Assessing Intel (Rating Downgrade)

Summary:

- Intel Fab news gets worse and worse.

- Servers are unlikely to improve in the visible future.

- Intel still owns the client market.

JHVEPhoto/iStock Editorial via Getty Images

After Intel’s latest earnings, I wanted to wait a bit and get a better assessment of where they are; more or less start from scratch in my thinking of their prospects.

In my previous articles, I rated them a strong buy. But, I no longer trust their leadership to nearly the same extent I did, and that’s even more important than any individual factor. However, the stock price dropping almost by a third certainly has an important impact, so I still rate it a buy. The company still has some extremely strong factors, but it’s also got some really important issues that I want to go over. Obviously, you should make your own decisions, and you could come up with a completely different assessment based on the same information; that’s what keeps horses racing.

Intel is viewing cuts, not growth now

One of the most obvious things that came from the earnings report is Intel’s leadership has completely given up on the projections they had. Their expectations for the foundry business have met with reality, and were crushed. That’s been ongoing for a while, with them saying they didn’t have to have major external foundry customers for a few quarters, but there was far more drama in this earnings report, not the least was the discontinuation of the dividend, to go along with the massive layoff plans.

Before, it was grown out of the situation, now it’s to shrink out of it. This is deeply disturbing from a company that spent massive amounts of money on the premise it would benefit from growth once completed. It still might, but it won’t be any time soon.

The problems with manufacturing

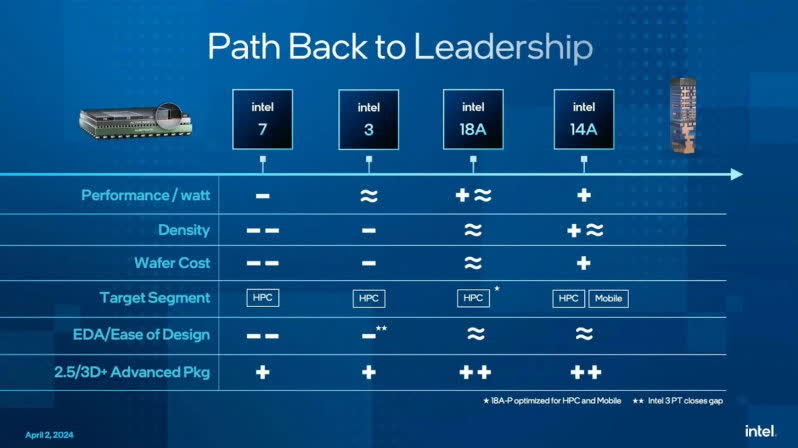

We also have more news from Intel’s 18A process, and it’s somewhat bad. Whereas before we were told by Intel reps 20A would offer a 15% improvement in perf/watt, and 18A another 10%, now we’re told that going from Intel 3 to 18A offers roughly a 15% improvement in that metric, as well as 1.3x the logic density. SRAM will almost certainly be the same, or very close to it. The problem with this is, 20A should have bad the 15% improvement, and 18A 10% improvement on that, which would have been over 26%. It sure seems like something changed for the worse.

Now, that’s all fine if Intel 3 is very good. Except we don’t know that it is, and what we have indicates it’s not very good. First, we know Intel 4 isn’t very high performing Meteor Lake showed a regression in clock speed from Raptor Lake, despite being essentially the same architecture. As I have noted before, Intel 4/3 are very similar nodes, and in fact, most people consider each a half-node, which is the same as 20A/18A. Intel didn’t, however, when they said each node should have 15% perf/watt improvement, but if they were wrong about 20A/18A, it stands to reason they may have been overly optimistic about Intel 3 as well.

More to the point, they aren’t even making any of their client parts on Intel 3. Two servers parts are made there, that’s it! No client parts (where the volume is), no GPUs, no accelerators, and apparently no external customer parts. If this were a good node, it’s very difficult to believe there would be so little being made on it. This is not to say it’s horrible like the initial Intel 10nm was, it’s fairly dense, and the clock speeds on Meteor Lake are not terrible. I also would not look too much into power use on Meteor Lake because it’s a chiplet design, not monolithic, and that does cost some power.

Intel will have improved versions of Intel 3, in the future, so maybe one of them will be good, but that’s hardly of great importance. By then, this will be a trailing node. It kind of always has been.

So, how good will 18A be? It looks decent. The density might not be the best, but it’s good enough, and apparently the cost per transistor is far better than Intel 7, which is atrocious. Intel 7 is a great performing node, but it’s extremely expensive per transistor, so this makes the foundry non-competitive. 18A promises a big improvement there, and that’s probably the most important improvement that’s needed.

Intel

I am focusing on manufacturing because that’s the primary reason Intel is in trouble now. They don’t have anything to really build with, current nodes are not competitive, and future nodes, are, well, future. Meteor Lake, their latest (as of this writing, but probably not by the time you’re reading it) mobile line, is made mostly at TSMC. Lunar Lake, which may be out by the time you read this, is entirely made at TSMC. That’s expensive for a company paying for their own fabs, but not using them. Remember, mobile is around 80% of the client market, so this is most important product segment Intel has.

It’s also well known their new GPUs will be made at TSMC. The upcoming desktop part, Arrow Lake, is rumored to be made at TSMC as well, but if it is, there likely will be some made at Intel, as several of their slides show it having a 20A component. But, it’s almost a certainty most of it will be made at TSMC, much like Meteor Lake, but probably more so.

So, Intel is spending enormous amounts of money on its foundry business, despite outsourcing more of its manufacturing to TSMC. In addition, the current process, Intel 7, is so uneconomical, even the company mentions this consistently, and how past mistakes caused this.

DCAI is doing poorly, with no end in sight

The server business (DCAI) is a mess too, with the world budgeting to AI accelerators rather than conventional server parts, to go along with Intel server parts still struggling to be competitive.

Why Intel is in such a difficult situation is very clear. Can they get out of it? Things should get better, but it’s unclear how much.

Things might get worse before they get better though, but it won’t be much worse, and for very long.

Intel 7 is a very high performance node, but it’s extremely expensive per transistor, and is not power efficient. For desktops, it gave Intel the performance it wanted, and it allowed Intel to dominate AMD in market share even in mobile (Intel still has almost 80% market share in client). The nonsense about Intel’s market share problems in client is pure alarmism, as they remain between 75% and 80% in both mobile and desktop. Intel has been good enough to maintain that, but with AMD moving to newer TSMC nodes, new competition from ARM, and the new AI craze, Intel 7 based processors will not sell well for much longer. Intel’s Meteor Lake apparently has been selling well given Intel said the demand is exceeding supply, and they’re moving production to Ireland. This despite it’s a mediocre design, lacking in power efficiency and performance. Although the processor is made on Intel 4, the rest of the active parts are not. More than this, even Intel must know this part isn’t very good because they have moved Lunar Lake from a purely high-end part to address a wider market.

Lunar Lake is entirely made at TSMC, and the 3nm node. This is an expensive node, so the cost of parts is going to be quite high, and of course, it means Intel fabs are not making parts. So, this will depress margins. We don’t know everything about Arrow Lake, but it’s very clear at least some of it will be made at TSMC, even if some of the CPUs are made on Intel 20A. The rumors indicate some CPUs will be made at Intel, some at TSMC, but other chiplets like the GPU will be made at TSMC. Intel has indicated a few times that a large portion of their devices will be made at TSMC as we go into 2025, until finally moving back to Intel 18A with Panther Lake and later parts.

As mentioned, Intel 7 is dreadfully expensive, whereas 18A is not. David Zinsner said that the cost of an 18A wafer was roughly the cost of a Intel 7 wafer, and the chart above indicates Intel is going from far more expensive than competitive nodes with Intel 7, to roughly parity on 18A. The cost of TSMC wafers go up considerably with each new node. So, in terms of cost, 18A will be much more cost competitive, as well as being roughly twice as dense, and having better performance per watt. Will it be better than what TSMC has? We don’t know, but it will be much competitive than what Intel is making now, particularly when cost is figured in.

Sadly for Intel, 18A is not going to be a big win for the external foundry business. Intel is still talking about $15 billion lifetime agreements, which isn’t good because it has been saying that for a long time, and one would expect additional signings to increase that. But, at least it has some, and can start the ball rolling. I think Pat Gelsinger finally understands opening up the fabs and having a decent node isn’t going to generate instant business, and it’s going to be a slow grind where he has to improve everything around the technology, most of all trusted relationships. It starts with 18A, but 18A isn’t going to be a big revenue generator for Intel.

If we look at servers, it doesn’t look much better for Intel. Granite Rapids is almost certainly another iteration of the same architecture of Sapphire Rapids, and Emerald Rapids. But, it’s on Intel 3, which is a far denser node, and should have better performance per watt. Even so, not a game changer. Sierra Forest looks like an interesting product, but it is likely to fundamentally change Intel’s server situation. It is trying to address high throughput scenarios, but with currently just 144 cores, and later 288 cores, it probably will not have much impact in the market. Other companies, like AMD, can use fewer cores that run two threads, and offer competitive performance. Sierra Forest is a good start, but it’s Clearwater Forest that will have the opportunity to gain traction.

Of course, the focus has been in AI training, and that has consumed a lot of the money that would have otherwise been spent on traditional servers. Intel has almost completely failed in this segment, and their new Gaudi 3 chip will not change that. Even Intel claimed it would only generate roughly $500 million this year. Intel points to Falcon Shores, which should be out next year, as their opportunity to impact this market. Why is it always “we have something next year” with this company?

I am oddly sanguine about Intel’s GPU future. Obviously, the company’s first line was a complete failure, now currently at below 1% market share. It spiked here and there to over 2%, but was always largely forgotten by the market. When the cards came out, the software/driver was terrible, which severely damaged the reputation of the products. The performance was also poor for the die size, and power usage. Intel came out with new software continuously, and the improvements were remarkable. The company also took discredit for design decisions in the hardware which made it less efficient, which have been corrected for Battlemage. The cards were always considered very well priced, so Battlemage has a real opportunity to make a splash. This is especially so since the gaming community really wants Intel to succeed and add a third option, particularly with the pricing NVIDIA has been imposing on their parts.

That is how I currently see things. The fabs are more disappointing than ever, but even with that, things will get better. The server market is a mess for Intel, and the new Granite Rapids and Sierra Forest will not reverse their market share losses. In AI server workloads, things look even worse, with no clear path to improvement. Intel still owns the client market, and Lunar Lake looks to be an outstanding product, in contrast to AMD’s disappointing Zen 5. The GPU segment should show improvement, but not enough to move the needle in their overall earnings. I am just hoping to see positive momentum this generation.

It’s not great for Intel, but at $22 a share, I’m still seeing it as a buy. If I didn’t lose my trust in Intel’s management, I would still rate them a strong buy, because the opportunities are still fantastic, even if clipped a bit, for the price of the stock. It is difficult not to feel a bit deceived, however, and there’s an old saying “It’s not that you lied to be me that bothers me, it’s that I can never trust you again”.

Of course, I can understand why people would disagree with me. Leave your comments below if you do.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.