Summary:

- AT&T’s Q2 results show steady progress towards key priorities of 5G wireless and fiber growth, with EBITDA growing 7% compared to Q2 2022.

- The company’s Free Cash Flow (FCF) is improving, with $4.2 billion for the quarter and $5.2 billion year-to-date, and management expects to meet the full-year plan of $16 billion FCF.

- After a 17% drop in share price, the company’s dividend yield is now at 7.45%, providing an appropriate premium compared to preferred shares and bonds.

Brandon Bell

Steady Progress Continues

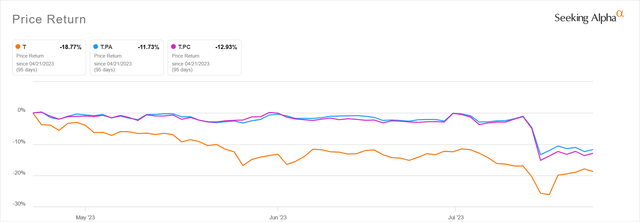

AT&T (NYSE:T) shares haven’t reacted much to 2Q 2023 earnings. This is in contrast to the over 10% drop they took from the Free Cash Flow Freak-Out that I discussed last quarter, as well at the 11% drop in 3 days during the mid-July panic over lead-coated cables. While the stock has mostly recovered from the lead cable issue, it’s still down about 17% from when I downgraded it to Hold after 1Q results.

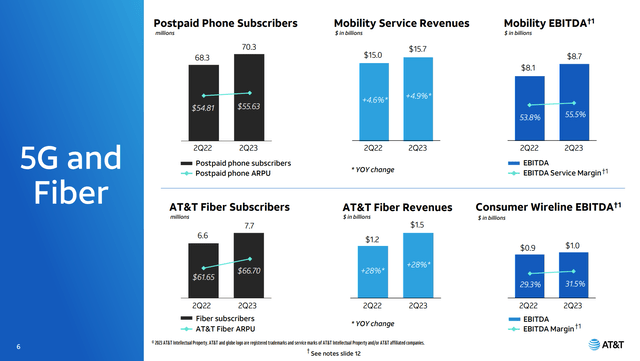

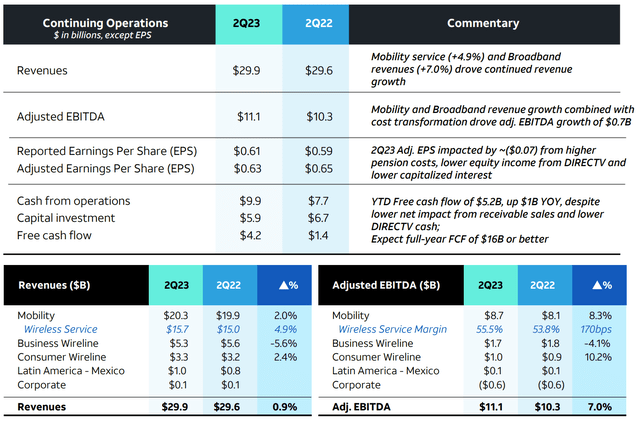

Not much has changed operationally for the company. They continue to make steady progress toward their key priorities of 5G wireless and fiber growth. The one key metric that slowed was postpaid phone net additions, which declined to 326,000 this quarter from 424,000 in Q1, although this is really just a return to normal from the elevated growth levels of 2021-22. AT&T continues to do a good job of retaining the customers they have, with a postpaid phone churn rate of only 0.79% in Q2. The average revenue per user (ARPU) continued to improve, up 1.5%. Most importantly for cash generation, EBITDA margins for the Mobility group are at their highest levels in over 2 years, at 43% overall margin and 55.5% service margin. Total EBITDA for the mobility group was up $0.3 billion, or 8.3% from a year ago.

Growth was even better in the consumer wireline business, with ARPU up 8% and EBITDA margins of 31.5%, also the best level in over 2 years. Overall consumer wireline EBITDA increased by $1 billion, or 10% from year-ago levels.

While it’s a small part of the company, the Latin America segment improved EBITDA margin by 430 basis points and total EBITDA by $59 million. The segment is now nearly profitable on an operating income basis. Rounding out the company, Business Wireline continues to be in secular decline, but even that has improved, with EBITDA down just $94 million compared to a year ago.

Putting it all together, EBITDA grew 7% compared to 2Q 2022, an acceleration from the 3.9% growth I noted in Q1.

Like last quarter, the EPS decline vs. 2022 came from non-operating impacts like pension costs, as well as lower income from the company’s stake in DirecTV. The earnings beat consensus estimates by $0.03, a bigger upside surprise than last quarter’s penny beat. As I will detail below, Free Cash Flow is improving as the company said it would, at $4.2 billion for the quarter and $5.2 billion year-to-date. Management states that they are still on track to meet the full-year plan of $16 billion FCF.

With this steady progress and the added assurance around FCF delivery, the 17% decline in the share price more than compensates for the long-term slow growth outlook for the company. At $14.90, the shares now yield 7.45%. Declining capex requirements, new cost cuts, and even a couple new growth areas in consumer broadband support the safety of the dividend. This yield now also offers enough premium to preferred and bond yields to compensate for the lower position in the capital structure.

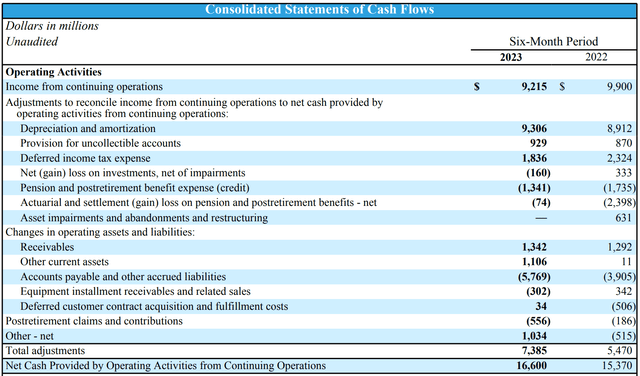

Delivering Free Cash Flow As Planned

After last quarter’s scary $1 billion free cash flow result, AT&T is now ahead of last year in year-to-date FCF generation. As a reminder, here is the cadence of FCF delivery by quarter:

- 1Q: $2.8B in 2022, $1,0B in 2023

- 2Q: $1.4B in 2022, $4.2B in 2023

- 3Q: $3.8B in 2022

- 4Q: $6.1B in 2022

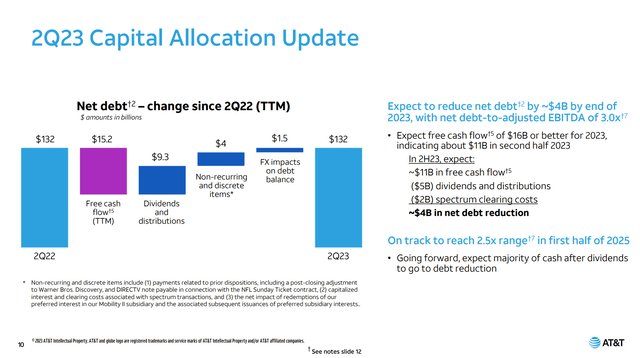

So far this year, AT&T generated $1.2 billion more in operating cash flow and spent about $0.4 billion less capex and vendor financing payments. This was offset by $0.6 billion lower distributions from DirecTV. That explains the $1 billion overall improvement in 1H FCF.

Looking forward, the CFO provided a bridge for the second half of the year on the earnings call explaining how AT&T would deliver the remaining planned $11 billion of FCF. The main differences resulting in $6 billion more FCF in H2 than H1 are:

- $1 billion lower capex

- $4.5 billion lower device payments (AT&T buys more phones from manufacturers in 1H, ahead of when the customers pay for them)

- $1 billion less in annual incentive compensation payments

- $1 billion working capital release

- -$0.5 billion lower cash distributions from DirecTV

- -$1.0 billion higher cash tax payments

The company has made no progress in net debt reduction over the last 12 months because of several one-time cash calls, including closing adjustments on the WarnerMedia (WBD) and DirecTV sales, interest and clearing costs on spectrum purchases, and redemption of privately-held preferred interests in subsidiaries. With none of these recurring in 2H, AT&T expects to reduce net debt by $4 billion.

AT&T expects to hit a net debt/EBITDA leverage ratio of 3.0 by the end of 2023. With capital spending decreasing over the next couple years with the end of 5G build out and spectrum purchases, the company expects to get to 2.5x net debt/EBITDA by the end of 2025.

Risks And Opportunities

The list of risks and opportunities is a little more balanced than last quarter. The concern I had about the cash draw for equipment installment receivables is still there, although the year-on-year change has improved slightly to $644 million from $780 million.

The macro environment is also still a risk, and as mentioned above, the decline in postpaid phone subscriber net adds could be a symptom of a weaker consumer. Higher interest rates also remain a concern as long as debt is maturing at a faster pace than new FCF generation after dividends is available to pay it off.

The one new risk is of course the lead cable issue. The share price has largely recovered from the market panic in mid-July, but it remains a lingering issue. The statement provided by Stankey on the call was about what one would expect: It’s low risk but the company will work with regulators and test for exposure as needed. Personally, I do not see major liability arising from this issue, understanding that most of the lead is coated and buried and therefore unlikely to pose a health issue in the same way that lead water pipes do. I encourage readers to review the full statement by Stankey and the Q&A exchange on the earnings call.

On the positive side, management states that they have delivered their $6 billion cost savings target and have added a goal of another $2 billion to be delivered over the next 2 years. As stated by CEO John Stankey on the earnings call:

These additional cost savings will be largely driven by the sun setting of our legacy product portfolio as supporting infrastructure. As we ramp our execution on this work, we’ll begin to enjoy the benefits of our simplified focus on wireless and fiber.

On the growth side, the Q&A brought up a couple initiatives not normally highlighted by management in their prepared remarks. While the company still sees fiber as the preferred strategy for consumer data connectivity, they also have a fixed wireless service known as Internet Air. This service is primarily intended for budget or government subsidized consumers in densely populated areas. It’s encouraging to see the company not put all its eggs in one basket when it comes to data delivery, allowing it to broaden its customer base.

Second, there was also a question about expanding broadband outside the current geographical footprint. In May, the company announced expansion into new service territories through its Gigapower joint venture with BlackRock (BLK). The earnings call had a longer discussion in the Q&A about footprint expansion, although it remains more of a 2025 and beyond possibility.

Dividend Yield Now Has An Appropriate Risk Premium

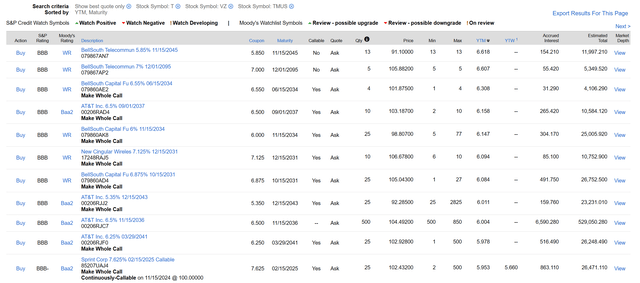

The common shares now yield around 7.45%, much better than the 6.3% mentioned in my article last quarter. This now is an appropriate yield premium for its position in the capital structure. This is now well above the preferred share yields. The A series (T.PA) now yields 6.32% and C series (T.PC) yields 6.44%. At over a 100 basis points, the spread between the common and preferred has widened since last quarter. This is despite the fact that the preferreds have been slower to bounce back from the drop that occurred when the lead cable issue came out.

The common share yield premium over bonds has also widened since last quarter. In that article, the bond with the highest yield to maturity yielded 43 basis points less than the common shares. Currently, the highest-yielding AT&T bond available yields 6.62%, meaning the yield premium for common shares has nearly doubled to 83 basis points. This is despite the fact that AT&T bond yields have increased more than those of Verizon (VZ) or T-Mobile (TMUS) since last quarter.

The wider yield premiums for the common shares now adequately compensate investors for their lower level in the capital stack. Still, the common yield appears safe given the outlook for free cash flow.

Conclusion

Second quarter results from AT&T show that the company is slowly delivering on its strategy to expand 5G wireless and fiber. While subscriber growth may be slowing along with the macro economy, the company continues to grow revenue per user and EBITDA. Free cash flow delivery improved from 1Q as expected and is now ahead of 2022 on a YTD basis. Given FCF projections, the common dividend appears safe.

The 17% drop in share price since last quarter’s earnings release has moved the dividend yield up to 7.45%. This provides an appropriate premium of over 100 basis points compared to the preferred shares and up to 83 basis points over the company’s bonds. This moves AT&T common shares back into the Buy zone.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.