Summary:

- T’s dividend investment thesis remains strong with stable performance metrics, sustained growth investments, reiterated FY2024 FCF guidance, and rich yields.

- The telecom’s growing fiber and internet air fixed wireless product adoptions are already driving growth opportunities, despite the temporal headwinds from the transition from copper-based broadband services.

- T’s valuations are attractive compared to its telecom peers, making it a discounted investment opportunity for those looking to dollar cost average.

- Combined with the improving balance sheet health, we believe that the stock is likely to continue performing well as a telecom/ dividend stock, despite the lack of tech-like (beat-the-market) growth prospects.

Shutter2U

We previously covered AT&T (NYSE:NYSE:T) in February 2024, discussing its misunderstood FY2024 guidance, since the net effect remained positive with growing Free Cash Flow generation and safe dividend investment thesis.

Much of the tailwinds were attributed to the telecom’s sticky consumer base and growing ARPUs, despite the recent price hikes and intensifying market competition, further exemplifying its ability to achieve the net debt-to-adjusted EBITDA ratio target of 2.5x.

Since that Buy rating, T has traded sideways at +1.1% compared to the wider-market at +3.9%. Even so, we are maintaining our Buy rating here, with the stock’s dividend investment thesis still robust thanks to the stable profitability, rich yields, and reiterated FY2024 FCF guidance.

Combined with the improving balance sheet, the management’s guidance of lower vendor financing payments, and intensified fiber expansion/ wireless network transformation in 2024, we believe that the stock is likely to continue performing well as a telecom/ dividend stock.

T’s Dividend Investment Thesis Remains Robust, Thanks To Its Converging Connectivity Approach

For now, T has reported a mixed FQ1’24 earnings call, with total operating revenues of $30.02B (-6.2% QoQ/ inline YoY), adj EBITDA of $11.04B (+4.6% QoQ/ +4.3% YoY), and Free Cash Flow generation of $3.14B (-50.7% QoQ/ +214% YoY).

Part of the top-line headwinds are attributed to the declines in Mobility equipment revenues at $4.6B (-27.5% QoQ/ -9.6% YoY) and lower Business Wireline revenues at $4.91B (-2.7% QoQ/ -7.8% YoY), attributed to lower Mobility sales volumes and lower demand for legacy voice/ data services, respectively.

Then again, these headwinds are well-balanced by T’s increased Mobility service revenues of $15.99B (inline QoQ/ +3.2% YoY), as its subscriber base grows with Total Wireless Net Adds of 741K (-2.3% QoQ/ +7.3% YoY) with postpaid ARPU of $55.57 (-1.1% QoQ/ +0.9% YoY) in the latest quarter.

Combined with the Communication segment’s growing operating margins of 23.4% (+1.9 points QoQ/ +0.3 YoY), Mobility at 31.4% (+3.7 points QoQ/ +0.9 YoY), Consumer Wireline at 6.4% (-0.4 points QoQ/ +3.5 YoY), with the only exception being the Business Wireline at 1.3% (-2 points QoQ/ -5.8 YoY), it is apparent that the legacy telecom continues to monetize its offerings excellently.

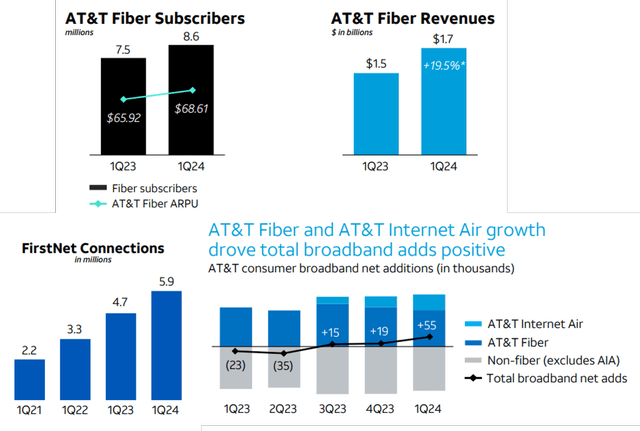

Fiber Adoptions Driving T’s Growth

T

At the same time, the T management has highlighted growing Fiber and Internet Air fixed wireless product adoptions, resulting in a net positive growth, despite the $159M in asset impairments/ abandonments charge in FQ1’24, attributed to the continued transition from its copper-based broadband services.

With its “broadband support costs already are decreasing, thanks to fiber’s more efficient operating model, greater reliability, and higher quality service,” we believe that these investments will eventually be bottom-line accretive despite the temporal headwinds.

Lastly, with T already reporting excellent “converging power of 5G and fiber together,” where more customers increasingly “converged provider seamlessly connecting them both in the home and on the go,” we believe that its service revenues, subscriber base, and ARPU are bound to grow together as churn declines, naturally triggering its growth opportunities over the next few years.

Combined with the relatively consistent consensus forward estimates and robust Free Cash Flow generation through FY2026, it is apparent that T remains well capitalized to deleverage moving forward.

Based on the moderating long-term debts of $125.7B (-1.6% QoQ/ +1.6% YoY) and growing cash/ equivalents on balance sheet at $3.52B (-47.6% QoQ/ +24.8% YoY), we are looking at a relatively stable net debt of $122.18B in FQ1’24, compared to $121.13B in FQ4’23, $120.9B in FQ1’23, and $139.17B in FQ4’19.

At the same time, based on the growing adj EBITDA, T’s net-debt-to-EBITDA ratio has been improving to 2.76x in FQ1’24, compared to 2.87x in FQ4’23 and 2.85x in FQ1’23, with the management still expecting to reach its target of 2.5x by H1’25, nearing the 2.47x reported in FQ4’19.

With telecom businesses typically debt laden, T’s leverage ratio remains relatively reasonable compared to its peers, such as Verizon (VZ) at 2.84x, Comcast (CMCSA) at 2.51x, T-Mobile (TMUS) at 2.43x, and the telecom service industry average of 2.08x.

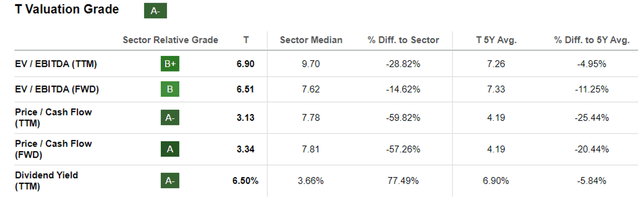

T Valuations

Seeking Alpha

As a result, we believe that the T management has demonstrated laser focus in improving its balance sheet while consistently paying out dividends to long-term shareholders, a feat that is increasingly viewed positively by the market as observed in its improving valuations.

At the time of writing, T trades at a higher FWD EV/ EBITDA of 6.51x and FWD Price/ Cash Flow of 3.34x, compared to its October 2023 bottom of 6.08x/ 2.75x and nearing its 3Y pre-pandemic mean of 6.86x/ 5.85x, respectively.

Even so, when compared its peers, VZ at 7.08x/ 4.68x, CMCSA at 6.28x/ 5.16x, and TMUS at 9.44x/ 8.0x, it is apparent that T remains discounted here, triggering its attractive dividend investment thesis.

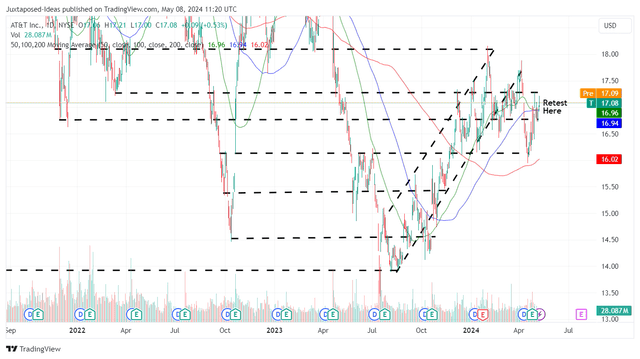

So, Is T Stock A Buy, Sell, or Hold?

T 2Y Stock Price

Trading View

For now, sentiments have improved drastically surrounding T, as observed in the immense recovery of +21% since the August 2023 bottom, well outperforming the wider market at +17.6% over the same time period.

Even so, as a dividend stock, T continues to offer a rich forward yield of 6.50% similar to VZ at 6.77%, and improved compared to CMCSA at 3.22%, the sector median of 4.14%, and the US Treasury Yields between 4.62% and 5.39%.

As a result, we maintain our Buy rating for the T stock, though without any specific entry point since it depends on individual investors’ dollar cost average and portfolio allocation.

It goes without saying that T is both a telecom and dividend stock, implying its unlikely tech-like (beat-the-market) growth prospects with debt likely to be common occurrence.

Even so, with a relatively reasonable weighted average interest rate of 4.2% (inline QoQ/ +0.1 YoY/ -0.2 from FY2019 levels of 4.4%) and well-laddered long-term debt portfolio through 2097, compared to the current Federal Fund Rate of 5.25%/ 5.5%, we believe that its debt leverage remains reasonable despite the rate tightening over the past few quarters.

Combined with the moderating leverage ratio, we maintain that T remains a more than excellent dividend stock, notwithstanding the unresolved lead lined issues previously here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.