Summary:

- AT&T’s stock has appreciated due to a favorable macro environment and successful deleveraging, making it an attractive long-term investment.

- Growth catalysts include expanding fiber footprint, increasing subscribers, and solid mobility business performance, supporting continued momentum.

- AT&T’s improved debt profile and high dividend yield make it appealing, especially with expected Federal Reserve rate cuts.

- Despite risks, AT&T remains a strong dividend and value play, poised to create additional shareholder value in a balanced portfolio.

Robert Way

In recent months, AT&T’s (NYSE:T) stock has greatly appreciated primarily thanks to the favorable macro environment and the ability of the company to speed up the deleveraging process, which reignited investors’ confidence. While the company’s latest earnings results were mixed, AT&T currently has several growth catalysts and still trades at an attractive price to justify a long position right now. That’s why I continue to be bullish about the company and still hold its shares in my portfolio.

The Growth Opportunities Are Still There

In June, I published my latest bullish article on AT&T where I noted that the company is on track to recovery after the Time Warner debacle and the expansion of its fiber footprint coupled with the addition of new subscribers should help it achieve its fiscal year goals. Since that time, AT&T’s shares have appreciated by ~20%, outperformed the broader market, and have the ability to retain their momentum thanks to several growth catalysts that the company has going for it.

Although AT&T reported mixed results for Q2, which showed that during the quarter the company’s revenues decreased by 0.4% Y/Y to $29.8 billion and missed expectations, there are nevertheless reasons for optimism.

First of all, the company’s mobility business continues to grow at a decent rate as its mobility service revenues in Q2 were $16.3 billion, up 3.4% Y/Y. At the same time, AT&T also continues to successfully increase the number of customers and in Q2 it added 419,000 postpaid phone net adds and increased the overall average revenue per user by 1.4% Y/Y to $56.42. Given the decent performance in the first half of the fiscal year, AT&T has all the chances to retain its momentum into the second half of the year.

What’s also important to note is that AT&T’s fiber footprint continues to expand as well and helps the company offset the underperformance of some of its other businesses. In Q2, AT&T had 239,000 fiber net adds, passed nearly 28 million fiber locations, and is on track to reach 30 million fiber locations by the end of next year. Add to this the fact that the management recently announced that it’s expanding its partnerships to scale its fiber network and it becomes obvious that the growth is not over yet.

Considering all of this, AT&T appears to be on the right track to grow its business and create additional shareholder value in the foreseeable future.

More Reasons To Be Optimistic About The Future

What’s even more important is that thanks to its ability to grow its customer base and expand its fiber footprint at a profit, AT&T is able to generate enough FCF to cover the interest payments, improve its debt profile, and retain the dividend payments.

If a year ago AT&T’s net debt position was $132 billion, then by the end of Q2, its net debt position decreased to $126.9 billion. This has helped the company to decrease its Net debt-to-adjusted EBITDA ratio from 3.1x a year ago to 2.78x today. Given that the company has more than enough growth opportunities to generate solid FCF in the foreseeable future, we should expect AT&T to continue to improve its debt profile and reach a net debt-to-adjusted EBITDA ratio of 2.5x in the first half of 2025. On top of that, the reduction of interest rates by the Federal Reserve should be considered as another positive catalyst. After all, the company now has a chance to pay lower interest expenses since lower rates will help AT&T refinance its debt at more attractive rates than a year or two ago when the central bank hikes began.

Given all of this, AT&T already looks like an attractive investment. However, there’s also one important thing that needs to be mentioned. If in the last two years, the American Treasuries were an attractive investment due to their relatively high yield, in the current environment when inflation appears to be under control and the Federal Reserve is cutting rates that’s no longer the case. As of now, the 10-year treasury note offers a yield of less than 4%. For comparison, AT&T pays dividends with a yield of 5.15% at the current price, which makes its stock a more attractive investment for dividend investors. With the expectation of generating $17 billion to $18 billion in FCF this year, AT&T has more than enough resources to honor its debt obligations and keep the dividend payments intact at the same time.

What’s Next For AT&T Shares?

AT&T also appears to be an attractive value investment at the current price. Back in June when my latest article on the company was published, the firm was trading at ~$18 per share and my DCF model showed that AT&T’s fair value was $20.40 per share. Since the Q2 numbers came out after that model was made and some revisions in recent months were made, it makes sense to update that model.

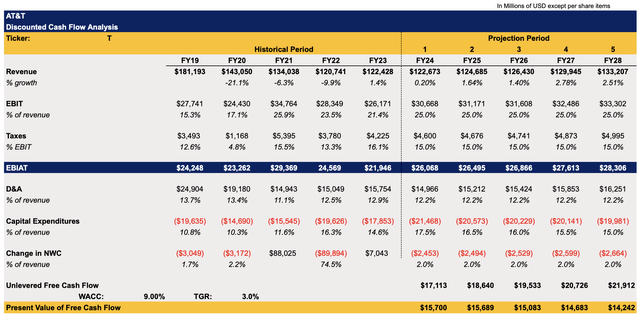

In the updated model that can be seen below several things have been changed. First of all, the revenue forecast there now closely aligns with the newer street estimates, which indicate that the company will continue to grow, but at a single-digit rate. At the same time, the capital expenditure assumptions were also slightly increased for FY24. This is due to the fact that in the recent conference call, AT&T’s management noted that they expect the spending to increase in the second half of the year as they expect to ramp up the modernization of the company’s wireless network. The management expects CapEx in FY24 to be in the range of $21 billion to $22 billion, and my updated DCF model aligns with those estimates for the current fiscal year. The assumptions for other metrics remained the same as before since they are not expected to change significantly anytime soon.

The terminal growth rate in the model remained at 3%, but the weighted average cost of capital decreased from 10% to 9% in the updated model. While the 10% rate was relatively high in the first place, we should not forget that AT&T is one of the most indebted companies in the world. In the high interest rate environment, it would’ve been much more expensive for the company to refinance its debt. Now that the Federal Reserve has begun to cut interest rates, the borrowing costs for businesses are expected to decrease and that’s why the cost of capital for AT&T in the model has been decreased as well. Currently, the average cost of capital for companies from the telecommunication equipment sector is slightly below 9%, so giving AT&T with its current debt profile a WACC rate of 9% is reasonable.

AT&T’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

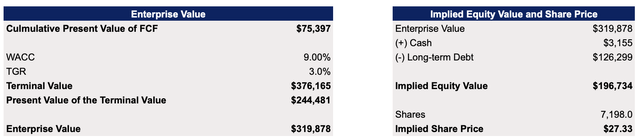

The updated model shows that AT&T’s unlevered FCF this year is going to be $17.1 billion, which is within the management’s expected range of $17 billion to $18 billion that was announced during the recent conference call. AT&T’s enterprise value in this model is $319 billion, which is close to what Seeking Alpha shows. The fair value is $27.33 per share, which represents an upside of ~26% from the current price.

AT&T’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

The major increase in value in this model comes primarily from the change in assumptions for the WACC. Considering that AT&T continued to actively deleverage its balance sheet while the Federal Reserve began to cut rates, it made sense to change the assumptions for the cost of capital. At the same time, AT&T was trading ~$27 per share in early 2022 when it had a much worse balance sheet and the macro environment was arguably worse than today, so the upside that my updated model shows is fairly realistic.

Major Risks Still Remain

While there are more than enough reasons to be optimistic about AT&T’s future, some major risks remain. There’s a risk that if the economy enters a recession, then it could negatively affect AT&T’s ability to expand its fiber footprint and grow the number of its subscribers. At the same time, the slowdown of the economic activity could also make it harder for AT&T’s profitable businesses to offset the losses of some of its other businesses. In Q2, AT&T’s mobility equipment business and business wireline service revenues already disappointed investors due to lower sales volumes.

On top of that, after the Time Warner debacle, AT&T has no room for mistakes. By having maturities up until 2097, AT&T can’t afford to buy other non-core assets that will probably worsen its debt profile and negatively affect its financial performance. There’s no guarantee that inflation won’t rise significantly above the Fed’s target a few years from now and make the cost of borrowing more expensive again.

The good news though is that it appears that inflation is currently under control and the Federal Reserve is likely to continue to cut interest rates, which is a positive development for AT&T for now.

The Bottom Line

Despite all the risks and challenges that AT&T faces, there’s a case to be made that the company’s stock deserves a spot in a balanced portfolio. Even after the recent rally, AT&T appears to be a solid dividend and value play that can continue to create additional shareholder value for years to come.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.