Summary:

- I’m downgrading Asana to a hold rating, after a severe slowing in the company’s growth rate in Q2.

- Importantly, the company’s net revenue retention rates have also sunk below 100%, indicating a net churn position that indicates Asana’s product is not sticky.

- Pro forma operating margins are also declining, as the company spends more on sales and marketing without bearing much fruit.

- Asana’s stock is cheap, trading at 3.1x EV/FY25 revenue, but a near-term rebound is unlikely due to decaying growth and poor retention trends.

Compassionate Eye Foundation/David Oxberry

The stock market is at record heights, and rather than be blindly bullish on all stocks in the wake of sharp interest rate cuts, it’s a great time for investors to rotate more of our portfolios toward lesser-known, value-oriented plays. Some of these stocks require tremendous patience as turnaround stories take hold, but to me, this is an acceptable trade-off against investing in momentum plays at what seems to be the top of the market. However, we must still emphasize value stocks that are high-quality: not those that are seeing flailing results.

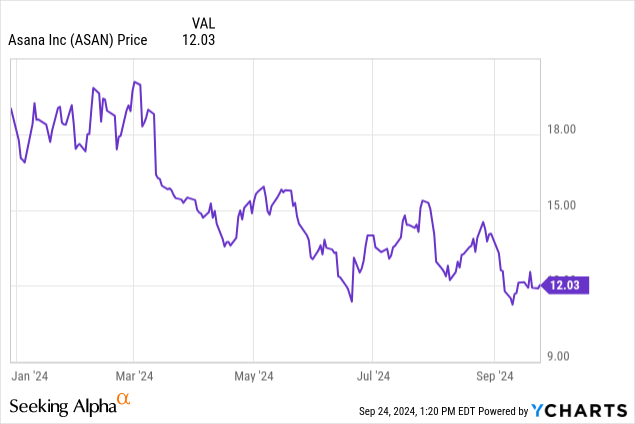

Asana (NYSE:ASAN), the collaboration software company founded by Facebook co-founder Dustin Moskovitz, has trailed tech stocks this year and over the past few years. Once a growth stalwart, Asana has been challenged by a stagnant buying environment, stiff competition, and weaker customer retention. Year to date, Asana has lost more than 30% of its value.

I last wrote a bullish note on Asana in June, when the stock was still holding at levels above $13. There’s a lot that I admire in the company: in particular, to cement the idea that the stock is undervalued, the company has plowed dollars into buying back stock. But on top of this, founder Dustin Moskovitz also owns a large stake in the company and has a track record for buying more shares.

But as much as I liked this story heading into 2024, fundamental circumstances have shifted. Asana’s growth rates have continued to slow, and its net retention rates have started to become an eyesore. And making matters worse, the company is starting to see operating deleverage, as operating margins worsen on weaker sales. As a result of degrading results, I’m downgrading Asana to a neutral rating.

At current share prices, I see a more balanced risk and reward profile for Asana. Still, on top of the founder-led management structure and insider confidence in the stock, there are other drivers on the bright side to consider, which include:

- Secular tailwinds toward remote work and distributed teams requiring organizational tools like Asana. More and more companies are embracing a distributed working model, if not a fully remote one. With fewer in-person touchpoints, software tools become critical to keeping teams together and in sync.

- Massive global TAM. Asana believes it has a $51 billion TAM by 2025 and is applicable to the global base of ~1.25 billion information workers. By that metric, Asana’s current user base represents only <5% of the global eligible workforce.

- Huge gross margin profile. Asana’s pro forma gross margins are in the ~90% range, making it one of the highest-margin software companies in the market. While the company isn’t profitable today, that gross margin profile gives Asana plenty of leeway to scale profitably when it’s larger, as nearly every dollar of incremental revenue flows through to the bottom line.

Still, a number of risks have emerged. To me, the most pressing concerns are:

- Sharp competition in a product that, let’s face it, is not exactly unique. Collaboration software tools have become as common as CRM tools in the market. Despite the mission-criticality of having a central platform of work to organize a team’s activities, a CIO now has many choices in the market outside of Asana. Core rivals include names like monday.com (MNDY), Atlassian (TEAM), and even Salesforce’s (CRM) Slack.

- Customers are peeling off. The company’s net retention rates have slipped below 100% for the first time, indicating that it’s suffering more churn than expansion. This indicates that the product is not as sticky as we might have originally thought.

The main saving grace to Asana is that the stock is quite cheap. At current share prices near $12, Asana trades at a market cap of $2.75 billion. After netting off the $521.6 million of cash against $41.1 million of debt on Asana’s balance sheet, the company’s resulting enterprise value is $2.27 billion.

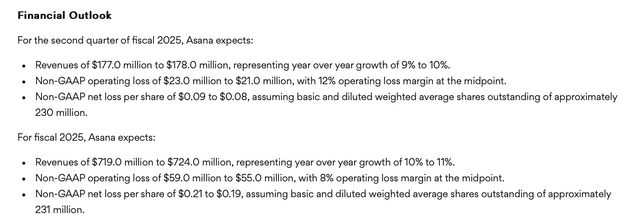

Meanwhile, adding insult to injury the company has slightly sliced the top end of its guidance range, now expecting $719-$721 million (+10% y/y) in revenue, versus a prior $719-$724 million view:

Asana outlook (Asana Q2 earnings release)

This puts Asana at just 3.1x EV/FY25 revenue, whereas most other companies trading at a 10% to low-teens growth profile typically trade in a 3-4x range. Still, with consistently decaying growth rates, poor retention trends, and the start of margin de-leverage, I’d say that a rebound for Asana is far from imminent.

Q2 download

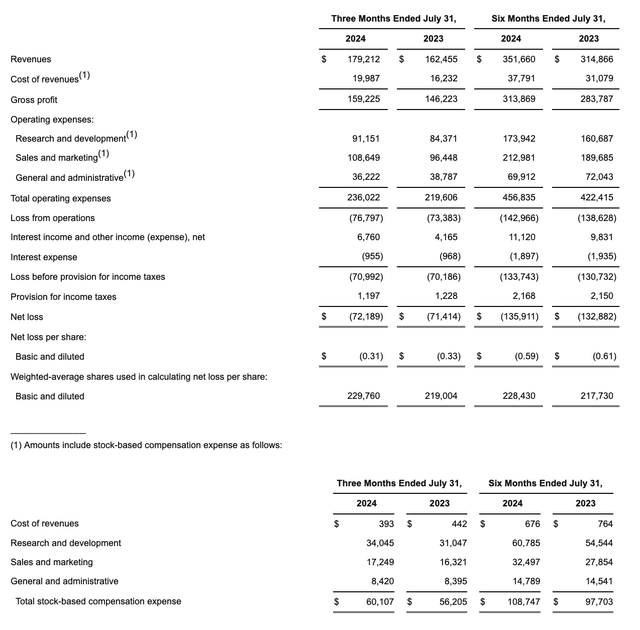

Let’s now go through Asana’s latest quarterly results in greater detail. The Q2 earnings summary is shown below:

Asana Q2 results (Asana Q2 earnings release)

Asana’s revenue grew just 10% y/y to $179.2 million, barely ahead of Wall Street’s expectations of $177.7 million (+9% y/y). Importantly, revenue growth also decelerated sharply from 13% y/y growth in Q1.

But even more painful, in my view, is the constant degradation in the company’s net retention rates, which measures its upsell/expansion activity versus churn. In Q2, retention rates finally broke below breakeven, hitting 98% (versus 100% in Q1) – indicating that more install base customers are leaving than staying to expand.

The company is counting to blame macro headwinds for pushing deals out further. It insists that deals are remaining in the pipeline, however. Per COO Anne Raymond’s remarks on the Q2 earnings call:

Turning to Q2, as we expected going into the quarter, ongoing budget scrutiny and longer sales cycles continued to impact our business, consistent with last quarter. As a result, we saw a number of deals pushed out, but they remained in our pipeline. Secondly, the headwinds in the technology vertical continue to weigh down our overall revenue growth. Despite the continued headwinds, we closed some very strategic deals across industries such as automotive, manufacturing, government, energy, among many others.

By geography, international-led revenue growth at 12.3% reported and 12.8% year-over-year when we exclude the currency impact. The international team continues to execute well with particular success in key verticals such as energy and manufacturing. In the US, we continued in Q2 to be pressured by early successes in the technology sector. Overall US growth was 9% year-over-year, heavily impacted by the technology sector exposure. Fortunately, we now have put our largest seat adjustments behind us as of last quarter and we believe that the in-quarter dollar-based net retention rate is at a stabilizing point. As Dustin mentioned on a previous call, in order to get to reacceleration, you need to first go through stabilization and that’s where we believe we are today. We are well poised for slight reacceleration in the near term and more substantial acceleration in the out quarters.”

The hope for stabilizing retention rates and delayed deals finally closing and contributing to revenue is what is upholding my neutral rating on this stock. However, if we see net retention continue to degrade in Q3, my sentiment in this stock will be severely shaken.

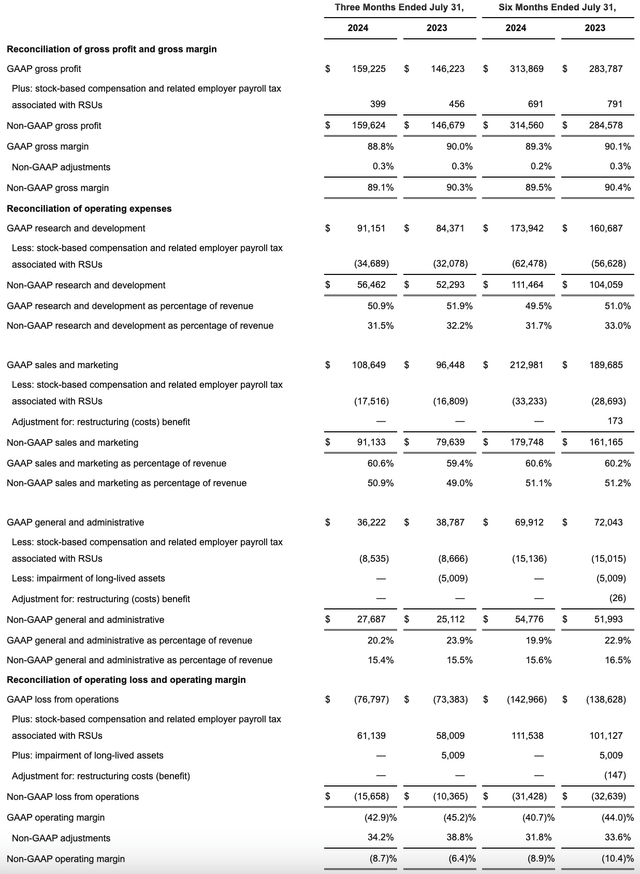

Making matters worse is the fact that Asana’s profitability is degrading. This is primarily driven by the fact that the company increased sales and marketing spend, on a pro forma basis excluding stock comp, up 14% y/y to $91.1 million and representing 50.9% of revenue (+190bps y/y), despite the fact that added sales expenditure doesn’t seem to be reviving growth.

Asana margin walk (Asana Q2 earnings release)

As a result, pro forma operating margins slipped -230bps y/y to -8.7%.

Key takeaways

We’d hope to at least see profit expansion and more cost-cutting measures at a time of slowing growth for Asana, but this doesn’t seem to be the case. Despite a confident management team, I’ve grown weary of Asana’s consistently decaying results and don’t have much hope for a near-term turnaround.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.