Summary:

- AT&T reported another strong quarter and the stock continued to move higher.

- AT&T’s 12% forward free cash flow yield and low debt to EBITDA support a longer term case.

- There are some risks here, and we think preferreds could outperform until the middle of 2025.

jetcityimage

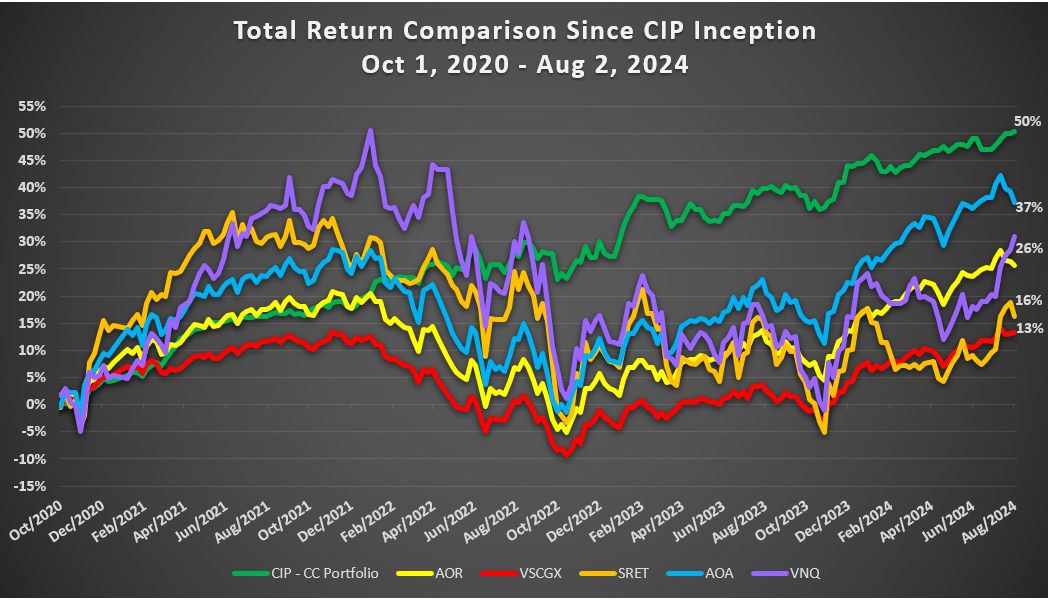

We have been on the neutral train for AT&T Inc. (NYSE:T) since July of this year. Our most recent piece on this communications company was in the beginning of October. We covered the sale of what we considered a ball and chain around its neck, namely, DirecTV. The deal will be completed in 2025 subject to regulatory approval, but as we noted in that piece, the likelihood is high. The 12% forward cash flow yield of the core business looked good and the lowest EV to EBITDA amongst its competitors did not hurt either.

For AT&T, the question now is how it deploys that excess free cash flow yield over and above its dividend. As long as the excess cash flow is spent in a shareholder-friendly manner, AT&T can continue to deliver decent returns. From our perspective, we see some bigger risks in 2025 than where consensus stands. The longest yield curve inversion is not something we would ignore simply because things look OK now.

Source: AT&TL Deleveraging Complete With DirecTV Sale, Now Comes The Hard Part

The stock has performed decently since then, even beating the overall market.

Seeking Alpha

The current price bodes well for our $20 strike covered call options expiring in January 2025. Today, we will cover the Q3 results that were released around the end of last month.

Q3-2024

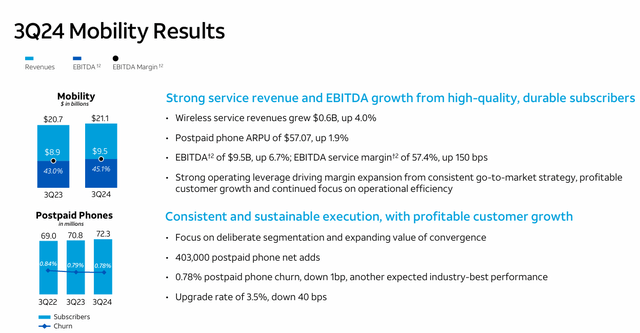

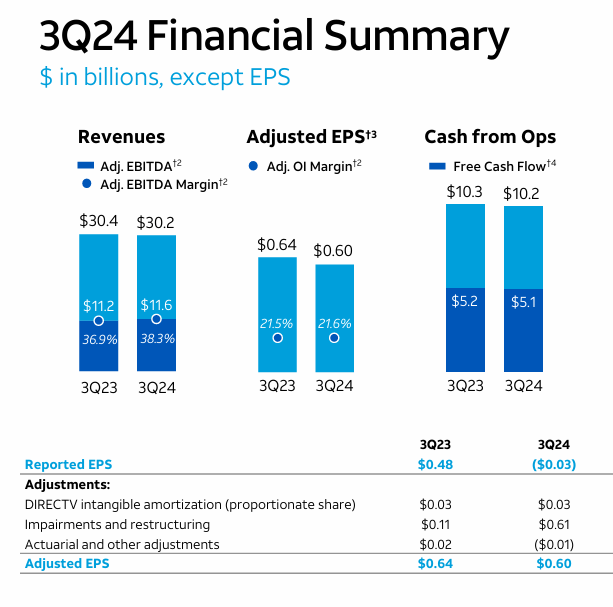

It has been some time since AT&T delivered a bad quarter and this one did not break the trend. There were no negative surprises on the revenues or margin front. Free cash flow came in at a solid $5.1 billion. The adjusted earnings per share (which no one is looking at nowadays) was also healthy at 60 cents a share.

Q3-2024 Presentation

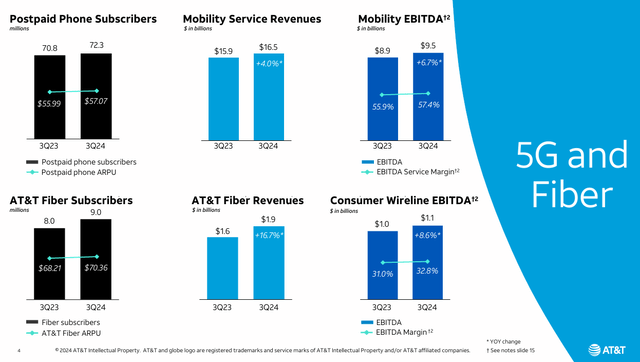

The strongest part about the results was the Mobility segment performance. Postpaid phone subscribers rose to 72.3 million and churn moved slightly lower. That is what we would call the best of all worlds. The climb in revenues with a lower churn rates meant that adjusted EBITDA margins increased again.

The company’s summary slide showing its key highlights resonated well with investors and analysts.

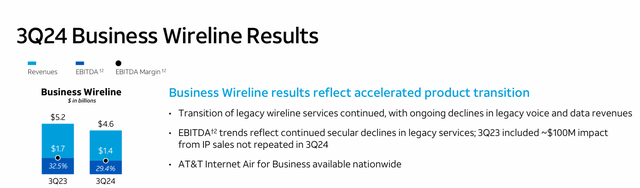

If there was a slight sour point in the results, it was in the Business Wireline numbers. That business is in secular decline and continues to act as a headwind to the good work that the company does elsewhere. Nonetheless, this quarter we saw an accelerated move down in the revenue and EBITDA.

Management attributed the worse than expected numbers from the financial impact of the two major hurricanes.

Adjusted EBITDA was up 3.4% for the quarter as growth in mobility, consumer wireline, and Mexico, which collectively drove more than 80% of our total revenues in the quarter, were partially offset by a continued decline in business wireline. Year-to-date, adjusted EBITDA grew 3.4%, and we continue to expect adjusted EBITDA growth in the 3% range for the full year. We expect to achieve this growth even with about $115 million of estimated financial impact related to the effects of Hurricane Helene and Milton and the work stoppage. Consumer wireline and business wireline are expected to bear most of this impact.

Source: Q3-2024 Conference Call Transcript

Overall, it was a very strong quarter and AT&T affirmed that its capex and free cash flow were tracking in line with guidance.

We also expect to sustain strong cash conversion in the fourth quarter and anticipate using our improved liquidity to continue reducing our short-term financing, including further paydown of vendor financing in the fourth quarter. These additional vendor financing payments put us on pace for a full year capital investment at the high end of our guidance range of $21 billion to $22 billion. Our free cash flow is tracking to the midpoint of our guidance range of $17 billion to $18 billion.

Source: Q3-2024 Conference Call Transcript

Outlook

Some time back, AT&T was considered a basket case, thanks to a large debt load and a foundering acquisition strategy. They have stopped buying new assets and are very focused on debt reduction.

We reduced net debt by about $1.1 billion in the quarter despite a $1.3 billion FX headwind related to foreign debt. Year-over-year, we’ve reduced net debt by approximately $2.9 billion and have lower vendor and supplier financing by $2.4 billion. At the end of September, net debt to adjusted EBITDA was at 2.8 times, and we’re making steady progress on achieving our target in the 2.5 times range in the first half of 2025. Looking forward, our debt maturities are very manageable and we’re in a great position with more than 95% of our long-term debt fixed with a weighted average rate of 4.2%.

Source: Q3-2024 Conference Call Transcript

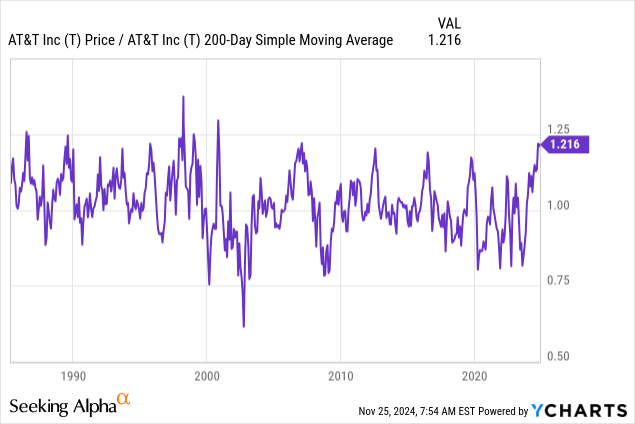

One thing that is not appreciated here is just how much AT&T benefits from not having played fast and loose with its debt maturities. Their weighted average interest rates are currently below the overnight Fed Funds rate. Their interest coverage will be close to 4.0X at some point in 2025. Also, the staggered maturities means that it can just keep paying down debt to the level it wants just via free cash flow. We are waiting for some firm guidance on 2025, especially on capex. Preliminary tone in the Q3-2024 conference call suggested that it won’t move up materially and that means that the free cash flow will be in the 11%-12% range. It is hard to say any of this is expensive or outrageous, despite the run it has had. At the same time, the stock is very close to levels that have historically produced a sell-off. We are at 21% above the 200 day moving average and we have seen some notable sell-offs at the 25% level. It is interesting to note here that most sell-offs from here dipped well below the 200 day moving average.

Verdict

The stock remains a good “hold” for income investors. You won’t find many “utility” stocks with these metrics. Actual utilities tend to use debt to EBITDA close to the 5X-6X mark versus AT&T’s 2.8X (headed to 2.5X). Current performance has put the stock in rarified air territory and it is possible there will be a substantial pullback soon. This might be “triggered” by the investor day update in early December. We would wait for that to initiate new positions rather than chase this here.

Preferred Shares

AT&T also has two different preferred shares listed. These are:

1) AT&T Inc. 5% DEP RP PFD A (NYSE:T.PR.A)

2) AT&T Inc. 4.7% DEP SHS PFD C (NYSE:T.PR.C)

Since our previous coverage, both of these have declined a bit. They both now have a stripped yield of about 5.9% on average. These are getting in the attractive range on a relative basis. They offer a small premium to the common shares in dividend yield and are obviously significantly safer. For those looking for AT&T exposure without chasing the stock, these could be good alternatives.

Baby Bonds

In addition to the preferred shares, AT&T also has baby bonds listed.

1) AT&T Inc. 5.625% BDS 01/08/67 USD25 (TBC)

2) AT&T Inc. 5.35% GLB NTS 66 (NYSE:TBB)

Both these yield about 5.65% on a stripped basis and are a bit lower than the preferred shares. Obviously, bonds are higher up the stack, but in this case we think it is worth shooting for the extra yield from preferred shares. They (the preferred shares) are also tax advantaged on a relative basis, so in taxable accounts that might make a difference.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult a professional who knows their objectives and constraints.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Take advantage of the currently offered discount on annual memberships and give CIP a try. The offer comes with a 11 month money guarantee, for first time members.