Summary:

- ASC operates 26 vessels, including 20 MR and 6 chemical tankers, with a market cap of $720 million.

- The global refinery market is becoming more polarized and supportive of high shipping rates. I believe the market has plateaued, and the current environment is sustainable.

- The company is continuing to drive down its cash breakeven level to ensure long term success.

- The balance sheet is in terrific shape with a net positive cash position.

- I rate ASC as a BUY.

HeliRy

Thesis

Ardmore Shipping Corporation (NYSE:ASC) has three key attributes that warrant a BUY rating.

First, the company is operating in a fundamentally advantaged shipping market for refined petroleum products. This allows the company to enjoy large operating margins.

Second, the high levels of cash generation allow the company to pay a large (although variable) dividend as well as reinvest in the business to drive down breakeven costs.

Third, these efforts have resulted in a net cash positive balance sheet and are improving the long-term profitability of the business.

Due to structural changes in the global refining industry, I believe these operating margins are sustainable for the long term, making ASC an attractive investment option.

Introduction To ASC

ASC is a small-cap maritime company that operates 26 tanker vessels. 20 of these vessels are clean petroleum product vessels of the smaller MR class and built between the years of 2013 and 2017. The company also has four 25,000-ton and two 37,000-ton chemical tankers. The ASC’s fleet is middle-aged with an average age of roughly 10 years.

The company operates predominately in the spot market, which can cause somewhat large swings in revenue and profitability. However, the current market for shipping services of refined products such as gasoline, diesel, and jet fuel is extremely tight, leading to excellent margins.

The Clean Product Trade Is Producing Historic Operating Margins

Since the onset of the COVID pandemic, the global refining industry has undergone a structural change in the geographical locations of supply and demand. Initially, the pandemic put downward pressure on refining margins as global economies contracted rather abruptly. This caused older, low-margin refiners to close, reducing global refining capacity rather significantly.

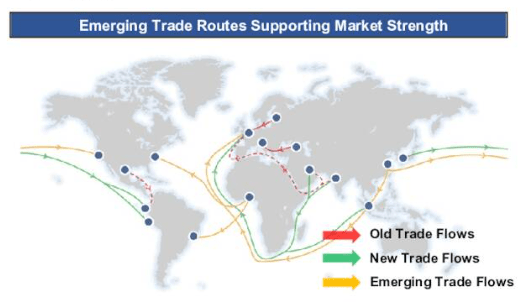

The bulk of these refinery closures occurred in developed nations in North America, Europe, and Australia. Shortly thereafter, newer refineries began to emerge in places such as China, the Middle East, and Africa. The supply sources shifted further away from key demand hubs, requiring more shipping services to keep the supply chains intact.

Finally, geopolitical events such as the Russian invasion of Ukraine and the Houthi rebel attacks in the Red Sea have disrupted normal trade routes, requiring longer journeys between suppliers and customers.

Global Shipping Routes (ASC Investor Presentation)

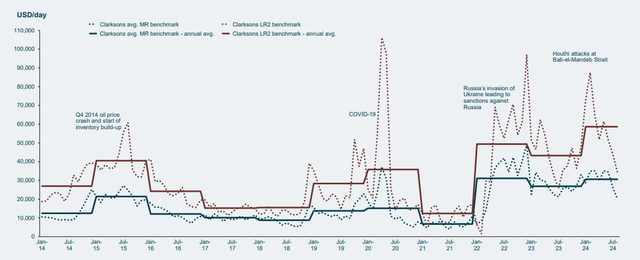

All of these events have resulted in a structurally enhanced market for shipping services, creating a new baseline for profitability compared to the last decade.

LR2 and MR Charter Rates (TRMD)

The increased profitability created by today’s market has drawn in competition from both crude tankers shifting into the clean product trade. as well as incremental new builder orders to support future growth in the industry.

These two factors have caused some investors to believe we are at a market peak and that there is a large risk in chasing the extremely high yields offered by the sector.

I, however, do not fully agree. While I believe we are likely at or near a top in shipping rates, I view the current market as at a plateau versus a peak.

New refineries in Africa and the Middle East are still in their ramp-up phase, which will likely continue through the first half of 2025. Coincident with this ramp, declines in European produced volumes are expected as multiple refineries are scheduled to close or reduce output in 2025. This will cause the global refining market to further polarize, benefiting clean product shippers.

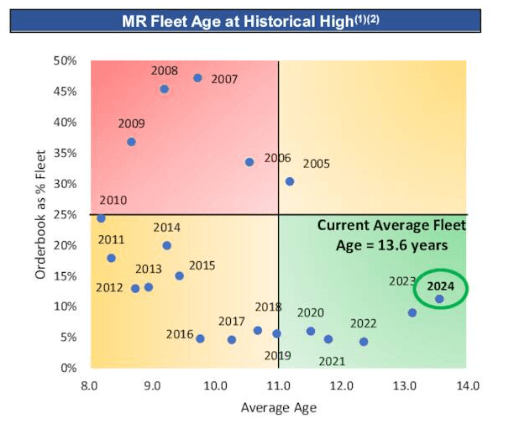

Despite concerns of a potential oversupply in the product tanker fleet, the majority of new build capacity stems from deliveries in the larger LR2 class. The order book for MR vessels remains healthy, with only 11% of the total capacity contracted for construction in shipyards. This is in sharp contrast to the LR2 class which currently has 36% of its fleet size under construction.

ASC Investor Presentation

Further, even if the conflict in the Middle East is resolved, the MR class had little exposure to the Suez Canal route before the conflict. In the Q1 conference call, CEO Anthony Gurnee detailed how only 5% of MRs actually took this route.

Prior to the Red Sea disruption, 20% of the LR fleet transited the Suez Canal and contrast to just 5% of the MR fleet.

If peace is eventually achieved, and the Suez trade route becomes trusted once again, the downward pressure may have only a marginal impact on MR vessel rates.

Strong Cash Flows Even After A Retraction In Rates

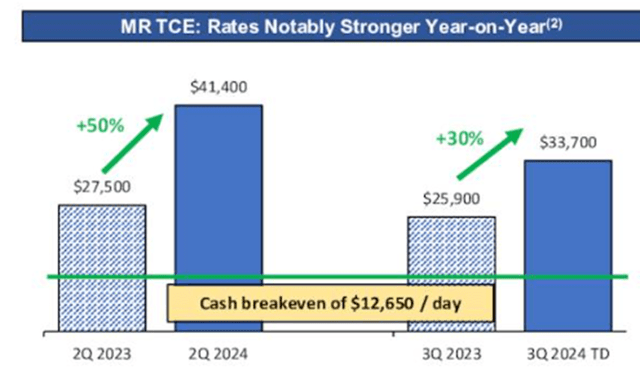

Q2 was one of the best quarters to date for shipping rates. Q3 took a step back but is still significantly higher on a YoY basis. The current rate yields an operating margin of over $20,000/d per vessel which is extremely attractive for investors.

Operating Margins (ASC Investor Presentation)

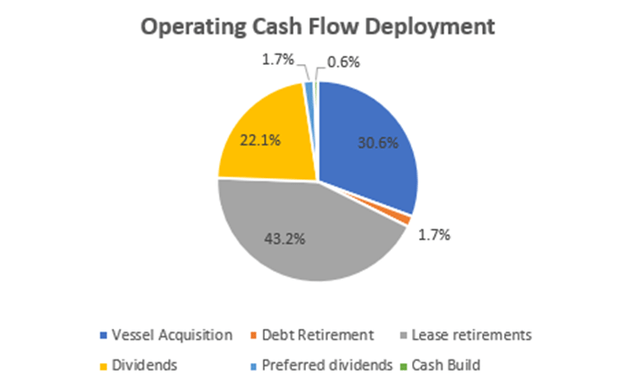

From this advantaged position, ASC has taken a balanced approach to cash deployment. While still rewarding shareholders with an annualized yield of 8%, the company has also deployed capital to refresh its fleet with the purchase of the Ardmore Gibraltar, a 2017 Eco-Design MR vessel. The company sold off a 2013-built vessel to partially pay for the Gibraltar vessel.

The balance of its cash generation has been deployed to retire sale-leaseback contracts on the Ardmore Seawolf and Ardmore Seahawk vessels. These purchases closed on June 25th and present the opportunity to reduce its lease expenses which are currently costing the company $10 million annually.

The company still has three vessels on sale-leasebacks through September 2025. Unless ASC can again extend these agreements, I expect these commitments will command the bulk of free cash flow over the next year to have the vessels repurchased.

Cash Flow Deployment By Type (ASC Q2 6-K Form)

Balance Sheet Review

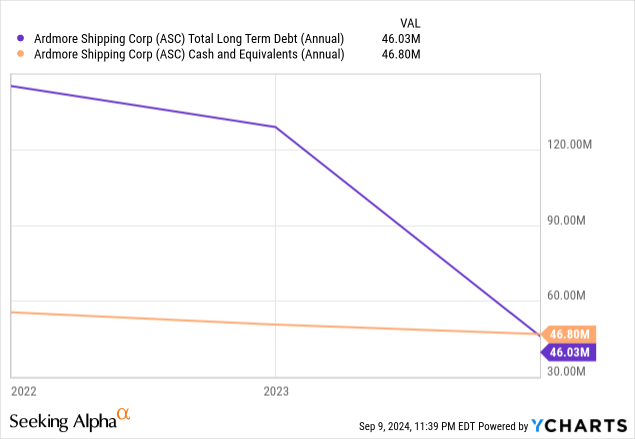

ASC’s balance sheet is in fabulous shape. The company has used the upturn in rates to aggressively retire debt and now sits in a net positive cash position. This allows the company to operate from a position of strength and has dramatically reduced its cash breakeven rate.

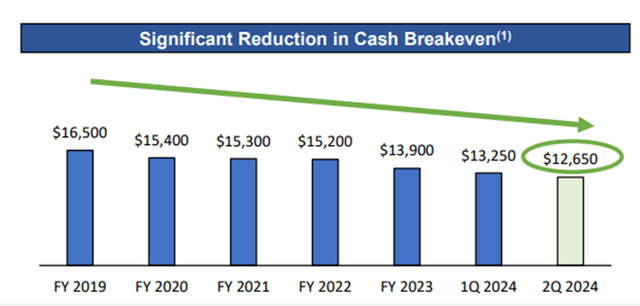

Since 2022, this debt reduction effort has allowed ASC to drive its operating breakeven down by 17%. The company’s long-term goal is to get below $11,500/d through the retirement of lease commitments and further debt reductions.

Cash Breakeven Rates (ASC Investor Presentation)

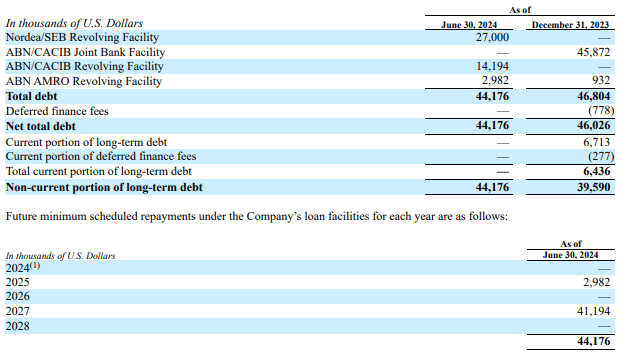

While the company is deploying free cash flow to improve the balance sheet, the global financial market may prove to be just as much help to improve ASC’s operating structure. All the company’s debt has floating interest rates. Therefore, as interest rates decline, the company’s interest expense will follow suit.

ASC Debt Portfolio (ASC Q2 6-K Report)

The next maturity in ASC’s portfolio is a mere $3 million due in 2025. The remaining debt does not mature until 2027. By retiring the 2025 notes with cash on hand, reduced lease expenses, and falling interest rates, a breakeven level of $11,500/d seems easily achievable.

Dry Dockings: A Curse And A Blessing

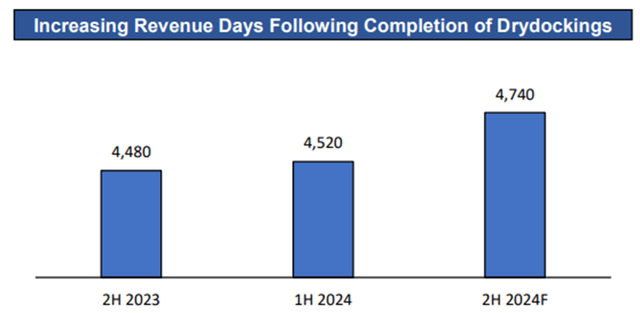

For the remainder of 2024, ASC is complete with all drying dockings. This will increase the total working days of its fleet by 5% in the second half of the year. This will improve both the top and bottom lines to finish the year.

Operating Days (ASC Investor Presentation)

However, 2025 will be a busy year in the drydocks for ASC’s fleet. Seven of the company’s 26 vessels will undergo drydocking, resulting in higher capital expenses and lost revenue. ASC plans to use this as another opportunity to create long-term value for the company.

The company plans to outfit four vessels in 2025 with scrubber units to improve emissions. The company has also partnered with Value Maritime to outfit its vessels with carbon capture and filtration units.

Normally, emission improvements are not associated with improved financial performance. However, in 2025, all vessels that dock in Europe will see the introduction of carbon permit expenses. The EU’s Emission Trading System will begin charging for carbon permits based on 40% of total emissions in 2024. In 2026, this measure will rise to 70% of emissions in 2025 before reaching 100% in 2027.

Carbon costs are generally a pass-through cost from the shipper onto the customer, so it’s not an item that is readily seen on the company’s cash flow statements. However, by outfitting the ASC vessels with emission-reducing equipment, it can provide a cost advantage for its customers and potentially secure higher rates in return.

Valuation

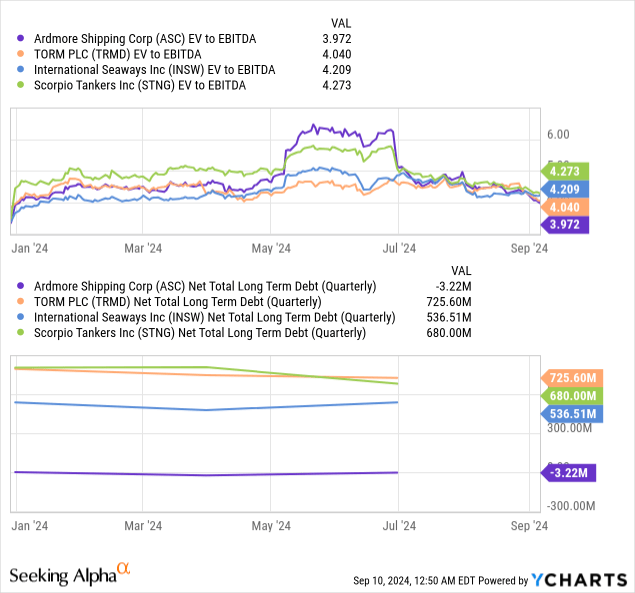

ASC trades generally in line with its larger peers, but it does slightly edge out of the competition. However, ASC has by far the best debt position of the four companies listed. This means all the cash generated by the business is either reinvested or distributed to shareholders.

I believe this gives ASC a slight edge for long-term value creation over its peers.

Risks

From an operational perspective, I am bullish on the product tanker sector. In addition, ASC has a solid dividend and a great balance sheet. Therefore, I don’t have a lot of concerns from a performance perspective.

However, on August 30th, the company filed a $500 million mixed securities shelf. Comparing the size of this filing compared to the company’s market cap raises a few question marks.

The funds could be used for various accretive opportunities such as new vessels or the acquisition of a peer. However, changes in share count tend to cause rapid fluctuations in share price and may also impact the company’s current dividend policy.

Ultimately, the uncertainty created by this move leads me to only rate ASC as a BUY. Otherwise, I feel the business fundamentals and balance sheet are deserving of a higher rating.

Investor Key Takeaways

1. The global refinery market is becoming more polarized and supportive of high shipping rates. I believe the market has plateaued, and the current environment is sustainable.

2. ASC has a moderate dividend for the shipping industry but reinvests the majority of its free cash flow back into the business.

3. The company is continuing to drive down its cash breakeven level to ensure long-term success.

4. The recent announcement of a $500 million offering introduces some uncertainties that should be monitored.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.