Summary:

- T’s Q2 earnings report show plenty of profit catalysts to support a buy thesis.

- The top ones include CAPEX stabilization, the growth of its fiber network, and the many synergistic opportunities between fiber and its other segments.

- Subsequently, I expect margin and free cash flow to expand, debt to reduce, and dividend coverage to improve.

jetcityimage

T stock: still a buy near 52-week high prices

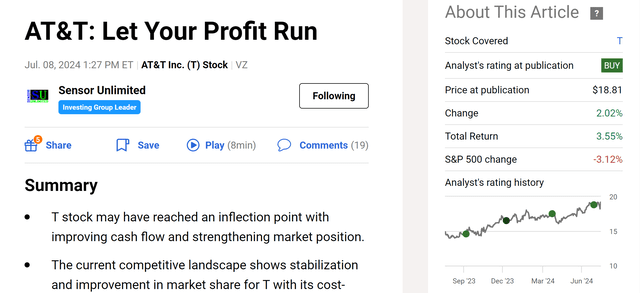

I have turned bullish on AT&T stock (NYSE:T) in the past 1~2 years and have written several articles on it. As you can see from the screenshot below, my most recent article on the stock was “Let Your Profit Run” and it was published on July 8, 2024, on the Seeking Alpha platform. In the article, I argued that:

T stock may have reached an inflection point with improving cash flow and strengthening market position. The current competitive landscape shows stabilization and improvement in market share for T with its cost-effective plans and reliable network. Despite some risks, T stock remains a deep-value play with a compressed valuation, high dividend yield, and improving fundamentals.

Since that writing, the stock price has kept advancing and now it hovers around a 52-week high. More importantly, the company also released its 2024 Q2 earnings report (“ER”) earlier this week. Given these changes, I think a follow-up article is warranted. My last article is more oriented to the longer term (3~5 years out). In this article, I will focus on reviewing the more immediate catalysts described in the ER.

If I must sum up my overall impression of the Q2 report in two words, they would be those two used in the title: catalysts galore. In the remainder of this article, you will see why I see the company swimming in catalysts and thus reiterate my buy rating.

T stock: Q2 recap

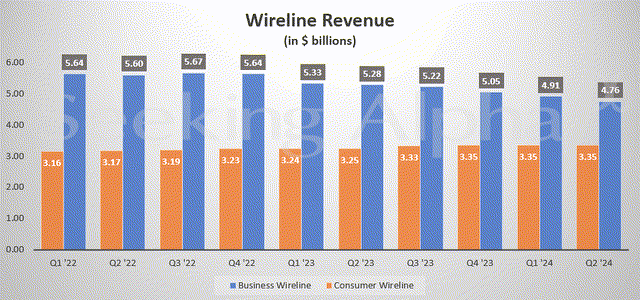

Purely judging by the bottom line and top line numbers, T’s Q2 results were a mixed bag. Its Q2 EPS (on a non-GAAP basis) dialed in at $0.57 per share, in line with market expectations. Its revenues totaled $29.8B for the quarter, missing market consensus slightly by $180M and translating into a slight decline of 0.4% YOY. The decline was largely driven by lower Business Wireline service revenues (more on this later) and also lower volumes on its mobility equipment.

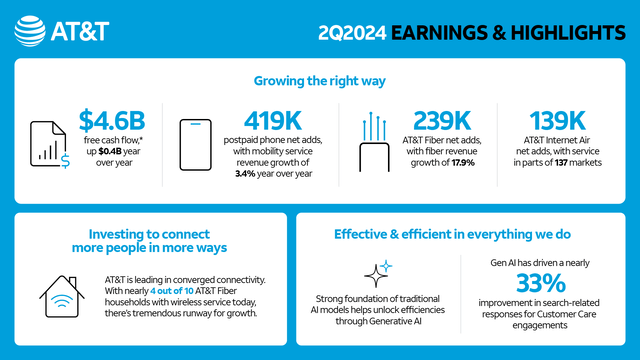

However, looking past the numbers and digging into the operational specifics (see the next chart below), the strength of the quarter begins to come into focus. Among the many positives, three come to the top of my list. First and foremost, the company achieved a free cash flow (FCF) of $4.6 billion, up $0.4 billion YOY. Later, I will elaborate on the implications of such a strong FCF. In a nutshell, I think its CAPEX has peaked and its heavy CAPEX investment in fiber and 5G will be paying dividends (sorry for the pun) for the years to come. As such, looking ahead, I expect margins to expand, de-leverage to continue, and dividend coverage to keep improving. Second, the company also reported a total of 419k postpaid phone net adds in the quarter. Furthermore, the company boasts an industry-leading postpaid phone churn rate of only 0.70%.

Last but not least, AT&T Fiber reported 239k net adds in the past quarter. This is the 18th consecutive quarter with more than 200k net adds for the company, an impressive run echoing my earlier comments about reaping the fruits from its CAPEX investment.

For the full 2024 fiscal year, the Q2 ER reiterated its guidance. You can read the full details from it press release. Here I will just quote the parts that are most relevant to my subsequent analyses, which are:

- Capital investment in the $21-$22 billion range.

- Free cash flow in the $17-$18 billion range.

- In 2025, the company expects to deliver adjusted EPS growth.

- On track to pass 30 million-plus consumer and business locations with fiber by the end of 2025.

And next, I will further elaborate on the implications of these items for its future growth.

T stock: EPS outlook and return potential

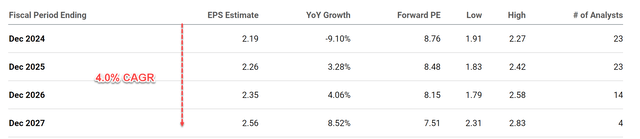

Management’s confidence to resume EPS growth is consistent with consensus EPS estimates for T stock too. As seen in the next chart, consensus EPS estimates point to an EPS decline of 9.10% for the fiscal year of 2024. EPS is then projected to rebound after that. Overall, consensus estimates project a compound annual growth rate (CAGR) of 4.0% in the next four years.

Under such EPS growth projections, the stock is very attractively valued despite its large price rallies in recent quarters. The forward P/E ratio for T stock is only 8.76 based on the 2024 EPS projection. The implied P/E would decrease to only 7.51 by the end of FY 2027. When adjusted for growth and dividends, the valuation is even more attractive. As a quintessential dividend-growth stock, I think it’s fitting to apply the following PEGY ratio Peter Lynch promoted:

For dividend stocks, Lynch uses a revised version of the PEG ratio – the PEGY ratio, which is defined as the P/E ratio divided by the sum of the earnings growth rate and dividend yield. The idea behind the PEGY is very simple and effective. If a stock pays out a large part of its earnings as dividends, then investors do not need a high growth rate to enjoy healthy returns. And vice versa. And similar to the PEG ratio, his preference is a PEGY ratio below 1x.

For T, with the above growth rate forecast of 4% and an FWD dividend yield of 5.8% at the price of this writing, its PEGY ratio is only 0.9x (which came from 8.76x P/E divided by the sum of 4 and 5.8), noticeably lower than the 1x ideal threshold.

Of course, the next logical question is if the 4% CAGR can be achieved. And next, I will argue why I think it is very likely for T to achieve it.

T stock: fiber in focus

Of all the catalysts mentioned above that can help T to achieve an EPS growth in the mid-single digits, I consider those surrounding its fiber network to be the most important for the next few years. First, T’s fiber network is a premium asset with differentiating strengths in my view. The following comments made by its CEO, John Stankey, sum up the strength quite nicely (the emphases were added by me):

AT&T is leading the way in converged connectivity as customers increasingly seek one provider who can seamlessly connect them in their home, at work and on the go. This is proving to be a winning strategy. Today, nearly four of every 10 AT&T Fiber households also choose AT&T wireless service. As the nation’s largest consumer fiber builder, we see this as an opportunity to continue to grow subscribers and revenues, while deepening customer relationships.

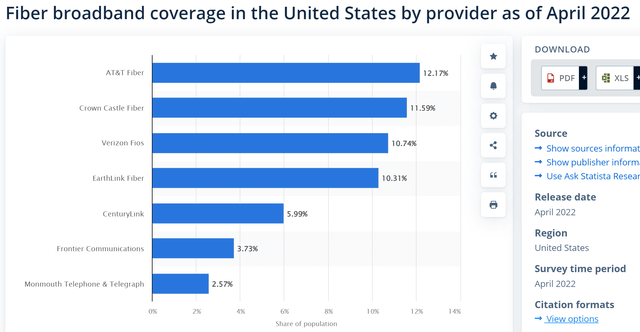

Indeed, with a leading market share (see the next chart below) in the segment, T is best positioned to leverage its scale and cross-sell opportunities with its other product lineup. To better contextualize T’s competitive advantage here, about 12%-13% of Comcast and Charter’s broadband customers take their wireless offerings in contrast.

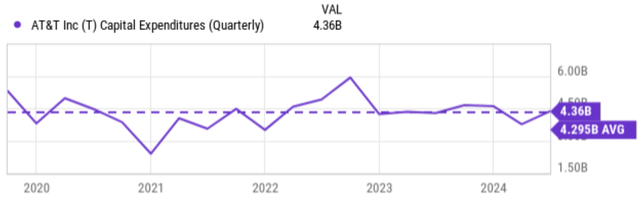

Second, as I mentioned earlier, I think the capital requirement for building up the network has already passed the peak (see the next chart below). As such, going forward, I see potential for accelerated profit growth and margin expansion.

Finally, I see plenty of synergies and growth opportunities that T can capitalize on going forward. The top possibility on my list is the resonance among its large-scale fiber network, 5G network, and Internet Air offerings. The synergies here could magnify its competitive advantage with a bundled/converged offering with the potential for customer lock-in. Another promising opportunity is the fiber joint venture with Gigapower.

Other risks and final thoughts

There are a few negatives to consider from the Q2 report. The chart below shows T’s business wireline revenue and consumer wireline revenue. As seen, the trend of declining wireline revenue continues. In particular, its business wireline revenue (the blue bars) kept declining, with a more pronounced drop starting in Q3 2023. Consumer wireline revenue seems to have stabilized in recent quarters, with a revenue of $3.35 billion. Given the secular shift in consumer and business preferences towards other communication technologies, the ultimate duration and extent of such decline is unclear to me.

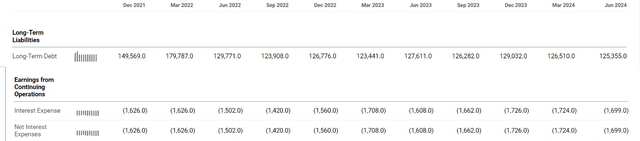

A second concern is T’s debt burden. The chart below shows T’s long-term debt and interest expenses in recent quarters. T has made substantial progress towards debt reduction in recent years and management reiterated its goal to keep deleveraging. As seen, its long-term debt peaked at $179 billion in 2022 and has decreased to the current $125 billion. However, interest expenses have remained elevated due to the impact of higher borrowing rates in this period. To wit, interest expenses were around $1,626 million in 2022 and currently hover around $1,699 million. Looking ahead, T aims to reach net debt-to-adjusted EBITDA in the 2.5x range in the first half of 2025. In the overall scheme of things, T’s current debt burden is relatively high in my view and could limit its options in the case of a downturn.

All told, I see far more positives than negatives from its Q2 report. I see plenty of profit catalysts to drive its EPS growth in the years to come. To reiterate, the top ones on my list are the stabilization of CAPEX (and the subsequent growth potential of FCF), the growth of its fiber network, and the many synergistic opportunities between fiber and its other segments.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.