Summary:

- AT&T has the potential to raise its dividend in 2024 due to growth in Fiber Broadband and prioritization of debt repayments.

- The company’s free cash flow outlook for 2024 is supportive of a potential dividend hike.

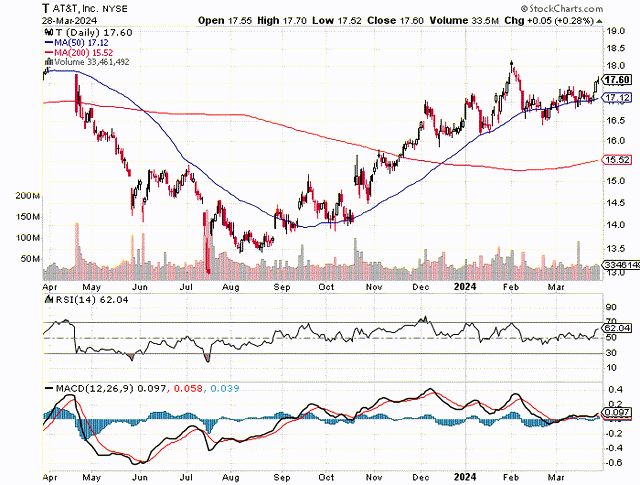

- AT&T’s stock has consistently moved above the 50-day moving average line, indicating significant re-rating potential this year.

jetcityimage

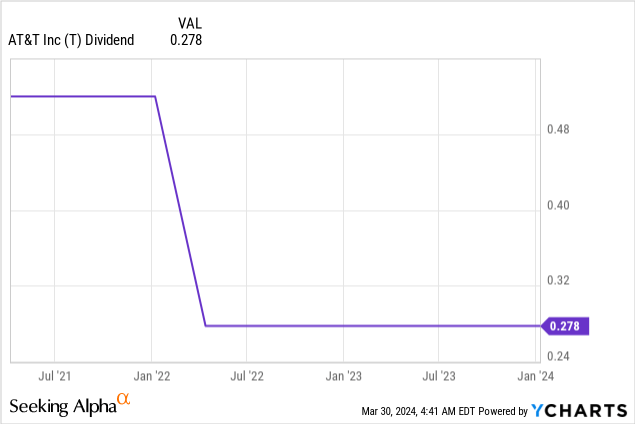

AT&T Inc. (NYSE:T) is a well-managed Telco that has potential to raise its dividend in 2024. Though the Telco’s dividend growth has flat lined after it separated itself from the media business, WarnerMedia, I think that growth in Fiber Broadband and a prioritization of debt repayments could led to substantial capital gains for AT&T investors this year.

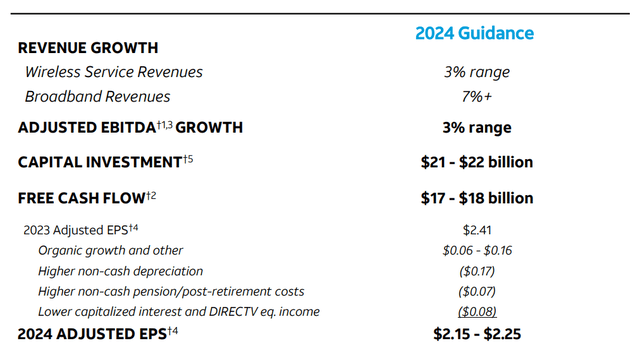

AT&T’s free cash flow outlook for 2024 is also strongly supportive of a potential dividend hike and with an earnings multiple of 7.6X, AT&T is a well-priced Telco.

Since AT&T’s stock is also consistently moving above the 50-day moving average line, I see significant re-rating potential this year.

My Rating History

In my December piece on AT&T I called the telecommunications business A Gift At $16 due to what looked like an impressive dividend coverage profile.

Strength in coverage was a main reason why I thought that AT&T’s stock could reprice which it did: AT&T’s stock has been in uptrend ever since 4Q-23.

I think that 2024 could be a year in which AT&T returns to dividend growth as Fiber Broadband and a strong free cash flow forecast provide support.

AT&T’s Fiber Business Is On A Role

Say what you want about AT&T, but the Telco continues to supply a well-covered dividend yield and the company’s free cash flow forecast for 2024 leaves room for an increase in the regular dividend.

AT&T’s free cash flow outlook for 2024, which sees $17-18 billion in free cash flow. With the dividend presently running at $8.0 billion annually, the Telco is poised to pay out only about 45% of its anticipated 2024 free cash flow.

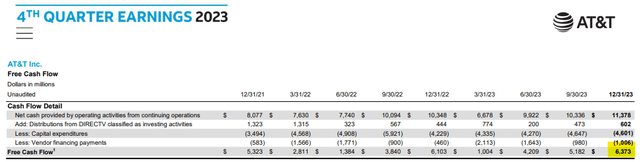

Free Cash Flow Guidance (AT&T)

AT&T profited from a strong upsurge in its free cash flow last year due to fast-growing Fiber Broadband and 5G businesses. In the fourth quarter, AT&T’s free cash flow was the highest in years and it resulted in the Telco beating its free cash flow forecast by a couple hundred million.

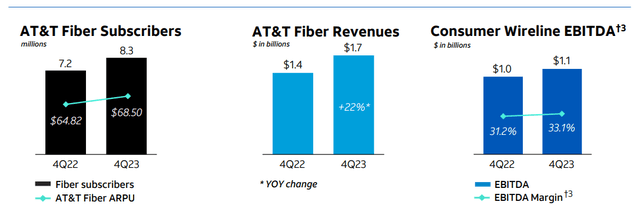

AT&T has made a concerted effort in recent years to increase the number of fiber locations in its Broadband segment which has resulted in AT&T reporting its sixth consecutive year of one million (or more) customer net-adds.

The Telco had 8.3 million subscribers in the fourth quarter and more are coming to AT&T’s business in 2024. Importantly, though AT&T’s sales are growing only marginally, Fiber Broadband is seeing some real momentum, with 4Q-23 sales growing 22% YoY.

With this broadband momentum underpinning AT&T’s free cash flow projections and business growth, I think that AT&T has a reasonable shot at handing shareholders a dividend hike.

The company presently pays only $1.11 per share in dividends and taking into account that the estimated pay-out ratio this year is only 45%, AT&T has a ton of room to grow its dividend in 2024.

With AT&T’s dividend going nowhere since the separation from WarnerMedia, the robust free cash flow forecast makes a dividend raise much more probable, in my view.

Technical Analysis

AT&T’s stock price has remained consistently above the 50-day moving average line since October 2023 and the stock has been building positive technical momentum ever since as well.

Presently, AT&T is selling at $17.60 which neither makes the Telco overvalued or undervalued, based on the Relative Strength Index. AT&T has built some support around $17 which is a bullish signal.

I am carefully watching the $17 price level as a drop below this level would indicate short-term correction potential until at least the 200-moving average line which presently runs at $15.52.

Moving Averages (Stockcharts.com)

How Much Should You Pay For AT&T?

Obviously, the less the better. AT&T is a cash flow-stock, meaning the company’s underlying Telco assets produce a boatload of cash that can be used for strategic investments (such as the expansion of the Fiber Broadband network, 5G), debt repayments, and, yes, even potentially a dividend hike in 2024.

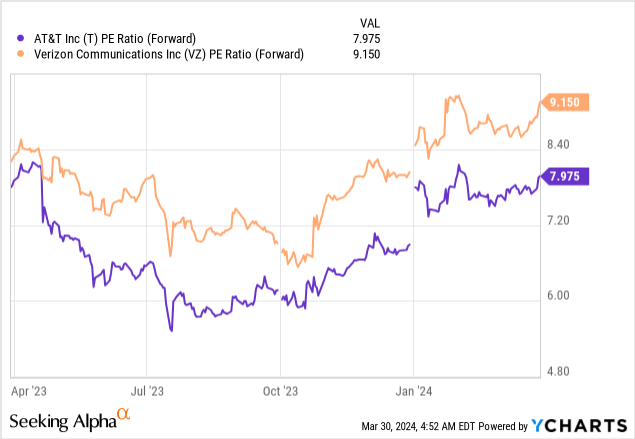

AT&T’s stock is presently selling for a 7.6x earnings multiple whereas Verizon Communications Inc. (VZ) is costing passive income investors 8.9x earnings. With AT&T selling at a lower multiple than Verizon Communications, I think that AT&T offers passive income investors a highly competitively priced 6.3% yield (Verizon’s yield stands at 6.4%).

What Are Some Of The Risks?

I mentioned the company’s high net debt as a reason in the past to be at least somewhat cautious with an investment in AT&T. For that reason, I think that AT&T, as solid as the dividend coverage ratio is, passive income investors may want to consider a limit to the portfolio weighting if they want to include AT&T.

Though the dividend is well-covered by free cash flow, AT&T’s considerable net debt of $128.9 billion is something that should passive income investors should at least consider as a potential anchor to AT&T’s stock.

My Conclusion

AT&T is, with a 5% portfolio weighting, my largest position in my passive income portfolio. Though AT&T’s lack of meaningful profit growth as well as the Telco’s large net debt are issues that investors should at least be aware of, AT&T is poised to deliver strong results in 2024, in my view, as its underlying Fiber broadband business continues to have a lot of growth momentum. Thus, I actually think that AT&T could be in a position to grow its dividend in 2024.

AT&T’s value proposition is substantially enhanced by the company’s low earnings multiple as well as the uptrend in the stock that has allowed AT&T to keep its head above the 50-moving average line ever since the fourth quarter.

With a possible dividend hike on the horizon in 2024 and ongoing momentum in Fiber, I think that AT&T is one of those companies that would be worthy of an overweighting in a passive income portfolio.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.