Summary:

- AT&T reported decent Q2 results, driven by growth in the fiber broadband segment.

- The broadband segment saw growth in fiber subscribers, revenues, and ARPU.

- AT&T’s free cash flow is growing and supported the dividend. Net debt reductions are ongoing.

- Shares still have a high safety margin from a valuation point of view.

jetcityimage

AT&T (NYSE:T) reported solid results for its second fiscal quarter this week which were driven by a resilient performance in the broadband segment. The telecommunications company saw resilient growth in fiber, with all major key metrics trending up — including revenues, subscribers and average revenue per user. AT&T also supported its dividend with free cash flow, grew its FCF by 9% year over year and repaid more debt in the second fiscal quarter. It appears AT&T has started to take its debt problems more seriously in FY 2024 which is something I am very happy about. With AT&T reducing its financial obligations and the shares still being cheap based off of earnings, I believe income investors are still getting quite a very good deal here!

Previous rating

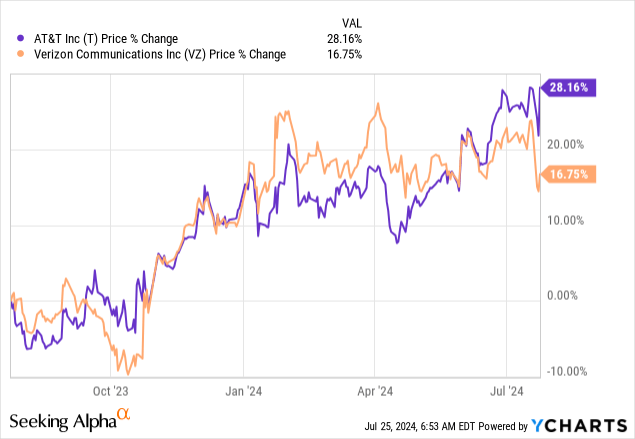

I rated shares of AT&T a strong buy in April after the company presented its first quarter accomplishments because the telecom had a debt repayment catalyst and a solid broadband business. Broadband momentum continued in Q2 and AT&T made further progress in reducing its net debt. The dividend was also well-supported by free cash flow and although shares have revalued higher by 13% since my last coverage, I confirm my strong buy rating for AT&T. I believe there are three reasons especially why dividend investors would want to own AT&T: 1) Broadband momentum, 2) A high safety margin based off of free cash flow, and 3) Debt repayments.

Broadband remains a shiny spot for AT&T

AT&T acquired a solid amount of new subscribers for its broadband business in the second-quarter. Besides growth in subscribers and segment revenue, AT&T saw upside momentum in its average revenue per user/ARPU figure which indicates the company’s monetization potential.

AT&T added 239k new subscribers to its broadband (fiber) segment in the second-quarter which was the 18th straight quarter in which net additions exceeded 200k. Fiber revenues, which are driven by growth in AT&T’s subscriber base as well as growing average revenue per user, increased 18% year over year to $1.8B. Total broadband average revenue per user — which is an important monetization figure for the telecommunications company — was up 6% year over year to $66.17. In total, AT&T had 8.8M subscribers in its fiber business at the end of the June quarter, showing a year-over-year growth rate of 14%.

|

Broadband KPIs |

Q2’23 |

Q3’23 |

Q4’23 |

Q1’24 |

Q2’24 |

Y/Y Growth |

|

Revenue |

||||||

|

Fiber |

$1,523 |

$1,613 |

$1,678 |

$1,736 |

$1,796 |

17.93% |

|

Non-Fiber |

$1,038 |

$1,054 |

$1,022 |

$986 |

$945 |

-8.96% |

|

Total Revenue |

$2,561 |

$2,667 |

$2,700 |

$2,722 |

$2,741 |

7.03% |

|

Net adds |

||||||

|

Fiber (in thousands) |

251 |

296 |

273 |

252 |

239 |

-4.78% |

|

Non-Fiber (in thousands) |

-286 |

-281 |

-254 |

-197 |

-187 |

-34.62% |

|

ARPU |

||||||

|

Fiber |

$66.70 |

$68.21 |

$68.50 |

$68.61 |

$69.00 |

3.45% |

|

Non-Fiber |

$56.71 |

$60.43 |

$61.38 |

$61.81 |

$61.38 |

8.23% |

|

Total Broadband ARPU |

$62.26 |

$64.91 |

$65.62 |

$65.98 |

$66.17 |

6.28% |

(Source: Author)

Free cash flow continues to imply high safety margin

Probably the most important metric for a telecommunications company is its free cash flow, which is important for a number of reasons. First, it signifies the amount of cash flow that is theoretically available for distribution to the company’s shareholders. Second, it also signals to investors how safe the current dividend is.

AT&T earned $4.6B in free cash flow in the second fiscal quarter which implies a year over year growth rate of 9%. The $1.11 per-share dividend that AT&T pays shareholders costs the telecom about $2.0B each quarter… which calculates to a dividend coverage ratio of 230%. Verizon (VZ), to provide some context, just released Q2’24 earnings and achieved a dividend coverage ratio of 207% in the second fiscal quarter.

AT&T also confirmed its free cash flow forecast for FY 2024 meaning the company still expects to pull in $17B to $18B in free cash flow this year. Based off of this guidance, AT&T is set to have a dividend coverage ratio of 220% at the mid-point of guidance. This ratio leaves room for additional net debt reductions and also implies a high safety margin for the dividend.

Financial debt profile

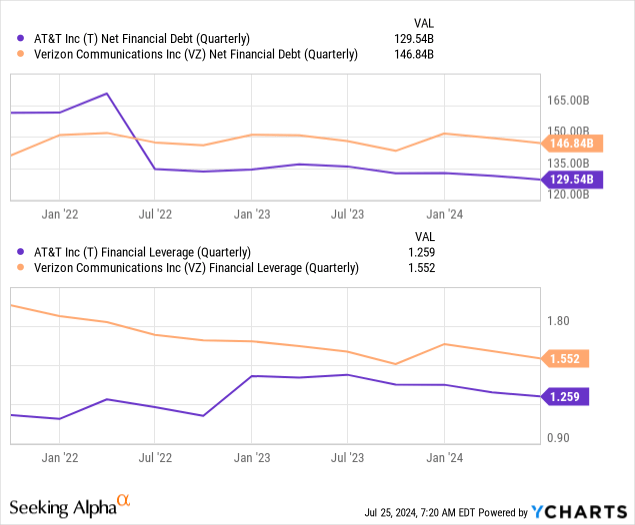

AT&T has a considerable amount of debt on its balance sheet which the company carries forward due to ill-fated and leveraged acquisitions. In the most recent quarter, the telecommunications company had net debt of $129.6B, showing a decline of $5.1B year over year. In the second fiscal quarter, AT&T repaid $1.9B of its net debt which compares to the repayment of $4.7B of debt maturities in the first-quarter. AT&T has lower financial leverage than Verizon, but both companies owe a significant amount of debt. I continue to see accelerated debt repayments as a catalyst for higher earnings as well as a higher valuation.

AT&T’s valuation compared against Verizon’s

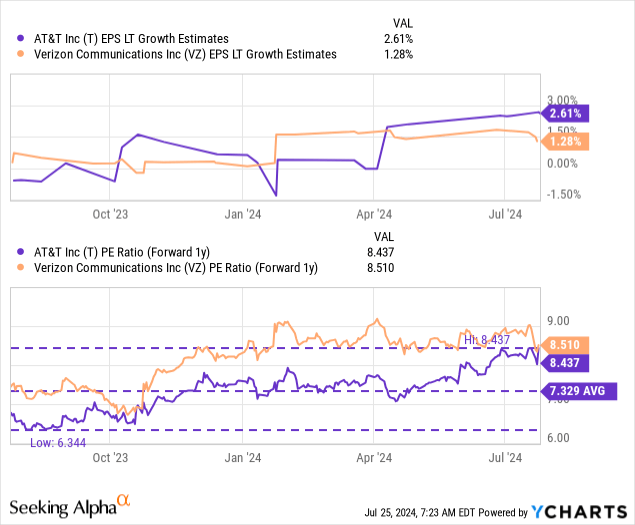

AT&T and Verizon are low-growth, high-FCF investments in the telecommunications industry and therefore trade at low price-to-earnings ratios. AT&T is currently valued at a price-to-earnings ratio of 8.4X which compares against a P/E ratio of 8.5X for Verizon. Both telecoms therefore have about the same earnings multiplier, but AT&T is expected to grow its EPS slightly faster in the long term (see chart below) and AT&T had a better dividend coverage ratio in Q2’24.

As I said in my last work on AT&T, I believe both large-cap telecoms — AT&T and Verizon — could trade up to a fair value P/E ratio of 10X since both companies cover their dividends with free cash flow and are seeing solid momentum in their broadband segments. A 10.0X earnings multiplier implies a fair value of $23 for AT&T and $47 for Verizon. Both telecoms have upside potential under the condition that they support their dividend with free cash flow and make progress in terms of debt reductions.

Risks with AT&T

Broadband is driving AT&T’s overall growth, so a loss of subscribers or slowing net additions would be a major concern for me and may result in a rating down-grade in the future. What would also change my mind about AT&T is if the company’s dividend coverage deteriorated or if the telecommunications company were to depart from its plan of reducing its net debt.

Final thoughts

AT&T submitted an overall very robust earnings scorecard for Q2’24 and investors have a triad of reasons to buy into AT&T. First, the telecom delivered strong results in terms of subscribers, revenue and ARPU growth in its fast-growing broadband segment. Second, free cash flow is growing (+9% Y/Y) and AT&T supported its dividend easily with FCF in Q2’24. Third, AT&T is also focusing more of its attention on getting a grip on its debt situation which I believe will benefit the telecommunications company in the longer term. AT&T is a bargain from a valuation point of view as well and the dividend yield of 6% should prove to be sustainable!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T, VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.