Summary:

- AT&T reported better than expected Q4’22 earnings.

- Free cash flow was $14.1B and the FCF outlook for the current year is very strong.

- Shares remain attractively valued based off of FCF and earnings.

- AT&T has better free cash flow coverage than Verizon.

Brandon Bell

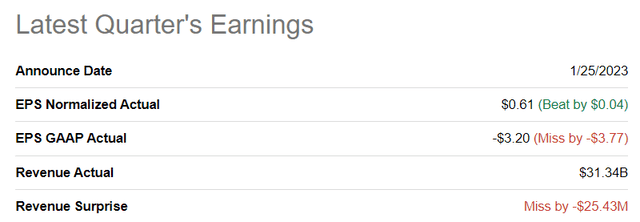

AT&T (NYSE:T) submitted its earnings sheet for the fourth-quarter earlier this week which beat on EPS but missed slightly on the top line. AT&T also met its free cash flow forecast of at least $14B and easily covered its dividend with FCF in the fourth-quarter. AT&T’s dividend, in my opinion, is also safer than Verizon (VZ)’s due to better free cash flow coverage.

AT&T’s outlook for FY 2023 is also solid and implies 13.5% free cash flow growth year over year. Given that the dividend is set to be well covered by free cash flow, I believe the valuation, yield and risk profile for AT&T remain highly attractive for dividend investors!

AT&T’s Q4’22 results beat EPS expectations, miss on the top line

AT&T earned $0.61 per-share in adjusted earnings compared to the street estimate of $0.57 per-share. Regarding revenues, AT&T did not better than the consensus prediction: the firm missed the revenue estimate by $25.4M.

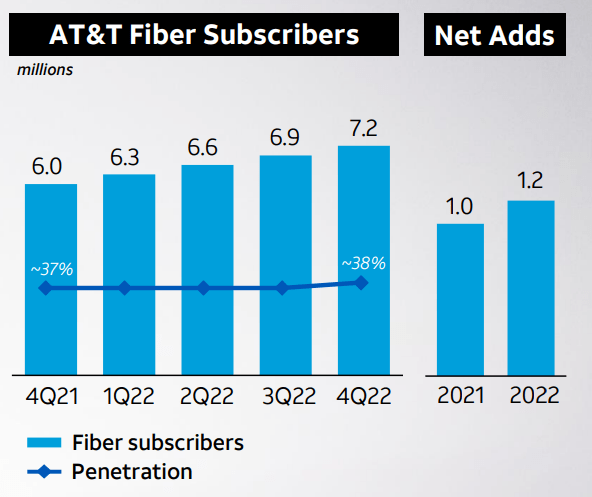

Broadband momentum remains a key reason for investors to buy AT&T

Just like Verizon (VZ), which reported its best broadband subscriber net-adds in a decade in Q4’22 due to rapid network expansion, AT&T added a ton of new subscribers to its broadband business. In the fourth-quarter, AT&T added 280 thousand AT&T Fiber customers to its broadband segment, which brought the full-year total to 1.2M net adds. According to AT&T, the company has achieved a minimum of 1M net adds for five years straight.

In FY 2021, AT&T added 1.0M net adds, which means the company is seeing strong momentum in its subscriber acquisitions in its fastest-growing business segment. In total, AT&T ended FY 2022 with 7.2M subscribers in its broadband business, showing an impressive year-over-year growth rate of 20%.

Source: AT&T

AT&T’s dividend is safer than Verizon’s

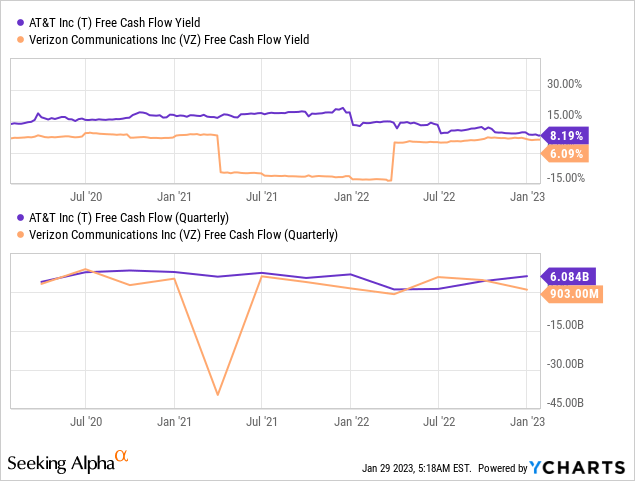

When it comes to telecommunications companies, free cash flow is one of the most important key metrics. Free cash flow shows investors the amount of cash flow that is available for distribution and it is a key figure for deciding whether a telecom’s dividend is safe. Since AT&T is a high-yield stock, dividend coverage obviously matters to dividend investors a lot.

AT&T reported $6.1B in free cash flow for the fourth-quarter, showing 15% year-over-year growth. In total, AT&T had full-year free cash flow of $14.1B. The dividend, which runs at $2B a quarter or $8B per year, was therefore easily covered by the telecom’s free cash flow: AT&T’s Q4’22 payout ratio, based off of free cash flow, was just 32.8%, and the FY 2022 payout ratio calculates to 56.7%. AT&T’s payout ratios are also better than Verizon’s which had a free cash flow shortfall in Q4’22. Verizon’s FY 2022 payout ratio was 76.6% which was much worse than AT&T’s… and which serves to make AT&T’s dividend safer.

Because of AT&T’s stronger free cash flow, the stock offers investors a higher free cash flow yield of 8.2% compared to Verizon’s 6.1%.

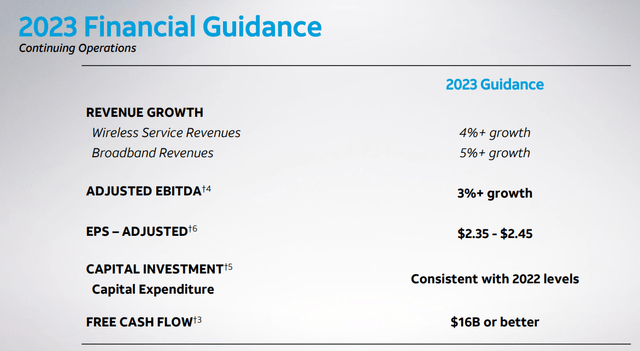

Guidance for FY 2023

AT&T’s guidance for FY 2023 is slightly better than Verizon’s. AT&T sees $16B in free cash flow and $2.35-2.45 in EPS. The guidance for free cash flow implies that AT&T’s can capture 13.5% year over year growth in its most important key metric. AT&T’s adjusted EBITDA is projected to grow 3.0% year over year, supported in part by AT&T’s robust broadband growth. Verizon’s outlook for FY 2023 was largely disappointing and included an expected (0.3)% growth rate for the telecom’s adjusted EBITDA.

With $16B in free cash flow expected in FY 2023, the forward FCF-based payout ratio for AT&T is about 50%… which makes the dividend well-covered and suggests that the dividend even has potential to grow.

Valuation comparison: AT&T vs. Verizon

Based off of $16B in projected FCF this year, AT&T has a P/FCF ratio of 8.9 X. Verizon, given its poor outlook for FY 2023, has a P/FCF ratio of 12.0 X, assuming no growth in FCF this year and a free cash flow level of about $14B. From a free cash flow perspective, AT&T is a much better deal for telecom investors.

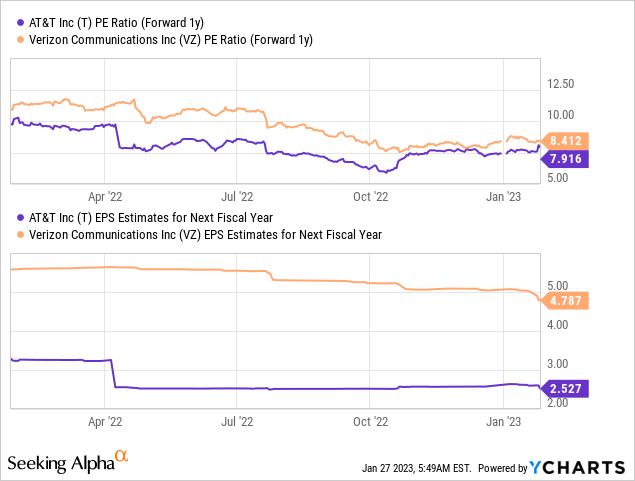

AT&T is expected to generate EPS of $2.48 in FY 2023 and $2.53 in FY 2024 which implies year over year growth rates of (3.4)% and 1.7%. Based off of next year’s EPS, AT&T is valued at a P/E ratio of 7.9 X which is cheaper than Verizon’s P/E ratio of 8.4 X.

Risks with AT&T

The biggest risk for AT&T is slowing top line growth and, potentially, slowing growth regarding the roll-out of its broadband network. What I don’t see as a risk is AT&T’s dividend coverage which strongly implies that the dividend can grow. Verizon’s free cash flow shortfall in the fourth-quarter raises dividend sustainability questions for me that I believe AT&T, at this point, doesn’t have. What would change my mind about AT&T is if the company saw a deterioration in its free cash flow prospects and a rise in its FCF-based payout ratio above 70%.

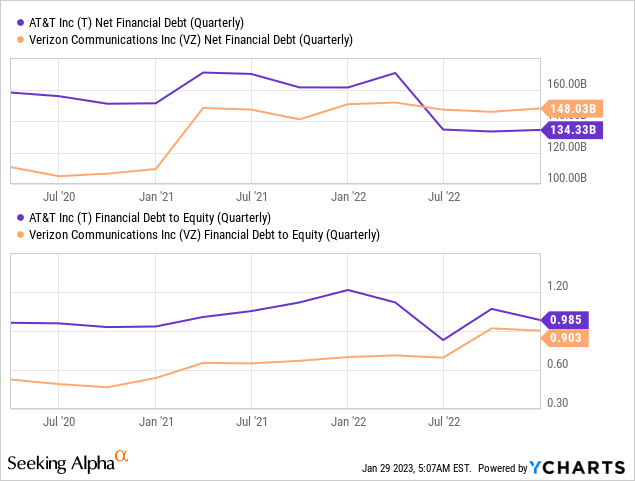

Another risk with AT&T relates to the company’s considerable debt and leverage. Both AT&T and Verizon carry a lot of debt on their balance sheets, a result of past debt-financed acquisitions. AT&T owed $134.3B in net financial debt at the end of the December-quarter which investors should obviously be concerned about. A significant portion of AT&T’s free cash flow going forward will have to be applied to debt repayments.

Final thoughts

AT&T submitted a really good earnings sheet for Q4’22, especially regarding its achievements in the broadband business, and I believe the free cash flow forecast for FY 2023 especially is what takes uncertainty and risk out of an investment in AT&T. With $16B in free cash flow and a 50% implied forward payout ratio, dividend investors really don’t have to be concerned about the coverage aspect of the dividend. I also believe the valuation, based off of FCF and earnings, is highly attractive for dividend investors and much better than Verizon’s!

Disclosure: I/we have a beneficial long position in the shares of T, VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.