Summary:

- I believe AT&T’s consistently poor revenue growth and high capital investment requirements make it a value trap for long-term investors.

- Stiff competition in the telecommunications industry limits AT&T’s pricing power and hampers revenue growth.

- AT&T’s massive debt load and low returns on invested capital further contribute to its unfavorable investment outlook.

Gearstd

Introduction

AT&T (NYSE:T)… It’s one of the largest companies in the world, and it’s one that many of us utilize on a daily basis. In fact, it used to be so important that up until a few years back, it was a part of the venerable Dow Jones Industrial Index.

Despite its notable history, I argue that it might represent one of the least favorable options for investors focused on the long term, resembling a classic value trap.

In a prior article, I claimed that an investment in AT&T could be analogous to an investment junk bond. My thesis centered on what I consider to be an extremely low-quality business model, one that relies on recurring substantial capex spend to support a product offering that has virtually no pricing power.

In today’s article, I will build upon my previous thesis, reviewing the outcomes of those forecasts nearly two years on, and offer updated insights related to that thesis.

Primary Concern

In my last article on AT&T, I summarized its poor business model using the following formula.

Low Revenue Growth + High Capital Investment Requirements = Poor Returns for Shareholders

We’ll begin by examining the first element: lackluster revenue growth. The primary reason for AT&T’s sluggish revenue expansion is intense competition. AT&T’s revenue streams come mainly from mobile, landline, and home internet services. In each of these sectors, the competitive landscape is aggressive; companies like Verizon (VZ) and T-Mobile (TMUS) constrain AT&T’s ability to price its mobile plans, while Comcast (CMCSA) and Charter (CHTR) exert similar pressure in the internet service domain. Additionally, the emergence of new players such as Starlink intensifies the challenge of pricing competition.

Internet access has essentially become a commoditized service; numerous companies are offering what is effectively the same product. This results in a highly competitive environment where each provider is continuously striving to capture a larger share of the market. In this scenario, differentiation is challenging as the core service provided by each company is largely indistinguishable from its competitors.

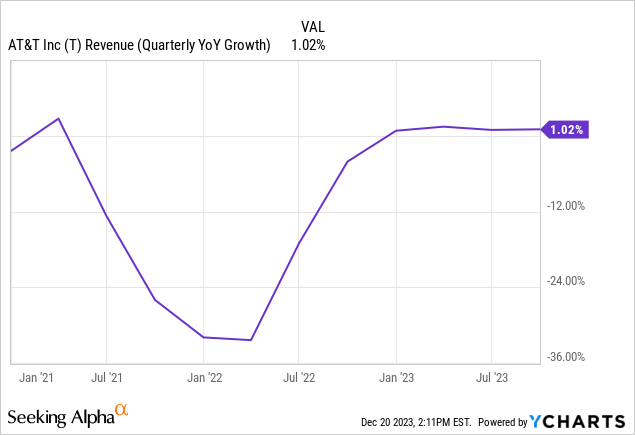

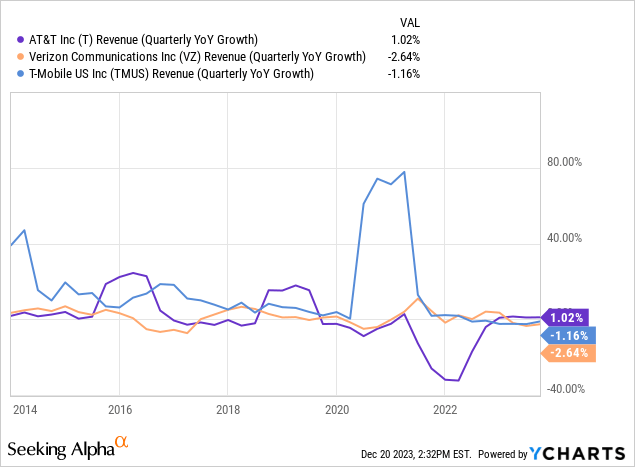

The financials back up this thesis:

Consistent with my earlier predictions, this difficult business model has resulted in persistently mediocre revenue growth. As illustrated in the chart above, AT&T’s revenue increase over the past three years has hovered around 1%, with the significant decline attributed to the divestiture of Warner Bros Discovery (WBD), which I discussed at length here.

Thinking about revenue growth going forward, I expect more of the same; low/no growth driven by stiff competition should keep the lid on pricing, thus limiting future growth prospects.

CapEX

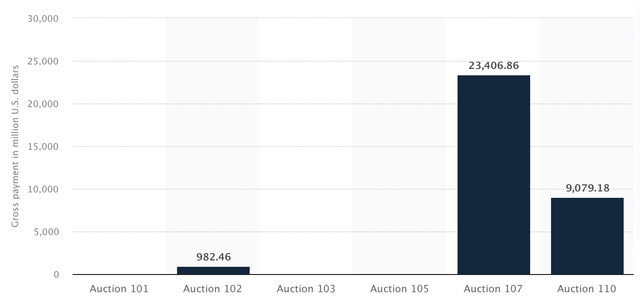

AT&T Spectrum Purchases History (Statista)

Let’s now turn our attention to the aspect of high capital investment. In summary, the infrastructure necessary for AT&T’s operations is immensely costly, involving recurring capital expenditures in the billions. This includes tasks such as laying cables underground, setting up antennas, acquiring spectrum, and fixing damaged lines. The demands of such work are seemingly endless.

A prime example is AT&T’s recent hefty expenditures in spectrum auctions to enhance its high-speed internet capabilities. The company invested a significant $23.4 billion in Auction 107 and another $9.1 billion in Auction 110. These substantial investments have led the company to incur considerable debt.

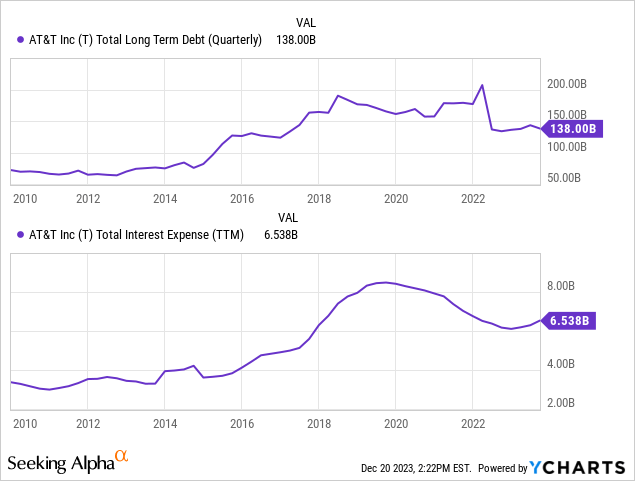

Debt Load

Expensive spectrum auctions, digital infrastructure investments, and acquisitions have helped to fuel a massive debt binge as AT&T roughly doubled its long-term debt total between 2010 and today. As of now, that value stands at $138B, making AT&T one of the most heavily indebted companies in the world.

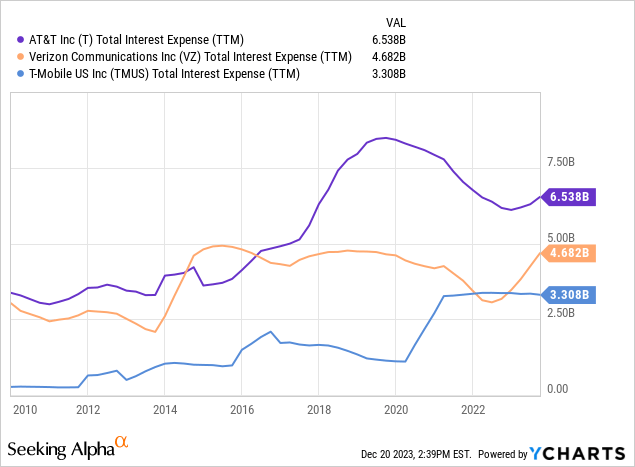

As a result of that debt load, interest expense is now more than $6B per year, and I expect this level to grow as older debt, financed at cheaper rates, must now be refinanced at a much more costly rate. The company has previously emphasized a commitment to balance sheet prudence by using excess cash to reduce its total debt load. Unfortunately for the company, with higher interest rates, that exercise may have a similar effect to scooping out water from a sinking ship.

And while dividend cuts and divestments help them to preserve cash flow to tackle their debt load that comes at the expense of investors and future growth opportunities.

There is no silver bullet for AT&T in my view.

AT&T Versus Peers

Revenue Growth

As you can see, apart from a few sporadic large acquisitions, the company’s revenue growth has been close to 0% for much of the past decade; while it has avoided sharp declines, once you factor in inflation and the increased interest expense, the company appears to be in a worse position than it was even a decade ago.

For its part, AT&T is not alone; Verizon’s growth has lagged, too, usually coming in well within the low single-digit range. That said, Verizon has largely managed to avoid the same sort of large problematic acquisitions that have so greatly challenged AT&T.

Interest Expense Growth

As you can see in the chart above, for various reasons, all 3 of the prime cellular providers in the US have interest expense levels that are greatly above the levels seen in 2010. While T-Mobile’s interest expense has increased by the greatest amount on a percentage basis, it is still the least indebted of the big 3 wireless players in the US.

Notably, AT&T and Verizon, which both had similar interest expense levels in 2010, are now in vastly different places as AT&T is forced to divert an extra ~$2B towards interest as compared to Verizon in 2023. In other words, if AT&T managed to keep its debt levels in a comparable range to what Verizon achieved, it would have roughly an extra $0.25 per share available for shareholders, which could have been used to maintain its dividend payment. Instead, in 2022, AT&T cut its dividend.

Returns on Invested Capital

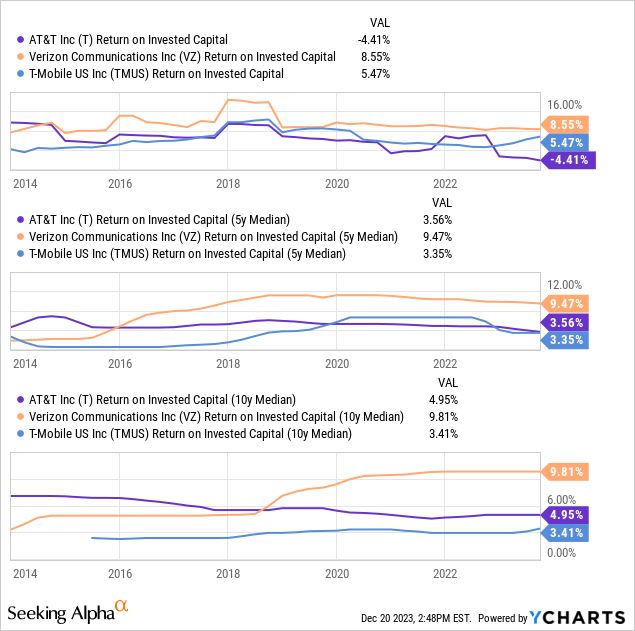

Furthermore, perhaps due to a series of poor investments, AT&T has an incredibly poor track record for returns on invested capital. Over the past year, each dollar AT&T spent on its business lost 4.4 cents. Over the long term, its track record is not much better, as its 10-year average sits at just 4.95%.

Valuation

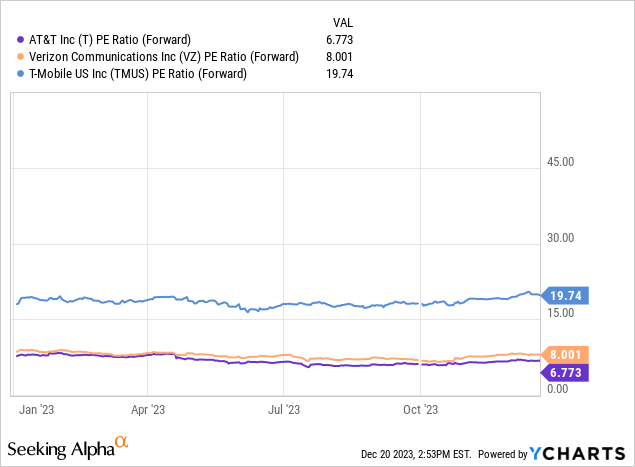

One bright spot for AT&T is its low valuation; trading at just 6.77X forward earnings, AT&T is one of the cheapest large-cap stocks on the market. But buyer beware, AT&T has traded at a low valuation for many years now; multiple expansion is no guarantee, and in my view, is highly unlikely unless the business model where to somehow magically radically reshape itself. Which, apart from a major acquisition, seems highly unlikely given their poor track record.

Conclusion

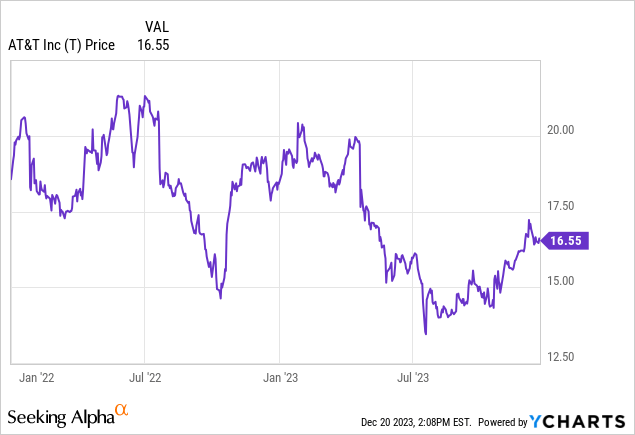

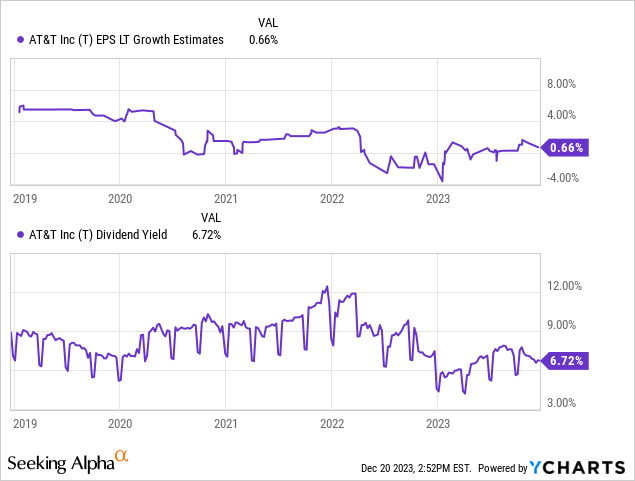

Despite its recent price rise from $14.50 to around $16.50, the company’s dismal forecasted earnings growth and poor returns on capital suggest limited future growth potential and inefficient resource use.

The low valuation may appear attractive, but it likely represents a value trap, making the stock much riskier than it appears. In my view, investing in AT&T at this stage presents more risks than opportunities, leading to my recommendation…

I rate AT&T a “Strong Sell”

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Why, no mention of the partnership with Microsoft and they’re moving all their stuff to the cloud in Microsoft AZure,, why no mention of them having intellectual rights of candy cloud that is required for any vendors of the government know also go mention of the 30% savings. They are going to have removing all their stuff to Microsoft Azure cloud. This equals billions per year in savings,, Why not mention all the partners ships they have no such as 59 the Candy platform Store well I agree with you on some things. You have to have many important things in my opinion did a half ass job of reading AT&T lately merry Christmas.