Summary:

- AT&T and Verizon have seen valuation pressure related to rumors that Dish Network is partnering with Amazon to sell wireless plans.

- However, AT&T confirmed its free cash flow forecast for FY 2023.

- AT&T’s shares just made a new 2023 low and the yield of 7.3% surpasses the company’s P/E ratio.

Ronald Martinez

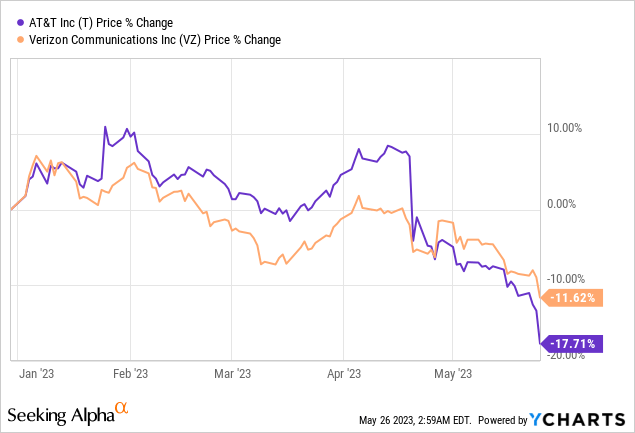

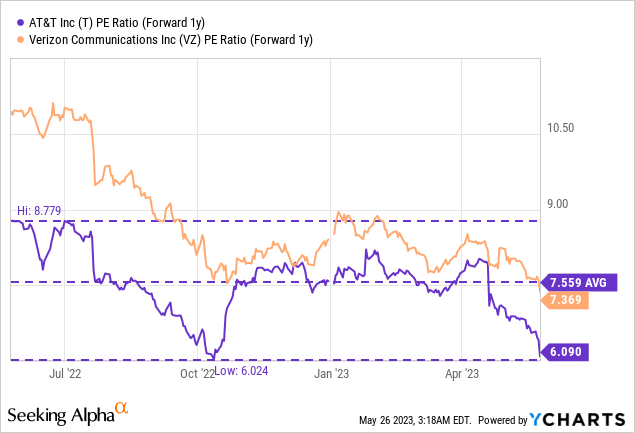

AT&T (NYSE:T)’s and Verizon (VZ)’s shares have experienced considerable selling pressure in recent days as the Wall Street Journal reported that DISH Network (DISH) was said to announce a partnership with e-Commerce giant Amazon (AMZN) in order to sell wireless plans. However, at the same time, AT&T confirmed at JPMorgan Chase & Co.’s annual Technology, Media and Telecommunications Conference last week that it continues to expect to generate $16B in free cash flow in FY 2023. I believe the market overreacted to the Wall Street Journal report and considering that AT&T’s shares are now selling for a dividend yield of 7.3% – which exceeds the telecom’s P/E ratio of 6X – I would recommend dividend investors to buy the new 2023 lows!

Rumors about a DISH-Amazon partnership in the wireless segment have led to considerable selling pressure for AT&T, Verizon

AT&T and Verizon both saw their share prices skid lower on Thursday after a Wall Street Journal report said that DISH Network was planning to sell its new mobile phone service through Amazon (AMZN). While the report didn’t lay out any specifics, it said that an announcement could come as soon as June. AT&T’s shares dropped 5% on the Wall Street Journal report while Verizon’s shares skidded 3%. Yesterday’s price drops have pushed the share prices of both AT&T and Verizon to new lows in 2023.

The market likely overreacted here…

Amazon owns the largest e-Commerce platforms in the U.S. which could give DISH Network critical distribution momentum after the company invested billions of dollars into the roll-out of its 5G network. Tapping Amazon’s enormous distribution power would likely be a big win for DISH Network, but that doesn’t mean that AT&T’s significant momentum in the segment is diminishing.

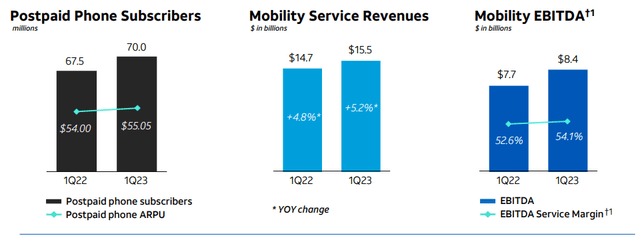

AT&T has seen strong growth in 5G post-paid subscribers in the last couple of quarters… momentum that continued in Q1’23. AT&T said that it achieved 424 thousand post-paid phone net adds in the first quarter and, according to company disclosures, it was the 11th straight quarter of net additions exceeding 400 thousand. Fiber and 5G are two growth areas for AT&T and both segments benefit from considerable customer acquisition momentum. Post-paid phone subscribers reached a record 70M in Q1’23 and the segment’s average revenue per user – a key metric for companies that run subscription businesses – improved 2% year over year to $55.05.

AT&T and Verizon are strong players in the 5G market and have invested billions of dollars into their 5G networks. While a DISH-Amazon partnership could indicate growing competition in the wireless market, AT&T’s valuation especially is what I believe makes the telecom’s shares attractive here.

Strong free cash flow prospects confirmed for FY 2023

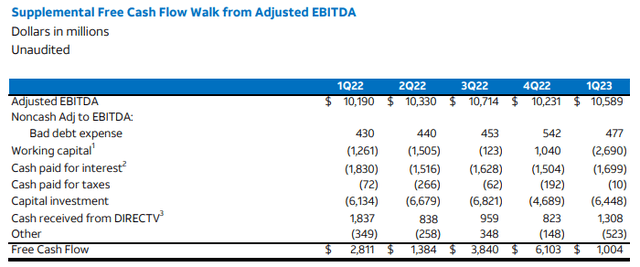

AT&T has previously guided for $16B in free cash flow for FY 2023, a guidance point that was confirmed last week at JPMorgan Chase & Co.’s annual Technology, Media and Telecommunications Conference by AT&T’s Chief Executive Officer John Stankey. The confirmed free cash flow guidance is a big deal considering that AT&T had a free cash flow shortfall in the first quarter, meaning the telecom did not cover its dividend obligation with free cash flow. AT&T generated $1.0B in free cash flow in Q1’23 which fell short of its dividend payment of $2.0B. With the free cash flow forecast confirmed yet again and the dividend yield crossing above 7%, I believe dividend investors especially have a good reason to buy AT&T on the drop. Verizon also had an FCF shortfall in the first quarter, and I am rating VZ currently as a hold.

Valuation has become a lot more attractive at new lows

Yesterday’s share price drop for both AT&T and Verizon has led to even lower P/E ratios for both telecoms which, in my opinion, is undeserved, especially in the case of AT&T which confirmed its free cash flow outlook last week. AT&T’s 5% price drop on Thursday pushed the P/E down to just 6.1X while Verizon is now trading at a P/E ratio of 7.4X. AT&T’s shares made a new 2023 low yesterday and shares are now trading 19% below the 1-year average P/E ratio of 7.6X. With a P/E ratio of just 6.1X, investors can buy AT&T at a 16.4% earnings yield and a 7.3% dividend yield.

Risks with AT&T

According to consensus estimates, AT&T is expected to generate only about 1% annual topline growth in the next five years as the telecommunications market overall is saturated. However, the telecom business is a high-FCF business, which makes AT&T an attractive dividend stock to own nonetheless. What would change my mind about AT&T is if the telecom pulled its free cash flow guidance for FY 2023 or saw a serious deterioration in its 5G/fiber subscriber momentum.

Final thoughts

Enough is enough. I don’t believe that investors have a real reason to be concerned about either AT&T’s or Verizon’s performance in the 5G market at the moment, and the market likely overreacted to the announcement of a potential DISH-Amazon partnership in the wireless segment. Both telecoms have considerable momentum in their 5G businesses and remain the two largest telecoms in the country. Additionally, AT&T last week specifically confirmed its $16B free cash flow forecast for FY 2023. I believe the sell-off yesterday, which caused AT&T’s shares to drop to a new 2023 low, is a huge opportunity for dividend investors to buy into the telecom at a much higher yield and at a discounted valuation!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T, VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.