Summary:

- AT&T Inc. is a battleground stock, with ardent bulls and pernicious bears, and there were downgrades just announced.

- The dividend is secure, but the telecom’s valuation may be stretched for the growth it is offering, relative to peers.

- The outlook for 2023 is going to determine the trajectory of the market, and we are pretty bearish.

- We would be buyers of AT&T Inc. again at $16-17, and we think this market could take us there in Q1 2023.

Klaus Vedfelt

Back in November, we told you we were taking some profit, and selling some covered calls in AT&T Inc. (NYSE:T) stock after the amazing run that it had following our big wave of buying when the stock fell under $15. Solid trade, but we also keep T and competitor Verizon (VZ) in our analysts’ long-term portfolios. An argument can be made that the latter may be the better buy right now, but we want to discuss AT&T.

We think AT&T Inc. stock is going to head lower in H1 2023, because its growth has stalled, and its valuation may be more than fair over $19. We think the stock can pull back another 3 points from here with ease, which would be a 15% retracement. We believe the market will fall as earnings estimates for 2023 come down. Folks, the entire market has a serious short-term valuation problem right now. Does this mean you slap the sell button on everything? Of course not. For AT&T, it will mean the yield will increase, which means the income on new buys will increase. We still believe investors can enjoy continued gains in AT&T Inc. stock long-term, collect income, and can compound their income through the appropriate use of a put selling and covered call selling approaches.

Right now, we think you should take a little something off, and you can even use the proceeds to sell puts for either income or to define new entry a few points lower. This is wise position management, something we teach. When done correctly, you can double the income when combined with the dividends being paid. Folks, we want to be clear. Although this column comes with a “sell” rating by definition, we are not advocating selling the entire position. Sell some of it here over $19. AT&T remains a core holding for our trading team and many of our members and followers.

The name has caught recent downgrades on valuation from Morgan Stanley and MoffettNathanson. While debt challenges persist, the company is certainly moving in the appropriate direction, but our decision to recommend selling some of the position is a market valuation call and comes as we expect earnings for 2023 to show little growth for AT&T. We remain long despite selling some of the stock. We want to be clear. We are trading around the core position and the reason we are holding on is that we see the dividend as secure. While we think the rate of the payout will be maintained, it could even be hiked. Let us discuss.

Momentum now reversing

AT&T was in rally mode since it reported Q3 earnings, spiking over 30% from trough to peak. Those were some solid gains. But momentum is now reversing. The market in our opinion is going lower again over the next few months. And so, we think paring some more of the stock and selling out of the money puts is a tremendous strategy here, while maintaining a core position. A few weeks ago, we also sold more covered calls following the 30%-plus rally. The momentum has been impressive. But a lot of macro risks persist. While a cooler than expected inflation in November and again last week was welcomed, inflation still remains rampant and the Fed came right out and said they will continue to raise rates and will remain higher for longer. Do not fight the Fed.

Keep in mind, that the Fed cannot and should not stop prematurely or inflation could become entrenched. The Fed can always loosen, and frankly, our firm believes we will be talking rate cuts in late 2023. We think stocks rally H2 2023. So, let the market knock T and other stocks down, then come in and do some buying. For now, lighten up some, and consider put selling with the VIX being elevated. You do not have to do this all at once, pick down days to sell out of the money puts.

The action in the stock was nice, but momentum is reversing, with shares down 5% from the recent peak, and heading lower. The good news? As shares fall the yield increases. If you have followed our previous advice then you are reinvesting dividends to compound your position. This is a strong way to generate wealth, especially if you add in trading around a core position. It works. But if you just hold, and do not reinvest, the dividend income will be nowhere near enough to offset capital losses. Why not pad your returns?

Peer comparison

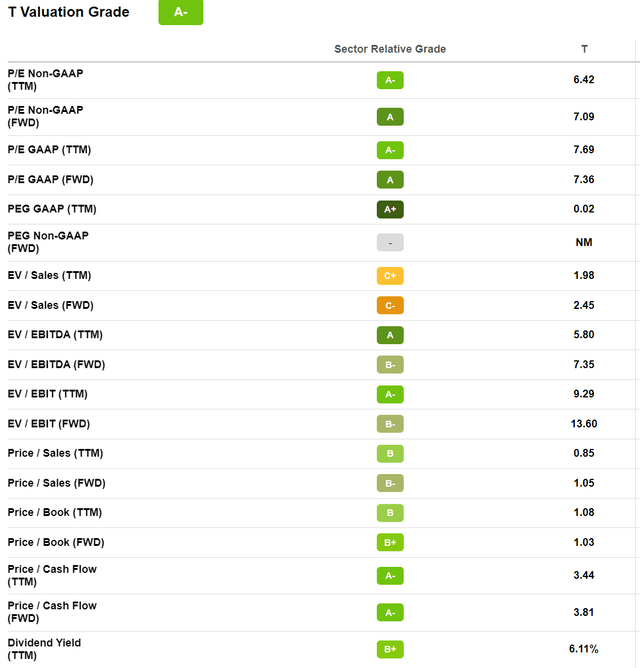

The downgrades that have landed are valuation calls. On its own, AT&T has a reasonable valuation, but relative to peers, it is another story.

So this looks great on its own. There is an overall A- rating, and the quant system is reliable. We like the EV/EBITA, the price-to-cash flow is solid, obviously the price-to-sales, and of course a FWD p/e at 7X is not a rich valuation, but given that growth is questionable, it may be expensive. Relative to peers, AT&T is less attractive on a number of metrics.

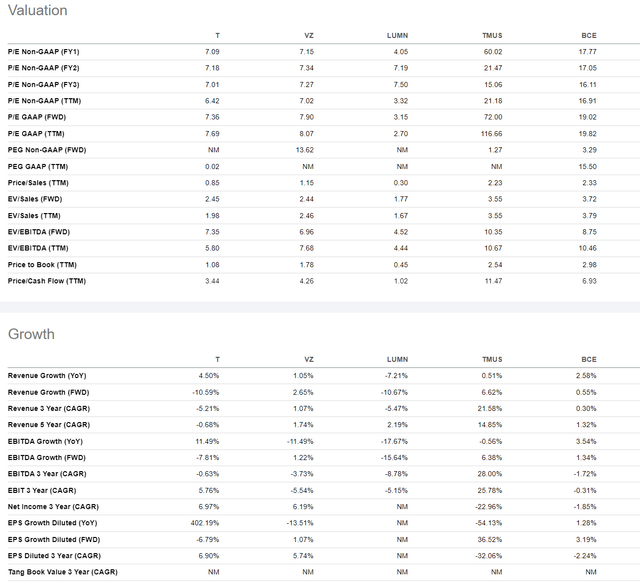

Seeking Alpha AT&T Peer Comparison

So here is the deal. AT&T has a lower yield than Verizon. It has a lower market cap too now to Verizon and T-Mobile (TMUS). From a growth perspective these stocks both outperform AT&T. On other valuation metrics, Lumen Technologies (LUMN) is more attractive. So, there are superior choices out there depending on what you are looking for whether it is growth, value, or yield. Now that said, we will say that AT&T has been righting the ship.

Righting the ship

We continue to believe AT&T is a great income stock. For the most part, we have seen some improvement in performance driven by management finally getting serious about cleaning up the balance sheet and seemingly realizing investors have been fleeced. Management has executed pricing adjustments to adapt to the high inflationary pressure. Their pricing strategy will continue to be modified to maximize retention, so that even the most loyal of customers to take advantage of special offers, while attracting new customers. We expect lots of different promotions and pricing points to reduce churn and grow subscribers. The balance sheet has improved. Basically, management had already been operating like the economy was in a recession, and those moves led to success.

We are a month away from Q4 results, but in Q3 wireless postpaid growth has been impressive. There were 708,000 adds here in the quarter which given all the choices out there and competition, this is quite strong. Further, in Q3, AT&T delivered industry leading 338,000 fiber net adds. These fiber adds were the second-best in the company’s history they were so good. For 5G, they are now on track to hit 130 million people. This is 30% ahead of what management had previously expected for 100 million, and nearly double the initial 2022 forecast for 70 million. So there is growth, but it has not translated to big gains in revenue and earnings for the legacy business. It is slow and steady which we like as a dividend play. This year one of the major concerns was declining free cash flow.

Free cash flow covers dividend, it is safe

In Q3, the company saw a big turn in cash flow. Cash from operating activities were $10.1 billion, but capex was high again at $5.9 billion, while total capital investment hit $6.8 billion. All of this led to free cash flow being about in line with expectations at $3.8 billion, more than double what it saw in Q2. Folks, what this means is that the dividend was covered. Dividends paid were $2.01 billion, leaving around $1.83 billion in excess free cash flow after the dividend. The payout ratio was a very safe 52.3%. As an income investor, you should watch that metric very closely. However, so far in 2022, the payout ratio is 97.6%, largely due to the Q2 2022 shortfall. that is painful. But for Q4, cash flow should also easily cover the dividend. Full year EPS is now expected to be $2.50 or higher. This is up from the $2.42-$2.46 prior view. Free cash flow of $14 billion this year will cover the dividend, and the yearly payout ratio, while higher than we would like, should come down to less than 80%, while and the high cash from operations should help the company chip away at more debt.

This dividend is safe. Folks, if AT&T were to cut the dividend it would obliterate shares. Look what happened to Lumen when it eliminated its dividend. As we look to Q4 we see about $5 billion in free cash flow, so the payout will be less than 50% for the quarter, and the annual payout ratio will come down sharply from 97%. Finally, the dividend might even be boosted, but we certainly see it being maintained.

Final thoughts

AT&T has caught some downgrades, but also has a number of buy ratings, and hold ratings. We see an earnings recession coming in 2023, and think the market is headed lower. Momentum has revered for T stock. We think you sell a good chunk here, and then sell some puts on pullbacks for income, or to define new entry to lower your cost basis. On the existing position, sell covered calls. Then collect and compound that dividend. Peers offer better yield, value, or growth, depending on what you are looking for, but we have owned and been in and out of AT&T Inc. for many years. The dividend is safe in our view, so if you can get shares lower, do it. No need to hold AT&T Inc. through capital losses on paper. Use any spike to take advantage.

Your voice matters

As always, our readers, both bulls and bears spark great conversations in our chat rooms and in the comment sections of our public columns. Do you like the options approach we embrace for more income? Is this a hard way to make an easy living? Is trading around the core position a bad idea? Why is a buy and hold better? Should folks just sell it all in favor of a peer? Let the community know below.

Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: We trade around a core position. We are selling common stock and using cash for put selling, while reinvesting dividends on the core position

This. Is. It. The Final Days of our 60% off holiday sale at our investing service

Stop wasting time and join our active hedge fund analysts at BAD BEAT Investing. JUST 3 more members will unlock 60% off the annual price

- Access an expert team of 4 analysts, available all day during market hours.

- 6 different chat rooms

- Rapid-return trade ideas each week with crystal clear target entries, profit levels, and stops

- Stocks, options, trades, dividends, and one-on-one portfolio reviews

- When the spots are filled, the discount is gone, and prices go up in 2023