Summary:

- Among the tanker companies I have researched so far, Ardmore Shipping is the only player exposed to the chemical market.

- Another important element that differentiates ASC from other tanker operators is its net cash balance, which represents ~5.0% of its current market capitalization.

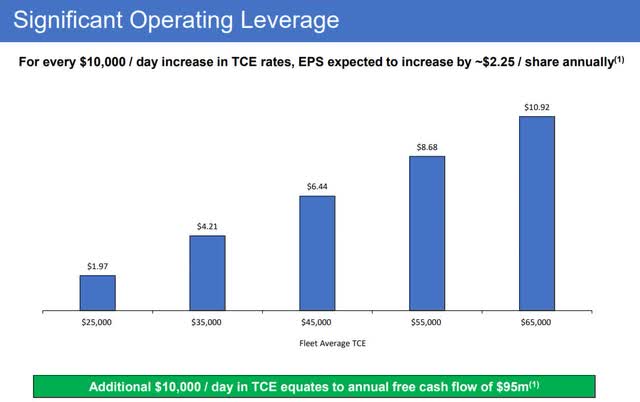

- According to management, Ardmore would generate earnings per share of approximately $1.97 using charter rates of $25,000 per day, which is roughly in line with what was reported in Q3.

- Relative to the current share price of $11.30, earnings per share of $1.97 would translate into an earnings yield of ~17.4%.

MenzhiliyAnantoly

Description

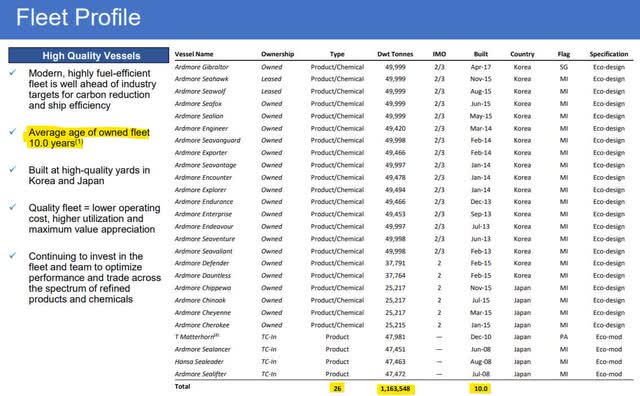

Ardmore Shipping (NYSE:ASC) operates a fleet of 26 product tankers, including four chartered-in vessels. The portfolio includes 20 Medium-Range (MR) tankers with capacities between 45,000 and 50,000 DWT and six IMO 2 chemical tankers with capacities between 25,000 and 40,000 DWT.

Fleet Overview (Ardmore Shipping Q3-24 Presentation)

Among the tanker companies I have researched so far, Ardmore Shipping is the only player exposed to the chemical market. As a reminder, Teekay Tankers (TNK), Nordic American Tankers (NAT), and Okeanis Eco Tankers (ECO) operate exclusively in the crude oil market. Scorpio Tankers (STNG) is on the other end of the spectrum, with a fleet exclusively focused on the refined product market. Finally, International Seaways (INSW) is characterized by its diversified portfolio, ranging from Very Large Crude Carriers (VLCC) to small MRs transporting refined products.

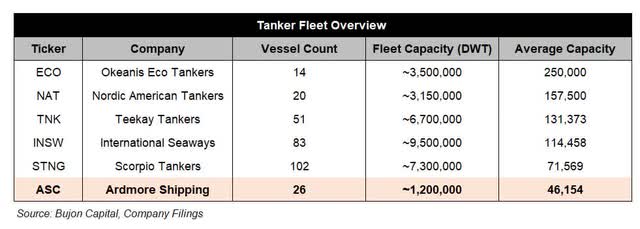

As illustrated in the table below, Okeanis Eco Tankers operates the largest vessels on average, which is understandable given the eight VLCCs in its fleet. Okeanis’ fleet is among the youngest and most efficient, so its vessels are perfectly adapted to transport crude oil over long routes.

Tanker Fleet Overview (Bujon Capital, Company Filings)

In contrast, Ardmore Shipping owns the smallest vessels on average, which is due to its exclusive focus on the products and chemicals market. As mentioned previously, Scorpio Tankers also has a pure-play exposure to the product market, although the company is absent from the chemicals market. Having no presence in the chemical market is the main reason why the average vessel in Scorpio’s fleet is slightly larger than those in Ardmore’s fleet.

Due to their specialized functions, chemical tankers generally have capacities below 40,000 DWT, meaning that roughly eight chemical tankers could fit into one crude VLCC. Chemical tankers often load and discharge in locations with less infrastructure and with size restrictions related to water depth.

Product tankers are generally much smaller and nimbler than crude tankers, as they transport refined products to consumption centers that may not have the required port infrastructure to receive large crude carriers. Even if product tankers could also transport crude oil, their smaller size would put them at significant disadvantages in terms of transportation cost per barrel of oil. Seeking Alpha

A smaller size is certainly an important differentiating factor between product and chemical tankers, but the largest difference is in the tanks’ design and coating. Chemical tankers with the IMO 2 classification are allowed to transport cargo with severe environmental and safety hazards, which require additional measures to prevent leaks and discharges. Of note, IMO 1 tankers carry the most dangerous substances. By definition, those vessels are better equipped to ensure that the most hazardous substances are carried safely. However, due to its highly specialized nature, the market for IMO 1 tankers is relatively small. Based on my current knowledge, I am not aware of a publicly listed company with some exposure to this niche market.

Chemical tankers can carry multiple types of cargo simultaneously, and each tank unit must be perfectly sealed to prevent contamination. They are often equipped with stainless-steel tanks to handle highly corrosive substances like sulfuric or phosphoric acid. For less corrosive substances like vegetable oil, epoxy-coated tanks are generally sufficient.

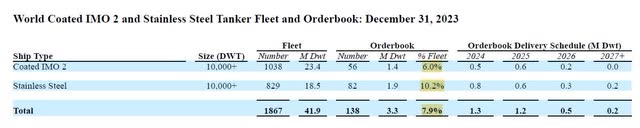

According to Ardmore’s 2023 20-F, approximately 1,900 chemical tankers operate worldwide today, so the six vessels owned by Ardmore have little market impact. As of the end of 2023, the IMO 2 and stainless-steel order book included 138 vessels, representing 7.9% of the global fleet. Based on the meaningful number of new orders we have seen in the product tanker market over the course of 2024, the current order book in the chemical market is probably closer to ~10% today. On that note, I will pay close attention to this number in Ardmore’s 2024 annual report.

Chemical Tanker Fleet Overview (Ardmore Shipping 2023 20-F)

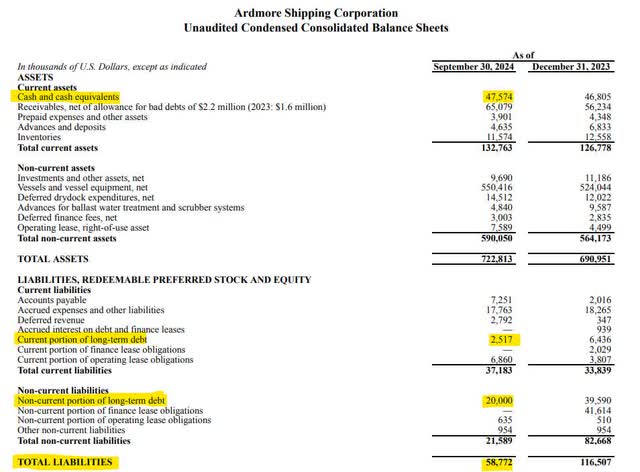

Balance Sheet

Another important element that differentiates Ardmore from other tanker operators is its net cash balance sheet. At the end of September 2024, the company had $47.6 million in cash and cash equivalents and $22.5 million in total debt. In other words, the net cash balance of $25.1 million represents approximately 5.0% of the current market capitalization of $465.0 million. If Teekay Tankers remains in a class of its own when it comes to balance sheet strength, Ardmore is closely following behind. I am still in the process of learning about the industry, so if you are aware of other tanker operators with net cash balance sheets, feel free to leave a comment below.

Using a share price of $38.77, Teekay has a market cap of $1.32 billion. If we subtract the net cash balance of $463.5 million, we obtain an enterprise value of $856.5 million. Teekay Tankers has one of the strongest balance sheets in the maritime industry, and it is one of the company’s most important strengths, considering the deeply cyclical nature of the market. Seeking Alpha

Q3-24 Balance Sheet (Ardmore Shipping Q3-24 Report)

When the capital structure has a lot of debt, the equity portion can be wiped out rapidly, and this is especially true in an industry like shipping. The higher the debt portion is, the more the equity will trade like an out-of-the-money call option. As I have seen in many cases, distressed equities can be caught in multi-year downtrends as the time value of the equity slowly erodes. In such a scenario, it becomes almost impossible to pick a bottom as, in fact, there is no bottom in some cases.

Conditions in the industry have deteriorated quickly in the last few weeks, and I do not pretend to know where the industry will go as we enter 2025. However, what I do know is that Ardmore would be fine in almost any market environment. If we witness an increase in charter rates in early 2025, Ardmore will benefit via stronger cash flow generation. On the other hand, if rates were to go lower and get closer to the industry breakeven rates, Ardmore would still be fine with its net cash balance sheet.

As illustrated below, Teekay Tankers and Ardmore Shipping have been the two worst performers over the last six months among the tanker operators I have covered so far. In my view, this is where the opportunity is at the moment, as the enterprise value of Teekay and Ardmore has contracted much more than the enterprise value of peers with leverage in their capital structure.

Considering their recent underperformance and their resilient capital structures, Teekay Tankers and Ardmore are my favourite picks in the industry at the moment. No matter how good the asset base is, it must be supported by a resilient capital structure. Charter rates are still historically strong, and it makes debt service a lot easier. However, a capital structure with a mix of 50% debt and 50% equity can quickly become a capital structure with 75% debt. At that point, the equity could have lost a significant proportion of its value. In my view, highly volatile and cyclic cash flows cannot support much leverage, especially when charter rates are above their historical average.

Tanker Industry Price Performance (Bujon Capital, QuoteMedia)

Valuation

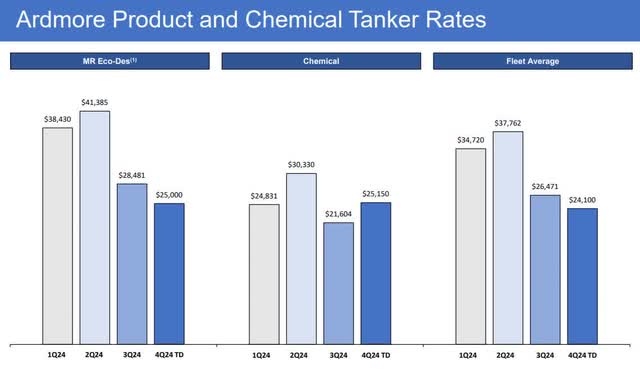

In the third quarter of 2024, Ardmore reported average TCE rates of $26,471. On the announcement date, approximately 50% of the fleet was already booked for the fourth quarter at an average TCE rate of $24,100. Given the industry’s significant weakness over the last few weeks, I would not be surprised if current market rates are closer to $20,000.

Product & Chemical Tanker Rates (Ardmore Shipping Q3-24 Presentation)

Based on the sensitivity table provided by management, Ardmore would generate earnings per share of approximately $1.97 using charter rates of $25,000 per day, which is roughly in line with those reported in the third quarter. Relative to the current share price of $11.30, earnings per share of $1.97 would translate into an earnings yield of ~17.4%. Even if we assume charter rates closer to $20,000 per day, Ardmore would still generate significant earnings and cash flows.

EPS Sensitivity Table (Ardmore Shipping Q3-24 Report)

Similar to Teekay Tankers, the absence of interest expenses on the income statement greatly helps in keeping breakevens low. For example, Okeanis Eco Tankers reported net interest expenses of $13.4 million in the third quarter, or the equivalent of almost $11,300 per day. Simply put, a net cash balance sheet also has a big impact on the resilience of the income stream.

Conclusion

Ardmore Shipping has one of the strongest balance sheets in the industry, with a net cash balance representing 5.0% of the current market capitalization. The strong balance sheet helps to mitigate the equity’s downside risk and also contributes to keeping breakevens low by generating interest income instead of expenses.

Based on my research so far, Teekay Tankers remains my favourite pick in the industry, followed by Ardmore Shipping in second place and International Seaways in third place. An important risk for Teekay is the fact that it owns a relatively old fleet, without any of its vessels equipped with scrubbers. Older tankers without scrubbers are generally synonymous with lower fuel efficiency and higher fuel costs, especially since the implementation of the IMO 2020. In comparison, Ardmore has a younger and more efficient fleet entirely composed of eco-design or eco-mod tankers.

Despite generating important free cash flow at the moment, Ardmore operates in one of the most volatile industries that I am aware of. The strong earnings yield of ~17.4% could be reduced quite rapidly if TCE rates were to decline further.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article should be seen as part of a personal notebook documenting a personal journey. Please consider that I have been consistently wrong in the past. I am not in a position to give advice to anyone.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.