Summary:

- Despite growth weakness, AT&T stock has trended higher despite the recent market pullback, with focus on margins and FCF outlook.

- The company’s margins continued to expand in 2Q, and the ongoing process of copper retirement is expected to help rationalize a cost base totaling $6 billion.

- FCF has seen significant growth driven by lower vendor financing payments, and the company’s FY2024 FCF guidance of $17 to $18 billion is likely conservative.

- Its postpaid phone net adds has experienced a 29% YoY growth in 2Q, largely due to lower churn, indicating an improvement in customer base.

- The stock is currently trading at 3.6x P/CF TTM, which is below its 10-year average and 55% lower than the sector average, with other valuation multiples also being lower than those of VZ and TMUS.

Laser1987/iStock Editorial via Getty Images

Investment Thesis

Despite the recent broad-based market pullback, AT&T Inc. (NYSE:T) has seen its stock trend higher over the past 12 months, with a positive price reaction following its mixed post-2Q earnings. Although its growth outlook remains muted, and it missed the 2Q revenue consensus, investors are more focused on the company’s margins and FCF trajectory. AT&T has significantly improved its FCF profile in recent quarters due to a significant drop in vendor financing payments. With a 5.8% dividend yield, I believe that investors appear comfortable with a modest return on capital appreciation from holding the stock.

In my previous article, I issued a buy rating in July 2023, due to a deep value opportunity with an attractive dividend yield. Since then, T has achieved a 40% total return including 31% of capital appreciation and 9% of dividend, significantly outperforming the S&P 500 index, which returned 18.6% over the past 12 months. With potential Fed rate cuts making short-term bonds less appealing, I maintain my buy rating on the stock due to its cheap valuation and attractive dividend yield. The recent shift from “large-cap growth” to “small-cap value” will also benefit the stock.

Growing More Customers Due to Lower Churn

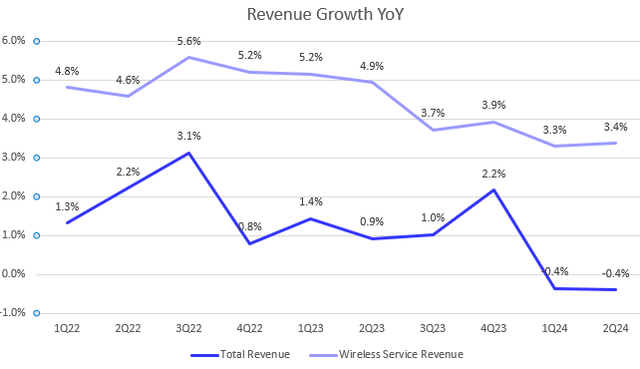

Let’s look at T’s 2Q earnings. The company’s total revenue declined by 0.4% YoY, missing the market consensus, driven by continued declines in the Business Wireline and Wireless Equipment segments. As shown in the chart, AT&T’s top-line growth is largely supported by its Wireless Service segment, which has maintained a 3% YoY growth range. The company expects this segment to continue growing at a 3% YoY range for FY2024.

However, it’s encouraging to see a 29% YoY growth on postpaid phone net adds, reaching 419,000, up from 349,000 in 1Q FY2024. This growth was driven by a decline in churn. During the 2Q earnings call, the management mentioned the success of their fiber business is driving growth in mobility. Therefore, the company’s core underlying business is not deteriorating, as we saw a strong customer growth in the last quarter.

Margin Expansion Is Still on the Way

The company model

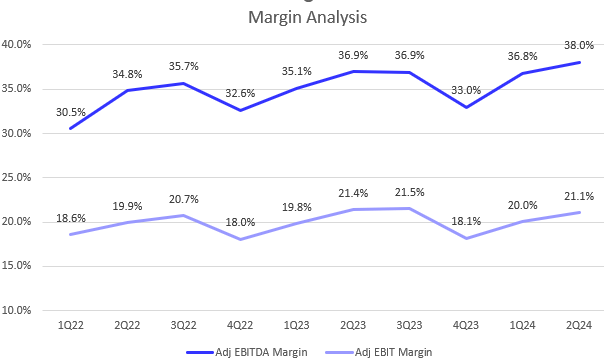

I believe the post-earnings rally in the stock was largely driven by significant margin expansion. As shown in the chart, the company achieved a record high adjusted EBITDA margin of 38%. Additionally, its adjusted EBIT margin improved by 110 bps QoQ to 21.1%. They have reiterated their guidance for a 3% YoY growth range in adjusted EBITDA for FY2024.

The company model

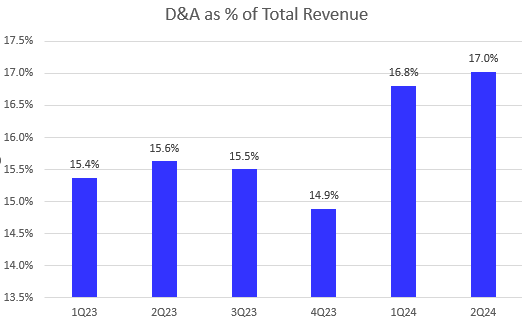

Despite a low single digit top-line growth trajectory, AT&T has significantly improved its margins in the previous quarters, supported by its wireless service segment. The company has expanded its adjusted EBITDA margin from 30.4% in FY2021 to 35.4% in FY2023 and continued trending higher in 2Q FY2024, largely due to increased depreciation and amortization costs. In addition, its adjusted EBIT margin is still resilient, maintaining the 20% level amid slowdowns in its top-line growth. Moreover, the company’s margin outlook can continue to improve due to a continued process of copper retirement. During the previous investor day event, the management indicated that the move would allow the operator to rationalize a cost base totaling $6 billion.

Focusing on FCF Amid Sluggish Growth Outlook

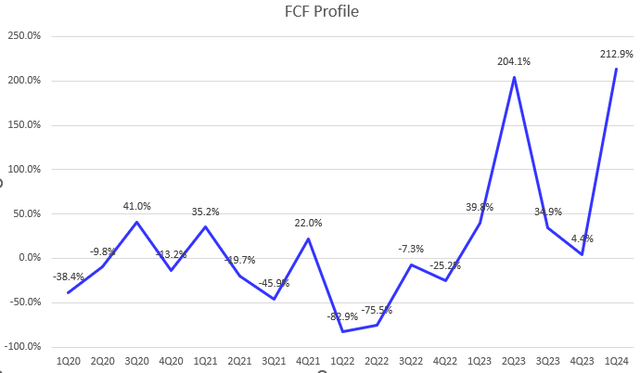

As a deep-value stock with a muted growth outlook, investors should pay more attention to its quality metrics, such as FCF. The company has achieved a 39.2% YoY growth in FCF in FY2023 after three years of decline from FY2020 to FY2022. Meanwhile, its FCF margin improved from 9.3% in FY2022 to 13.7% in FY2023.

In 2Q FY2024, despite a high YoY comparison in 2Q FY2023 (growing 204% YoY), the company still achieved a 9% YoY growth in FCF, driven by a significant decrease in vendor financing payments that offset higher capital expenditures and a decline in OCF. Excluding dividend payments, its FCF after dividends grew by 16.5% YoY.

The management also reiterated FY2024 FCF guidance in the $17 to $18 billion range. Although this indicates a potential decline in FCF in 2H FY2024, I believe that the guidance might be conservative and will likely exceed $18 billion.

Valuation

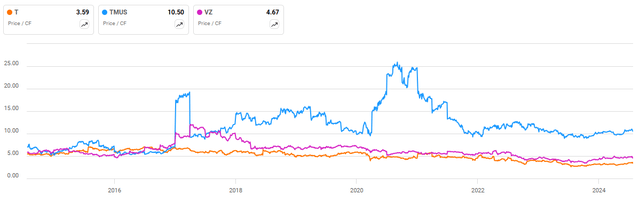

According to Seeking Alpha, T’s valuation still looks very attractive, especially its P/CF ratio. We know that the company is boosting its FCF over the past quarters, which made this multiple cheaper. The stock is currently trading at 3.6x of P/CF TTM, which is below its 10-year average and 55% below its sector average. Particularly, the multiple is 23% below Verizon’s (VZ) 4.67x and 66% below T-Mobile’s (TMUS) 10.5x.

As AT&T has significantly improved its margins, the stock is trading at 6.7x EV/EBITDA fwd, which is not only 8.7% below its 5-year average but also 4% below VZ’s 6.95x and 33% below TMUS’s 10x.

Lastly, despite an expected YoY decline in its non-GAAP EPS for FY2024, with the company reiterating its guidance range of $2.15 to $2.25, its non-GAAP P/E fwd sits at 8.7x, which is in line with VZ. Therefore, I believe that the stock is still a buy due to its margin’s expansion outlook and improved FCF generation.

Downside Risk

However, I believe there are two primary downside risks that investors should focus on. First, as a value stock, T may start to underperform if the Fed’s rate cuts are delayed due to a rebound in CPI data, causing the market to rotate back to large-cap growth stocks, as seen in 1H FY2024 when the stock was almost flat. A delay in rate cuts would also keep short-term treasuries at 5.4%, nearly risk-free and similar to AT&T’s dividend yield.

Second, while investors may currently pay less attention to the company’s growth outlook, the stock might trigger a selloff if its margins and FCF start to deteriorate, impacting its valuation. Another risk is a potential dividend cut, which I don’t think is likely as the company still maintains plenty of FCF.

Conclusion

In summary, AT&T is still flashing a buying signal amid recent market volatility. The stock has shown a steady upward momentum over the past year, driven by consistent margin expansion and improved FCF, which has been driven by higher D&A costs and lower vendor financing payments. With an attractive 5.8% dividend yield and record high adjusted EBITDA margin in 2Q, T offers an attractive total return, particularly as I believe the short-term treasury will drop below 5% this year. Despite a mixed 2Q quarter, investors should focus on the company’s cash flow. Most importantly, the stock’s valuation is still cheaper compared to VZ and TMUS, with many multiples trading below historical averages and sector peers. Therefore, I believe the company’s improved margin’s outlook, solid FCF generation, and attractive valuation convince me to reiterate a buy rating for the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.