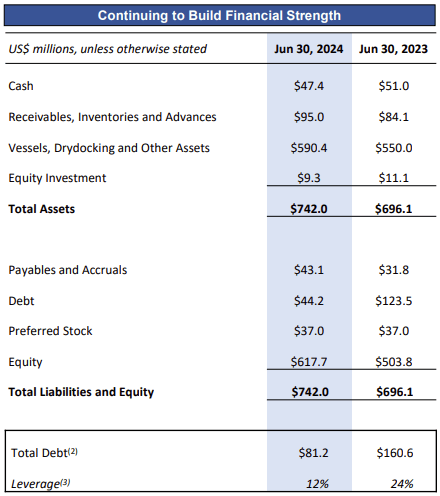

Ardmore’s financial position is rock solid. However, I consider this to be a poor capital allocation. Considering the receivables and payables, Ardmore Shipping has $18 million in net cash.

Q2 presentation

A shipping company with owned vessels and net cash is something out of the ordinary. Typically, vessels are leveraged to increase returns and improve profitability. To further aggravate the situation, management did not disclose the company’s future plans with such a strong balance sheet, and shareholder returns are modest, with just one-third of earnings as dividends. However, the intention to approach to zero debt could be an advantage in a prolonged bear market, which I do not expect.

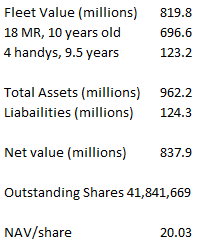

Besides the capital allocation, an important factor in valuing the company is to calculate the NAV. I will use the same methodology as in the past, using Arctic asset values and Q2 figures:

Author

Currently, the stock trades at around 0.85 times NAV. This discount is the main reason I won’t short the stock anymore; however, I do not see any appeal in going long. I believe that the company is fairly valued at around $17-$18. At current valuations, I would favor the peers who pay out most of their earnings as dividends and have similar valuations. For example, Hafnia (HAFN) trades at a similar valuation and pays out around 80% of its earnings as dividends, while d’Amico (OTCQX:DMCOF) trades at a larger discount and aims to pay out around 50%.

If product tanker rates follow the usual seasonal patterns, they should start to increase this month. Such an increase could generate some momentum and rerate the stock higher. Additionally, although I don’t understand why, Ardmore typically trades at a slight premium compared to its peers, which could still justify a slightly higher valuation.

Risk

There are several risks that could affect Ardmore Shipping. At a company-specific level, the main risk is management’s desire to grow the fleet. In the past, management has stated growth as one of the main priorities. However, at least until now, they haven’t increased the fleet.

At a more general level, I see two main risks. In the short term, the most important risk is a weaker-than-expected strong season, which would impact sentiment and likely push the stock lower. In a longer-term horizon, the main risk is a global recession or a slowdown in growth, which would decrease demand and reduce rates.

Conclusion

Ardmore Shipping has a rock-solid balance sheet. However, it only pays out one-third of earnings to shareholders as dividends and management has not provided a clear explanation of their future plans.

I consider the current valuation fair, and I do not see much potential for either a long or short position. A near-term spike in rates could benefit the stock; however, I see more downside than upside potential given the grimmer outlook after the strong season.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.