Summary:

- My SPAC strategy involves saying no to almost everything, focusing on $10 units with shares, free warrants, and redeemable cash in trust.

- dMY III’s merger with IonQ was my top SPAC pick, leveraging short hedges against market cycles and capturing deflating hype.

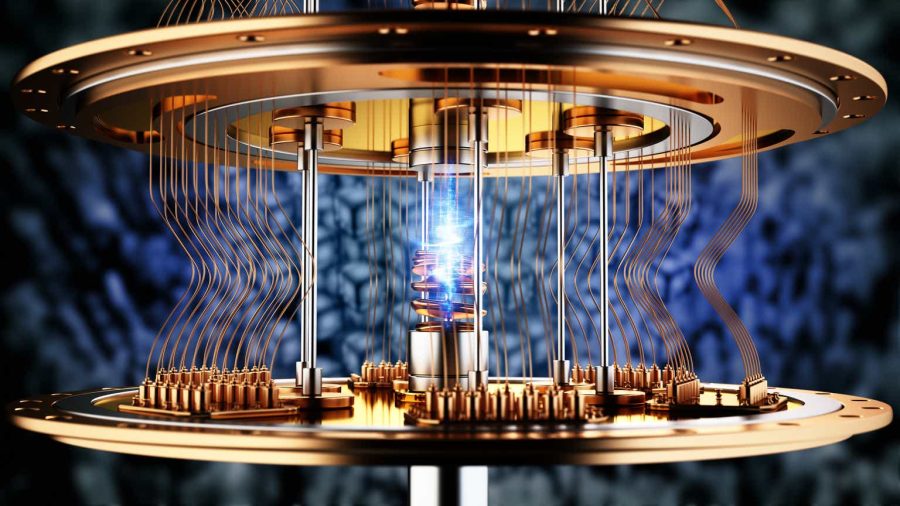

- IonQ’s success highlights the potential of SPAC IPOs, offering risk-free capital with significant upside; IONQ is now a quantum leader.

- Despite past SPAC failures, I believe in the revival of SPACs by 2025, particularly with dMY Technology’s next deal. Stay tuned.

adventtr

My investment strategy in general and with SPACs in particular is an exercise in radical selectivity: I say no to almost everything. If I can pay $10 for a unit with a share, a free call (in the form of warrants), and a free

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

https://seekingalpha.com/instablog/957061-chris-demuth-jr/5549358-legal-disclosure

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Be the first to get my best ideas here.