Summary:

- AT&T maintains a leading market position within the U.S. telecom industry, is significantly undervalued, and offers a safe and lucrative dividend to shareholders.

- In the aftermath of various prior missteps, the company has streamlined operations and improved its balance sheet while also investing for the future.

- The company’s reliable free cash flows should result in value accumulation for shareholders. Notably, the stock trades at ~7x FCF.

- Equity in AT&T is a bargain compared to shares in its competitors, with strong cash flows and a high likelihood of capital appreciation.

Joe Hendrickson

Making the case that AT&T Inc. (NYSE:T) is undervalued is a lot like stepping over a one-foot bar. The U.S. telecom giant is comfortably profitable, trading at low multiples, cleaning up its balance sheet, investing for the future, and even marginally growing – all while distributing a highly attractive dividend to shareholders. With universal brand recognition and only two true competitors, AT&T’s moat is vast and its market position is firmly entrenched. The company’s recent performance evidences that it isn’t going anywhere.

That said, AT&T is widely considered a controversial investment – giving rise to the extraordinary opportunity present in its shares. I believe corporate governance has been an area of weakness for the telecom giant in the recent past, as well as multiple ill-fated acquisitions fueled by ill-advised debt. The dividend has been slashed, segments have been spun off at valuations well below their acquisition prices, and a changing of the guard atop the company has failed to inspire confidence despite solid execution. Moreover, in the high-rate environment we are currently experiencing, dividend stocks are largely out of favor – as income investors do not need to resort to the equity markets in their quest for attractive yields. Higher rates also threaten to impact AT&T’s financial performance, as the company carries a large debt burden. All of these factors have contributed to the stock currently trading around a 20-year low.

I was fortunate enough to get out of T years ago, and I remained on the sidelines as the company worked to address its vulnerabilities. Now, I believe the time has finally come to buy again. AT&T is undervalued relative to its cash generation abilities, its balance sheet is much improved from several years ago, its operations are more streamlined, and the dividend is attractive and safe. Accordingly, I recently initiated a position in the stock and will likely add to it moving forward. As I see it, AT&T’s single-digit P/FCF is unjustifiably pessimistic, and investors at these levels have the opportunity to lock in a generous income yield attached to a low valuation. AT&T’s investment proposition may be analogized to that of a corporate bond, but with the added benefit of a high likelihood of capital appreciation.

Operations & Performance

AT&T is one of the world’s largest telecom companies, with annual sales of ~$120B, a market cap of ~$130B, and annual FCF of ~$17B. AT&T boasts a broader global reach than any other carrier, offering voice coverage in 220 countries and data coverage in >190. The company’s operations are concentrated in the telecommunications industry, with its primary segments consisting of Mobility, Business Wireline, and Consumer Wireline.

The Mobility unit comprises AT&T’s wireless voice, text, and data services, which are marketed to both consumers and businesses across the U.S. It also includes Cricket Wireless, AT&T’s low-cost value brand, as well as the wholesaling of network capacity to other telecom providers. Unsurprisingly, the bulk of AT&T’s revenue is derived from its Mobility segment, which accounts for over two-thirds of total sales. Last year, this unit grew its sales by 4.4% to $84 billion and posted its highest-ever operating income. Mobility’s operating margin is consistently a healthy 25-30%.

The Business Wireline division markets IP and traditional data services to business customers across the U.S. This segment boasts “nearly 2.5 million customers, from the largest global companies and government agencies to small businesses.” AT&T derived $20.9 billion in revenue from Business Wireline services in 2023, down from $22.5B in 2022 and $23.9B in 2021. Management has attributed the slow bleeding of this division to “lower demand for legacy voice and data services and product simplification, partly offset by growth in connectivity services.”

The Consumer Wireline segment provides broadband internet and voice calling services to residential customers. While legacy voice and data revenues are declining over time, these contractions have been offset by impressive fiber-optic sales gains. AT&T Fiber has been growing at rapid clip, adding over a million subscribers annually for six consecutive years. Accordingly, Consumer Wireline revenues have grown from $12.5B in 2021 and $12.7B in 2022 to $13.2B in 2023.

AT&T also breaks out its small but fast-growing Latin America – Mexico unit. In Q1 2024, Latin America revenues rose 20.4% YOY to ~$1.1B. In Q4 2023, the unit’s revenue rose 26.6% YOY to $1.1B. Its annualized run rate is thus ~$4.4B. Operating loss in Q4 2023 narrowed from $79M to $43M, indicating that the segment is on track to begin positively contributing to AT&T’s bottom line in the not-too-distant future. Indeed, in Q1 2024, the Latin America division eked out a tiny $3M profit.

Show Me The Money

Even after the company’s recent downsizing, the list of corporations generating more cash than AT&T is probably shorter than you think. The company has been a steady cash cow for decades, converting its revenues to cash flows at a rate that would make most similarly-sized companies salivate. Operating cash flow sits at ~$40B annually, and 2023 FCF was $16.8B. Management forecasts FCF of $17-18B in 2024, after factoring in capital investment of $21-22B. Despite the capital-intensive nature of its industry and its slimmed-down operational structure, AT&T remains a money-printer business at an attractive valuation.

Come For The Value

For value investors, every investment decision boils down to what you pay and what you get. In AT&T’s case, what you get is ownership interest in a market leader within one of the most stable and predictable U.S. industries. AT&T shareholders are the beneficiaries of the company’s strong cash flows, powerful brand, massive economies of scale, and a telecom network that would take many tens of billions of dollars to replicate. Alongside Verizon (VZ) and T-Mobile (TMUS), AT&T enjoys a triopoly within its core industry. The cash flows streaming out of AT&T’s businesses – and into investors’ pockets – are extraordinary, even after accounting for the massive investments necessary to keep the company on the cutting edge of its industry.

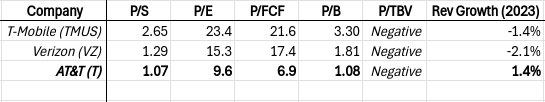

As for price, AT&T is a bargain. On a TTM basis, the company features a P/S ratio of 1.07, P/E of 9.6, and P/FCF of 6.9. The P/B ratio is just 1.08, though tangible book value is decidedly negative. Contrast these ratios with those of AT&T’s primary competitors:

Author’s Calculations Based On Financials

While it is perhaps unsurprising that AT&T is so much cheaper than its competitors in terms of price ratios, what may raise more eyebrows is that it also outperformed last year in terms of sales growth. It’s worth noting that 2023 was an anomaly in this regard, but 2023 also offered the first full-year comparison of YOY revenues following AT&T’s 2021 restructuring moves. Admittedly, analyst forecasts anticipate that this trend will marginally reverse itself this year and next. In 2024, AT&T is anticipated to grow its revenues by 0.3%, identical to Verizon and trailing T-Mobile’s 2%. In 2025, AT&T is forecast to grow sales by 1.1%, behind Verizon’s 2% and T-Mobile’s 3.7%. The question investors must ask is, would this degree of underperformance justify AT&T trading at such comparatively low multiples?

In short, the numbers don’t lie. AT&T offers the best value for money in its industry, and it’s not particularly close.

Stay For The Income

A former Dividend Aristocrat, AT&T was forced to slash its dividend in 2022 in order to conserve cash and pay down debt. Although the current quarterly dividend of $0.2775 per share is barely half its pre-2022 levels, AT&T’s yield remains uniquely attractive at a high and mighty 6.09%. While Verizon’s yield is slightly higher at 6.46%, the key difference lies in payout ratio. While AT&T’s trailing payout ratio is a healthy 59.4% on a TTM GAAP basis, Verizon’s is 99.2%. (While Verizon’s payout ratio looks healthy on a non-GAAP basis, its free cash flows align much more closely with its lower GAAP earnings.) Considering the safety of AT&T’s yield, it compares favorably to corporate bonds even in today’s high-rate environment. Barring unforeseen circumstances, I believe locking in AT&T’s dividend at today’s rates will ensure a steady and reliable (if not growing) income stream for many years to come.

Past Issues & Restructuring

As most readers are painfully aware, AT&T’s operational structure looks very different today than it did 5 years ago, which in turn looked very different than it had 5 years prior. In 2015, AT&T closed on its ill-fated acquisition of DirecTV (near the cable TV industry’s historical peak) at a valuation of $67.1B including debt. In 2018, the company overcame DOJ opposition – and shareholder interests – to consummate a $108.7B deal (debt-inclusive) to acquire Time Warner. Following the Time Warner deal, AT&T’s total debt ballooned to ~$200B.

Not long after these acquisitions were completed, it became clear that AT&T had grossly overpaid for the businesses. In 2019, Elliott Management took a $3.2B stake in the company, criticizing management’s conglomerate-building efforts and calling for the divestiture of non-core assets. In its letter to AT&T’s Board, Elliott also alluded to the need for fresh leadership atop the company. Months later, AT&T announced the retirement of CEO Randall Stephenson, to be replaced by company veteran John Stankey.

Though Elliott liquidated its AT&T stake in Q3 2020, the hedge fund’s impact on the telecom was more enduring. In 2021, AT&T spun off DirecTV (along with U-verse and AT&T TV) into a new entity 30% owned by private equity firm TPG, with AT&T retaining a 70% stake. The transactional math was ugly, with AT&T receiving only $7.1B in cash, $5.3B of which was borrowed by the new venture. AT&T still receives several billion dollars of distributions from DirecTV each year, but these distributions are depreciating by a ~20% annual clip.

In 2022, AT&T spun off WarnerMedia (formerly Time Warner) in a merger with Discovery, creating a new publicly-traded company called Warner Bros. Discovery (WBD). AT&T received $40.4B in cash, and its shareholders were awarded 71% of the new company in the form of stock dividends. While AT&T’s short-lived WarnerMedia investment was an abject failure, the divestment appears to have been wise considering that Warner Bros. Discovery has lost two-thirds of its value since going public in 2022.

Aside from the above restructuring efforts, AT&T also undertook less significant moves to streamline its business structure and raise capital to reduce its debt burden. In 2021, the company divested Warner’s mobile gaming segment Playdemic to EA for $1.4B and sold ad tech platform Xander to Microsoft for an undisclosed sum. By year-end 2022, total debt had fallen to $158B. This figure continues to decline, with total debt of $137.3B at year-end 2023.

Moat

Following Sprint’s 2020 merger with T-Mobile, AT&T is one of just three key players within the U.S. telecom industry. This market dynamic is unlikely to change anytime soon, as the extreme barriers to entry in the telecom industry are unparalleled. The existing incumbents each operate many tens of billions of dollars of infrastructure and equipment to facilitate their coverage networks and spend many billions annually on maintenance and upgrades. This represents a level of investment that few would-be competitors could even imagine. Moreover, attracting enough subscribers away from the existing triumvirate to make such investments worthwhile would be daunting to impossible.

Indeed, to the extent that new participants are entering the market, they are forced to piggyback on the 3 existing carriers. This has given rise to a wholesale market for network capacity wherein AT&T, Verizon, and T-Mobile sell excess capacity to smaller brands. Because the excess capacity provides for less reliable service, these smaller competitors are generally forced to differentiate themselves as “low-cost” alternatives to the dominant industry players. This model allows the incumbents to preserve their elite brand images and pricing power while also capitalizing on a more cost-conscious consumer market.

AT&T’s wholesale customers include Straight Talk Wireless, PureTalk USA, H2O Wireless, and Boost Mobile. Additionally, AT&T’s low-cost brand Cricket Wireless operates on a similar business model.

Risks

Debt & Interest Rates

Global Finance ranked AT&T the 8th most indebted global company in 2023. (Verizon was ranked #4.) Even on the heels of AT&T’s massive debt reduction program, debt remains a primary concern – not so much a solvency threat, but more a risk that higher interest rates could eat into the company’s future profits. As the market shifts toward a “higher for longer” interest rate mindset, there is a very real risk that a sustained period of higher rates could negatively impact AT&T’s bottom line.

Thus far, AT&T’s debt reduction effort has been effective in keeping its interest costs under control. Interest expense in 2023 was essentially identical to that of 2021, and actually below 2018-2020 levels. Hopefully, management will continue to prioritize debt reduction. Of course, the longer that elevated rates persist, the greater the risk that AT&T’s interest costs could skyrocket as more bond batches reach maturity and must be refinanced. Moreover, if rates rise further, AT&T’s stock could become less attractive to dividend investors, causing its price to fall.

Governance

The company previously made a number of decisions that resulted in significant value destruction. It’s also questionable whether the timing and nature of the DirecTV spin-off maximized shareholder value. Rich cash flows don’t do investors much good when reinvested at negative rates of return.

For what it’s worth, in the aftermath of the prior regime’s many stumbles, AT&T has cleaned house at its top levels. The company’s CEO, COO, and CFO have all assumed their current positions within the last 5 years. As noted, the new management team has cut the company’s losses resulting from investments gone wrong, optimizing operations and right-sizing the balance sheet. History has demonstrated that the company can and will accumulate value for shareholders so long as management can execute within the core business and otherwise stay out of its own way. We can only hope – and expect – that the company has learned valuable lessons from its expensive past mistakes.

Competition

Of the 3 U.S. telecom giants, T-Mobile clearly has the wind beneath its sails. T-Mobile exhibited heady revenue growth through 2021, at which point its sales growth stalled (though net income ballooned last year). Despite the recent stagnancy of its top line, T-Mobile has the largest market cap of the group by a wide margin. This is despite its sales paling in comparison to those of AT&T and Verizon, indicating that the industry’s youngest giant is expected to achieve market share growth moving forward.

As of now, AT&T is growing the subscriber count within its core Mobility segment, with postpaid net adds of 1.7M+ in 2023. Even if T-Mobile gobbles up the bulk of the industry’s growth moving forward, the AT&T thesis is not dependent on growth – just stability.

Conclusion

Relative to AT&T’s generous and stable cash flows, its stock is a bargain. Debt is in retreat, aggressive capital investment continues even in the wake of the 5G network rollout, and AT&T is comfortably entrenched as one of just three players towering over a cyclically-defensive industry. Featuring a 6.1% yield with a 59% payout ratio, the dividend is lucrative yet conservative. With postpaid phone and AT&T Fiber subscribers growing at impressive rates, the company is well-positioned for continued operational success. AT&T’s disciplined approach and solid execution vis-a-vis its strategic priorities give rise to the likelihood that its best days are ahead of it.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T, VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.