Summary:

- Palantir’s profitability and go-to-market strategy have improved, but the stock is currently fully valued and trading at a premium.

- The company reported strong financials, with impressive margins and record free cash flow generation.

- Palantir’s AIP bootcamp go-to-market strategy is driving competitive advantages and accelerating revenue growth.

JHVEPhoto/iStock Editorial via Getty Images

Palantir (NYSE:PLTR) is a company that divides opinions like few others. I’ve been following the company trying to get a good entry point, but I’ve always held back due to either a lack of fundamentals or a price tag that was too steep for me.

I think Palantir has seen tremendous improvements in both profitability and its go-to-market motions in the last few quarters, but I believe the company is currently fully valued and trading at a premium. However, I believe the premium might not be as absurd as some might think, as I see Palantir as a $20-$21/share company. Because of its current valuation, I rate Palantir a HOLD and I won’t be building a position just yet. However, I recognize the company has tremendous optionality value and I think it is too early to completely sell out of your position. If I had a large position in Palantir, I would consider gradually trimming at these levels.

If Palantir keeps performing well in its commercial segment and bootcamp go-to-market strategy, I would start building a position in the $18-$19/share range.

Here are my quick thoughts on the Q4-23 earnings release and the current valuation.

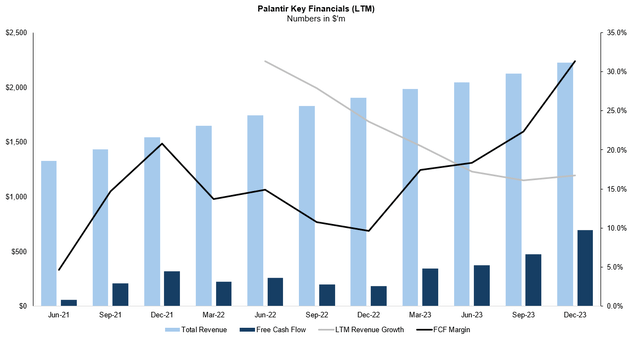

The financial profile is strong, with impressive margins and FCF generation, but I think there is little room for FCF margin improvements after a stellar Q4-23 earnings release

On the 5th of February, Palantir reported Q4-23 results with Revenue of $608.35m (+20% YoY) beating analysts’ estimates by $5.55m, while non-GAAP EPS of $0.08 was in-line with expectations. Commercial revenue grew an impressive 32% YoY and 13% QoQ, reaching $284m in the quarter and surpassing the $1bn mark for the first time in FY23. Quarterly US commercial revenue grew +70% YoY driven by strong momentum in AIP.

Performance in the Government segment was also solid, with quarterly revenue growing to $324m, +11% YoY. Total customer count grew +35% YoY.

Palantir generated a record $697m in FCF LTM Dec-23 (FCF defined as reported Cash from Operations less Capex), a 31% margin. The company has executed well on the margins side (for reference, just a year ago LTM FCF margins were less than 10%), but I believe it is pretty much optimized for FCF generation. If Palantir keeps executing, I think it could reach steady FCF margins of ~35%, a modest expansion from current levels.

The company provided revenue guidance with Q1-24 slightly below expectations but FY24 above analyst estimates. For the full year, management is calling for $2.652bn-$2.66bn, above the $2.64bn consensus. At the midpoint, this would represent ~19% growth YoY in FY24, a reacceleration from the 17% YoY revenue growth seen in FY23 and a testament to a successful go-to-market strategy and AIP popularity among commercial clients.

Palantir’s AIP bootcamp go-to-market strategy is resonating well with customers and I see it as one of the company’s big competitive advantages

I think the company’s unique bootcamp go-to-market strategy will continue to drive competitive advantages. Q4 numbers were phenomenal: in October the company laid out the goal of executing 500 AIP bootcamps within one year; fast forward to Q4-23 and Palantir already completed more than 560 bootcamps across 465 organizations to date.

I see bootcamps providing extreme value to clients and I think they are the best way of showcasing the capabilities of a very complex product. Bootcamps are hands-on sessions with customers where participants can expect to go from zero to use case in just 1 to 5 days, and they were key in driving commercial revenue to new highs. Bootcamps are helping the company to meaningfully compress sales cycles and accelerate new customers acquisition, as demonstrated by US commercial customers growing at 22% in Q4 vs 12% and 4% in Q3 and Q2, respectively. Bootcamps are also driving larger deals, with the number of US commercial deals with TCV >$1m more than doubling YoY in Q4 vs last year.

Bootcamps show a clear improvement in unit economics, and how the company will manage the high demand and the monetization strategy will be key in driving acceleration in commercial revenue.

At these levels, I believe Palantir is fully valued and trading at a modest premium. I see Palantir as a $20-$21/share company and I would be comfortable building a position around $18-$19/share

Palantir stock has been on a tear, with 1Y returns of 190%+ at the time of writing. I believe the initial jump post earnings was somewhat justified, but with the stock now trading at $23+/share, I view shares as marginally overvalued. I don’t have a position in Palantir, but I would be happy to start building one if the stock dropped to $18-$19/share.

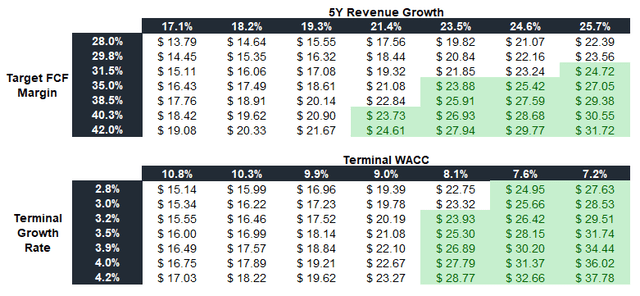

As mentioned, when I look at Palantir I see a company that is optimized on a FCF basis, but I believe there is still room for some modest margin expansion to ~35% FCF margins long-term vs 31% LTM Dec-23. Regarding top-line growth, analysts are expecting 20% growth in FY24 and if the company keeps executing on its AIP bootcamp strategy, I believe low 20%s growth for the next 5Y is more than achievable. This is where I see AI optionality value for Palantir. So far, bootcamps have been an extremely effective strategy in accelerating commercial revenue and if this positive momentum continues, there is the chance revenue growth is currently misvalued. I wouldn’t be surprised to see revenue re-accelerating in the mid 20%s over the next few years because of AIP bootcamps’ success and the introduction of new AI products.

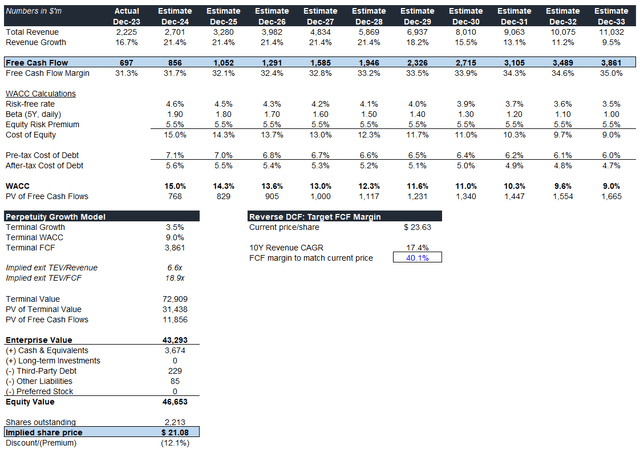

Under these assumptions (low 20%s growth, ~35% FCF margins), I see Palantir generating ~$3.9bn in FCF in 10 years-time, vs $697m LTM (+19% 10Y FCF CAGR). At this stage, I believe Palantir is a $20-$21/share company. From a reverse DCF perspective, if Palantir maintains around a 17% 10Y revenue growth, the company would need ~40% FCF margins to justify the current price, which I think is aggressive but not impossible.

SEC Filings, CapIQ estimates, own estimates

I believe Palantir will keep on executing on the margins side, so for me the big question mark is on top-line growth:

- Grey Sky Scenario: Palantir can’t reaccelerate revenue, and growth stays around 17% for the next 5Y. The company would be trading at a 40%-50% premium to fair value ($16-$17/share valuation).

- Base Case Scenario: we see a modest reacceleration in revenue following the success of AIP bootcamps. The company would be trading at a modest premium of 10%-15% to fair value ($20-$21/share valuation).

- Blue Sky Scenario: new AI products and great execution on the bootcamp strategy push revenue growth to ~25% for the next 5Y. Palantir would be trading at a 12%-16% discount to fair value ($27-$28/share valuation).

Personally, I see more optionality value to the upside (Base and Blue Sky scenarios more likely than Grey Sky scenario), which is why I would be willing to build a position if the stock traded down to ~$19/share or lower, assuming fundamentals remained intact.

Here’s what fair value sensitivities look like (fair values > current share price highlighted in green):

SEC Filings, CapIQ estimates, own estimates

What I will be monitoring going forward

Bootcamps have been driving the bulk of outperformance in the commercial segment and I will be closely following any changes to the go-to-market motion. For me, the 2 big questions regarding bootcamps are around monetization strategy and how easily scalable they are. As mentioned, if the company keeps executing well and can keep up IBM (IBM) with the demand for AIP bootcamps, I see the possibility for meaningful revenue reacceleration in the coming years.

I like the fact Palantir is diversifying away from the government segment thanks to the impressive growth seen in commercial clients. But the company is still heavily dependent on government contracts, which by nature are lumpier and subject to political risk/budget constraints.

Finally, while Palantir has a cutting edge platform, we will likely see increased competition in the data analytics sector from more established players like Microsoft (MSFT) Google (GOOG) (GOOGL), IBM etc. The way Palantir will navigate competition through the introduction of new products or changes to its go-to-market motion will be key in maintaining 20%+ growth.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.