Summary:

- AT&T shares have dropped due to concerns about lead cables. However, Q2 results showed no signs of cash flow or broadband momentum deterioration.

- The telecom company added 251,000 new subscribers in Q2, marking the 14th straight quarter of exceeding 200,000 net adds. Fiber ARPUs kept growing as well.

- Rebound in free cash flow in Q2 results in a YTD free cash flow payout ratio of 77%. The dividend should be safe, in my opinion.

- AT&T confirmed its FCF guidance of $16B and with shares trading at just 6.6X FCF, I believe AT&T is a value stock.

Anne Czichos

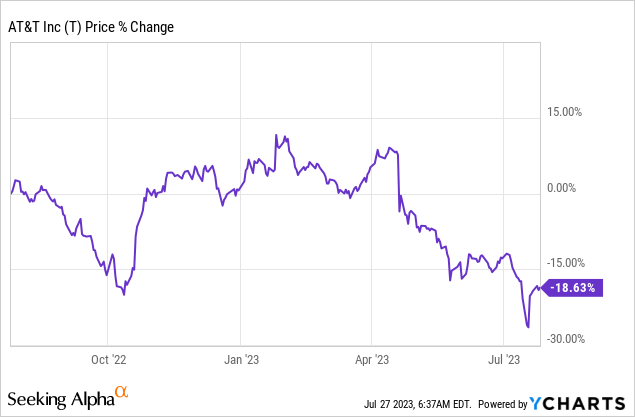

Shares of AT&T (NYSE:T) recently collapsed to new three-decade lows on reports that the telecom faces costs related to the use of toxic lead cables. Concerns over clean-up costs have resulted in investors speculating again about whether or not the telecom will have to cut its dividend, but the company’s second-quarter earnings release showed strong dividend coverage and broadband momentum… which I take to mean that the dividend won’t be cut.

AT&T just posted its 14th straight quarter of achieving more than 200 thousand fiber broadband net adds. Considering that AT&T once again confirmed its $16B free cash flow outlook for FY 2023 and that shares are cheap at 6.6X FCF, AT&T is a deep value stock for me. I see no reason to change my rating on the telecom and confirm it as a strong buy!

Previous rating

My previous rating on AT&T was strong buy in May and shares have declined by approximately 6% since. My strong buy recommendation followed a sell recommendation in April (shares are down 26%). I have previously recommended AT&T because of misguided rumors about a Dish Network/Amazon partnership that hurt AT&T’s share price. I am confirming my strong buy rating here due to AT&T Q2’23 free cash flow rebound, improved dividend coverage, momentum in its core broadband business and because AT&T’s share price got further depressed by a lead cable issue.

Lead cable issue

AT&T has sold off in response to an alleged lead cable problem that was reported on by the Wall Street Journal in July. Considering that lead cables represent less than 10% of AT&T’s telecom network, I believe the market overreacted to this report. I think AT&T has significant free cash flow to handle potential clean-up costs, pay its dividend and invest in its growth.

AT&T’s strong momentum in fiber broadband continued in Q2’23

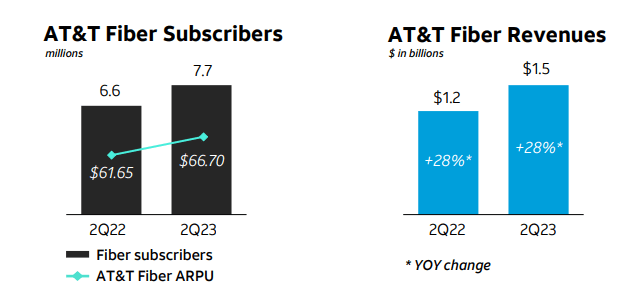

AT&T’s fiber segment has seen both strong subscriber growth as well as growing average revenue per user/ARPU, a key measure for monetization success. In the most recent quarter, Q2’23, AT&T added 251 thousand new subscribers in its fiber segment and it was the 14th straight quarter of subscriber net adds exceeding 200 thousand. In total, AT&T’s fiber business had 7.7M subscribers at the end of the second-quarter and generated $1.5B in revenues.

Source: AT&T

Additionally, Fiber ARPU is growing steadily as well, reaching $66.70 in Q2’23, showing 8.2% year-over-year growth. Fiber ARPU has grown for six straight quarters (Source) and I expect moderate growth for the remainder of the year as well. Fiber growth especially has fueled AT&T’s broadband results in recent quarters with fiber revenues soaring 28% year over year and fiber ARPUs growing much faster than non-fiber revenues (8.2% vs. 4.7%).

|

Broadband KPIs |

Q2’22 |

Q3’22 |

Q4’22 |

Q1’23 |

Q2’23 |

Y/Y Growth |

|

Revenue |

||||||

|

Fiber |

$1,190 |

$1,271 |

$1,376 |

$1,453 |

$1,523 |

28.0% |

|

Non-Fiber |

$1,203 |

$1,158 |

$1,116 |

$1,074 |

$1,038 |

-13.7% |

|

Total Revenue |

$2,393 |

$2,429 |

$2,492 |

$2,527 |

$2,561 |

7.0% |

|

Net adds |

||||||

|

Fiber (in thousands) |

316 |

338 |

280 |

272 |

251 |

-20.6% |

|

Non-Fiber (in thousands) |

-341 |

-367 |

-323 |

-295 |

-286 |

-16.1% |

|

ARPU |

||||||

|

Fiber |

$61.65 |

$62.62 |

$64.82 |

$65.92 |

$66.70 |

8.2% |

|

Non-Fiber |

$54.17 |

$54.80 |

$55.54 |

$56.00 |

$56.71 |

4.7% |

|

Total Broadband ARPU |

$57.64 |

$58.63 |

$60.31 |

$61.31 |

$62.26 |

8.0% |

(Source: Author)

AT&T’s confirmed free cash flow guidance, dividend coverage and payout implications

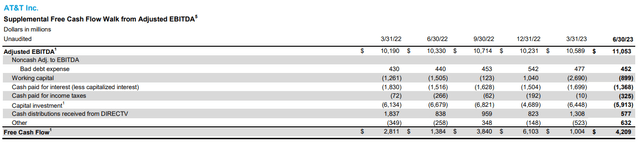

In Q1’23, AT&T generated only $1.0B in free cash flow, resulting in a free cash flow shortfall of $1.0B (the dividend costs AT&T approximately $2.0B quarterly).

AT&T generated $4.2B in free cash flow in Q2’23 which is bringing the telecom’s year-to-date free cash flow total to $5.2B. In the same period last year, AT&T generated approximately $4.2B in free cash flow, meaning the telecom actually added $1.0B to its free cash flow in the first six months of the year, relative to the year-earlier period.

AT&T reported significantly higher free cash flow in the second-quarter which was expected as the telecom’s CFO guided for $3.5B to $4.0B in Q2’23 FCF in June 2023. Given the rebound in free cash flow in the second-quarter, AT&T fully restored its payout ratio: AT&T paid out less than half (48%) of its Q2’23 free cash flow as dividends and 77% of its YTD free cash flow.

The implication is that AT&T, despite a Q1’23 free cash flow shortfall, fully earned its dividend on a year-to-date basis.

AT&T also confirmed its $16B free cash flow guidance for FY 2023 which should remove some of the negative sentiment overhang that has been created in response to the firm’s lead cable issue.

AT&T’s valuation is a bargain

Just because shares are cheap doesn’t mean they can’t become even cheaper… this is the painful lesson that many AT&T investors have learned the hard way over the last few decades.

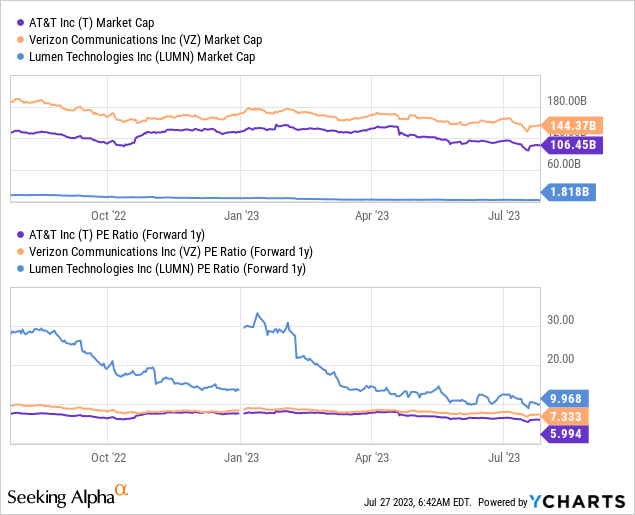

Nonetheless, the argument that AT&T is undervalued and cheap still has credibility, in my opinion. AT&T is trading at a P/E ratio of 6.0X and a P/FCF ratio of 6.6X. Verizon (VZ), AT&T’s chief rival, is trading at a 7.3X P/E ratio and a 9.0X P/FCF ratio (based on annualized H1’23 free cash flow). Applying a 9-10x P/E ratio to AT&T estimated earnings for FY 2024, shares of the telecom could have a fair value between $22.00 to $24.40.

Lumen is almost trading at twice as high a P/E ratio as AT&T and the telecom is also seeing strong broadband momentum. In my opinion, AT&T currently represents the best value in the telecom sector as the market appears to be suffering from a serious confidence crisis… which I believe is not supported by AT&T’s actual financial results.

Risks with AT&T

AT&T should not be expected to deliver strong top line growth as the company and other telecoms operate in a mature sector with muted growth prospects. If AT&T has to deal with contamination issues and costs are incurred, this would be a negative for AT&T, but likely only in the short term. With $16B in expected FCF just this year, AT&T would likely be able to handle both its dividend (about 50% of FCF) as well as clean-up costs. What would change my mind about AT&T, however, is if the company reported decelerating momentum for its fiber broadband business.

Closing thoughts

AT&T’s shares dropped to a new three-decade low in July, due to reports of a lead contamination issue which raised yet another round of dividend sustainability concerns. However, the telecom’s second-quarter results suggest that neither AT&T’s guidance nor dividend are at risk.

AT&T also benefited from continual momentum in its core fiber broadband business which saw its 14th straight quarter of more than 200 thousand broadband net adds while the segment’s ARPU has also been on the rise. Since AT&T confirmed its guidance for $16B in free cash flow yet again and shares are selling for just 6.6X free cash flow, I consider AT&T to be a deep value stock. With a 77% YTD free cash flow pay-out ratio, the dividend should be reasonably safe as well!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T, VZ, LUMN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.