Summary:

- Asana’s stock surged 40% post-earnings, driven by optimism around its new AI Studio product, despite modest top-line growth and profit margins.

- The company’s valuation appears inflated due to tech sector euphoria, making the current risk-reward proposition unattractive.

- ASAN’s strong balance sheet and new AI product are promising, but I need to see clear evidence of revenue acceleration before re-entering.

Kimberly White

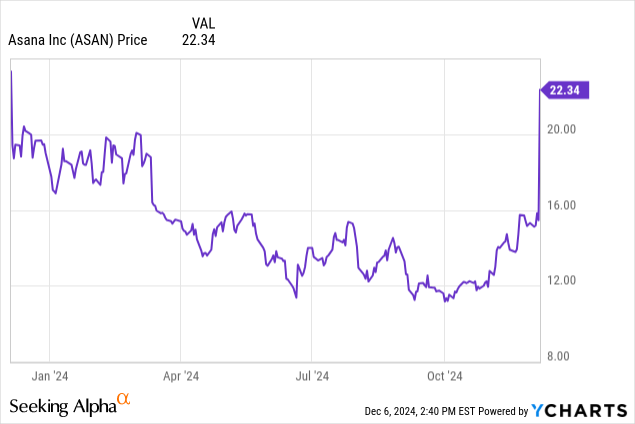

Asana (NYSE:ASAN) saw its stock pop to the tune of 40% after releasing earnings. While the company has yet to see top-line growth accelerate meaningfully, it did roll-out a new AI Studio product which appears to have analysts optimistic about accelerating growth in the future. The current valuation is far from bubbly, but I am of the view that it is pricing in strong execution on the rollout and impact of AI Studio, far beyond what I am comfortable with given the currently modest top-line growth and profit margins. The company still has a solid balance sheet but I fear that valuations have run-up due to tech sector euphoria. I am downgrading the stock as I no longer see a compelling risk-reward proposition.

ASAN Stock Price

I last covered ASAN in July where I stuck by my buy rating even as the company tested my patience waiting for an acceleration in top-line growth.

While the stock is up 46% since that latest call, this has overall not been a successful pick as in hindsight I did not expect growth to decelerate so rapidly and I had expected growth to accelerate more promptly. It is ironic that the fundamental story has arguably deteriorated yet the stock is rising rapidly. This is looking like an opportune moment to re-evaluate the investment thesis.

ASAN Stock Key Metrics

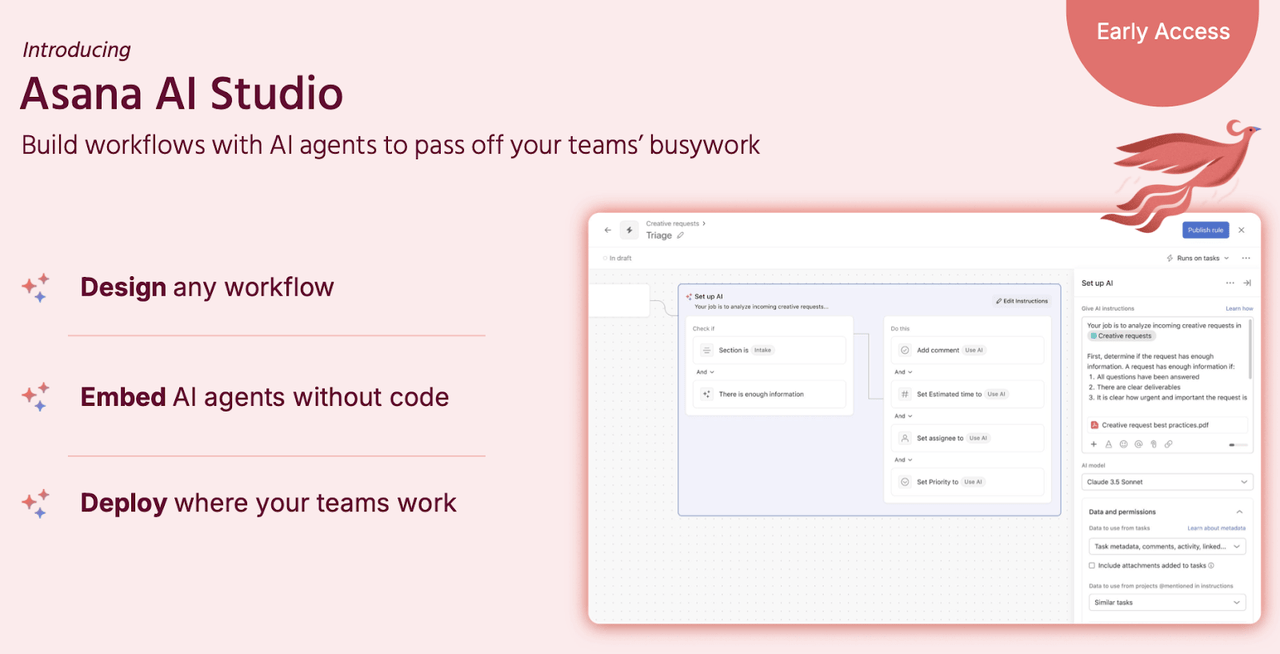

The story of the day is ASAN’s AI Studio, which is still in “early access” and promises to further bolster the company’s work productivity products.

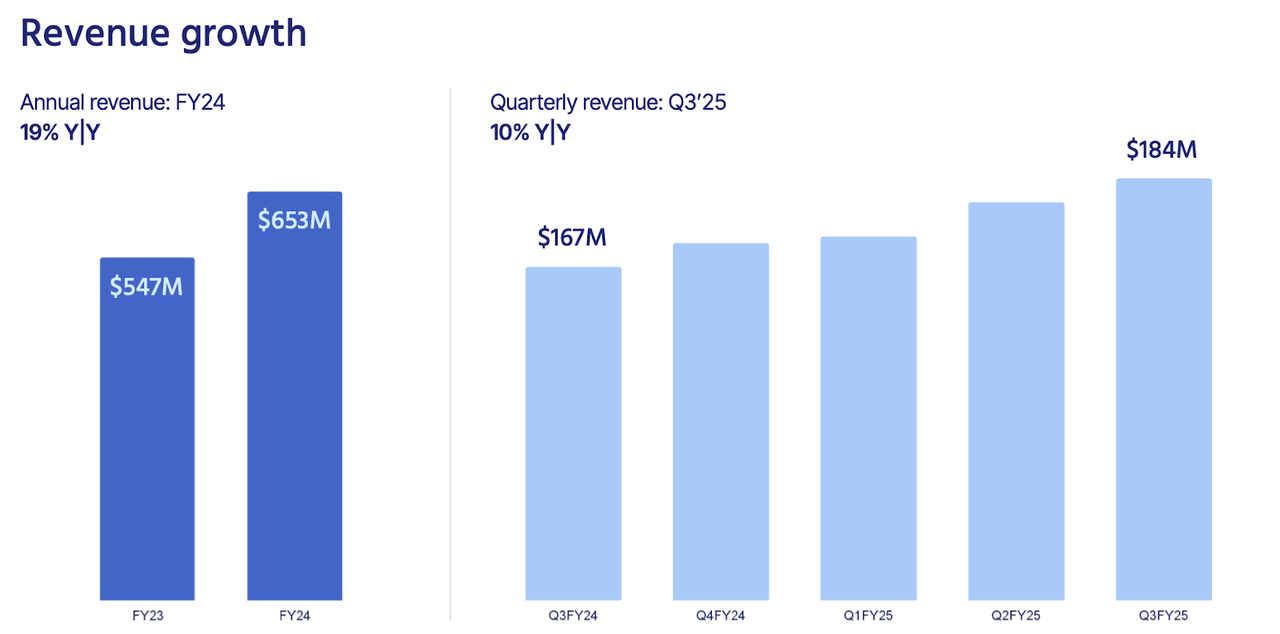

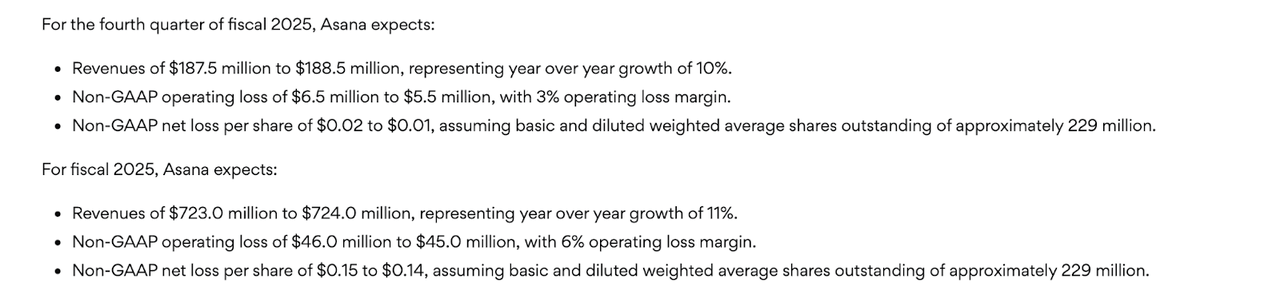

The actual results, however, were more modest. ASAN delivered 10% YoY revenue growth to $184 million, slightly beating guidance for up to $181 million.

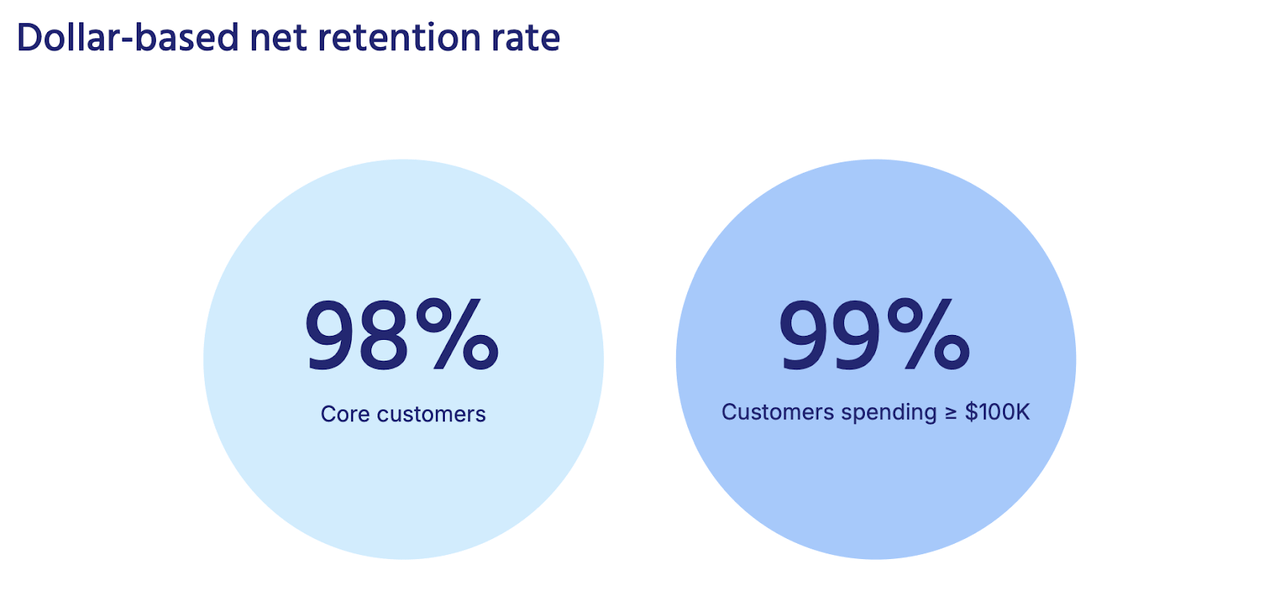

The dollar-based net retention rate stood at 98% for core customers. I note that close competitor Monday.com (MNDY) recently reported 32% revenue growth with a 111% net retention rate. By all indications, it looks like ASAN might be failing to grow or even losing market share to MNDY.

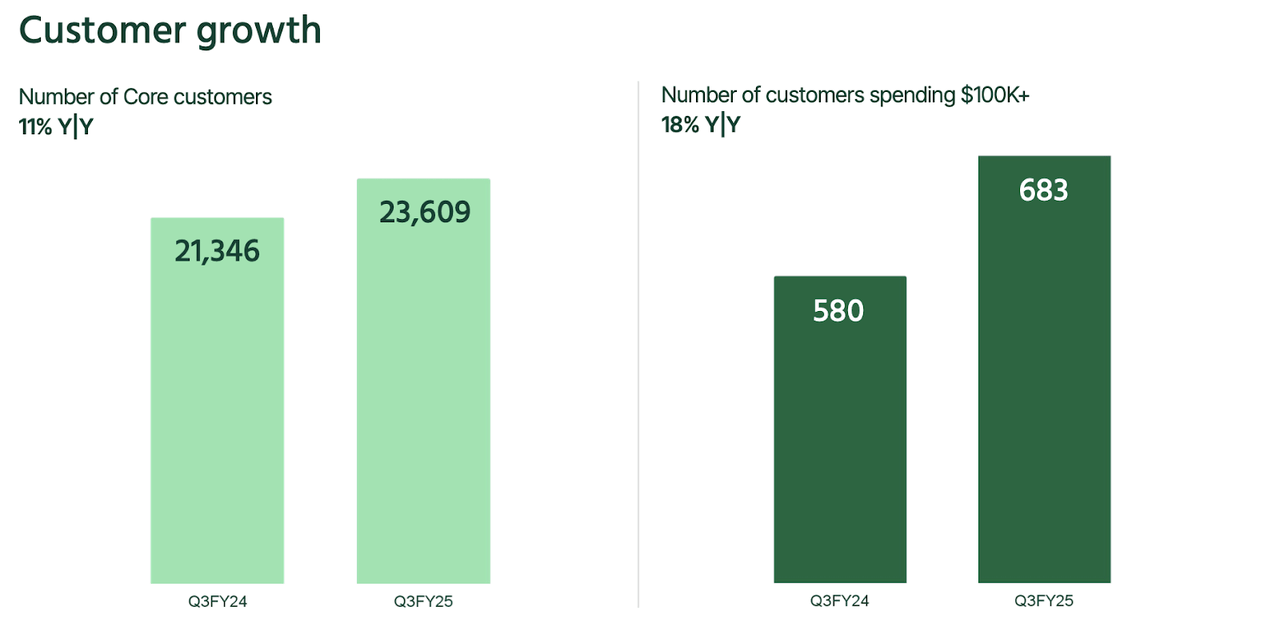

ASAN did manage to grow its customer count by 11% YoY but I am frankly not seeing any evidence of the promised acceleration in revenue growth.

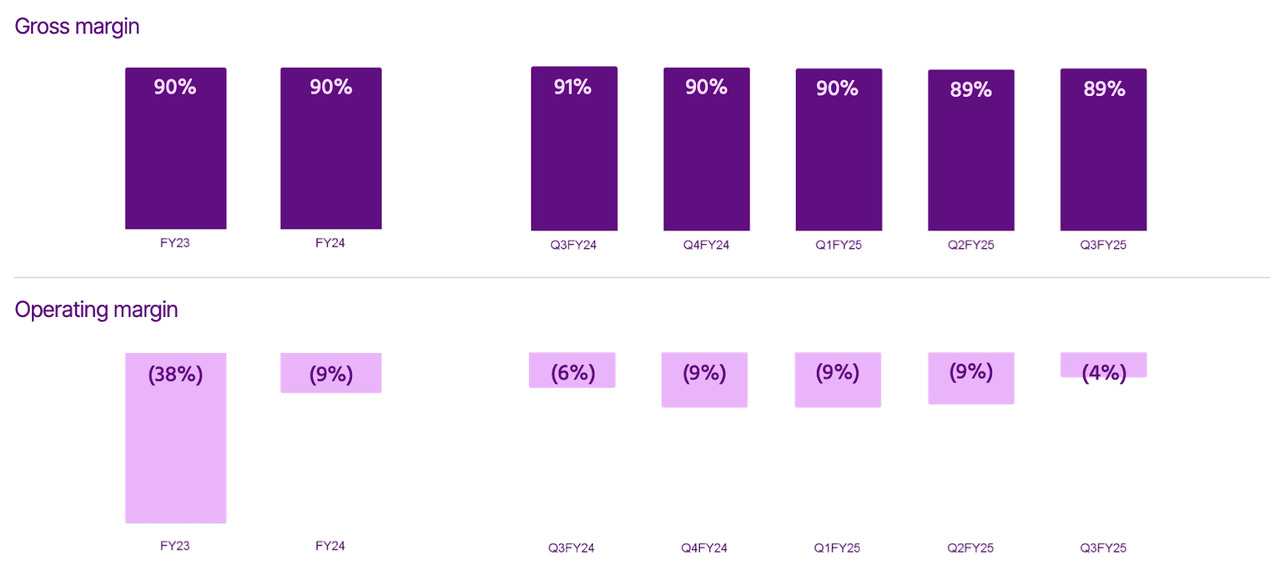

On the profitability front, ASAN slightly reduced its non-GAAP operating loss margin to 4%, significantly beating guidance of 10%. That beat might not be so significant given the loss margin was 6% in the prior year’s quarter.

ASAN ended the quarter with $456 million of cash versus $40 million in debt, representing a strong balance sheet. ASAN is not profitable on a non-GAAP basis, but this net cash position can fund many years of the ongoing cash burn – I am not concerned about financial solvency here.

Looking ahead, management guided for the fourth quarter to see up to $188.5 million in revenue, representing 10% YoY growth. While that represents an increase to full-year guidance, the vast majority of that increase has already been accounted for in this past quarter’s beat.

On the conference call, management was very upbeat about their new AI Studio product, stating that they are “officially entering a new era as a multi-product company.” This could be significant because platform software companies tend to earn higher valuations due to the longer term potential of cross-selling. Management noted that these are “not chatbots” but instead AI agents that are “automatically initiated in reaction to things people are doing, like filling out forms, or changing task statuses.” Management believes that AI Studio alone has the potential to exceed their current revenue run-rate over time. Given the use of AI agents, this product is priced with a usage-based model. Management noted that they are seeing many of their initial pilot customers scale “beyond the base allocation as they discover transformative AI use cases.” Management has guided for AI Studio to be generally available by the end of the first quarter of fiscal 2026 (that is two quarters away).

Is ASAN Stock A Buy, Sell, or Hold?

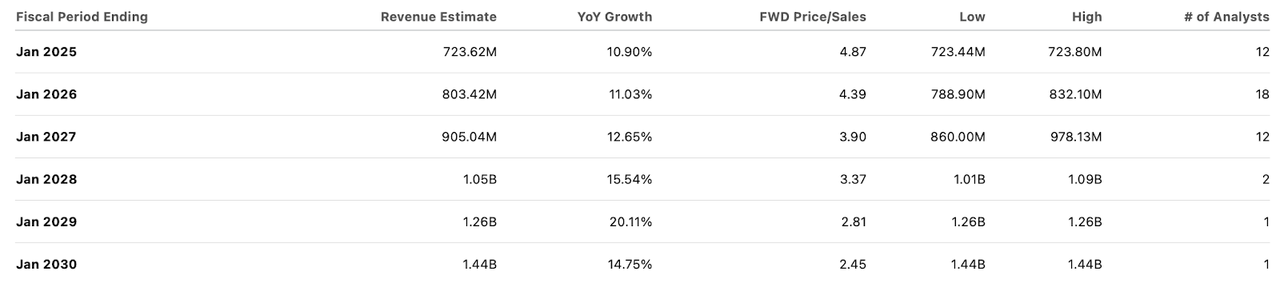

After the run-up the stock found itself trading at 6x consensus estimates for next year’s revenues.

That is arguably a hefty multiple given the consensus estimates for modest growth rates and also the long gap from GAAP profitability. For reference, the current $200 million GAAP annual loss run-rate might dilute returns by around 6% annually. Compared against the 12% consensus forward growth rate, that would make forward projected returns rather uninteresting. With the stock soaring today, it is clear that some investors might be expecting growth rates to accelerate far beyond those implied by consensus estimates. I am no stranger to such hopes as I had been hoping for exactly that result for the duration of my holding period in the stock. After many quarters of watching competitor MNDY deliver incredible growth rates while ASAN’s own growth rates continued to decelerate, I am no longer holding such an optimistic view. While the release of the new AI Studio product might lead to some acceleration in the near to medium term, I wouldn’t be surprised if 15% to 18% growth represents the higher-end of what to expect. Even if growth were to accelerate to that level, the current valuation might not look so attractive given the aforementioned poor profit margins.

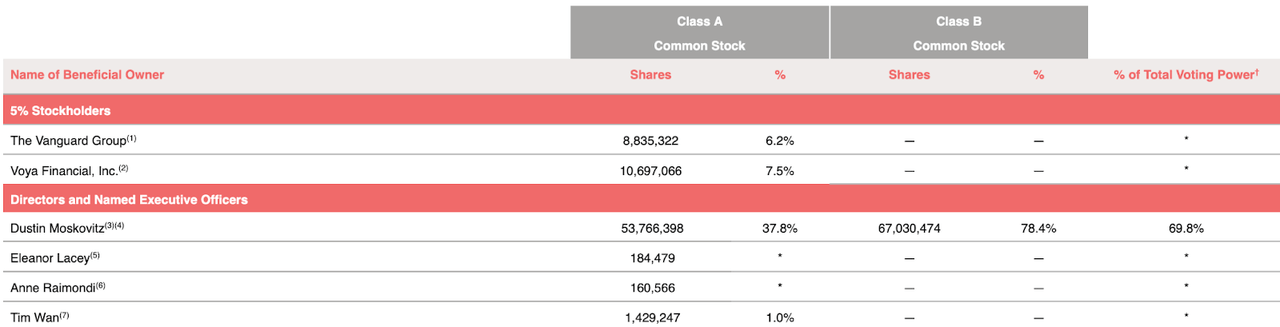

I cannot omit mentioning that ASAN might continue to catch a bid in today’s market, which appears to be marked by shades of irrational exuberance. While I am not keen on “meme investing,” it is worth noting that ASAN may have many characteristics worthy of becoming a meme stock. The company’s new AI Studio product already makes it a legitimate AI play, but I note that CEO Moskovitz (also known as a co-founder of Facebook) owns an unusually large stake in the company totaling around 50% of shares outstanding.

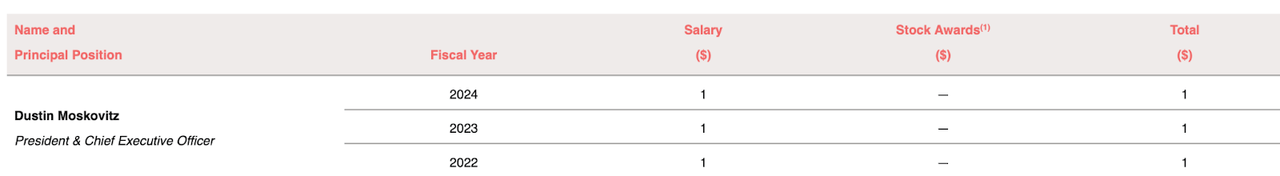

CEO Moskovitz’s total compensation is one dollar.

Again, I am not one to invest in meme stocks, but ASAN might have more legs to run.

ASAN Stock Conclusion

ASAN appears to be gaining traction with its new AI Studio product, and the market is rewarding the stock for it. The stock run-up unfortunately worsens the risk-reward proposition as it is never easy to bet on strong execution. I prefer to see clear evidence of the acceleration in revenue growth prior to re-entering this name. At Best of Breed Growth Stocks, I focus on high-growth stocks that are paired with strong balance sheets and attractive valuations. I am downgrading ASAN to a “hold” rating, representing a neutral view as I am closing my position.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!