Summary:

- AT&T is a large-cap telecommunications and technology services provider with a high dividend yield.

- The company’s financial position and outlook for free cash flow generation are looking great – way better than the Market expected.

- AT&T is focusing on capturing market share in the fiber market and maintaining stability in its declining core industry.

- Based on my DDM calculations, AT&T’s fair value should be $18.78 per share, which is 18.26% more than today’s price.

- From a technical analysis perspective, AT&T looks like an excellent ‘Buy’ also.

Justin Sullivan

AT&T Inc. (NYSE:T) is a $113-billion market cap global telecommunications and technology services provider, headquartered in Dallas, Texas, and operating in 2 segments: Communications and Latin America. The Communications segment offers wireless voice and data services, broadband, data solutions, security, and cloud services to various customer segments, including multinational corporations, small businesses, and residential customers. The Latin America segment provides wireless services and smartphone sales in Mexico.

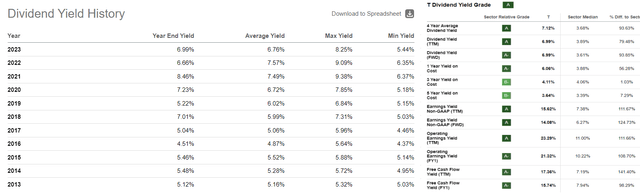

For many years, the company has paid a fairly high dividend yield, which is well above the median values for the communication services sector:

Seeking Alpha, author’s compilation

For this reason, the income-seeking investor community is always looking at AT&T with great interest, trying to understand whether the company’s financial position continues to meet the standards to maintain such a high yield. This demand sparks analyst interest to write about the company more frequently than usual: In October alone, Seeking Alpha published 29 articles, many of which were bullish.

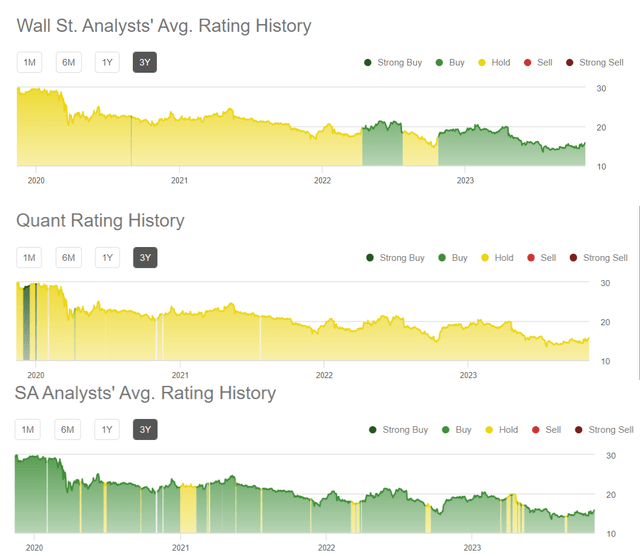

However, as we can see from the history of AT&T coverage, both Seeking Alpha analysts and Wall Street analysts could not predict the stock’s inflection point. Over the last 5 years, the stock’s total return has failed even to offset inflation and over the last 3 years, AT&T has had a negative total return despite its many “buy” ratings.

Seeking Alpha, author’s compilation

Today I decided to take a chance and initiate my coverage of AT&T stock after avoiding this story for a long time. Let’s see where my thoughts take me during the analysis.

AT&T’s Financials, Prospects, And Valuation

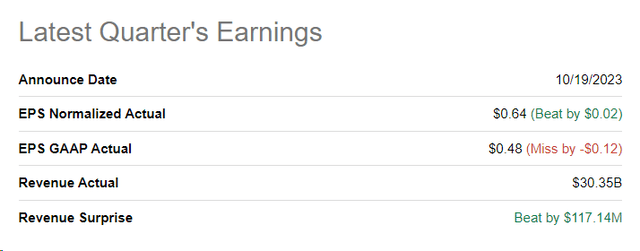

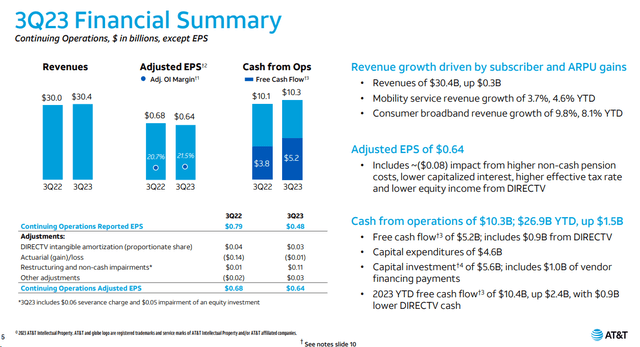

AT&T reported its 3Q FY23 results on October 19, exceeding revenue expectations by $130 million and adjusted EPS expectations by $0.02.

While reasonable subscriber additions were reported, revenue was impacted by the ongoing decline in Business Wireline. Overall, third-quarter revenue increased 1% to $30.35 billion, with growth in Mobility, Consumer Wireline, and Latin American revenues partially offset by a decline in Business Wireline. Adjusted EBITDA rose 4.6% to $11.2 billion, but adjusted diluted EPS fell 6% to $0.64. AT&T Mobility had subdued subscriber gains, with net additions of 468,000 postpaid subscribers, while ARPU for Mobility postpaid phone business rose 0.6% to $55.99.

More importantly, FCF amounted to $5.18 billion in Q3, compared to $3.8 billion in the third quarter of the previous year. In just 9 months of FY2023, the company generated $10.4 billion (+30% YoY), which is higher than was expected by most analysts.

Against this background, management increased its FCF target for the end of the year by $500 million to $16.5 billion. AT&T also improved its EBITDA growth forecast from 3% to 4%.

We’re also now tracking to about $16.5 billion free cash flow for the full year. <…>

In fact, due to our increased revenue growth and overachievement in cost savings, we now expect to grow adjusted EBITDA by better than 4% versus our prior guides of 3% plus.

Source: AT&T’s Q3 Earnings Call

In general, I see sustainable maintenance of business margins with a growing gross profit margin in a 10-year perspective, which is a kind of proxy for the future increase in EBITDA and bottom-line margins.

Given the management’s outlook for FCF generation, the target of reducing debt to $128 billion by year-end seems achievable. During the last quarter, AT&T reduced its net debt by $3.3 billion to $128.3 billion (the Net debt/EBITDA ratio decreased to 2.99x), maintaining its target to reduce this ratio to 2.5x by FY2025.

In Q3 AT&T reported a 9% ARPU growth in fiber and broadband, attributed to customers migrating to higher-speed plans and pricing adjustments. The executive team believes there’s room for further growth as they deploy 5 gig networks and that their pricing strategy allows for bundling flexibility.

According to MRU Research, one of AT&T’s initial markets – the wireless communications market – will grow at a CAGR of 20.4% between 2023 and 2030, and the market is expected to be worth $122.5 billion by 2030, which is a lot.

AT&T is trying to capture as much of the fiber market’s share as possible from cable providers. They are constantly fine-tuning their approach and switching tactics when markets reach a 40% penetration level, the management says.

On the other hand, the market size of the Satellite TV providers industry in the US (another major market for AT&T) has declined 5.0% per year on average between 2017-2022, according to IBISWorld’s data. Market Research Guru recently published a research paper stating that the market is expected to decline at a CAGR of -1.23 % from 2023 to 2028, which is less than in previous years as you may notice. For AT&T it’s a cash cow business unit that is running well as far as I can see despite all the challenges around it, generating the expected cash flow. I believe this will continue for the foreseeable future.

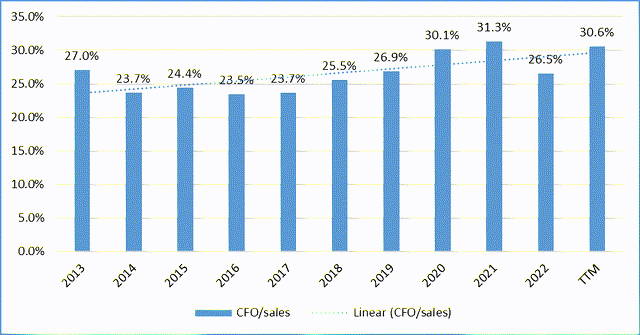

Over the last 10 years, the company’s operating cash flow has grown by an average of 1.5% per year, although it has ranged from -23.7% to +16.3%. Furthermore, if the CFO to sales ratio has been on an upward trend during this time, that tells me personally that AT&T’s management is managing its late-cycle business quite effectively, while not forgetting to develop other, faster-growing areas that have allowed the company to stay afloat in a shrinking industry (sales have fallen by an average of 0.1% over the last 10 years).

Author’s work, Seeking Alpha data

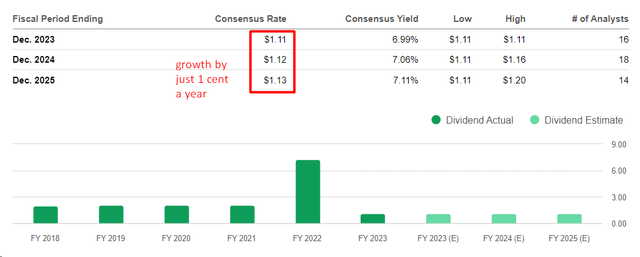

The company has been paying dividends for decades. Although AT&T had to make a dividend cut in 2022, I think we can now have more confidence in the sustainability of the current dividend yield given the company’s recent financial results. In addition, the payout has increased by 1.82% for eight years up to and including 2021, while the company’s revenue and the industry as a whole have continued to decline. I expect AT&T’s dividend to return to that growth rate. Well, it might be a little less than 1.82% though: I think 1.5% is a viable option. While this assumption of mine doesn’t seem overly optimistic, it is well above the consensus payouts for the next 2 years:

Seeking Alpha, T’s Dividend Estimates

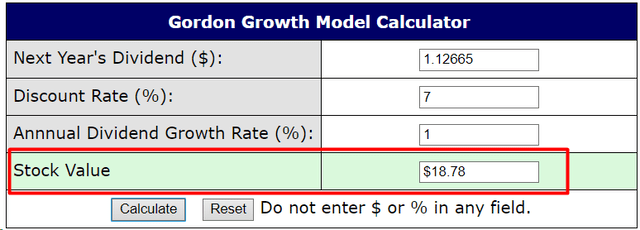

The valuation of stocks like AT&A is similar to that of bonds – the most basic theory uses the Gordon perpetuity model, which assumes that the fair price of a stock is determined by discounting the dividend at a constant growth rate over an infinite time interval. This is of course a very simplistic approach, but it illustrates the principle of comparing the profitability of “risk-free” investments and the proposed dividend yield.

If we assume that “the Fed stops raising interest rates”, the risk-free rate should fall. For T stock, I assume a 7% discount rate – this high rate partially offsets my bold, out-of-consensus assumptions about the company’s growth rates in payouts. Then AT&T’s fair value should be $18.78 per share, which is 18.26% more than today’s price:

buyupside.com, the author’s inputs and notes

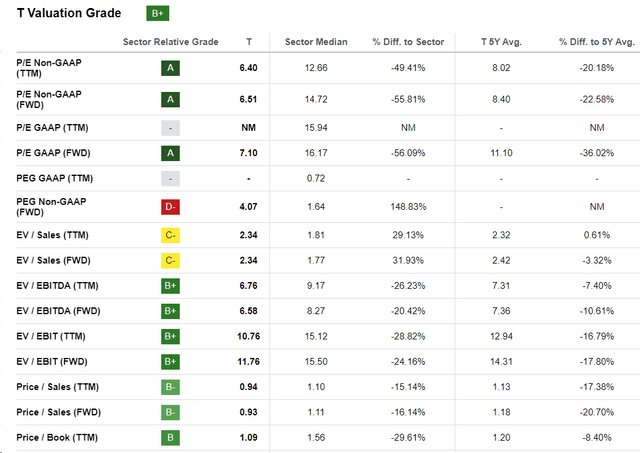

This undervaluation finding is supported by AT&T’s relatively low multiples, many of which are on average 20-30% below the median figures of the communication services sector:

The Verdict

Of course, investing in AT&T involves careful consideration of several key risk factors. These include intense competition in the telecommunications and media industries, changing consumer preferences, potential regulatory challenges, and the burden of a significant long-term debt load resulting from acquisitions. Furthermore, as technology continues to evolve, AT&T faces technological risks and the need to make substantial infrastructure investments to stay competitive. High levels of market and stock price volatility, potential dividend cuts during financial difficulties, and integration challenges from past acquisitions are also critical factors that could impact the company’s financial performance and stock value. In addition, the substantial cost of producing and maintaining content for its media and entertainment divisions, along with sensitivity to economic conditions, should also be taken into account when considering an investment in AT&T.

But despite these risks, I think the company has finally started to look like a solid, dividend ‘buy” stock that continues to look for new growth drivers despite its declining core industry while showing hope for stabilizing its dividend payments in the foreseeable future. The market punished the stock for the dividend cut in 2022, but it was necessary, and as we see it today, it has helped AT&T gain more financial stability.

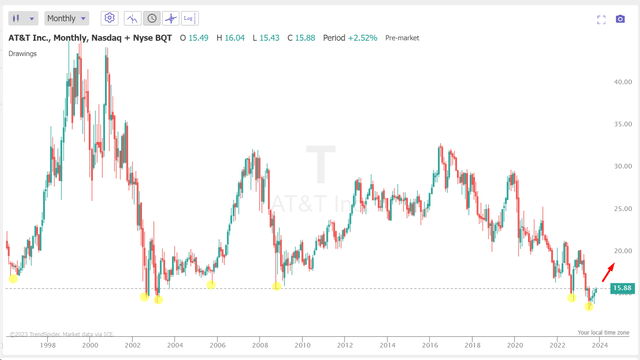

Also, from a technical analysis perspective, AT&T looks like an excellent ‘Buy’: The price is still in the long-term demand zone (monthly chart) after several unsuccessful attempts to go lower. Testing this level has led to medium-term outperformance in the past, which is what I hope to see again this time:

TrendSpider Software, author’s notes

Therefore, I rate AT&T stock as a ‘Buy’ this time around.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in T over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!