Summary:

- AT&T is benefiting from steady price momentum and an improved free cash flow outlook, leading to less concern about the dividend.

- The company is seeing growth in its Fiber Broadband segment and higher free cash flow compared to the previous year.

- AT&T is on track to reduce its net debt significantly by 2025, with a focus on capital investments and debt repayments.

jetcityimage

AT&T Inc. (NYSE:T) is profiting from some slow-and-steady price momentum. Passive income investors seem much less worried about the Telco’s dividend this year, which is probably attributable to the company guiding for at least $17.0 billion in free cash flow and laying out an ambitious target for net debt reductions.

AT&T is also seeing steady momentum for its core Fiber Broadband segment and had substantially higher free cash flow compared to the year ago period.

All things considered, I think the profit and free cash flow outlook for the Telco has considerably improved as of late, and the stock remains undervalued from an earnings angle, in my view.

My Rating History

In my March 2024 piece Are We Going To Get A Dividend Hike In 2024? I evaluated the odds of AT&T deciding to raise the dividend this year.

AT&T has performed very well in 2024 with the stock marching to new 52-week highs, aided by growing investor confidence in the Telco’s net debt reduction. While we have not yet received a dividend hike, it is still a possibility given how much progress the company is making in terms of net debt reduction.

Since my last piece on the Telco was published, AT&T has steadily re-rated higher, which is good news for investors that have been concerned about the Telco’s dividend.

With ongoing momentum in Fiber Broadband and a reasonably robust forecast for free cash flow, I think that AT&T’s earnings prospects and dividend are still undervalued, particularly because AT&T is ramping up its efforts to reduce its considerable net debt.

Free Cash Flow, Pay-Out Ratio And Broadband Growth

AT&T reaffirmed that it anticipates producing at least $17.0 billion in free cash flow this year, but FCF could go as high as $18.0 billion due to robust momentum in the company’s Fiber Broadband unit.

In 1Q24, AT&T produced $3.1 billion in free cash flow, up 210% YoY, primarily due to lower vendor financing payments. With the Telco anticipating $17-18 billion in free cash flow in 2024, and the dividend costing $7.96 billion annually, so AT&T is on track to pay out only 45% of its free cash flow this year. The remaining 55%, $9.5 billion, will be used for capital investments and net debt repayments.

A stricter focus on capital expenditures and ongoing momentum in the Fiber Broadband unit are what supports the Telco’s free cash flow forecast.

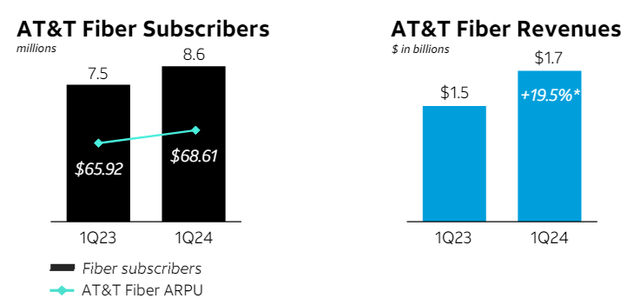

Broadband added 252K customers to AT&T’s Fiber business in the first quarter, resulting in a 19.5% YoY jump in Fiber Broadband sales to $1.7 billion. This growth was partially offset by declines in voice and data, but AT&T’s consumer wireless sales nonetheless continued to increase 3.4% YoY.

Most importantly, this Fiber Broadband momentum is creating a lot of latitude for the Telco to tackle its net debt situation aggressively in the next couple of years.

Fiber Broadband Subscriber Growth (AT&T)

On Track To 2.5x Net-Debt-To-Adjusted-EBITDA In 2025

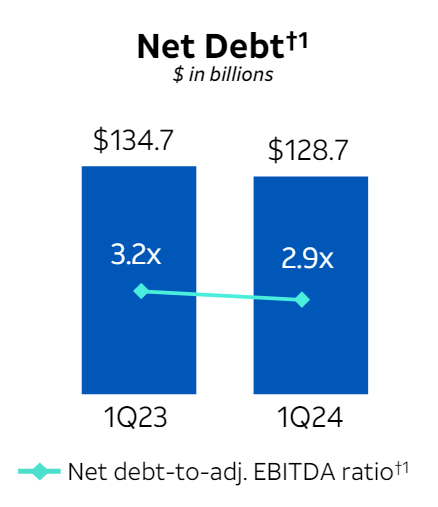

AT&T is a slow-growth Telco with a mountain of net debt to service. This net debt amounted to $128.7 billion as of March 31, 2024, but the company has moved to repay this debt.

In the first quarter, AT&T repaid $6.0 billion of this net debt, which caused the net debt-to-adjusted EBITDA ratio to fall from 3.2x in the year ago quarter to 2.9x. AT&T’s excess free cash flow facilitates further repayments of this net debt, and the Telco has guided for a 2025 net debt-to-adjusted EBITDA ratio of 2.5x.

AT&T produces $11.0 billion in adjusted EBITDA, which means that the company is shooting for a net debt target level of $110 billion by mid-2025.

A $110 billion net debt target (implied by the target 2.5x net-debt-to-adjusted-EBITDA ratio) reflects a substantial decline from today’s net debt level of $128.7 billion. I thus estimate that AT&T could repay $18-19 billion in net debt until mid-2025, or an average of $3.7 billion in the next five quarters.

The average $3.7 billion is substantially below the $6.0 billion net debt reduction AT&T pulled off in 1Q24, so I am very confident that AT&T can achieve its deleveraging goal.

The deleveraging of AT&T’s balance sheet, in my view, is a catalyst for AT&T’s stock to continue its bull run in the latter half of 2024 and possibly even in 2025.

Net Debt (AT&T)

High Margin Of Safety For AT&T Investors

Though AT&T is selling near 52-week highs, in my view, the stock is still a hard-to-ignore bargain for three reasons:

- AT&T’s Broadband platform is growing fast, and the Telco is adding a boatload of new subscribers on a quarterly basis.

- AT&T’s forecast implies at least 2023-level free cash flow, with an upside of up to $1.2 billion (which is why I see room for a dividend hike).

- AT&T is paying back more debt, which is urgently needed and which could create a leaner organization with higher profitability.

All of this progress (Broadband growth, growing FCF strength, net debt relief, and prospects for a dividend increase) can be had for 8.0x this year’s earnings.

I would be more than comfortable paying 10-11x earnings for AT&T primarily because the dividend is very well-covered by free cash flow and because AT&T is finally addressing the elephant in the room: Its net debt. A multiple of 10-11x reflects back to us an intrinsic value that is 25-35% higher than the present stock price of $18.69 (implied intrinsic value of between $23.36 and $25.36), hence my remarks about AT&T having a high margin of safety.

The reason for AT&T’s low valuation is that the market is not yet seeing enough progress in terms of net debt reduction, but this view may be corrected over the next year. A leaner, less leveraged AT&T with considerable FCF could be a much more attractive passive income investment for investors in 2025.

AT&T’s biggest peer, Verizon Communications Inc. (VZ), is selling for 8.6x this year’s profits. Both AT&T and Verizon Communications cover their dividends with free cash flow on an annual basis and have similar trajectories in the Broadband business.

Considering that AT&T is selling for a lower multiple, the earnings value is higher and AT&T’s 8x P/E implies a higher margin of safety for passive income investors.

Why The Investment Thesis May Not Benefit Passive Income Investors

AT&T has to work with what it has got: The Telco is not growing its sales or EBITDA very much, but produces a lot of free cash flow. This free cash flow, unfortunately, will have to be used at least in part to clean up areas like AT&T’s excessive net debt.

AT&T’s debt ballooned on the back of misguided acquisitions in the past, and we shareholders today still have to pay the price for it. The reduction in net debt therefore will remain a pressing issue in the next twelve months.

Should AT&T suffer a decline in Fiber Broadband momentum and free cash flows, the Telco’s deleveraging target could be put at risk.

Considering that AT&T is anticipating substantial excess FCF in 2024 (in the amount of $9.5 billion), I think AT&T should be able to achieve its net debt goals rather easily.

My Conclusion

Two things keep the investment thesis regarding AT&T afloat: The Telco’s free cash flow forecast for 2024 implies that the dividend is well-covered (and leaves room for a dividend hike).

Furthermore, AT&T has considerable latitude in applying excess free cash flow to its high net debt, which should yield a considerable deleveraging effort in the next 12 months.

A target net-debt-to-adjusted-EBITDA ratio of 2.5x implies close to $20 billion in net debt repayments during this period, all the while the Telco should have no issues covering its dividend with free cash flow. The icing on the cake here is that AT&T is selling for a low earnings multiple of 8.0x.

I thus see a positive risk/reward relationship for shareholders, even with AT&T’s stock trading up to challenge new 52-week highs.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.