Summary:

- Tesla, Inc. is a diversified business focused on the transition to renewable energy, not just an auto company.

- Asia will play a crucial role in Tesla’s auto revenues, making it a key market for the company.

- Both Tesla and BYD Company Limited understand the importance of vertical integration, positioning them ahead of traditional auto companies.

Justin Sullivan

SUMMARY

Tesla, Inc. (NASDAQ:TSLA) has never been a pure auto play, and it has become increasingly less of one. It is a new technology company and as such it can obtain a higher valuation.

As it increases its vertical integration, it should accordingly be seen as more attractive by investors as it controls costs better.

Asia will play an increasingly important role in the company’s revenues, especially its auto revenues.

Although the company remains a long-term Buy, its main auto competitor, BYD Company Limited (OTCPK:BYDDF), is a stronger short- to medium-term Buy at this moment in time.

Stock price reaction to Tesla’s Q3 figures are an investment opportunity long term for Tesla investors.

——————————-

Skeptics who see Tesla as an over-valued auto company constantly fail to see that it is not one. It is a technology company. Its modern diversified business is helping to bring about the transition from a fossil fuel economy to one based on the renewables future. Tech companies by nature have higher valuations. They are able to sell high margin software and services on the back of hardware. Apple (AAPL) and Sony Group (SONY) are two examples of companies who have successfully done this.

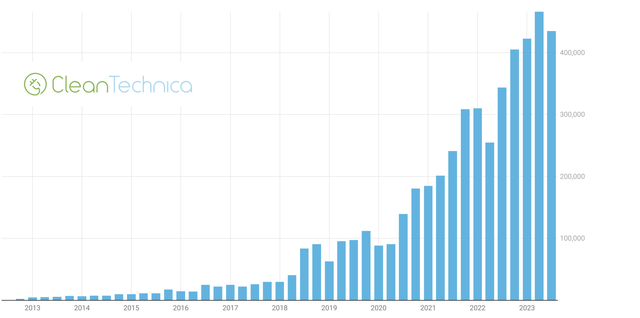

My article in January detailed how Tesla’s auto business will grow rapidly in 2023 and indeed it has done so. Analysts were disappointed by the Q3 numbers, but the company still expects to hit its annual CAGR for vehicles of 50% this year.

My recent article in October illustrated the increasing importance of energy storage and how it could attain the company’s long-term goal of matching the revenue of the auto unit. In Q3 revenue increased by 40% year on year to over half billion dollars. It currently represented 6.6% of total company revenue.

That article also summarized the various other vertically integrated businesses which should drive further long-term growth. Any risks to the auto business can be countered by the growing non-auto business of the company. These are growing more rapidly than the strictly auto revenues.

As Asia comes increasingly to the fore in Tesla’s auto business, BYD and Tesla will be fighting it out as the two main auto players. They are far ahead of the competition. I last wrote about BYD in depth in October last year. The company is going from strength to strength, based around its vertical integration and Asian base.

Tesla & BYD Investment History

The tremendous stock returns from investing in Tesla need little repetition. An investment of $10,000 shortly after their IPO in 2010 would now be worth $2.4 million.

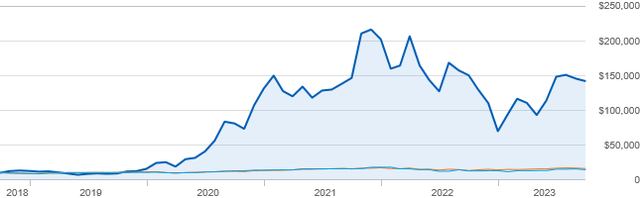

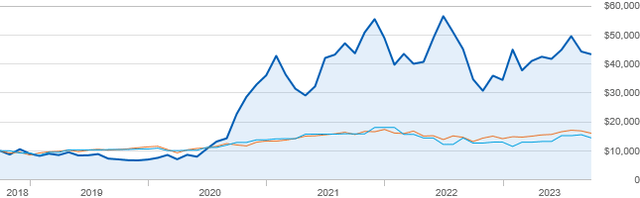

The 5-year investment timeline remains impressive:

I have been recommending BYD as an investment since my article in September 2016. The 571% return since then is meaningful, for any investor. Their 5-year timeline is illustrated below:

There is a specific negative factor for BYD shares caused by Warren Buffett’s regular drip-feed of stock sales in the company. In late October, he sold another $25.78 million worth of stock and took his company’s share down from 8.05% to 7.98%. This has been a regular occurrence and acts as a brake on the stock price once it hits a certain level.

We are in a very difficult world economic situation brought on by high interest areas and political factors. Both companies have excelled in difficult times. When the world economy enters its next growth phase, this will benefit investors. As Elon Musk several times emphasized on the analyst call, interest rates are the prime roadblock right now.

Additionally in the case of Tesla in particular, investors should note the cycles. High capex in new models leads to increased costs short term and increased free cash flow long term. This is a phase right now for the company. As this article detailed, in the last decade Tesla has enjoyed 50% CAGR per annum. They forecast the same rate of growth up to 2030. The stock price should continue to follow its historic rise accordingly. Long-term investors should not be concerned about any short-term dips in quarters which do not meet analyst forecasts.

We study history so as not to repeat the errors of the past. Both companies have volatile stock prices. Both companies are now in far stronger positions than they were 5 years ago. Investors not already invested in BYD should not miss the opportunity now. For Tesla, they may wish to see a bit more downside following the Q3 numbers before investing for the long term.

The Vertical Integration Advantage

My article in August 2021 detailed the way BYD had ridden on its vertical integration strengths. I will not go into detail on BYD in this article. That will await a full investment case on BYD in a forthcoming article.

This was exemplified in BYD’s Q3 results. Their net income rose 82% year-on-year to 10.4 billion yuan ($1.4 billion). They were able to do this, at a time of the price war initiated by Tesla, mainly because of the control of their supply chain thorough vertical integration.

Tesla is in fact following BYD’s blueprint in this regard. The great innovator Musk is emulating BYD’s founder and president Wang Chuanfu. Traditional auto such as Ford (F) and General Motors (GM) are far behind in the rearview mirror in this transition. A look at their stock price history tells you this. GM recently declared it was slowing down its EV program rollout. This followed disappointing results from the company. It was already reeling under the UAW strike and from the projected costs of transitioning from an ICE to an EV company. Ford has announced recently it is putting a new battery plant on hold. It has the same problems.

BYD has a wide range of EV vehicles, much wider than that of Tesla. It is now the 4th biggest car brand in the world after Toyota (TM), Volkswagen (OTCPK:VWAGY), and Honda (HMC). Swiss bank USB has forecast that Chinese companies’ share of the world market will rise from this year’s 17% to 33% by 2030. BYD is expected to be at the head of this charge.

The company has a very strong bus and commercial truck division. Tesla only has the much-delayed Semi. It has a huge battery manufacturing division. Indeed it is probably the third largest battery manufacturer in the world. It has 16% of the global EV battery market alone. Tesla is ramping up its battery manufacturing from a small base. Musk detailed some of this in the Q3 earnings call.

My article in August last year detailed BYD’s battery strength. That article is still relevant, though the company has gone from strength to strength since then. The Buy case is even stronger now. In addition it has wisely co-operated with a range of competitors (as well as with Tesla) in many different geographies. My article in August 2020 detailed this. This includes a partnership even with Apple on electronics development.

BYD has an energy storage business, similar to Tesla. It has a fledgling electric mass transit business. It has a semiconductor business. It is going to the source by becoming a producer of minerals that the new world needs. Again this is something Tesla is investigating.

Tesla is catching up fast through its huge capex program. That, along with their strong EV sales, should enable healthy profits, though it may fall further short term

Tesla Auto Sales Going Forward

It is likely that sales and margins will improve markedly in Q4. Brand loyalty is much stronger for Tesla than for any other auto brand. Customer loyalty is a much sought-after metric in any consumer market. Apple and Sony are good examples of that.

The company sees the interest rate environment as the key short-term factor, along with unit costs.

As CFO Vaishav Taneja stated at the analyst call:

Reducing the cost of our vehicles is our top priority.

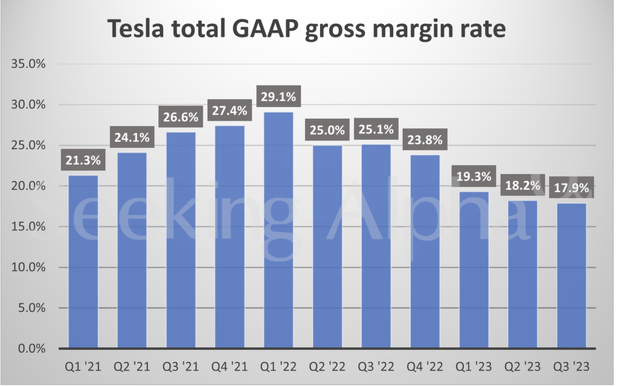

In Q3, Tesla saw some production loss due to retooling and model changes. Total revenues were up 9% year-to-year on revenue of $23.4 billion. That is healthy enough for most companies but expectations are high with Tesla. The results caused a steep fall in the stock price. Its operating profit was down to 7.6%, but gross margins were 17.9%. Margin history as reported by SA is illustrated below:

Traditional auto companies averaged gross margins of about 8% in the first half of the year. It seems impossible to see how U.S. legacy auto can match Tesla in the foreseeable future. The recent travails of GM illustrate the picture. With slow growth and labor problems to deal with, they have announced they are slowing down their transition to EV’s. This will make them even more of a niche player in the world market. The only company with similar margins on autos to Tesla is Porsche (OTCPK:POAHF), a niche luxury car maker. Indeed, one might say it is not legacy auto that Tesla has to compete with, but the new breed of EV manufacturers.

Tesla’s own margins in the quarter were lower due to lower auto prices, spending on factories, and AI spending. The price cut factor has been over-emphasized by Tesla skeptics. They have suggested this shows a worldwide slowdown of demand for Tesla vehicles. However, already in late October there have been upward price revisions in European markets for the Model Y. This was followed by further upward price revisions in China.

Tesla’s growth does continue at a stellar pace. After delivering 1.3 million vehicles in 2022, it is expected to deliver about 1.8 million this year. This remains the company expectation. Analysts see a figure of 2.74 million for 2024, but I think that may be a stretch. The growth history should not be under-estimated as illustrated below:

The Cybertruck was expected to have a full year of sales in 2024. That has changed. At the analyst call, Musk reckoned the company could deliver 250,000 in 2025. Recently on television he targeted a figure of 200,000 in 2024. It is thought the current capacity of the plant in Texas is 125,000. The early optimism on this product is declining in some quarters. I personally doubt its appeal outside of the USA and do not see it as being a real game-changer. It could turn out to be an albatross around Tesla’s neck.

Other analysts disagree and see Cybertruck and FSD licensing as the big spurs to auto growth in the coming years. As this article detailed, there are 1 million reservations in the USA. It is expected to cost about $50,000 for the consumer. That should lead to a significant increase in free cash flow when sales start. There would be a consequent decline in capex once production is fully up and running.

The Supercharger network is being taken up by other companies and is becoming another spur to sales growth. The news in October that BP was contracting for $100 million of ultra-fast chargers for their “Pulse” network was an example of this.

The Semi may well produce the same effects of increased free cash flow and lowered capex over time. Production is still very limited and it was not discussed in the earnings call.

In a sign of Tesla’s expectation for the continuation of growth, an SEC filing a few days after the results detailed capex plans. The company expects capex to be $9 billion in 2023 and between $7 billion and $9 billion in both 2024 and 2025. This includes spending on battery development, factory expansion and on expanding the Supercharger network. It is expected that free cash flow would continue to easily exceed capex. Musk emphasized the importance of capex in increasing vertical integration. The capex numbers are not a sign of a company expecting a fall-off in demand.

As Tesla increases its capex in a number of fields, so legacy auto will have to follow suit. This will be in order just to stay as far behind as they already are, never mind closing the gap. (it is also doubtful if anyone, tech company or not, in this space will be able to get close to Apple’s operational margins of 38%). One should also remember that long-term Tesla’s margins may rise substantially as manufacturing costs fall.

Margin growth could be on the back of FSD, new models, expanding the supercharger network, increased energy business, and of increased production of Tesla’s #4680 batteries. The coming investment of $1 billion in Dojo may be the spur for FSD. Autonomy through AI is a potential further advantage for Tesla over the competition. However these are possibilities, not certainties. The potential for Dojo and the AI divisions could be merely an addendum to the value of the company. Or, as this article details, it could as some analysts believe, add $600 billion to the market value of Tesla.

The energy division was the fastest growing sector of the company in Q3 and this trend will continue. Sceptics keep repeating that it is low profit and only a commodity business. The constant repeating of a false premise does not make it any less false. As Musk stated at the analyst call;

The energy business is becoming our highest margin business.

The energy storage market worldwide is huge and growing. Tesla has been ramping up production to try to get close to meeting the surging demand. This includes the new factories in California and in Shanghai. In what could be seen as a tail-wind to the economic benefits of battery based energy storage, developments in sodium batteries could enable the to be a lower-cost replacement of lithium batteries.

Tesla Worldwide

As of August, the Model Y became the best-selling car model in the world, just above the Toyota Corolla. It is the first time an EV has won this accolade. The Model 3 came in tenth. A big unanswered question is whether the new Model 3 will appear fresh enough to consumers to give a renewed boost to its sales.

* The Americas.

In the U.S., legacy auto is in a bind. In the 1st half of 2023, Tesla sold 325,291 vehicles in the country. The next 19 suppliers sold 214,542 vehicles. In Q3, Tesla’s market share dropped to about 50% against an increasing number of companies with an increasing range of product. Market share will fall as the market expands hugely beyond the ability of any single manufacturer to meet the demand. It is unlikely to fall due to inroads by legacy auto. What counts for a company’s revenues though is not market share but total sales.

It is true that Tesla needs to expand the breadth of its product. In the USA, there will be a point reached where the stock of affluent Tesla buyers will be largely sated. That makes the markets of Asia even more important. The potential for growth there is far greater.

The Cybertruck is intended to provide this breadth, but time will tell how successful is that product. The Semi looks as though it will be a meaningful revenue source in a different area of the market. One advantage Tesla does possess is that for the time being American protectionist sentiment will keep BYD cars out of the market.

The company has been slow to bring the Tesla brand to South America, but recent reports suggest this is about to change. The move will presumably accelerate when the Mexico factory comes online, but that project is delayed.

* Europe

This is currently Tesla’s most buoyant market for EV sales. The Model Y has been the best-selling car and the Model 3 the second best-selling car for months in the EV sector. The VW ID 3 is trailing far behind. In September, the Model Y became the best-selling car of any type in Europe. There is no doubt where the continent of Europe is going in the move from EV’s to ICE. This is less certain in the USA, to my mind.

In early October, when the company again cut prices in the USA, they increased prices in most of Europe. By 2035 all auto sales in the EU are slated to be EV’s. (This year it is estimated that 35% of auto sales worldwide will be EV’s and 80% by 2040.) The importance Tesla puts on Europe may be seen by the continent being the first recipient of ship-loads of the new Model 3 Highland out of Shanghai. The Middle East was also being supplied at the same time. Europe is being prioritized over the USA for this, perhaps because of longer wait times for the buoyant customer orders.

*Asia

In South Korea the Model Y is now the best-selling imported car and the 5th best-selling car of any type. That is against a swathe of excellent cars from Korean manufacturers.

In Australia the Model Y and the Model 3 are the best-selling models, followed by the BYD “Atto.” BYD has launched in Australia just this year and along with Tesla they are likely to gain a majority of the market. The country had previously suffered with a lack of supply of the right model for the country’s specifications. The ramped-up production in Shanghai is starting to overcome this problem. This improved product range from Shanghai is beginning to prove beneficial in many markets in Asia.

In Taiwan, the Model Y leads the EV pack even though they cannot supply from the Shanghai factory for political reasons.

In Singapore, a small but affluent market with the world’s most expensive cars (the most basic Model 3 costs about $170,000), BYD has replaced Tesla as the country’s best-selling EV brand. Around Asia this might well be replicated. It would not foretell a decline in Tesla sales but a decline in market share as BYD and Tesla increasingly carve up a growing market.

In India, the company has been trying for some time to set up operations in this huge but very difficult and protectionist market. Tesla wanted to have trial exports from China into India free of the almost 100% import duties. This was to test demand in the market before investing in the country. The Indian government has refused this. It has insisted Tesla invest huge amounts of money in the country first. The impasse has not been broken despite Musk arranging meetings with Prime Minister Modi.

In China, the company sold 222,517 China-made vehicles in Q3, up 18% year- on-year. By comparison worldwide the company sold 435,059 cars in the same period, up 26.5%. More of Shanghai production went to export markets where many countries have long waiting lists. Q4 may see a big boost in China domestic sales. The slightly revised Model Y has been launched and the new Model 3 “Highland” is now being launched in the country. That will be a test case for the continuing appeal of Tesla in China. Already, insurance registrations for the first 3 weeks of October show a surge in sales while at the same time export shipments for the new Model 3 are busy. The central issue in Shanghai is how the company prioritizes.

The China figures in Q3 can be seen as disappointing but the numbers also show the increasing importance of Asia. Manufacturing over half their production in China is a success story. It is though also a strategic risk, as this article discussed.

BYD’s strength in their home market is shown by the latest auto sales in China:

Recent figures for BYD illustrate how strong both sales and revenues are rising for BYD.

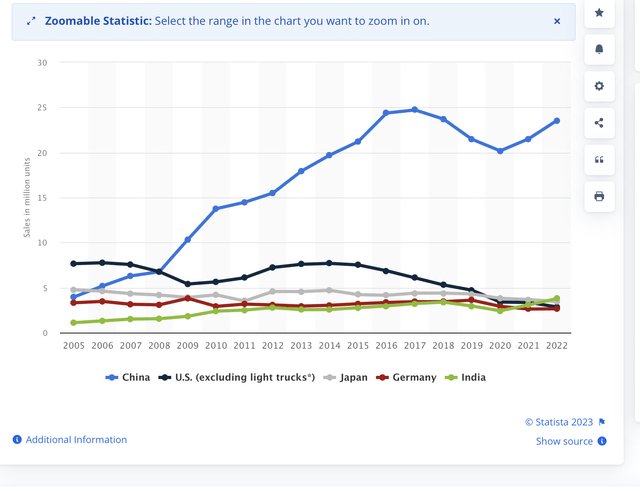

China is vital for everyone. The chart below shows the key importance of China to the world auto market:

Another way of looking at this is to see car sales numbers from 2022:

The trend is more important even than the raw numbers. Increasingly Asia is becoming more important and the USA less important for the world auto market. The top 4 auto markets are all in Asia. Further down the list are fast-growing markets such as South Korea, Thailand and Indonesia. The Asian auto markets are about three times the size of the U.S. market. This disparity will increase as Asian economies and populations grow more rapidly than those in the West.

Possible Negatives to the Thesis

* The uncertain political and economic outlook for the world.

* Possibility of strong economic contraction in China.

* Lack of new models for Tesla with uncertain time-lines for Cybertruck, the Semi and a lower cost auto model.

* Lessening of worldwide enthusiasm for the pure EV concept. This would harm BYD less as the company has a very strong hybrid offering.

Conclusion

Tesla and BYD are far ahead of the competition, both strategically and in terms of revenues. Stellantis (STLA), Volkswagen, Hyundai (OTCPK:HYMTF), and NIO Inc. (NIO) may all have their backers. Tesla and BYD have innate advantages, and they have great strength in Asia which will be the most important market in the foreseeable future.

Tesla’s brand equity, vertical integration and technological primacy are perhaps its greatest strengths against the competition.

BYD is able to ride with Tesla’s price-cutting policies and maintain healthy margins primarily because of its vertical integration as well as its cheaper labor cost base. This enables it to be recommended by most analysts at this point in time. A caution about investing in Chinese companies will though seemingly always act as a somewhat moderating force on BYD’s stock price.

Tesla’s stock price has fallen in reaction to the Q3 results. Auto growth and margins should improve again and non-auto products continue to increase in importance to ensure continued robust growth.

The stock price is being brought down to levels which are very attractive for the long-term investor. In Q3, auto sales revenues grew by 5%. Energy sales revenues grew by 40% and “Services & Other” grew by 32%. AI areas such as Dojo and FSD are yet to come.

The sales revenues show the vertical integration advantages Tesla enjoys over its competitors is increasing all the time. As it becomes increasingly a tech company, its stock price will rise on the back of the high profits that a successful tech company can attain over pure hardware companies.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA BYDDF AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.