Summary:

- Arrival’s quarterly cash burn is abnormal for a company of its size and its current cash position is not sufficient for up to a year of operations.

- The EV upstart has had to execute a 1 for 50 reverse stock split and has proposed another merger with a blank check company to avert collapse.

- The transaction could see Arrival gain access to $283 million in cash from the SPAC’s trust. However, redemptions are likely to be significant.

halbergman/E+ via Getty Images

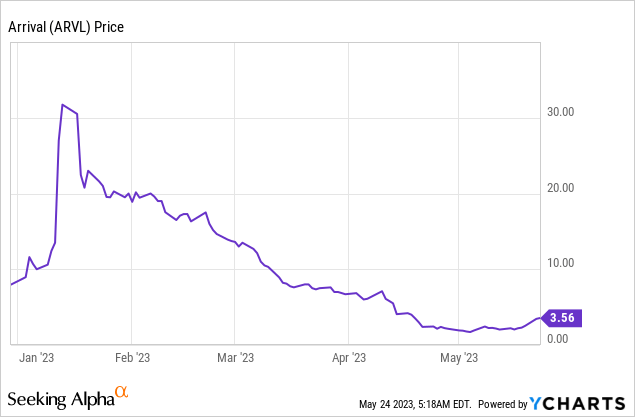

Arrival’s (NASDAQ:ARVL) visceral struggle for survival has seen the EV upstart execute a 1 for 50 reverse stock split, jettison plans to build a microfactory in the UK, and launch a second merger with a blank check company. The proposed merger with Kensington Capital Acquisition Corp. V would see Arrival valued at a $524 million pro-forma valuation and would allow the EV company to gain access to $283 million in cash held in Kensington’s trust account. Whilst news of the deal initially drove the commons up by 50%, Arrival’s year-to-date returns currently sit at negative 60% with bears and shareholders alike experiencing angst over the company’s liquidity position.

Arrival had cash and equivalents of $130 million as of the end of its fiscal 2023 first quarter. This was down sequentially from $205 million in the fourth quarter. Critically, whilst the $75 million quarter-on-quarter fall in liquidity is smaller than the prior third-quarter to fourth-quarter fall of around $126 million, Arrival’s cash burn still poses an existential risk to its future and is far too outsized for a company with its operational footprint. To place this in context, the pre-revenue company’s current market cap stands at $54 million.

Liquidity Dries Up As Arrival Attempts A Salvo

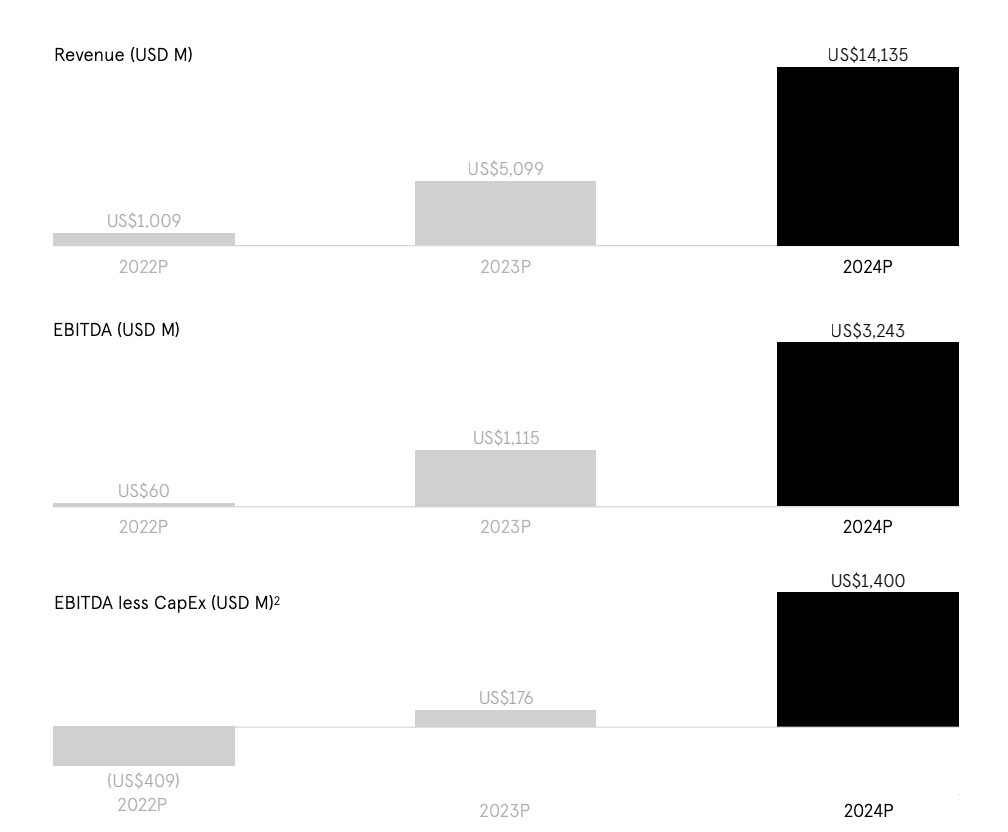

To be clear, Arrival is swapping hands for less than its cash burn from operations for a reason. The company remains pre-revenue against the initial guidance provided when it went public in 2021 that it would realize revenue of around $5.1 billion and EBITDA less capital expenditure of $176 million in 2023. Its seemingly unique approach to EV manufacturing through the use of a distributed production network has failed to materialize, with just three of its vans built during the quarter as testing continues ahead of commercialization guided to start later this year.

Arrival 2021 SPAC Presentation

Arrival does not have the liquidity required to mass produce its vans and to bridge over what would likely be a few years of cash burn on the back of its start of production. Manufacturing a vehicle is a very cash-intensive business, and Arrival’s cash burn is already so high. This renders the company a total avoid from an investment perspective. What’s the investment story here? Indeed, whilst demand for EVs forms a secular growth sector set to be bolstered by the 2022 Inflation Reduction Act and fast-ramping efforts to combat anthropogenic climate change, there are a lot of better-capitalized companies chasing this market.

The company’s inherently small low-cost microfactories were meant to differentiate it from the sea of competition with Arrival also stating that its van would reach price parity with competing ICE vehicles with a lower total cost of ownership. A fall from a $10 SPAC reference price to a few cents before the reverse stock split was the market signal that the company is hurtling toward the brink. Arrival should run out of cash by the end of its fiscal 2023 third quarter at its current pace of burn. Further, the proposed transaction with Kensington to gain access to $283 million in cash from the trust is being built on the assumption that there won’t be significant redemptions.

Survival Seems Unlikely

Arrival has hinged its build-out of its Charlotte, North Carolina factory on accessing its full funds held in Kensington’s trust. Hence, a large degree of redemptions would not only see the company scrap plans to build its first North American microfactory, but it would also inevitably mean Arrival ceases to be a going concern beyond its current cash runway. This bearish perspective is built on the company not being able to access other avenues of cash. Whilst unlikely, Arrival accessing any other large source of funds if the Kensington deal was to fall through would form a significant rebuttal of this liquidity crunch argument.

That the proposed transaction is being completed at a 10x premium to Arrival’s current market cap will likely form a core reason for current holders of Kensington to redeem their shares. The pace of Arrival’s fall from its $10 SPAC reference price to a few cents has been dramatic, and Kensington’s holders could simply avoid being exposed to a similar price movement by redeeming their position. The stock is rightly being priced for bankruptcy with the company unlikely to see sales for its EV van start anytime soon.

Arrival is not an investment here and current shareholders would likely be best served by closing their position ahead of what could be a Chapter 11 filing later this year. The stock perhaps made sense in an era of low rates with its previous valuation north of $12 billion a direct product of the unfettered euphoria that defined that period of the pandemic. Arrival’s future is uncertain and the Kensignton deal likely represents the last possible salvo. I’d don’t have a position here but might consider buying some puts next month with shorting shares likely to form a too-risky positioning.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.