Summary:

- AT&T is nearing a pivotal point, with potential for aggressive debt repayments and an improving balance sheet.

- I expect Q3 net broadband subscriber additions of 230-250k, increased ARPU, a confirmed free cash flow forecast, and $1-2B in net debt repayments.

- AT&T has a favorable deleveraging trend, as indicated by falling net financial debt and lower interest expenses.

- AT&T’s valuation is attractive with a forward P/E ratio of 9.5X, and continual debt repayments could drive share price appreciation and a return to dividend growth.

jetcityimage

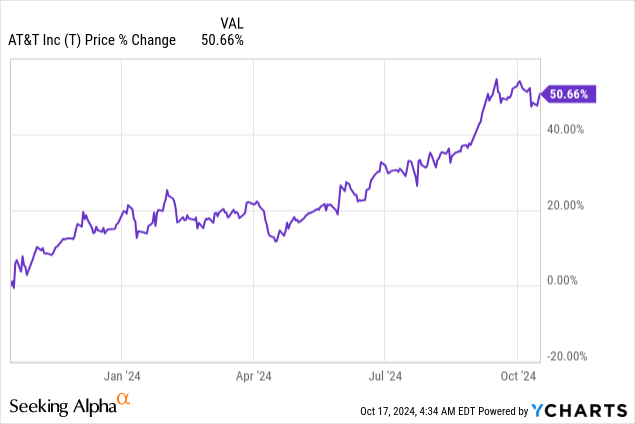

AT&T (NYSE:T) is due to report financial results for its third fiscal quarter on October 23, 2024, for which the market does not have very high earnings expectations. I, however, believe the telecom is nearing a pivotal point in the sense that management is way more focused on accelerating the telecom’s debt payments. Assuming that AT&T is set to confirm its FY 2024 free cash flow forecast (which I consider likely) and announce a reasonably high number of net additions in its broadband business (which is an almost certainty given recent subscriber trends), faster debt repayments could be a catalyst for a significant upside revaluation in the weeks and months ahead. Shares of AT&T have soared 51% in the last year, but the rally has staying power, and shares are trading at an 11% earnings yield.

Previous rating

I rated shares of AT&T a strong buy in my work in July due to growth in both fiber and non-fiber average revenue per user, which translated to surging broadband revenues: A Triad Of Buy Factors. While I consider it a relative shortcoming that AT&T is not growing its dividend, the telecom generates enough free cash flow to suggest that the dividend at its current level of $0.2775 per-share quarterly is sustainable. Excess cash flow could therefore be turned towards repaying more debt, which, I believe, is what is likely. In my opinion, the biggest accomplishments for AT&T we are going to see next week likely relate to net debt repayments, which means the telecom could be steering towards a healthier, less leveraged balance sheet.

My expectations for AT&T’s Q3

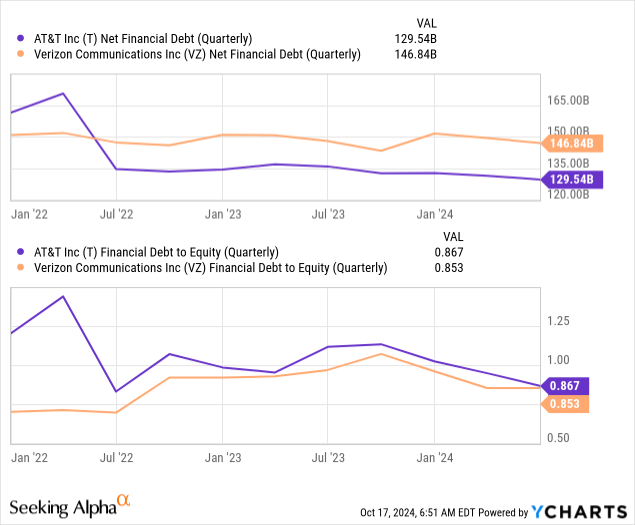

With broadband momentum being persistent and well understood by investors, I believe the biggest catalyst for AT&T could come from a fundamental restructuring of its liabilities on its balance sheet in the year ahead. AT&T has already made considerable progress in repaying debt and actually has out-performed Verizon Communications (VZ) in this regard.

AT&T had total net financial debt of $129.5B at the end of the June quarter, showing a 3-year decline rate of 19.7%. Verizon, on the other hand, reduced its net financial debt only by 2.5% over this same time period, indicating that AT&T is much more committed to restoring stronger leverage metrics.

AT&T’s leverage ratio — as measured by the debt-to-equity ratio (see below) — at the end of Q2’24 was 0.87X, compared to 0.85X for Verizon. AT&T’s accelerating debt repayments in the last three years have resulted in a comparable leverage profile, and I expect more debt repayments to follow. In Q2’24, AT&T repaid $5.1B of its net debt year-over-year and reduced its debt burden approximately $2.0B quarter-to-quarter.

One of the biggest criticisms of AT&T is that the company conducted too many ill-fated acquisitions in the past, and financed those with debt… the price of which is that the telecom’s dividend growth has been negatively impacted. As opposed to Verizon, AT&T has not delivered any dividend growth at all, putting the telecom at a competitive disadvantage merely from a dividend growth point of view.

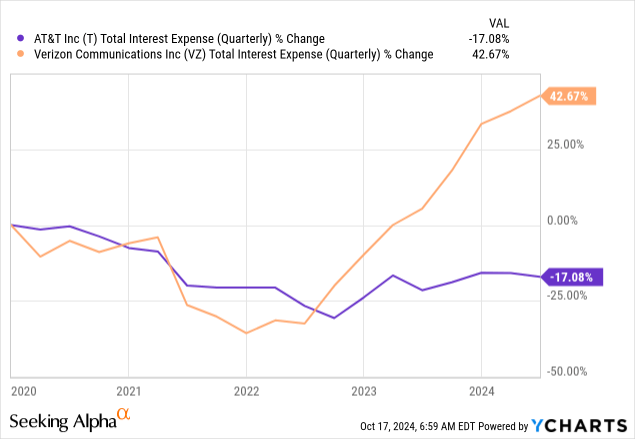

However, this could change as AT&T puts more effort (and cash) towards solving its debt problem. Lower interest expenses are what could make the difference: If AT&T throws more cash at its debt problem, the company is saving millions of dollars annually on financing costs, which could be a catalyst for management to finally raise the dividend.

Because AT&T repaid more debt than Verizon in the last three years, the telecom has a very favorable interest expense trend, which I expect to continue in the remainder of FY 2024 and beyond.

For the third-quarter, I specifically expect AT&T to report:

- Net broadband subscriber additions of 230-250k, which would be broadly in-line with past quarterly numbers

- A sequential increase in broadband average revenue per user/ARPU of 2-3% to ~$66-67

- A confirmed free cash flow forecast of $17-18B

- Net debt repayments of $1-2B, which the company could easily afford based off its free cash flow. Anything below $1-2B would be a disappointment for me.

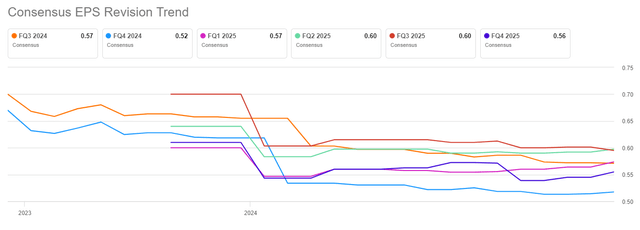

EPS estimate trend ahead of Q3’24

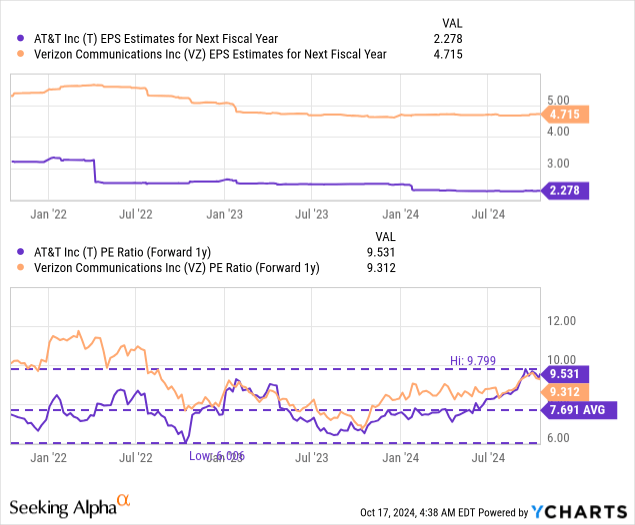

My expectations about AT&T’s Q3 may be more optimistic than what the market expects, in large part because I don’t see a slowdown in ARPU or subscriber growth. I also believe that a fundamental driver of AT&T’s earnings growth going forward is a continual decline in interest expenses. In the last ninety days, there were 13 EPS estimate downward revisions compared to 3 upward revisions, creating a very low bar for AT&T to step over next week.

AT&T’s valuation

Telecoms don’t have a lot of revenue upside, and investors can be happy to see single-digit top-line growth rates for both AT&T or Verizon. This is because telecom markets are well-served, mature and have high levels of competition (low switching costs) which limits the potential for top-line growth.

However, telecoms are also widely profitable, on both an earnings and free cash flow basis: currently, shares of AT&T are priced at a forward price-to-earnings ratio of 9.5X, which implies a healthy earnings yield of 11%. Verizon, on the other hand, trades at a lower forward P/E ratio of 9.3X, but also implying an earnings yield of 11%.

Under the assumption that AT&T can further make progress in deleveraging its balance sheet, I am willing to assign a higher earnings multiplier factor. If AT&T can reduce its net debt further and lower its leverage ratio to below Verizon’s in FY 2025, I see a strong upside revaluation case. AT&T could trade, in my opinion, at 11-12X forward earnings, which implies a fair value in the range of $25-27 per-share. A lowering of the telecom’s net debt is set to have positive impacts on many other elements of AT&T’s business as well (besides a healthier balance sheet), including a favorable interest expense trend.

Risks with AT&T

AT&T has a number of issues that could hold back the share price: first, as we have seen, AT&T still has a ton of financial obligations to service. With ~$130B in net debt, it will take years for the telecom to move towards a healthier balance sheet. But slow progress is still better than none. Further, telecoms may choose to maintain high leverage given that they generate high levels of recurring free cash flow, which sustains a large amount of debt. Therefore, what would change my mind about AT&T is if the telecom were to not lower its net debt significantly and if it failed to grow its dividend in the future.

Final thoughts

The moment of truth is arriving for AT&T: the telecom could be headed for a very strong earnings release: I expect the telecom at the very least to confirm its free cash flow guidance of $17-18B and report net subscriber additions of 230-250k in the broadband business in the third-quarter. Average revenue per user likely increased as well Q/Q, and I am looking for a low single-digit growth rate of 2-3% here. What could make a difference for AT&T (and for the share price) is how much net debt the telecom repaid in the third-quarter (my guess is about $1-2B).

Debt repayments accelerated earlier this year, and I believe that AT&T understands that investors want to see the telecom’s balance sheet deleveraged. From a valuation point of view, I believe AT&T is a very solid deal, trading at an earnings yield in excess of 11% ahead of the Q3 report. Further, EPS estimates seem low, creating a low bar for AT&T.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T, VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.