Summary:

- AT&T Inc. is currently a deep value stock with a low forward earnings multiple and high yield.

- Negative switching costs have led to a disproportionate share of industry profits being captured by other sections of the vertical rather than telcos like AT&T.

- Tower REITs are strategically positioned within the vertical and have been eating AT&T’s lunch.

15703083

AT&T Inc. (NYSE:T), along with the other Telcos, are major tenants of many of the tech real estate investment trusts, or REITs, so I came across them in performing due diligence on tenant rosters. As of late, AT&T has gotten quite cheap at 6.4X forward earnings with a greater than 7% yield. That makes it even cheaper than Crown Castle (CCI) which I presently consider to be the best-valued tower REIT.

The two companies are linked in that AT&T pays 19% of Crown Castle’s overall rental revenues.

So, should one own the landlord or the very cheap tenant? I believe the answer comes down to strategy with one section of the industry vertical being structurally advantaged.

Here are the topics involved in the thesis:

- Industry vertical

- Historical performance

- Competitive landscape

- Phenomenon of negative switching costs

- Forward growth outlook.

The Phone Service Vertical

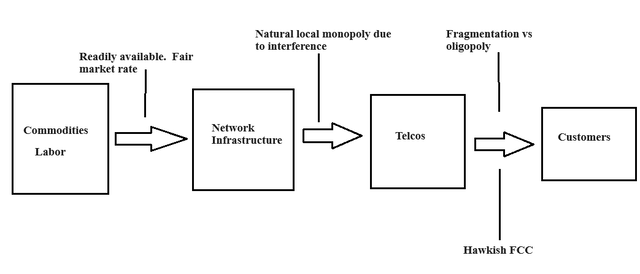

Customers interact directly with the Telcos to get cell service which the telcos provide through an extensive physical network involving fiber, towers, and various other pieces of infrastructure and equipment. Many of the carriers, AT&T included, are partially vertically integrated owning significant portions of their own network infrastructure. The infrastructure assets are largely supplied by readily available commodities such as steel for towers. So the overall supply chain looks like this.

Squares represent the main players in the industry vertical, with the most basic suppliers on the left flowing through to the end users on the right.

The overall value created by the industry is massive, making it a multi trillion dollar industry worldwide. However, as is often the case, the value created is not distributed evenly among the players.

Ratios of value capture are often decided by strategic aspects of the points of interaction which we will examine in more detail below.

Telcos are somewhat concentrated with 3 major players, T, Verizon Communications (VZ) and T-Mobile US (TMUS), along with a variety of much smaller competitors such as DISH Networks (DISH) which is supposed to become a 4th major carrier. It is not quite an oligopoly, but close given the market shares.

Customers, on the other hand, are extremely fragmented with millions of customers and virtually no pooled purchasing power beyond a family plan or the phone service of a business.

Ordinarily, the concentrated section of the vertical would be advantaged in negotiations over the fragmented section resulting in the Telcos capturing more of the surplus than the customers, but the U.S. has a rather hawkish Federal Communications Commission (FCC) ensuring there is ample price competition in the space. Thus, the customers keep a decent chunk of the surplus.

I believe the towers are strategically advantaged over the Telcos due to the natural monopoly of towers.

As a quick review, a natural monopoly is one in which it is simply most efficient for the given service to be produced by a single provider.

Towers are very local in function, having a radius of efficacy, and it is bad engineering to have multiple towers covering the same radius for 2 reasons:

- The towers will interfere a bit with each other

- Redundant cost of infrastructure.

There are many tower owners including the big tower REITs, American Tower (AMT), CCI and SBA Communications (SBAC), as well as the telcos themselves having significant tower ownership. Thus, the tower industry is not a monopoly, but each individual tower sort of is a natural monopoly within its local radius.

For competitive reasons, a T-Mobile tower is unlikely to be leased to AT&T, but a neutral tower such as one owned by Crown Castle can be leased to 3 or even 4 cell service carriers. This multiplies the service provided relative to the cost of infrastructure. By getting 3 or 4 sources of rent on a single construction, a long-standing tower owned by one of the REITs can generate annual net operating income of as much as 30% of the cost of construction, and these have almost no maintenance cost due to just being steel frames.

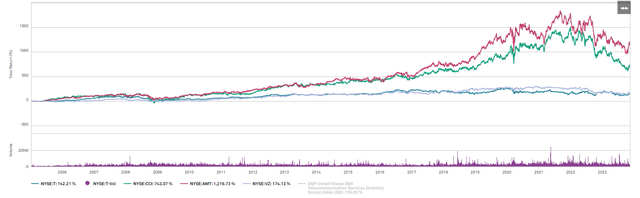

Through this double dipping of rent, the tower REITs are capturing a disproportionate share of the industry profits. A concept that is strongly backed up by the long term relative performance.

S&P Global Market Intelligence

Since January of 2005, which was the earliest date at which all 4 companies had return data, CCI and AMT returned 743% and 1219%, respectively, while the Telcos, T and VZ returned 142% and 174%, respectively.

That is the sort of difference strategic advantage within an industry vertical can make. I believe that advantage is ongoing for macro towers and exists in small cell as well (although to a lesser extent).

The relatively weak value capture of the telcos has also been exacerbated by negative switching costs.

The phenomenon of negative switching costs

As a quick review, switching costs are the expenses (financial, time or other) involved in switching providers. Microsoft Excel is a famous example of profit margins being protected by switching costs.

Nearly everything that can be done in Excel can also be done in competitors like Google Sheets for free, yet companies and individuals continue to pay the subscription to keep Excel.

Why?

Because the switching costs are significant. Syntax is different. User interfaces are different.

It would be quite a hassle to convert despite the products being largely the same.

The Telcos have created the opposite situation for themselves and actually managed to make switching cost negative for the customer, meaning it is profitable for the customer to switch. There are 2 main contributors to why this happened:

- Low incremental cost of providing service

- Hyper-competition.

Providing national service reliably requires a vast amount of initial and ongoing capital expense to maintain the equipment and infrastructure. Most of this is fixed overhead while the incremental cost of providing service to an additional customer is very cheap. Adding a million customers might require a little bit of network densification, but the cost per customer declines the more customers they have.

As such, it becomes paramount to capture as much market share as possible. It becomes worth it to pay $500 to capture a $600 customer from a competitor. The telcos have consistently offered huge sign-on deals such as a subsidized iPhone to entice customers of competitors to make the switch.

Subsidies of this nature functionally make switching costs negative for the consumer. One can get the best deal by switching providers every few years.

The ferocity of competition pushes a large portion of the value capture into the hands of consumers and the beneficiaries of the subsidies such as Apple.

Valuation

Even with a large portion of the profits going to other sections of the industry vertical, AT&T is pulling in a healthy profit each year resulting in a forward multiple of 6.4X. If they can maintain that level of profitability it would probably be a good investment just from the cashflow, but I think there are 3 hurdles making business hard for AT&T:

- Aforementioned recurring customer acquisition costs (negative switching costs)

- Large capex ahead in rollout of 5G

- High cost of capital (both equity and debt).

In comparison, Crown Castle is a bit more expensive relative to current earnings at 14.7X forward adjusted funds from operations, or AFFO, but the earnings are of much higher quality.

Rather than having to re-acquire its customer base each year, Crown Castle’s revenues are recurring in nature. They get rent checks from their towers and they will still be getting rent checks from the same towers in 20 years. In fact, these rent checks grow with escalators and rent bumps upon renewal. Organic revenue is positioned to grow 5%-8% annually.

The rollout of 5G which represents massive capex for telcos is a source of external growth for CCI. Its fiber network makes it the best positioned among the tower REITs to deploy small cells with tens of thousands already in the pipeline. Each small cell comes with rent checks and the potential to multiply those rent checks through co-location.

14.7X forward AFFO is not deep value, but it is quite cheap relative to CCI’s history and relative to the broader market.

I can entirely understand the appeal of AT&T’s extreme value and the dividend yield that comes with it. However, from a longer-run perspective, I would much rather own the landlord.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CCI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

All articles are published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person.

The information offered is impersonal and not tailored to the investment needs of any specific person. Readers should verify all claims and do their own due diligence before investing in any securities, including those mentioned in the article. NEVER make an investment decision based solely on the information provided in our articles.

It should not be assumed that any of the securities transactions or holdings discussed were profitable or will prove to be profitable. Past Performance does not guarantee future results. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. Historical returns should not be used as the primary basis for investment decisions.

Commentary may contain forward looking statements which are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MC and its affiliates cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts, and findings in this article.

S&P Global Market Intelligence LLC. Contains copyrighted material distributed under license from S&P

2nd Market Capital Advisory Corporation (2MCAC) is a Wisconsin registered investment advisor. Dane Bowler is an investment advisor representative of 2nd Market Capital Advisory Corporation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The REIT market has gotten egregiously underpriced making it a great time to get in to the right REITs. To help people get the most updated REIT data and analysis I am offering 40% off Portfolio Income Solutions, but you can only get it through this link.

https://seekingalpha.com/affiliate_link/40Percent

I hope you enjoy the plethora of data tables, sector analysis and deep dives into opportunistic REITs.