Summary:

- MULN reports Q4 2022 results showing zero sales despite multiple announcements of vehicle orders.

- The company is building assembly lines to assemble EV vehicles using Chinese EV parts and designs.

- Balance sheet challenges will likely result in significant share dilution enough to send shares lower, regardless of the company’s progress in commercializing its vehicles.

- Cash burn will likely increase as the company continues efforts to assemble its EV.

MrIncredible/iStock via Getty Images

Investment Thesis

Last week, Mullen Automotive (NASDAQ:MULN) reported FQ1 2023 results for the three months that ended December 31, 2022, recording no revenue despite prior announcements of vehicle purchase orders that were supposed to be delivered by the fourth quarter. Net loss per share stood at $0.28, with a significant ramp-up in operating expenses as the company continues its efforts to commercialize its Electric Vehicles.

Our Sell rating on MULN stock mirrors the belief that the company cannot meet the short-term revenue targets. It is also not well-managed, as reflected in the company’s lack of internal accounting controls, as noted in its SEC filings, and lack of operational focus and profitability path. Finally, the company has significant balance sheet challenges, especially as it ventures to ramp up production. We expect substantial share dilution. The share price declined significantly in the past few months, and the company will likely be removed from the Russell index this year.

Revenue Trends

MULN is seeking to commercialize Chinese EV technology into the American market by building production lines that assemble imported automotive parts, with tweaks to obtain regulatory clearances for the vehicles to run on US roads, including air-bags, seat-belts, etc., that abide by local regulatory standards.

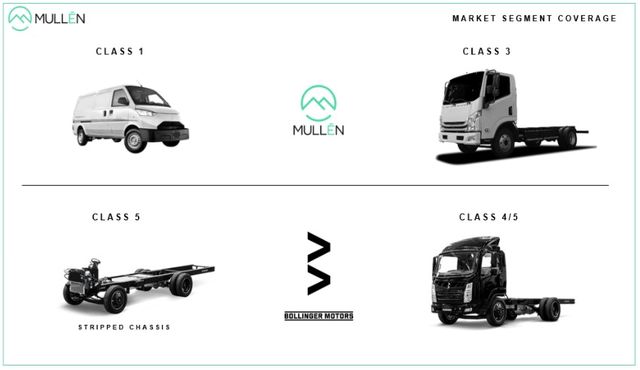

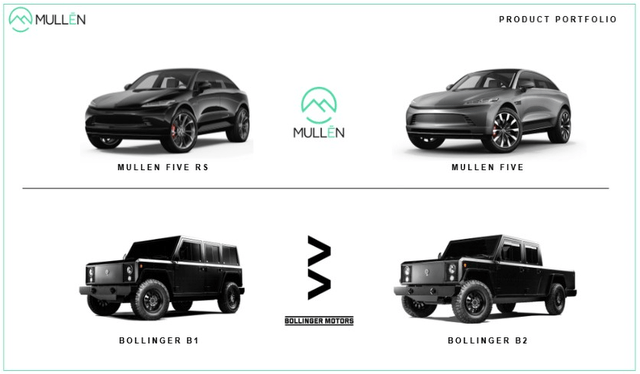

While it’s true that there are many competitors in the EV market, there’s a lack of model options to meet the varying needs of customers in different markets. This is where MULN can help, filling the gap by offering various models with distinct price points. With a developed Chinese EV market with a size multiple that of the US, MULN was able to build partnerships beyond those that went sour with good specs. For example, the company offers Mullen Van, Mullen Five SUV, I-Go last-mile delivery, and Bollinger off-road vehicles. The company’s sports car is a rebranded model of Qiantu’s K50.

Mullen Automotive Mullen Automotive

However, although the market is big enough to accommodate new market entrants, success in rolling out a product that meets consumer tastes is a bit tricky, especially for companies and management personnel with no experience in the market, such as Mullen and its CEO. The first line of defense against these dynamics is offering price differentiation or discount, but this tactic can only get you so far.

Mullen also has difficulty building its assembly lines. In July 2022, the company announced a binding agreement with DelPack for 600 Class 2 EV Cargo Vans, 300 of which were supposed to be delivered in November. Yet, results for the three months that ended December show no revenue recognition. The order wasn’t fulfilled.

This is not the first time the company has reneged on its promises of deliveries from supposedly “binding” purchase agreements. In 2020, the company announced a letter of intent from Unlimited Electrical Contractors for 10,000 Mullen Five, 1500 for initial delivery, and 8500 to be delivered by 2025. In November 2021, the company announced the debut of Mullen Five, which implicitly means that it can produce the vehicle, at least in a certain capacity, given that the company was accepting reservations. In December 2021, the company announced the following:

Mullen is currently on track to deliver initial vans to existing fleet order customers starting in Q2 2022

In January 2022, management stated:

The time frame for the first fully functional and drivable vehicles, including the FIVE RS, is currently on track for Q3 2022

Various reports have also cast doubt on the financial position and reputation of the entities mentioned in the purchase agreements, including Heights Dispensary, a small cannabis shop (order: 1200 Mullen One Vans at $60 million), and Unlimited Electrical Contractors, an engineering contractor with less than $5 million revenue (order: 10,000 Mullen Five worth $500 million).

Multiple car dealers expressed interest in showcasing Mullen’s products on their websites and showrooms, including Randy Marion and Newgate in Ireland. There might be some demand, but one can’t help but wonder if a Chinese vehicle design will match the tastes of Western customers. Uncertainty regarding the ability and timeline of delivery and revenue recognition is also a pressing issue.

Operating Expenses, Cash Burn, and Dilution

The company consists of a cluster of failed EV start-ups. Its Indiana manufacturing facility was bought from defunct ELMS in October 2022. The company bought its Missouri facility from Green Tech Automotive, which also went bankrupt in 2018. Its California battery assembly was purchased from Coda, which, similar to MULN, relied on Chinese EV design and partnerships to supply its assembly lines.

MULN’s programs and acquired assets have different technology, production, and supply-chain modes. Management is utilizing the help of third-party professional services to put these pieces together, such as:

- Hofer powertrain for EV powertrain

- Comau for engineering

- ARRK for manufacturing

- Dürr for vehicle production systems

- DSA Systems for vehicle system diagnostics

These disperse technological and production packs will make it hard to streamline production, increasing operating and per-unit costs.

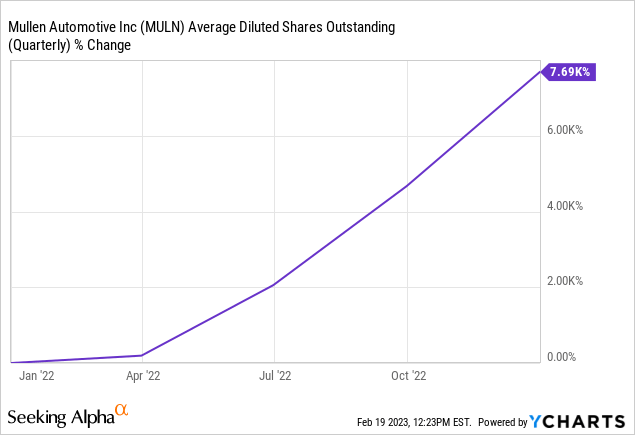

The company burnt $33 million during the quarter, translating to a $130 million cash burn. The most recent report’s cash reserves of $86 million indicate balance sheet difficulties. I anticipate the company will seek funding through equity or debt in the next few months. Share dilution in the past few months was astronomical, as shown below.

Upside Risk

There is a broad interest in electric vehicles, especially commercial vehicles, and trucks, and Mullen is well-positioned to capitalize on that interest. Given this public enthusiasm, the company could succeed in raising capital to supplement operating expenses, purchase equipment, build assembly lines, and invest in its facilities.

There are also many opportunities for MULN to be pragmatic as it attempts to scale production. Essentially, MULN imports a Chinese car before adjusting it for US road standards, and this could translate to a faster production cycle, contrary to what we imply in this article. An aggressive operational readjustment could provide MULN the means to deliver commercial vehicles more efficiently, and this is an area where MULN’s suppliers can help with.

Summary

At this point, MULN should be fine driving preorders for its vehicles. The company has a variety of models with different applications, including commercial vehicles, vans, and last-mile delivery vehicles.

However, bringing vehicles on the road is challenging. The company assembles Chinese car components, which requires ramping up industrial capacity. This is a technically and financially tricky task, underpinning its failure to meet its vehicle delivery orders.

The company’s balance sheet is weak and plagued with convertible notes that will mature soon. The number of shares outstanding will likely increase exponentially in the coming twelve months. Even if MULN succeeded in commercializing its products, this share dilution alone is enough to send shares lower.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.