Summary:

- AT&T released earnings recently and the financial performance was middling, but the dividend is well covered and offers a healthy premium over the risk free rate.

- Comparing the stock to 10-Year Treasury Notes we see that the dividend yield of AT&T is 6.10% compared to the risk free rate of 4.2%.

- Analyzing the dividend sustainability we see that the company has sufficient cash flow to cover obligations and investments, with a low payout ratio of 59%.

Images By Tang Ming Tung/DigitalVision via Getty Images

AT&T (NYSE:T) has just released earnings, and I wanted to review them to see if it’s worthwhile buying this former dividend aristocrat at current prices or not. I’ll make that determination by looking at the most recent financial statements, paying particular attention to the viability of the dividend, for obvious reasons. I’ll then compare the stock to the risk free rate to see if investors are being adequately compensated for the risk of stock ownership or not.

Welcome to the thesis statement portion of my article. It’s here where I give you the gist of my thinking so you can get in, and then get out before you’re exposed to too much of my bad jokes and correct spelling. You’re welcome. I am buying this stock even after the runup in price over the past year. While the financial performance was middling in my view, the dividend is reasonably well covered, and I think this is one of those rare stocks that pays a healthy premium over the risk free rate at the moment. For those reasons alone I’m inclined to buy. Thus ends the thesis statement. If you read on from here, that’s on you.

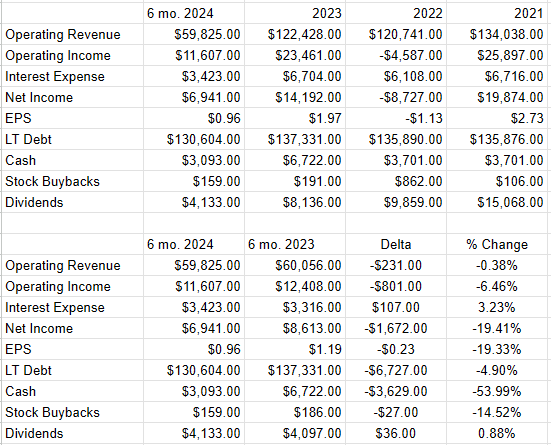

Financial Snapshot

The most recent financial results are “ok” in my estimation. Revenue was basically unchanged from the same period a year ago, down only .38%. The problem is that net income fell by a much steeper 19.4% decline. The chief culprits here were the drop off in the equity net income in affiliates, and “other income.” The $639 million asset impairment and $813 million uptick in depreciation didn’t help. I was a bit surprised that net interest expense rose by only $107 million, or ~3%.

In spite of the relative softness of this period relative to the same period a year ago, there’s nothing here that would drive me away. Assuming the dividend is reasonably secure, and assuming that the compensation here is greater than the risk free rate, I’ll buy.

AT&T Financials (AT&T investor relations)

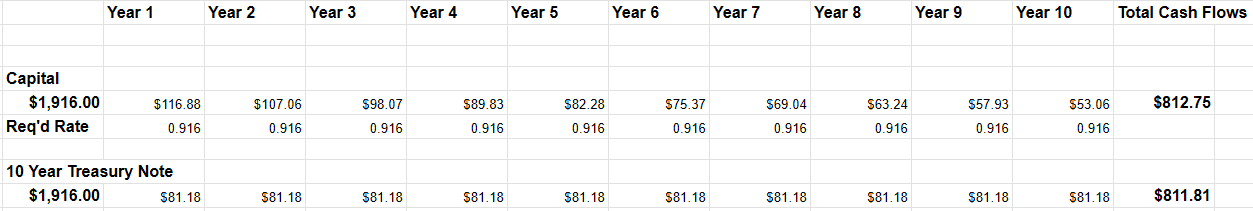

The Stock v Treasury Note

In the world of investing, everything’s relative. We’re always looking for the greatest risk adjusted returns, which means we’re always pitting one investment against others. If you buy “X”, you definitionally are eschewing a host of “Ys.” The most important investment to compare any stock to, in my view, is the 10-Year Treasury Note. The reason for this is that it is what I consider to be a foundational asset, the first benchmark against which we judge all other investments. My thinking is that if a stock can’t generate for you the same level of cash flows as the risk free rate, why on Earth would you buy it?

At the moment, the yields on government bonds are pretty high, so TINA (there is no alternative) doesn’t live here anymore. Bonds offer a viable choice, and now reasonably compete with stocks for capital. As of this writing, the yield on the 10-Year Note is about 4.237% and the dividend yield on AT&T is 6.10%. This is one of those relatively rare situations where the dividend yield is actually appreciably higher than the risk free rate.

The way I typically compare the stock to the risk free alternative is to answer the question “at what rate will the dividend need to grow to make the cash received by shareholders equal the cash received by Treasury Note holders?” If the rate is excessive, I eschew the stock and put capital to work in the Treasury Note. In this case, though, I can reverse that question. In the case of AT&T, I ask the question “at what rate can dividends fall and shareholders still receive the same level of cash as the holders of the Treasury Note?

Per the table below, the dividend could fall at a CAGR of about 8.4% for the shareholder to receive the same cash flows that the Treasury Note holder would receive over the next decade.

In my view, that’s a very healthy discount for a company with this track record. I understand why some would fret over this stock. The company left its dividend unchanged in 2021, and actually (gasp) cut it in 2022 as the company spun off WarnerMedia. That written, we investors should be focused on the future and not the past. I think a much more relevant exercise at this point will be to evaluate the sustainability of the dividend. I do this by comparing the current and likely future sources of cash with current and future contractual obligations and likely investments needed in the business.

AT&T v Treasury Note (Author calculations)

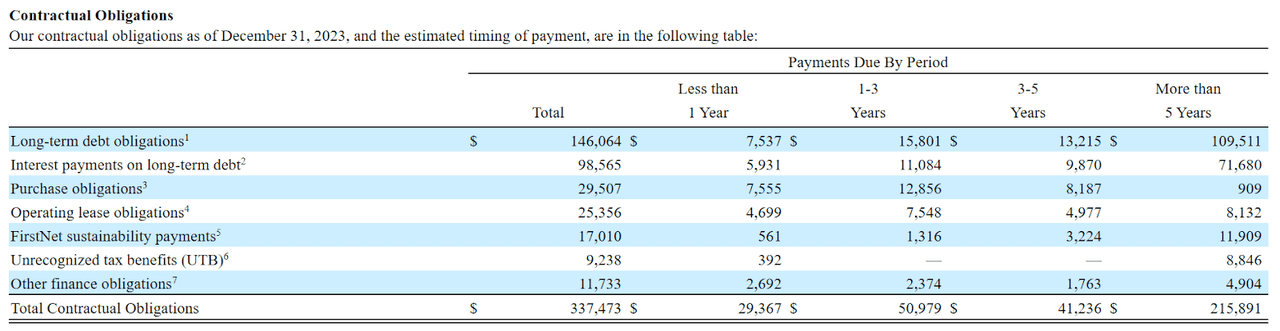

Dividend Sustainability

As I’ve said many times in the past, I’m as much of a fan of accrual accounting as it’s possible to be while maintaining some appearance of sanity. When it comes to dividends and their sustainability, though, I think cash is king. If a company is not generating sufficient cash flow to finance the dividend, there’s a risk, and I won’t buy, no matter what the current yield is.

In particular, I compare the current level of cash, and likely future sources of cash with the size and timing of upcoming obligations and investments. If the company has and/or generates way more cash than they are “on the hook” for, contractually or otherwise, that’s a very good sign.

In terms of current and future sources of cash, the company currently has ~$3 billion in the bank, and over the past three years has generated an average of ~$37 billion a year in cash from operations. They have invested about $26.35 billion on the business over the past three years, suggesting that this is a fairly healthy cash flow generator, spinning off (very) roughly $11 billion per year. Additionally, they have the following schedule of obligations that I’ve plucked from page 37 of the latest 10-K for your enjoyment and edification.

The company has $29.367 billion due in 2024, and just under $51 billion due over the next two years ($25.5 billion per year on average). Given the above, I’d say of this dividend that it’s not the most covered I’ve ever seen, but certainly not the worst. Obviously much of the debt that makes up these obligations will need to be rolled, but will do so at a much higher interest rate. Given the relatively low payout ratio of 59%, I don’t worry about the interest expense crowding out the dividend anytime soon, though.

Taking all of the above into account, I’m comfortable putting some risk capital to work here.

AT&T Contractual Obligations (AT&T Latest 10-K)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I don't actually own any AT&T as of this writing, but as soon as the market opens I'm going to pick up 800 shares.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.