Summary:

- Tesla, Inc. AI robots gained increased media attention. If these robots are commercially successful, it could represent a dramatic economic shift in many industries and a boon to Tesla stock.

- However, the Tesla robotic push is going to take time. Maybe a few years. This will require patience from investors.

- Other Tesla divisions appear to be doing very well, such as fixed energy storage.

- Tesla stock has risen over 35% in a month. P/E ratios are rather high too. Investors are paying a premium for potential growth. Yet, CEO Elon Musk has delivered in the past and could continue to do so. We are adding to our Tesla position.

Yagi Studio/DigitalVision via Getty Images

Years ago, I was a Tesla, Inc. (NASDAQ:TSLA) skeptic. I remember talking to a buddy of mine who owns Tesla stock and drives a Tesla. My argument to him was, “How is Tesla going to compete once all the large car companies get serious and enter the market?” Given the large market cap of Tesla (that was bigger than all the car companies combined), it did not make sense to me. Yes, I listened to his words and ideas, but I remained skeptical for years. My friend was patient with me and I kept listening to him. Eventually, I changed my mind and I watched Elon Musk push SpaceX forward, I watched him build a lithium refinery in Texas, I saw he also designs semiconductor processors for his cars. Now I understand, and I own Tesla stock.

The difference is Mr. Musk is at the top as a dictator, able to quickly shift and plan, as opposed to legacy companies who have to contend with layer upon layer of corporate bureaucracy. Elon also has the planning, vision, and funding to make his aspirations reality. In this article, we are going to explore something that intrigues me: Tesla, Robots, and Lithium.

Robots and Lithium

AI, AI, AI. I find that misnomer distasteful. It might be because I have been in technology for so long that I have become somewhat of a semi-Luddite. Maybe it is just that I see so much hype being “AI” at the moment. That is not to imply that if you throw a trillion dollars at programming, you will not get some projects that work. You will, but you will also get many fly-by-night projects that go kaput once reality hits.

Semi-Luddite or not, I can see some practical implications of a Tesla or Apple (AAPL) branded robot. Societal implications aside, I can see a future where the person driving the postal truck for the Post Office or FedEx (FDX) or United Parcel Service, Inc. (UPS) is replaced by a Tesla robot. A repetitive job like driving a heavy ore truck in out and of a dangerous open pit mine could be replaced with a robot who would have the flexibility to operate other equipment, too.

Dangerous Ore Road (Google)

Let’s explore what we know about Tesla’s robotic efforts so far, and then we will explore how this ties into Mr. Musk’s lithium aspirations in Texas.

Tesla’s Optimus Robot Revolution

Robots are nothing new. We have had robots for decades, most of this has been limited to larger industrial applications or robotic vacuum cleaners. I do recall some medical technology involving robots. Boston Dynamics has robots too, however, Tesla’s robots might bring the programming that offers the ability to solve tasks for businesses and the household. I wonder what Mr. Musk has to say on the subject, but first we need to look at the health of Tesla as a company, and then we can ponder robots further.

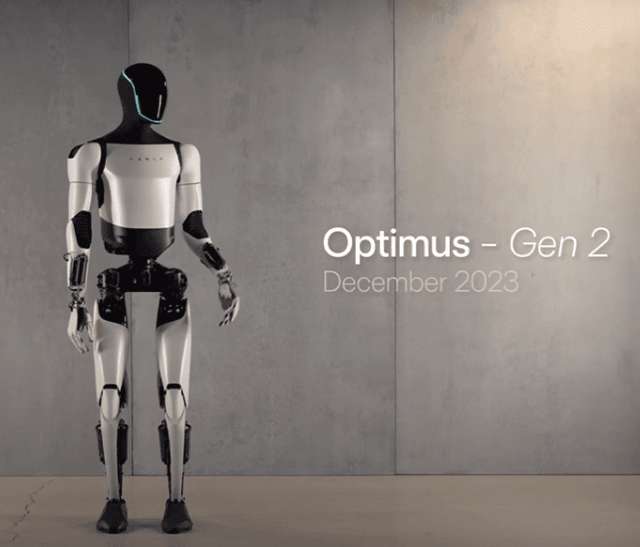

Tesla Optimus – Gen 2 (Gizguide)

Cyber Roundup 2024 Texas Shareholder Meeting

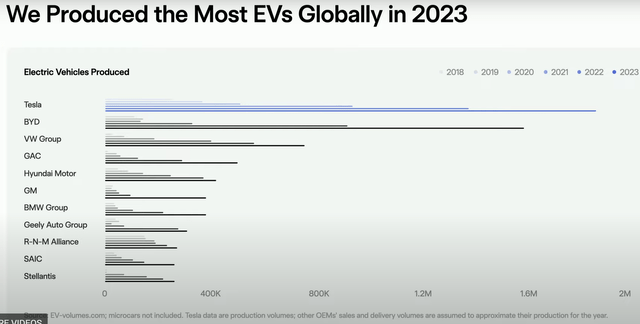

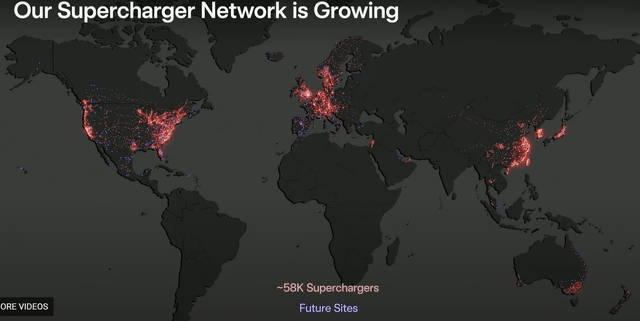

During the annual shareholder video at the 1-hour mark, we can see Tesla is still ahead of all legacy automakers by a large margin in sales and the Supercharger network is growing.

Electric Vehicles Produced (Tesla) TSLA Supercharger Network Growing (Tesla)

Per Mr. Musk:

“Our Supercharge network is continuing to grow. Rumors of the death of the supercharge are greatly exaggerated. We are in fact continuing to grow the supercharge network significantly. In fact, this year, I think we will put more, deploy more superchargers this year that are actually working than the rest of the Industry combined.”

“Even for the remainder of the year we expect to spend about half a billion dollars on supercharge deployment. So it’s, it’s very significant, it is well spent, half a billion.”

Elon then goes on to talk about international expansion into new markets at the 1 hour 9 min mark. Per Elon:

This is actually not showing a bunch of new markets that will be opening up later this year and next. So we’re, obviously, we want Tesla to be worldwide and there’s still a lot of countries that we, you know, have zero to very few Tesla’s and we obviously, we want Tesla everywhere so there are a lot of new markets that we’re going to open up later this year and next.”

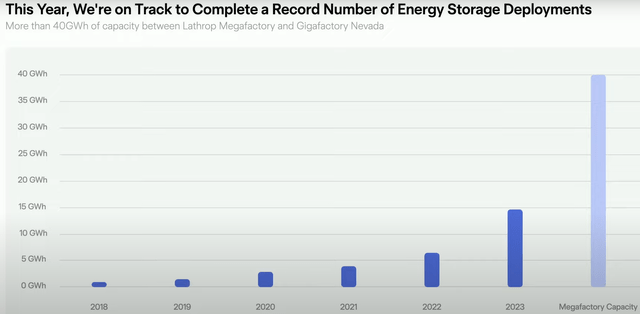

Tesla Energy Storage Deployments

Tesla energy storage is growing quickly.

Tesla Energy Storage Deployments (Tesla)

Per Mr. Musk:

“We seem to be tracking to a sort of 200% to 300% year-over-year growth in energy storage deployment and stationary pack so it’s giant. The limiting factor really is being able to build more Mega packs and build more power walls. So we’re ramping up production of the power wall 3 which is really a game changer.”

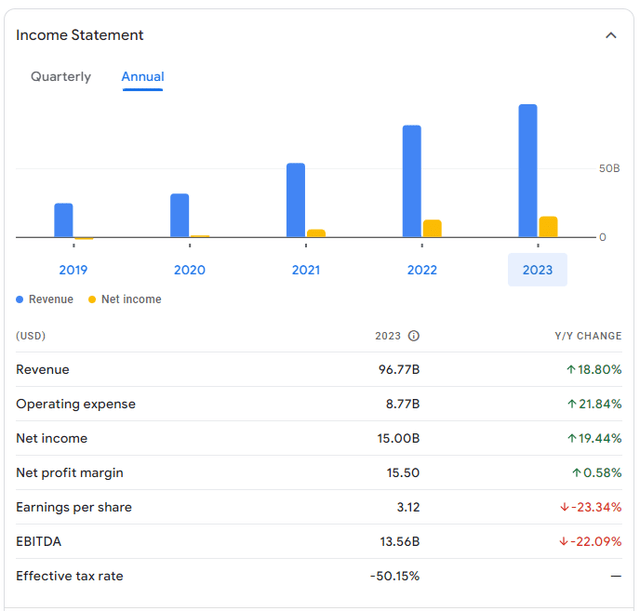

Tesla Services And Financial Numbers

Tesla Service profits are growing. I find that to be a very impressive, as back in 2018-2019, Tesla was losing about $500 million on services. A few years later and that number has inverted to Tesla making a $500 million gross profit. We can also see that Tesla is generating profits. Do they justify that high P/E ratio? It is arguable but given potential growth I see no reason not to take a small position in the company.

Tesla Income Statement (Google Finance)

Tesla Optimus Robot

At the 1 hour 29 min mark during the annual shareholder meeting, Mr. Musk talks about the Tesla Optimus Robot.

“I think we’ve got kind of like one major hardware revision, which should be done by the end of this year or early next. Then we’ll move into a limited production next year of Optimus. Limited production for use in our factories where we’ll test out the product.”

My prediction is next year we’ll have over a thousand, maybe a few thousand Optimus robots working at Tesla. And things are going to scale up very rapidly from there.”

What could Optimus change? Maybe a lot. If you can teach it things just by showing it a task, I see no reason why it could not engage in dangerous mining or military applications. Granted, they might be mission limited to the military for some time, but kicking a few hundred out of the back of a cargo plane could sow some chaos in an area or improve Taiwan’s coastal defense. It will be most interesting to watch the nature of warfare shift, but these military ponderings are ideas that are not investible at the moment. The reality is, Optimus could be good at simple tasks such as driving a loader at a mining site, stocking shelves, or engaging in repetitive tasks.

Tesla Cars As A Distributed Computing Platform

Mr. Musk has spoken about possibly using the computing power of Tesla cars as a sort of distributed computing platform. Owners of the cars would get paid, Tesla would make a profit, and computing problems would be tackled. I’m in favor of it. Frankly, the Tesla is a computer with wheels. In the future, if the car owner does not have it out and about as a Robotaxi, I see no reason not to let the car join the Tesla cloud service while not in use and get paid for it.

Robots and Tesla Lithium Refining

Let’s warp forward 5 years and pretend that Optimus has found a role in society and is successful. We might assume that Optimus is powered by lithium batteries and with that Tesla has a lithium refining facility in Texas. It might make some sense if Tesla were to acquire a lithium mining operation. When thinking of Optimus robots, though, we really have no way to gauge what that market might look like. We can, however, look at some speculative guesswork.

Is Tesla Overvalued?

If we look at today’s numbers for P/E ratios and the like, then yes, they are overvalued. However, metrics such as these fail to capture investor excitement, in my opinion. I used to look at Nvidia (NVDA) years back when the PEG ratio was several multiples over the base number of 1. It makes little sense to overpay for growth, but occasionally, you have to pay a premium for growth. In this case, if Tesla Robotaxi pans out, it could be a game changer for the planet. Granted, I am skeptical of self-driving cars, but it does not mean it could not happen. What interests me more though is EV growth, Tesla lithium refining, Optimus, and lastly using the massive consumer base of Tesla cars as a distributing computing platform. Note: Some call this distributed inference.

Conclusion

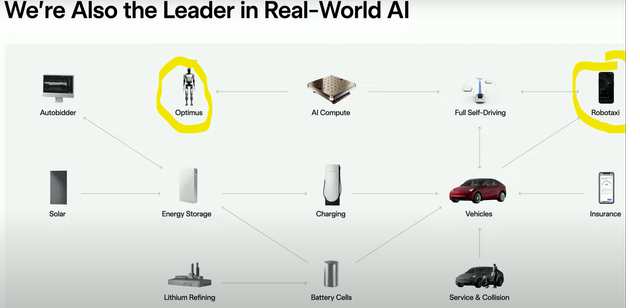

Tesla is a very successful software and semiconductor design company that makes cars, but the most impressive attribute is that Tesla offers a complete EV ecosystem such as:

- Buying an EV.

- Insuring that EV with Tesla’s car insurance.

- Charging at home.

- Charging at Tesla charging sites.

- Tesla designs the semiconductors that go in the vehicles.

- Fixed power storage

- Solar options to charge at home, and expanding into new realms:

- Maybe Tesla robots and distributed computing options with time.

The scope is really remarkable when you consider it (and given Tesla’s ability to pivot when necessary) it makes me believe that Optimus could be successful. With that, I have a small position in Tesla that I am expanding.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.