Summary:

- DCF analysis yields a price target of $24 or 40% upside to today’s pricing.

- The business has significant room to grow via strong fundamentals and can absorb the sizeable cost or capital pressure before the current price is at risk.

- With a strong price target and the dividend looking quite safe, I rate AT&T a strong buy.

Justin Sullivan

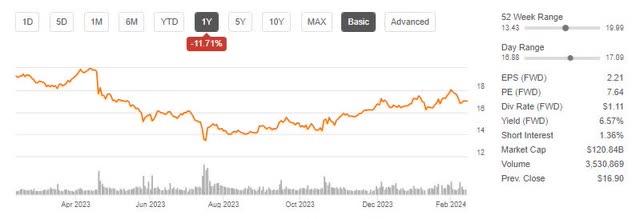

AT&T Inc. (NYSE:T) had a solid 2023, more than delivering on guidance and core priorities, but it is still down more than 11% across the last year.

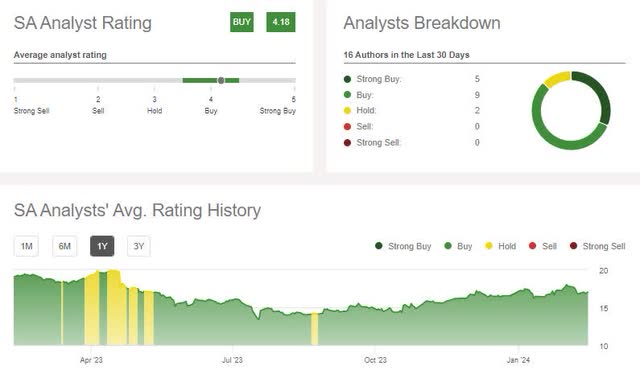

What really caught my attention after Q4 earnings was the gap in market reaction to analyst sentiment. The stock barely moved, but Seeking Alpha analysts are overwhelming rating buy to strong buy.

SA Analyst Rating (Seeking Alpha)

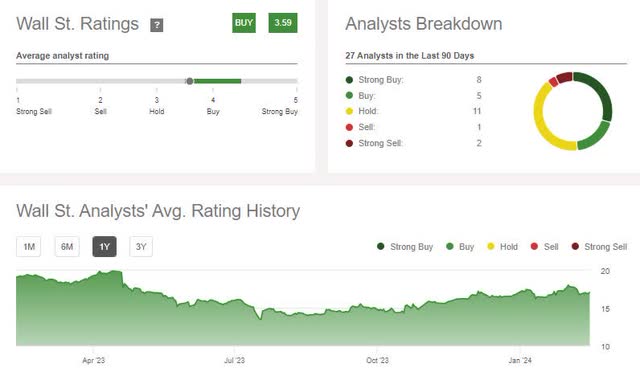

Wall Street is slightly more mixed, but still leans towards outsized upside potential.

Wall Street Rating (Seeking Alpha)

With this discrepancy in mind, I wanted to dive into not just the valuation of the stock, but how much downside AT&T could absorb before the current price was at risk.

My DCF analysis yields a price target of $24 or 40% upside to today’s pricing. As I will detail below, the business has significant room to grow via strong fundamentals and can absorb sizeable cost or capital pressure before the current price would be at risk. In addition, the dividend looks to be safe. With a strong price target and significant room to absorb risk, I rate AT&T a strong buy.

Valuation And Sensitivity

Usually, when covering telecom, I lay out the fundamentals and then provide the valuation. However, sensitivity analysis is critical given the scale of the business and my strong recommendation, so I am going to do this in reverse.

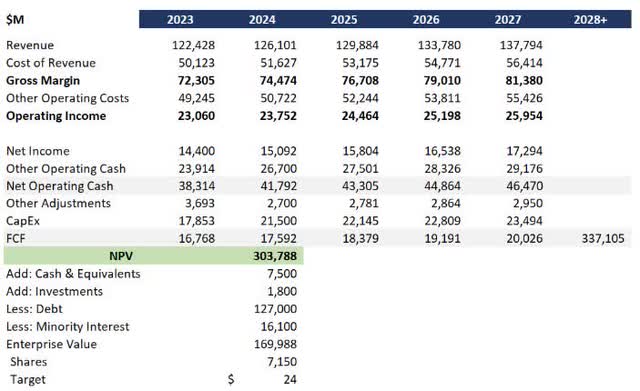

Starting with the DCF analysis, I made the following assumptions:

- Management delivers 2024 guidance

- 3% revenue growth through 2027, pacing slightly behind the overall telecom market at 3.42%. This is achievable primarily with organic growth and fiber offsetting declines in copper

- 3% expense growth slightly ahead of the US inflation forecast at 2.40% for 2025

- 7% discount rate assuming a current WACC of 6.3% with an upward trend over the long term as AT&T deleverages

- 1% long-run growth rate as a conservative estimate to hedge 3.42% market growth against AT&T’s scale

This yields a price target of $24 or 40% upside to today’s pricing.

T DCF (Data: T 10-Q; Analysis: Author)

Next, I ran a sensitivity analysis to understand how different assumptions would impact the price target.

T Sensitivity Analysis (Author)

All of the sensitivities are aligned to a $1 change in price target. As an example, decreasing the long-run growth rate from 1% to flat would be a $5 impact (0.2ppt x 5), resulting in a price target of $19, still a buy by my standards. To approach today’s pricing, you would need seven steps (or a material shock to dividends).

AT&T Has Plenty Of Room To Grow

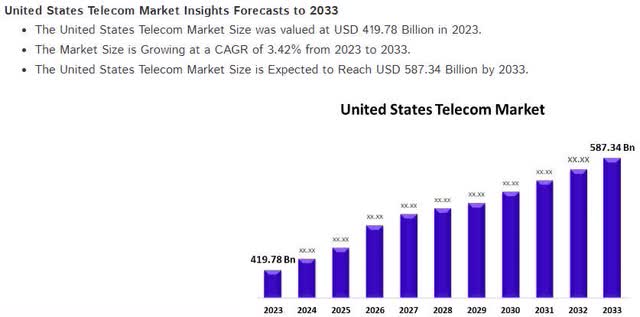

The primary driver of my price target is revenue. Fortunately, AT&T looks to have plenty of room to grow. Keeping in mind that I assumed 3% short-term growth and 1% long-term growth, the overall telecom market is expected to grow organically at a CAGR of 3.42% through at least 2033.

US Telecom CAGR (Spherical Insights)

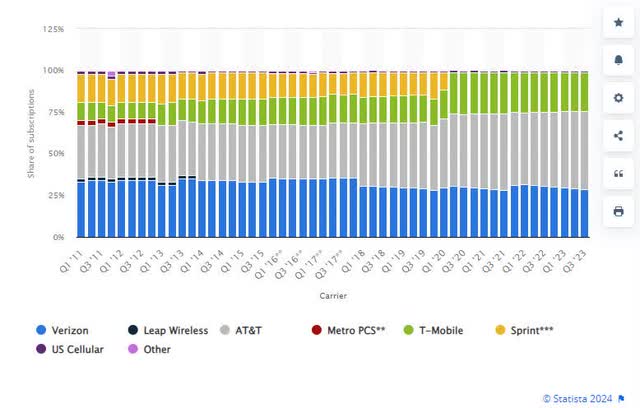

With this market growth rate, AT&T can afford to fall slightly behind the market overall. On the volume side, they have defended their market share against large wireless companies well, rising from 38.5% in 2018 to 45.7% in 2021 and 46.91% last year.

Wireless Market Share (Statista)

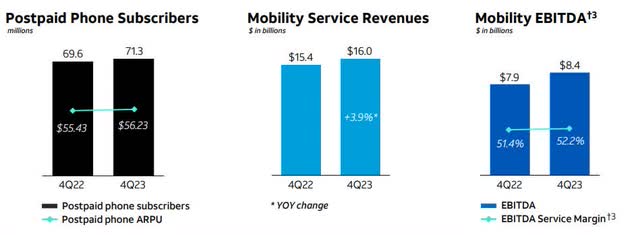

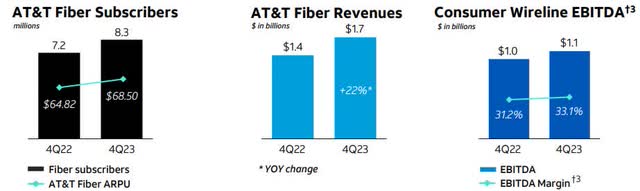

For AT&T, maintaining 3% growth looks like moderating wireless growth and declining copper offset by an aggressive growth strategy in fiber. Wireless continues to perform well, but growth is likely limited purely by the scale of the business.

Postpaid and Mobility (T Investor Relations)

Fiber is delivering on both the rate and volume side, and AT&T is rapidly outpacing Verizon (NYSE: VZ) and its other competitors in passings.

Fiber Growth (T Investor Relations)

In my opinion, the primary risk is on the wireless rate side as consumers look increasingly to MVNOs, which are expected to grow at 7.5% and take share from the major telcos. This is partially mitigated as the MVNOs are wholesale customers for AT&T, but ARPU will be something to keep an eye on.

Cost Management

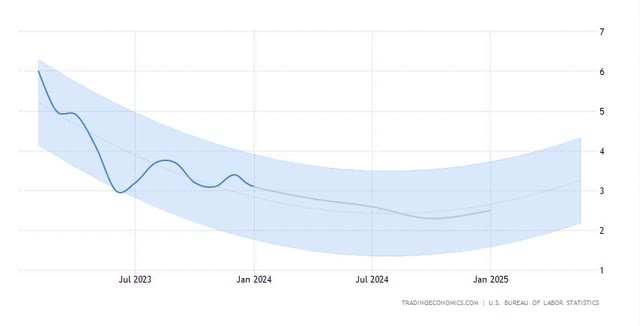

On the cost side, I gave AT&T room to slightly outpace US inflation with a 3% growth rate versus an inflation forecast of 2.40%.

US Inflation Forecast (Trading Economics)

There is a slight headstart on the cost side as AT&T delivered $6 billion of run rate savings as of July 2023 and is targeting an additional $2 billion in savings by mid-2026. With a 2023 cost base of $99 billion and less equipment of $23 billion, these savings can offset a full year of 3% inflation.

One risk to keep an eye on is union contracts. Two major contracts covering 25,000 union workers expire in 2024. Recent union successes in auto and airlines have driven double-digit growth in wages and benefits.

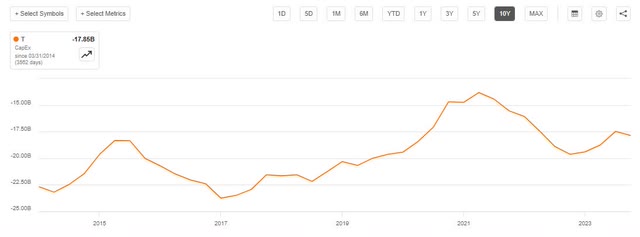

CapEx Management

AT&T has guided a 5-year-high in CapEx spend at $21-22 billion in 2024. From discussion in the most recent earnings call, this reflects an increase in capital projects, partially offset by favorable unit economics and vendor financing. The capital investment continues investments in 5G as well as fiber expansion. As discussed above, fiber is paying off in the form of growth.

As a conservative assumption, I carried this level of CapEx forward, although, in all likelihood, there will be a step-down in the next few years as AT&T has historically had cyclical investment trends as projects come and go.

As it comes to CapEx, I see upside potential outweighing downside as 5G and fiber near a peak and management controls spending to drive free cash flow, a stated goal from the last several calls.

Dividend Safety

As we saw during the previous dividend cut, a reduction in cash flow to investors or a failure to raise when expected throws all bets on pricing out the window.

Looking at dividend safety, giving a hold rating of C, you could easily be concerned about the state of the dividend program.

T Dividend Safety (Seeking Alpha)

Here is why I believe you shouldn’t be concerned:

- There is a high likelihood that cash flow will continue to increase as discussed in the sections above

- Management is in control and critical payout ratios have improved significantly from the 5-year average

- Cash from operations is extraordinarily strong at $38 billion, and management has a historically large capital pool of $21-22 billion to adjust in the event of a shortfall

- The sector median is slightly misleading, with AT&T and Verizon being outsized players as it weights towards smaller companies. In my opinion, T is in a much better position than Verizon that is running a cash payout ratio of 59% and a coverage ratio of 1.05%

Verdict

In 2023, AT&T Inc. exceeded its guidance and solidified its core priorities. Despite these achievements, the stock fell by more than 11% over the past year. The discrepancy between the stock market movement and the overwhelmingly positive buy-to-strong buy ratings from Seeking Alpha analysts after the Q4 earnings particularly caught my attention.

In my DCF model, I determined a 40% upside for AT&T, with a price target of $24. This optimistic outlook is based on conservative assumptions, such as a 3% annual revenue growth through 2027 and a 7% discount rate. Sensitivity analysis reinforced my confidence in the stock’s robust growth potential and its ability to withstand substantial economic and operational pressures without endangering its current valuation.

The company is strategically positioned to capture market share through organic growth and an aggressive fiber expansion strategy, despite a slightly slower growth rate compared to the overall market. I believe AT&T’s ability to maintain a 3% growth rate, supported by strategic investments in fiber and 5G technology, positions it well for sustained success. I’ve also carefully considered cost management and CapEx spending, noting AT&T’s significant savings and ambitious capital project investments.

Moreover, I’ve weighed potential risks such as union contract negotiations and the competitive threat from MVNOs but concluded these are manageable given AT&T’s strategic advantages and operational efficiency. Finally, I evaluated the dividend’s safety, supported by strong cash flow and improved payout ratios, indicating a stable return for investors.

Given the considerable upside potential and AT&T’s solid fundamentals, I rate AT&T a strong buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.