Summary:

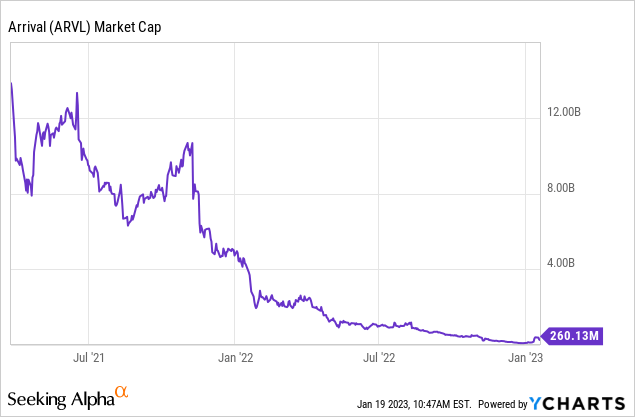

- Arrival is taking tough measures to ensure its survival with its stock price collapsing and cash position dwindling.

- The EV upstart is scaling back on its planned UK microfactory and is ditching plans to manufacture an electric bus and passenger vehicle.

- Significant doubt exists on whether Arrival will be able to remain a going concern exiting 2023. The company’s cash position is seemingly insufficient to meet near-term cash demands.

pawel.gaul/E+ via Getty Images

Bringing a new EV to market was never going to be easy and Arrival’s (NASDAQ:ARVL) mission was made even more difficult by its approach to manufacturing through local microfactories. The idea is simple and would see the firm skirt the gigafactory approach for smaller low-cost micro-scale factories that would be able to build up to 10,000 fully electric delivery vans annually. These microfactories could be located closer to cities and use preexisting factory space retrofitted to its new use.

Arrival’s efforts were initially going to be on a delivery van, but it would eventually expand to buses and passenger cars. The latter two have been scrapped with the London, England-based company also reducing its UK footprint in a hard pivot to the US. Arrival’s cash position is under siege from consecutive quarters of high cash burn and expected capex. This would not have been a problem had the stock market maintained the multiples on the pre-revenue company that it did when Arrival initially started trading on Nasdaq. Critically, Arrival is now stuck in a rut as it cannot lean on secondary offerings of its common shares for liquidity with its stock price so depressed.

Now In A Struggle To Have A Role In The EV Future

Arrival’s market cap was once north of $14 billion at its peak but has since declined markedly to $260 million with fears that it holds an insufficient cash balance to bring its electric van to market and ramp production. The most pertinent part of the company’s actions over the last few months to starve off a collapse has come from a shift of its production effort to the US. Initial plans would have seen its first microfactory built in Bicester, England then eventual expansion to the US. However, against the tax credits being provided by the Inflation Reduction Act for domestically produced EVs, the company has understandably pivoted to Charlotte, North Carolina to take advantage of the credits. However, significant doubt still exists about the Arrival’s ability to meet this revised ambition. The situation is serious. Firstly, Arrival has received a non-compliance letter from Nasdaq with its commons no longer meeting the minimum listing requirements. The company has also had two rounds of layoffs and has warned that it doubts its ability to remain a going concern beyond 2023.

Arrival’s fiscal 2022 third quarter business update was sobering. Whilst the company stated it had at least $330 million in cash and equivalents on hand, management warned repeatedly that this balance was not sufficient to cover twelve months of operations. Net loss for the 9 months to the end of the third quarter was $410.3 million, down from $1.24 billion in the year-ago comp with negative EBITDA also falling to $357.7 million from $1.22 billion in the year-ago comp. These numbers for a company that is still pre-revenue are staggering. Arrival did not realize any revenue during the period but somehow managed to realize an adjusted EBITDA loss of $216.44 million, up from $118.18 million in the year-ago comp.

Hope For Survival Looks Slim

Here’s what we know. Arrival is down 93% over the last 12 months and faces a material liquidity gap by the next winter. We also know that the company is now focusing purely on the US in an effort to get its van to take advantage of the Inflation Reduction Act. However, with the revised plan and layoffs, Arrival still warned that it holds insufficient funds.

Arrival will need to carefully manage its leftover funds but needs to raise more money to fully build out its first microfactory. Whilst it still has access to a $300 million at-the-market offering facility, the depressed stock price renders this a non-starter as it would essentially amount to 115% of its current market cap. Manufacturing a car is difficult. It’s an incredibly capital-intensive process that requires almost constant access to capital to build out initial production capacity and then to fund what would likely be losses in the first few quarters or years of ramping production and making deliveries.

We are early in the transition to low-carbon modes of transport and the scope of chapter 7s now haunting the sector has swelled. Electric Last Mile, a commercial EV deSPAC collapsed last year, Canoo (GOEV) is struggling, and XL Fleet, now named Spruce Power (SPRU), divested entirely from its ICE engine to electric system retrofitting businesses. Arrival’s microfactory idea seemed genuinely innovative and fresh but the heavy losses perhaps allude to a structural weakness of the concept. Apart from a buyout from a larger player or a strategic but highly dilutive investment from another company, it’s hard to see what the near-term salvo for Arrival, its commons, and its future will be.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.