Summary:

- AT&T is a high-yield investment with a 5.74% dividend yield, which can be attractive to income-investors.

- Despite past mistakes, AT&T is seen as a defensive stock with steady cash flows and potential for earnings growth that could see dividend increases in the future.

- We take a look at a recent put selling trade that expired worthless, allowing us to pocket the option premium and look toward further ideas moving forward.

wdstock

Written by Nick Ackerman

AT&T (NYSE:T) is a high-yield investment choice thanks to its 5.74% dividend yield. This telecom giant has made several mistakes over the years, but they seem to be focusing back on their core business and righting the ship. While we haven’t seen any dividend growth yet, as earnings and free cash flow climb, there is a possibility there.

I discussed my thoughts on T more in-depth relatively recently. However, today, I wanted to provide a quick update and discuss a recently put-selling trade that just expired. This trade expired worthless, allowing us to pocket some options premium and that means we’ll also be looking at some additional ideas going forward.

Pocketing Premium

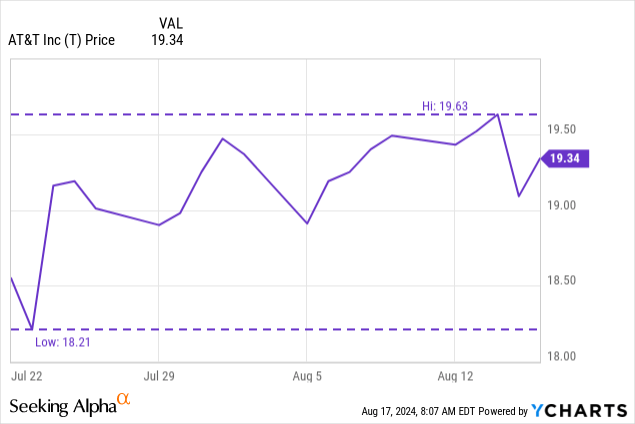

The most recent puts we sold were on July 22, 2024; this was after our prior written put trade had expired worthless, so this was a quick follow-up to bank more premium. In that previous trade, we wrote puts at a $17 strike and collected $0.73 in premium, which was over 102 days and worked out to an annualized return of 15.37%. In this latest trade, we sold the $18 strike for a premium of $0.24.

That’s just shy of collecting an ‘extra dividend’ out of this stock, as the regular quarterly dividend is $0.2775. However, we also did that over only 25 days—less than a month and much less than the every ~90 days investors holding for the dividend receive cash flow. In terms of annualized return potential, that comes out to 19.47% against the 5.74% current dividend yield.

During this time, the broader equity market did end up being a bit more volatile but it was mostly the mega-cap growth names that had run up massively. Defensive names such as T held up quite resiliently and never really threatened to breach the $18 strike price that we selected.

YCharts

T can be seen as defensive given the telecom industry is utility-like—phones have become an integral part of society. This provides steady cash flows even during a recessionary environment. Even further, as we get nearer rate cuts, higher-yielding stocks like T become more attractive.

That higher yield can help make up for a lack of dividend growth, as the company reset its dividend after its WarnerMedia spin-off and hasn’t raised it since.

With earnings growth looking to start in fiscal 2025 and growing free cash flow, that could change going forward. Also worth noting is that both fiscal 2024 and 2025 saw their EPS estimates shaved lower by $0.01 each since our prior update. It’s not catastrophic, but a good reminder that estimates are only estimates and that they can and will change moving forward.

T EPS Estimates (Seeking Alpha)

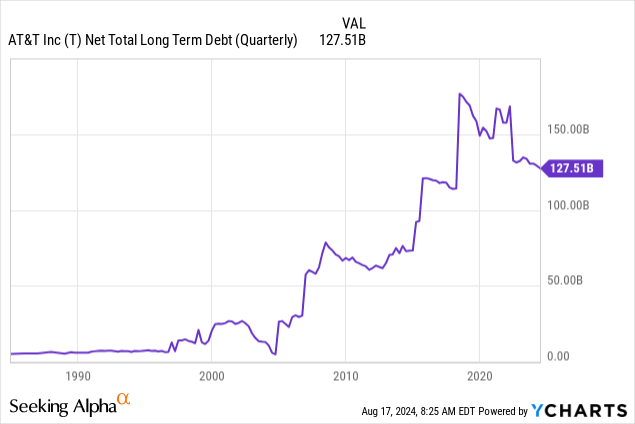

With that said, they’ve also been focusing on paying down debt, which ballooned during the zero-rate environment. Paying down debt can help avoid having to refinance at now higher rates.

YCharts

Of course, also with a lower rate environment expected, that’s where T once again can be helped out as refinancing becomes cheaper once again. However, it is not likely that we go back to a zero-rate environment again unless some black swan event occurs or we see a severe economic slowdown. Either of those events could pressure T, even if it is a relatively more defensive play.

Next Ideas

Looking forward, even with the share price of T rising, I think there is some more opportunity to write puts. I believe that picking up shares at $20 or below makes sense.

T Fair Value Range (Portfolio Insight)

With that, here are two more potential ideas that we could take when markets open.

- September 20, 2024 expiration at the $19 strike could take in $0.20. On an absolute basis, not too much in terms of premium received. However, let’s put it into perspective. If we are able to do that every 25 days, it means a potential annualized return of 15.37%. That’s certainly nothing to scoff at, and even further, writing cash-secured puts still means currently collecting about 5% in cash. That will come down when the Fed cuts, but for the duration of this trade, that’s still mostly applicable.

- Going further out, for investors that want a larger upfront premium, one could go with the October 18, 2024 expiration. Going with the $19 strike price again could net an investor $0.48, which works out to a PAR of 14.87%. In this case, this expiration date is expected to be after their next earnings report, which is something to consider as it could end up being quite volatile around that time. Further, if the Fed does cut in September as expected, there will be a period where that ~5% cash yield might be a bit lower.

Conclusion

Overall, I feel more optimistic about this name in the future—hence why I’m still long some shares and writing puts to go even longer potentially. They certainly made several bad decisions but they’ve mostly been staying focused now, and that’s been paying off. By writing options, we can generate some additional cash flow out of this name while we wait for the continued recovery to take hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Interested in more income ideas?

Check out Cash Builder Opportunities, where we provide ideas about high-quality and reliable dividend growth ideas. These investments are designed to build growing income for investors. A special focus on investments that are leaders within their industry to provide stability and long-term wealth creation. Along with this, the service provides ideas for writing options to build investors’ income even further.

Join us today to have access to our portfolio, watchlist and live chat. Members get the first look at all publications and even exclusive articles not posted elsewhere.