Summary:

- AT&T Inc. management guidance had (and has) been met with skepticism from the market, providing an investment opportunity for those who believe in the company’s ability to improve its remaining businesses.

- The company is bringing costs under control and catching up with competition, leading to faster growth in income and cash available for dividends compared to revenue.

- EBITDA and free cash flow have both shown significant growth, indicating potential for long-term price appreciation and the fastest free cash flow growth in the industry.

- Management credibility continues to grow, which should eventually be reflected in a better common stock price valuation.

- The first quarter stock price dip in particular should mitigate in the future as management credibility builds. Overall stock price valuation should continue to improve.

Ronald Martinez

As I noted in a previous Verizon Communications Inc. (VZ) article, the market has had no trouble accepting the fact that Verizon would make most of its free cash flow in the second half of the fiscal year. But that acceptance did not extend to the guidance of AT&T Inc. (NYSE:T) management. This provided an investment opportunity for those who believed that all AT&T management had to do was run the remaining businesses as they should be run. That should have been a far easier assignment than the previously “diversified” (which some would call “diworsified”) company.

But you would not know that from the market reaction today. Investors should, therefore, expect the positive revaluation of T stock to continue. More importantly, the first quarter weakness that we saw as investors should fade in coming years as management establishes a track record.

Operating Leverage

This company is bringing costs under control as it is also catching up on the competition. The nice part about this is that “the bottom line” as well as EBITDA (for example) should grow faster than revenue because they are a smaller part of revenue. Therefore, income growth and cash available for dividends should grow faster than revenue for some time to come. That would imply long-term price appreciation potential in excess of market expectations for some time to come.

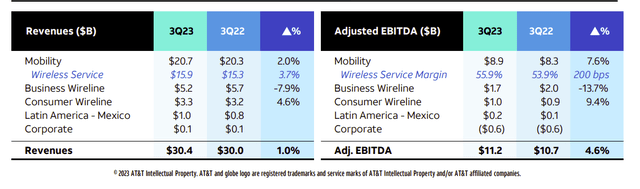

AT&T Revenue And EBITA Comparison Third Quarter 2023 (AT&T Quarterly Highlights Summary October 19, 2023)

In line with this, notice that the increase in EBITDA is well in excess of revenue growth. Now, at some point, most items can only grow as fast as revenue. But we are probably years away from that, as large companies take a long time to refocus.

Free cash flow took an even larger percentage jump in the third quarter to $5.2 billion from $3.8 billion in the third quarter of the previous fiscal year. As a result, this may be the company with the fastest free cash flow growth in the industry for some time to come because it is in the process of refocusing its businesses (and that includes slimming down the corporate costs).

Earnings

As a result of this, the cash flow and earnings pattern is beginning to follow a pattern that Verizon long established. For whatever reason, the market did not expect that of AT&T post divestitures. It is not exact, of course, because each company does have its specializations and relative strong points. But what is slowly happening begins with the cash flow pattern. That pattern appears to be one of climbing throughout the fiscal year.

The earnings will be dependent upon what can be capitalized compared to what can be immediately expensed in the fiscal year. That can vary with management assumption variations allowed under GAAP.

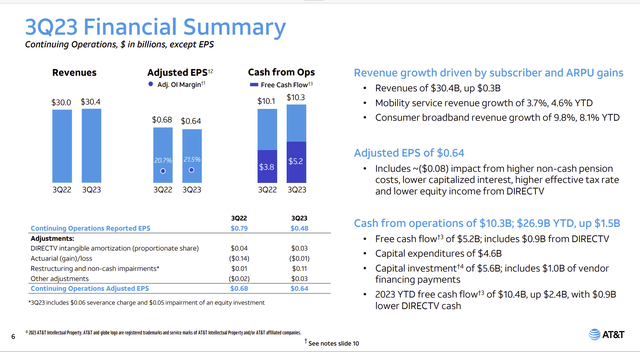

AT&T Graphical Summary Of YTD Results (Conference Call Presentation Third Quarter 2023)

The market appears to demand a history of the cash flow pattern before giving credit to AT&T for having a similar cash flow pattern to Verizon. Establishing that pattern implies more upside to AT&T stock in the future until there is no stock price reaction to a light free cash flow first quarter. Long-term investors will not have to worry about a first quarter stock price fluctuation because they “know” that more free cash flow will be back-end loaded.

The adjustments show that there is still a lot of “noise” in the earnings from prior years that is obscuring the business results. The need for that adjustments section should decrease over time. However, it does provide a view as to what is happening in the business as management views the comparison.

My personal big deal is always cash flow from operating activities and whether or not I agree with the expenditures that management has made. To me, free cash flow growth is okay as long as it does not impair the long-term competitive position of the firm. Given that management appears to be spending more to “catch-up,” it would appear to be that the cash flow growth right now is ok.

Management Credibility

The effect of all this was solidified when management raised the full year guidance for free cash flow and EBITDA. This management appears to understand the idea of setting conservative goals that you can exceed to build a favorable reputation with Mr. Market.

Management has been saying something like this for a few years. So, it was a definite goal for some time. But Mr. Market often does not have the patience for the time it takes for a company like this to turn around. Many times, large companies get started on a new goal and investors see the effect years later. This is one disadvantage of large companies.

On the other hand, the telephone industry is really an oligopoly which usually means that market competition is not intense. So, there is some room to fall a little behind and then catch up. That might not be a viable strategy in a highly competitive market like oil or insurance where there are a lot of competitive companies.

Conclusion

That means that the business market will give management the time needed to turn the business around (which they are now doing). Getting the business focused and “slimming down” is part of that. Clearly, AT&T got off-track in the diversification process. But they had a safety valve in the oligopoly that allows for a little less competitive pressure.

The other advantage is that the company has some operating leverage to produce outsized results when compared to revenue growth due to the “refocusing of the business” process. That should mean growth in EBITDA, earnings and cash flow (including free cash flow) well in excess of the company growth for years to come.

Eventually, things like earnings can only grow as fast as revenue. But right now, that “eventually” appears to be a long way off. Therefore, this stock is likely to have quite a bit of appreciation potential from the current price. Long-term this will likely become a growth and income play in a mature industry that will likely return a low double-digit percentage from both the dividend and stock price appreciation (combined).

The recovery potential from refocusing the company appears to far exceed that and that recovery process will take years (it has already taken years). So while the strong buy stance does not change. What is materially changing is management credibility for the better. That should continue as long as management keeps the current focus and manages market expectations properly with good communication.

As a result, the stock price action will likely reflect that growing management credibility. The overall stock price discount should disappear and the particular price plunge of the first quarter should become history. These things will take time. But the market does “get there.”

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclosure: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Long Player believes oil and gas is a boom-bust, cyclical industry. It takes patience, and it certainly helps to have experience. He has been focusing on this industry for years. He is a retired CPA, and holds an MBA and MA. He leads the investing group Oil & Gas Value Research. He looks for under-followed oil companies and out-of-favor midstream companies that offer compelling opportunities. The group includes an active chat room in which Oil & Gas investors discuss recent information and share ideas. Learn more.