Summary:

- I previously rated AT&T Inc. a strong buy due to a DCF analysis suggesting a 19% upside and the beneficial DirectTV deal.

- T stock has outperformed the S&P 500, returning 9.7% compared to the S&P 500’s 5.8% since my last analysis.

- AT&T’s strategy focuses on accelerating bundling and premium services, which are expected to drive margins and market share.

- The company’s fiber investment is crucial in staying competitive against Verizon and Frontier and to ensure future growth and stability.

jetcityimage

I am updating my ongoing analysis on AT&T Inc. (NYSE:T) in light of the strategic update provided during analyst and investor day on December 3rd, 2024.

I previously rated AT&T a strong buy for the following reasons:

- DCF analysis suggested a price target of $25.90, 19% upside from prices at the time.

- DirectTV deal was a win for shareholders from the value of the deal itself and the value of AT&T dropping a distraction.

- AT&T was poised to accelerate bundling and premium services, driving margin and market share.

Since then, AT&T has returned 9.7%, while the S&P 500 (SP500) has returned 5.8%.

AT&T Price Trend (TrendSpider)

I have already been bullish on AT&T as they continually double down on the core business and shed distractions, unlike their competitors. The investor’s day conference showed them doubling down again on their core Fiber and 5G mobility business.

The value unlocks here are twofold. First, AT&T is heading off the Verizon and Frontier merger with an equally aggressive fiber strategy. Second, this strategy enables further bundling, which I continue to argue based on market and consumer data is the future of growth in the industry.

The guidance accompanying the strategy signals an additional upside to the share price beyond what I had previously estimated. Based on a DCF-generated price target of $28.70, which is a 21% upside from today’s pricing, I maintain my buy rating on AT&T.

Investor Day Recap

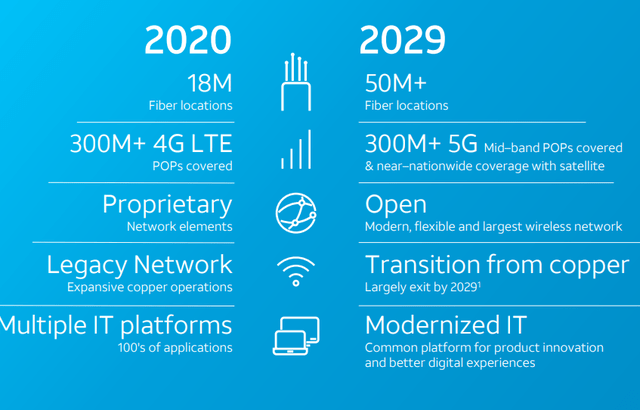

In the investor’s presentation on Tuesday, December 3rd, AT&T unveiled a strategic plan to more than double their fiber passings and 5G coverage while simultaneously modernizing the entire infrastructure and exiting copper.

Strategic Plan Summary (AT&T Investor Relations)

From a financial standpoint, it’s expected to be a major win for shareholders. The plan will be delivered sustaining capital at the current levels while growing EBITDA 3%+ annually and driving $18 billion in Free Cash Flow by 2027.

AT&T Investor Returns (AT&T Investor Relations)

The cash flow improvement will drive $50 billion of financial capacity, with $40B being returned to shareholders via repurchases and dividends.

Capital Allocation Priorities (AT&T Investor Relations)

There is certainly a lot that AT&T needs to execute on, but this plays right into my ongoing thesis. The thesis being that there is significant upside from driving the core business and ignoring nearly everything else.

Valuation

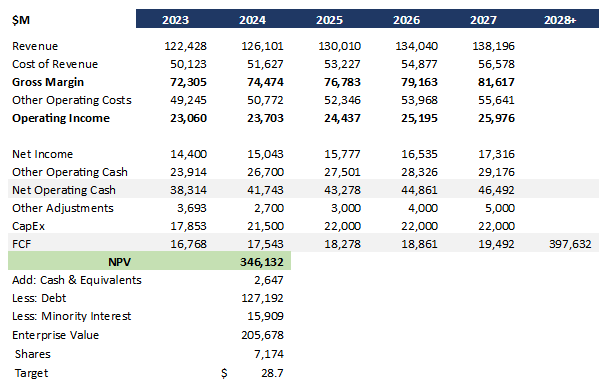

I updated my ongoing discounted cash flow, or DCF, analysis for AT&T using the following drivers:

- Management delivers the mid-point for the 2027 guidance released during the investor conference

- 7% discount rate, assuming an estimated WACC of 6.9%

- 2% long-run growth rate to hedge 6.6% market growth against AT&T’s scale and cost base

- 3% or greater EBITDA growth through 2027, pacing behind the overall telecom market at 6.5% due to AT&T’s scale and balanced against union considerations for the cost base.

This DCF analysis yields a price target of $28.70, 21% upside from today’s pricing.

AT&T DCF Analysis (Data: Seeking Alpha; Analysis: Mike Dion)

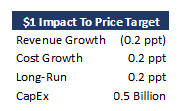

With the current price between $23 and $24, the model has significant headroom. AT&T can miss by any combination of 4 points of impact from the table below and still support the current price. With the new commitment to capital expense, that largely removes this from being an impact, making the case even stronger.

AT&T DCF Sensitivity (Mike Dion)

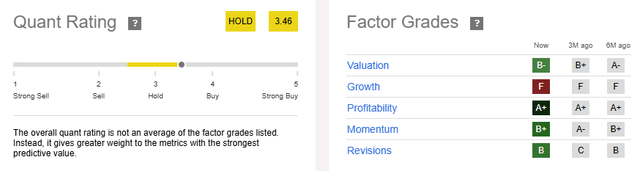

The quant rating signals a hold, albeit on the strong side of hold. This is weighted down by the growth score of F with all other factors being in the buy range. There has been a lot of volatility in EPS as AT&T exits underperforming businesses, so I largely discount this low rating.

AT&T Quant Rating (Seeking Alpha)

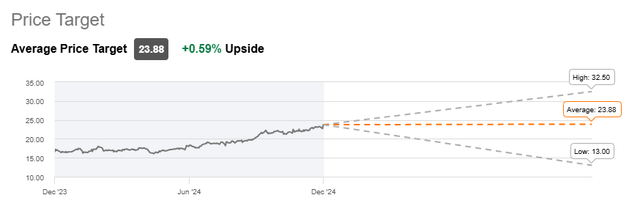

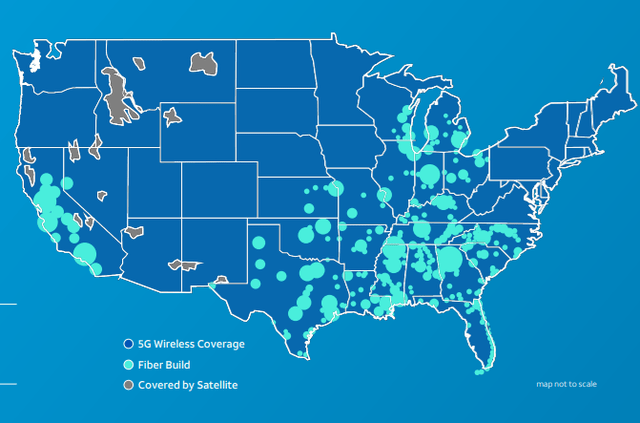

Current pricing is largely in line with average analyst expectations, although my price target sits with the average to high range of $23.88 to $32.50.

AT&T Wall Street Rating (Seeking Alpha)

That said, analysts continue to be largely bullish, maintaining primarily buy ratings over the recent quarter.

AT&T Analyst Ratings (TrendSpider)

Fiber Investment Heads Off Verizon/Frontier

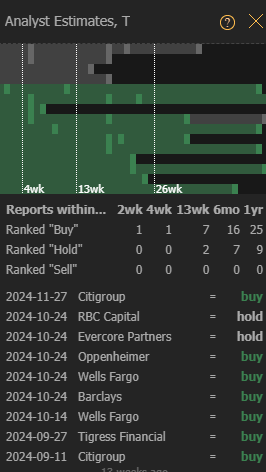

On September 5th, 2024, Verizon (VZ) announced an offer to acquire Frontier Communications (FYBR) in a cash offer of $38.50 per share. The deal would close in approximately March 2026 pending regulatory approval.

As I have been covering, this is an expensive deal for Verizon. Regardless, it gives Verizon a formidable fiber network that is largely incremental to the current network.

Frontier and Verizon Fiber Network (Verizon Investor Relations)

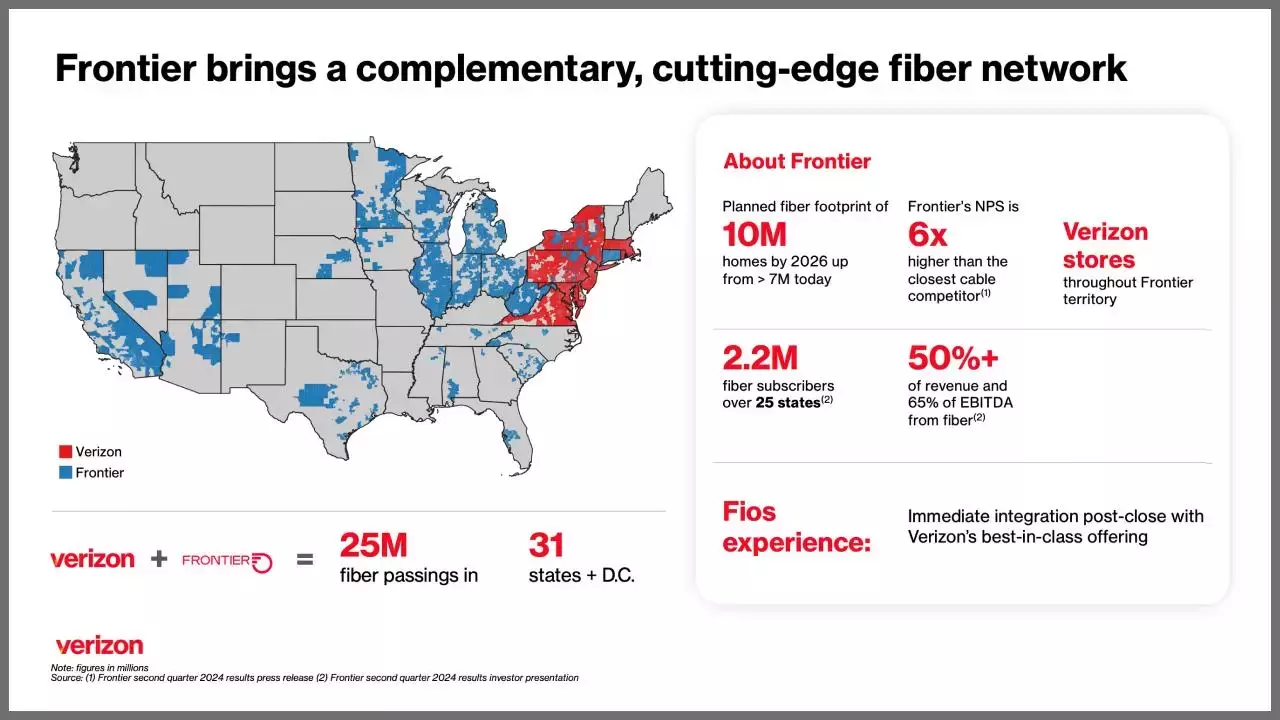

AT&T’s fiber expansion plan is competitive in many areas with Verizon and Frontier, and their 5G coverage is comparable, allowing them to be a bundling option and maintain market share against the newly combined competitor.

AT&T Fiber Expansion (AT&T Investor Relations)

Premium Services And Bundling Are The Way Forward

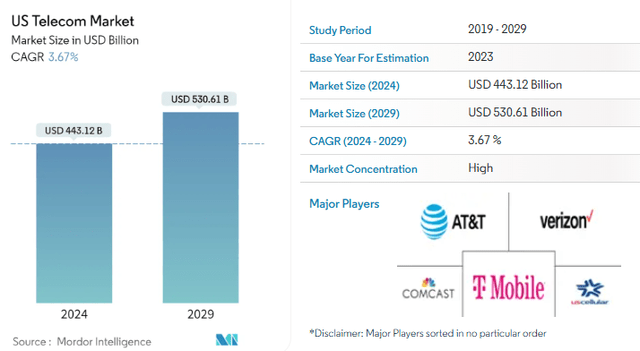

It should not be any surprise that the US Telecom market is fairly mature, with a forward CAGR forecast of only 3.67%.

US Telecom CAGR (Mordor Intelligence)

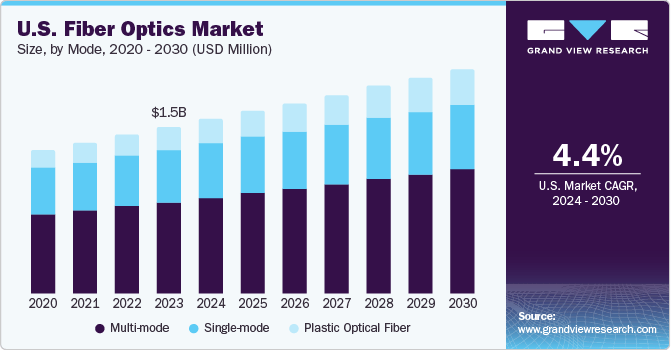

Fiber, a premium product, fares slightly better at 4.4% offsetting declines in the legacy copper businesses inherent in the overall telecom CAGR.

North America Fiber Optics Market size and growth rate, 2024 – 2030 (Grandview Research)

With the slow growth in the market, driving volume becomes harder, so telcos need to be competitive on a rate standpoint. This means offering premium services like fiber and 5G, or bundling consumers together. The good news is that AT&T has been driving both volume growth and bundling growth concurrently in the fiber business.

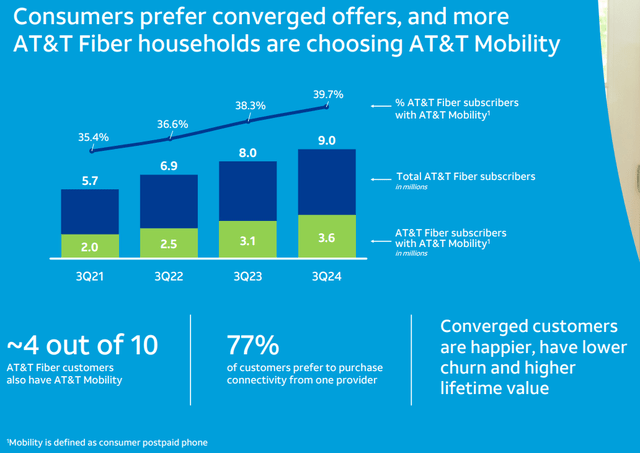

Bundling penetration is up from 35.4% in 2021 to 39.7% in 2024 and continuing to grow. AT&T reports these customers have lower churn. Industry analysis agrees that customers prefer purchasing from one provider, as there is a perceived value and ease of use.

AT&T Bundling Trend (AT&T Investor Relations)

I have no doubt that the big 3 will continue churning between each other for mobility, as they have well-developed 5G coverage. But bundling is a great play against MVNOs and T-Mobile that have less developed fixed access strategies. The continued focus on this strategy is a massive win for shareholders, as it doubles down on what is already working and aligns with market trends.

Downside Risk

The primary downside risk is execution. AT&T has to execute on this growth plan within capital constraints and within cash flow constraints to maintain promised returns for shareholders. Given the exit from multiple side businesses, including DirectTV most recently, the organization is certainly focused on executing on the fiber and wireless business. That said, I will be keeping a close eye on volume and rate relative to competitors, in addition to cash flow, to look for any signs of risk or sliding off target.

The secondary risk, as is ever present, is a price war between telcos. This is largely mitigated as the big 3 all focus on premium services versus lower pricing, given margin pressures they all equally face. Still, it is important to keep a close eye on the rate to look for any signs of weakening.

Verdict

AT&T has shed distractions to focus on its core fiber and mobility businesses. In the December 3rd investor conference, AT&T doubled down further on this strategy, announcing a complete rebuild of their infrastructure and more than doubling fiber passing, all while driving higher shareholder returns.

This strategy is well-supported by AT&T’s current execution as well as industry trends pushing for bundling and premium services to grow revenue in a mature industry. As an added benefit, this strategy heads off Verizon’s advantage, assuming the merger with Frontier is completed.

While there are downside risks from execution and price wars, they are largely mitigated by demonstrated success and the discipline exhibited across the big three telcos.

At a DCF generated price target of $28.70, 21% upside from today’s pricing, I maintain my buy rating on AT&T.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.