Summary:

- The management team at AT&T is due to report financial results for the final quarter of the company’s 2022 fiscal year.

- There are some major items that investors should be paying attention to, but the firm as a whole appears to be a fantastic prospect.

- Of course, we need to be especially attentive to the tone the company sets for 2023, because that could change the picture for better or worse.

Ronald Martinez

On the morning of January 25th, before the market opens, the management team at telecommunications conglomerate AT&T (NYSE:T) is expected to report financial results covering the final quarter of the company’s 2022 fiscal year. Although the company significantly outperformed the broader market during 2022, much of this performance has been attributed to the expectation by investors that the company will continue to fare well through 2023. Amongst other things, the company is expected to report even stronger cash flow figures than it did last year. Leading up to the earnings release, there are a few key metrics that investors should be wise to pay attention to. But absent anything significantly negative impacting the firm, I believe that the ‘strong buy’ rating I assigned the company some time ago is still warranted.

Keep an eye on growth areas

The larger a company becomes, the less it can be understood as a single, cohesive entity. And the more it can be understood as a collection of companies, each with its own trajectory and prospects. For a massive company like AT&T that has been around for a long time, this is especially true. Right now, some of the operations within the firm, largely dubbed legacy operations, aren’t doing all that well. But there are some growth areas of the company that are serving shareholders wonderfully. Investors should especially pay attention to these particular activities.

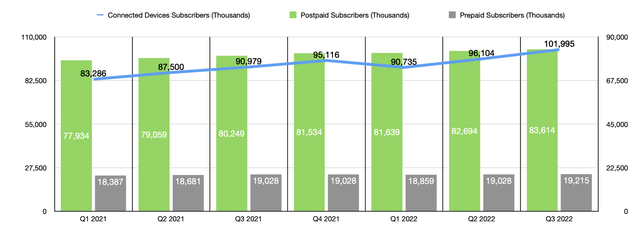

The first of these worth mentioning is most certainly my favorite. And this is referred to as the Connected Devices portion of the firm. This is an IoT (Internet of Things) play made by management that I have written about before. For the sake of brevity, I will only recommend that you read more about this portion of AT&T here. Despite being a massive part of the company, the Connected Devices unit continues to expand nicely. During the third quarter of the company’s 2022 fiscal year, the number of subscribers under this umbrella totaled nearly 102 million. That was up from the 96.1 million reported only one quarter earlier. And one year earlier, the number had totaled nearly 91 million, with an adjusted figure to account for the company’s decision to end support for 3G devices, bringing that number down to 82.2 million.

Similar to the Connected Devices portion of the firm would be both its Postpaid and Prepaid subscribers. By the end of the third quarter, the company reported over 83.6 million Postpaid subscribers on its network. This was 920,000 higher than the 82.7 million reported only one quarter earlier and was up almost 3.4 million from the 80.2 million that the company reported in the third quarter of 2021. Prepaid subscribers, meanwhile, totaled 19.2 million. This was up 187,000 from the 19 million reported one quarter earlier and up the same amount compared to one year earlier.

When it comes to growth, another area worth mentioning involves its fiber network. At present, the company’s goal is to hit 30 million customer locations by the end of 2025. By the end of the third quarter of last year, it succeeded in hitting 18.5 million. The company also saw 338,000 net additions to its fiber network. Naturally, investors would be wise to pay careful attention to any guidance that management provides on this and to understand how much growth occurred in the final quarter of the year. The picture on this front could get very interesting because, in late December of last year, the company announced that it was forming a joint venture with BlackRock Alternatives called Gigapower, LLC, that would involve providing access to the company’s fiber network to Internet service providers and other businesses across the US.

The joint venture will serve customers outside of AT&T’s 21-state wireline service footprint with fiber access technologies in innovative and efficient ways. And AT&T will utilize its own nationwide wireless sales capabilities to sell fiber to customers in Gigapower’s territories. The current plan for that joint venture is to deploy a multi-gig fiber network to an initial 1.5 million customer locations nationwide and will actually not even be counted in the 30 million or so fiber locations that AT&T is already pushing for the end of 2025. Along these lines, investors would also be wise to pay attention to the company’s mid-band 5G spectrum objectives. By the end of the year, the company had hoped to be able to cover more than 130 million people. That compared to their prior target of 100 million in the second quarter of last year and the 70 million to 75 million when the company offered guidance previously. It will be interesting to see how that picture looks moving forward.

All in the numbers

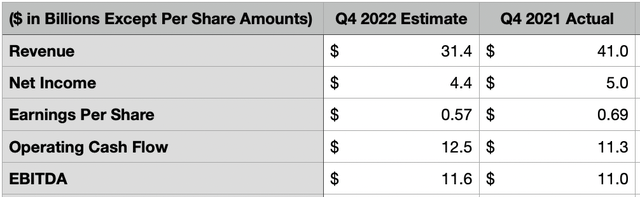

All of these growth areas are incredibly important. But at the end of the day, what’s most important is what the company’s fundamental picture looks like. At the heart of this would be its core financial results like revenue, cash flows, and more. For the final quarter, analysts are anticipating sales of $31.4 billion. This is actually down substantially from the $41 billion reported the same time one year earlier. But it’s also important to keep in mind all of the asset sales and other divestitures that the company engaged in, the largest of which was WarnerMedia, which was ultimately spun off and merged with Discovery to create Warner Bros. Discovery (WBD). Earnings per share, meanwhile, should be around $0.57. That compares to the $0.69 per share, or $0.78 per share on an adjusted basis, that the company reported in the final quarter of 2021. Total net income in the final quarter of 2021 was $5 billion. If management can hit the estimates put out by analysts, then this would translate to profits of nearly $4.4 billion.

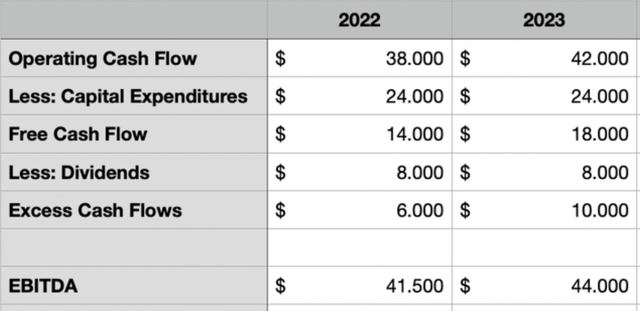

No estimates were provided by analysts when it came to other profitability metrics. But the most recent guidance provided by management called for operating cash flow for 2022 as a whole of $38 billion. This would mean that the company should have generated around $12.5 billion in operating cash flow in the final quarter of last year. And with EBITDA for the year forecasted at $41.5 billion, the company would need to hit almost $11.6 billion to be on point. More important than what the company achieved in the final quarter of last year though will be the expectations set by the company for 2023. The most recent data available suggests that the firm should generate operating cash flow of $42 billion and EBITDA of $44 billion for the year.

If the company can hit these targets or come anywhere close to them, a big question will be what the future holds for returning cash to shareholders. In a prior article, I addressed some concerns that investors had regarding the company’s dividend. By my estimate, if everything plays out according to plan, the company can afford the roughly $8 billion in dividends anticipated for 2023 and still have $10 billion in cash flows left over. With a yield of nearly 5.9% right now, the company is already paying out a great deal of capital. But it may not be a bad idea strategically, at least to boost investor sentiment, to consider a dividend hike. This would certainly not be out of the realm of possibility. An alternative to this would be to pay down debt further. Using estimates that I did previously for 2022, the company had a net leverage ratio of 3.13 by the end of the year. Allocating all of its excess capital toward debt repayment while still paying out the $1.11 per share in distributions per year would reduce this further to 2.72 by the end of 2023.

Takeaway

Fundamentally speaking, I believe that AT&T is one of the best investment opportunities on the market right now. As a high-quality firm that’s generating a tremendous amount of cash, the firm was already rewarded some in 2022 with share price appreciation, inclusive of distributions added into the picture, of 6.5%. That stacked up favorably against the 19.4% decline the S&P 500 experienced over the same window of time. Absent anything materially bad happening, I expect that kind of outperformance to continue into 2023, especially if the market spends another year in the doldrums. And because of this, I have no problem keeping the company at the ‘strong buy’ rating I had it at previously.

Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!