Summary:

- AT&T should continue to grow organically at a slow pace, driven by a higher share of cable connections and proliferation of IoT devices.

- However, the mobile sector is characterized by steadily declining ARPU, and the rate of subscriber takeover has slowed significantly.

- Profitability of the company and in the industry is stable, and the cost structure of the company should prevent it from seeing lower margins in the future as well.

- Due to its high profitability, AT&T has no problem generating FCF and dividend payments are protected, but we believe current yields are insufficient.

- Although AT&T’s fair valuation retains a conservative upside, we would wait for it to become more attractive.

Brandon Bell

Investment Thesis

AT&T (NYSE:T) is a typical representative of the telecom industry. Further growth of the company is limited by declining ARPU and slowing subscriber growth, so the company should be considered only as a defensive asset. Though there is still a small discount relative to the fair level in our view, we believe it is better not to hurry with the purchase. We think the market looks overheated and instead of dividend yields it makes sense to consider short bond issues of these companies – since the bonds usually have higher yields.

Communications will persist with slow organic growth

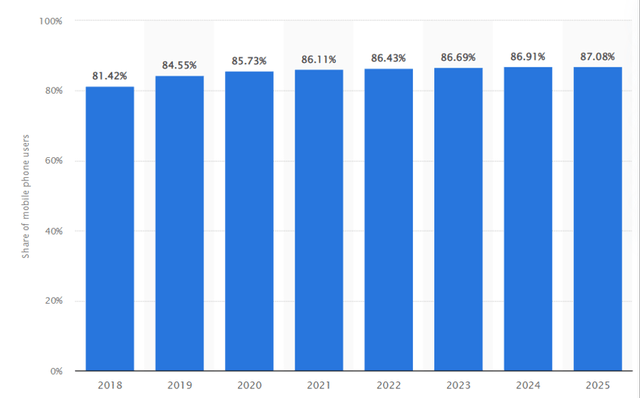

The telecom sector as a whole is not seen as a growing or promising industry – the peak of 5G technology advancement in developed regions is well behind us, and the next generation networks are still a long way off, so the industry is consolidated by major players offering similar services with slight differences in price and quality. Smartphones and communication services are used by almost 90% of the U.S. population.

Nevertheless, there is room for moderate organic business growth in the industry, and specifically for AT&T, due to the following factors:

- Continued moderate growth in Postpaid and Prepaid subscribers due to increased smartphone usage and mobile Internet connections: although we expect the sale of WarnerMedia and the likely cancellation of the free HBO Max subscription promotion to increase churn-rates to the historical average (1.21% for Postpaid subscriptions), the company can offset this by overall growth in smartphone users.

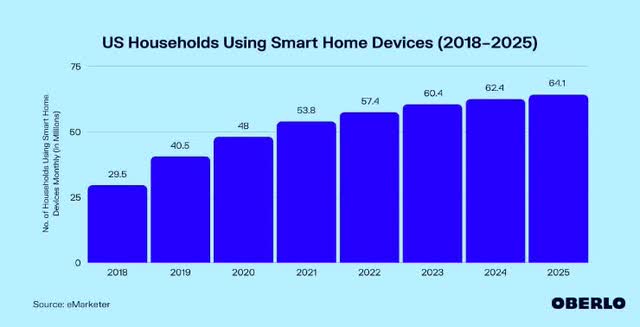

- The rapid development of IoTs, which will contribute to the growth of subscribers in the Connected Devices segment: technological ecosystems are tightly integrated into people’s lives, as evidenced by statistics on the use of smart home devices. Meanwhile, there are a lot of other segments like smartwatches, next-generation vehicles, and so on. There’s still a lot of growth potential here for AT&T and other telecom companies. We believe that by increasing the number of IoT devices in households, the company will manage to increase the number of subscribers over the next 3 years at an average growth rate of 12.8% per year. Therefore, we think this number will exceed 154 million by the end of 2025.

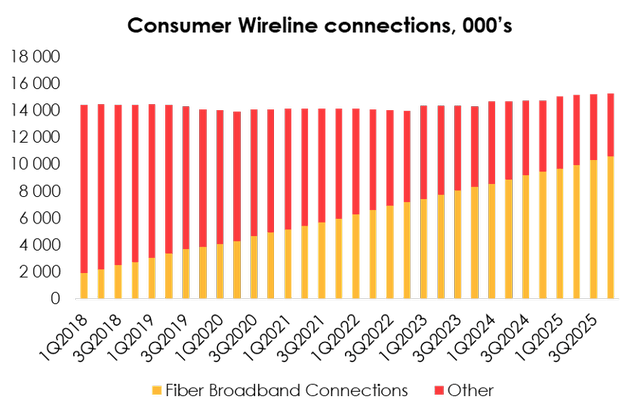

- High-speed Internet is another important aspect of the strategy. Here the company is less limited in terms of price competition and can steadily increase the average ticket per user, albeit at a low rate. At the end of 2022 it reached only 51.6% of their total number in the B2C segment. Meanwhile, the general trend for the growth of the amount of information transferred via the Internet (streaming services, cloud storage, etc.) is stable. We believe that the Consumer Wireline segment will be one of the most successful divisions over the next few years and expect it to grow to 15.3 million subscribers by 2025 ( fiber- 69.4%). This will also be driven by a joint venture with BlackRock, announced in December 2022. Meanwhile, the transition of subscribers to high-speed connections will support the rate of revenue growth per user, despite competition in the industry.

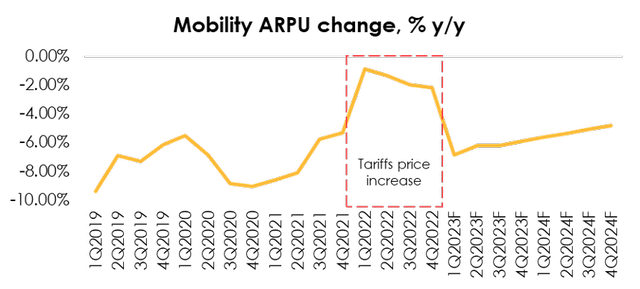

In 2022, AT&T was raising rates to combat inflationary pressures, so the decline in telecom services ARPU is lower this year. However, in the future, AT&T is unlikely to go against the industry trend and continue to raise rates heavily, as this will result in higher customer churn.

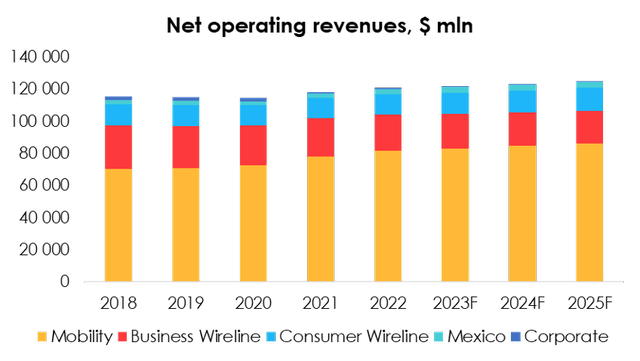

Given all factors, we expect AT&T revenue to reach $121,971 mln (-5.6% YoY including WM sales) in 2023 and $123,356 mln (+1.14% YoY) in 2025.

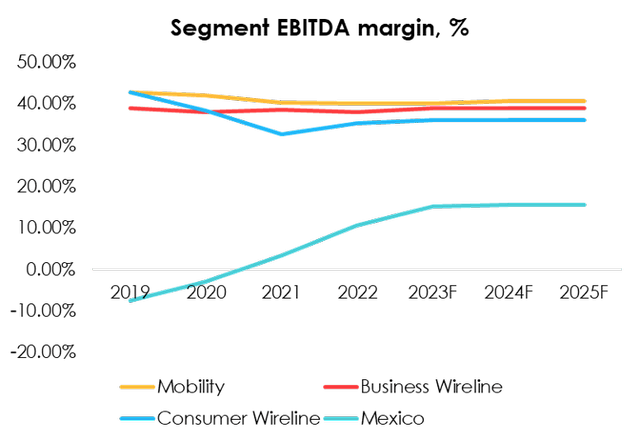

Stable margins = sustainable cash generation

We believe AT&T’s cost structure remains as stable as possible, and the company successfully passes the consequences of inflation to the end consumer without a drag in terms of profitability. We believe the situation will not change in the future since this is the primary goods sector and the cost structure of all communications providers is identical, the industry will target current levels of profitability in its pricing policy.

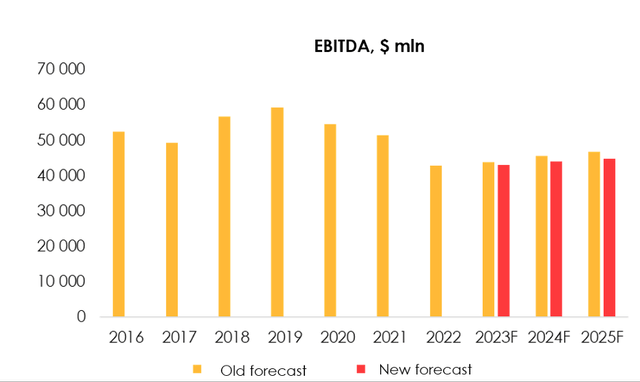

Nevertheless, we have revised our consolidated EBITDA calculation. Previously, we tried to detail the adjustment items, but due to their high volatility, we got an inflated result. Over the past four years, the average adjustment amounted to $1,029 million per quarter, so we have included an adjustment item of $1 million per quarter in our forecast.

Therefore, we have revised our 2023 adjusted EBITDA forecast downwards from $43,733 mln (+6.1% YoY) to $43,051 mln (+3.8% YoY) and 2023 adjusted EBITDA from $46,093 mln (+4.2% YoY) to $44,022 mln (+2.3% YoY).

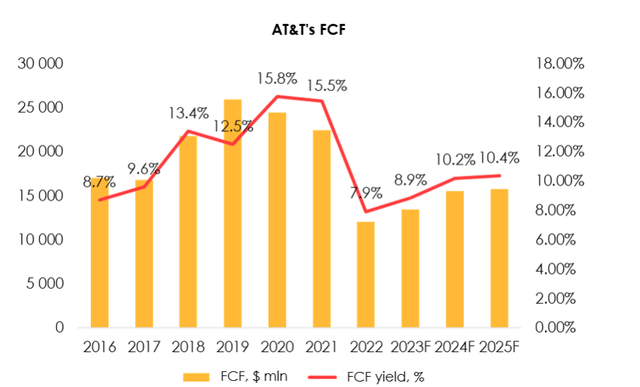

We also improved AT&T’s financial model at the end of the quarter and added a calculation of the company’s FCF.

According to our estimate, AT&T’s FCF in 2023 will reach $13,454 mln (+11.6% YoY) and $15,506 mln (+15.3% YoY) in 2024. We did not include payments from DirecTV and vendor financing in the forecast due to the uncertainty of pay-outs for these items next year.

In 2023, the management expects the company to generate FCF of at least $16 bn, which we think is quite optimistic given the expected effective income tax rate of 23-24% and the capex being comparable to 2022 levels (~$20 bn).

Although expected FCF will be lower than historical figures (partly due to the sale of the WarnerMedia division), it still allows the company to make stable dividend payments at current levels ($1.12/share) and possibly even raise them to $1.20/share by 2025 without compromising AT&T’s financial stability. Nevertheless, we consider the current dividend yield to be insufficient to purchase the stock – AT&T’s debt instruments yield higher than the current dividend yield (about 5.8%), and the expected dividend growth does not imply significant growth.

Valuation

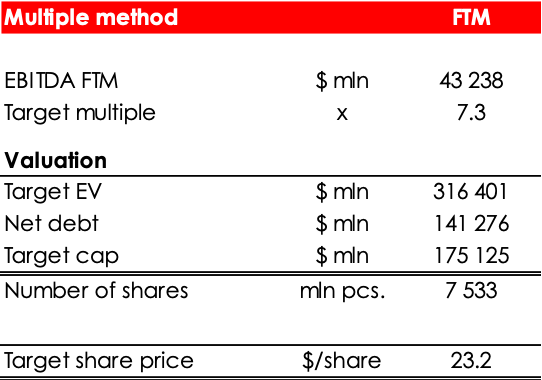

Our AT&T stock valuation is based on FTM EV/EBITDA. The fair value price is $23.2. The status is HOLD. The projected upside is 18%.

Invest Heroes

Conclusion

AT&T is a typical representative of the telecommunications sector. The growth of the company’s financial results will be very limited, and although the business shows good dynamics in the fiber connections and connected devices segments, steadily declining ARPU in the mobile segment and a slowdown in the rate of subscriber takeover will limit the company’s organic growth.

The positive aspect of AT&T is the protective properties of the business – stable profitability and the ability to generate FCF, which the company then directs to dividend payments. However, in our opinion, cash-income seekers should pay attention to short-term bonds of AT&T.

Although AT&T is slightly undervalued relative to its fair price, we think it is a bit early to purchase: the market looks expensive, a more attractive entry point is likely to emerge.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.