Summary:

- I previously rated AT&T a strong buy due to their disciplined strategy, industry tailwinds, and a DCF price target of $26, indicating 46% upside.

- AT&T’s strategic focus on core businesses, including the DirectTV sale, positions them well for the bundling trend, but recent price gains lower potential returns.

- I reaffirm my DCF price target of $26 but downgrade AT&T to a buy due to reduced margin of safety and potential return.

- Key earnings metrics to watch include capital allocation from the DirectTV sale, ARPU, and subscriber volume, which could impact my investment thesis.

jetcityimage

I am updating my ongoing analysis on AT&T, Inc. (NYSE:T) in advance of Q3 2024 earnings.

I previously rated AT&T a strong buy for the following reasons:

- AT&T was executing a strong and disciplined strategy of optimizing and growing core businesses instead of M&A like their competitors

- Telecom industry tailwinds were improving, leaving potential for additional growth

- DCF analysis suggested a price target of $26, 46% upside from pricing at the time

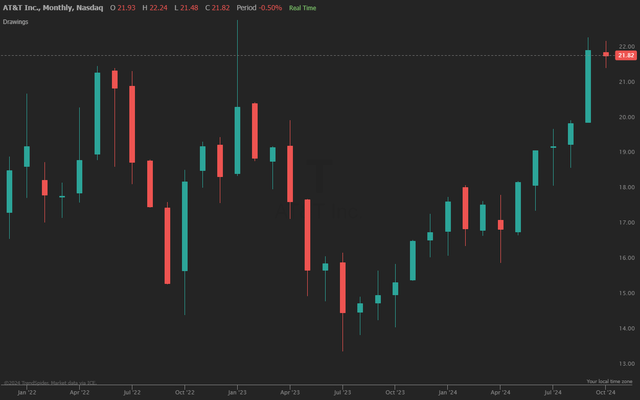

Since then, AT&T has returned 23%, while the S&P 500 has returned 6%.

T Price Trend (TrendSpider)

I believe that AT&T continues to make strong strategic decisions to focus on their core business, including the recently announced sale of DirectTV that will greatly benefit shareholders. In addition, the relentless focus on the core business has set up AT&T to benefit from the ongoing bundling trend at an even greater degree than their competitors.

Based on DCF analysis, I reaffirm my price target of $26 while lowering my rating from strong buy to buy as the recent upswing in pricing has reduced the potential return and margin of safety.

AT&T Q3 Earnings Preview

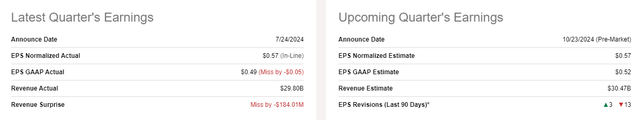

AT&T will announce earnings pre-market on October 23rd. They are expected to announced EPS of $0.57 and Revenue of $30.47 billion with EPS in line sequentially and Revenue up slightly.

T Earnings Summary (Seeking Alpha)

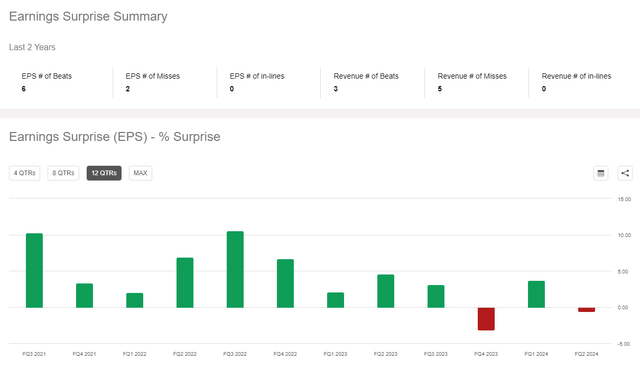

AT&T has mixed revenue results but largely leans conservative with EPS and delivers above expectations in most cases.

T Earnings Surprise (Seeking Alpha)

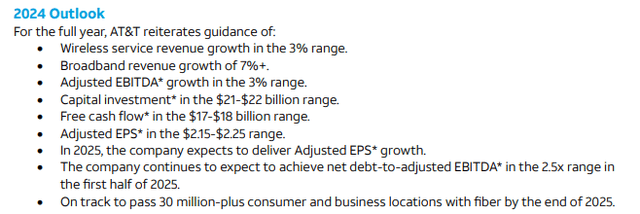

Revenue and EPS consensus keep AT&T right on track for the 2024 guidance that they most recently reaffirmed during Q2 earnings.

2024 Guidance (T Investor Relations)

As earnings are released I will be closely watching for details of how AT&T will allocated capital from the DirectTV sale as well as rate (ARPU) and volume (subs) in the core businesses to look for additional strength or unexpected weakness that could impact my thesis.

T Stock Valuation

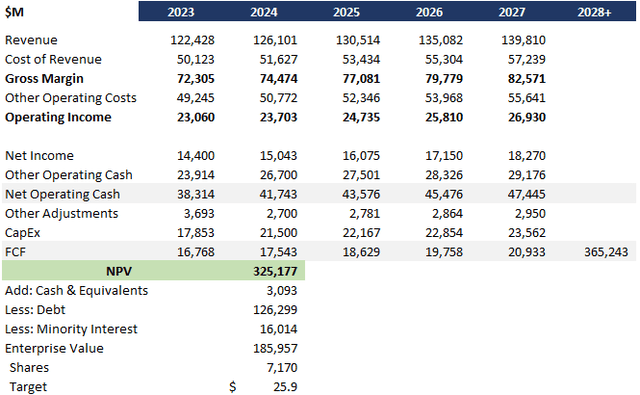

I updated my ongoing DCF analysis for AT&T using the following drivers:

- Management delivers the mid-point for the Q2 reaffirmed 2024 guidance

- 7% discount rate assuming an estimated WACC of 6.9%

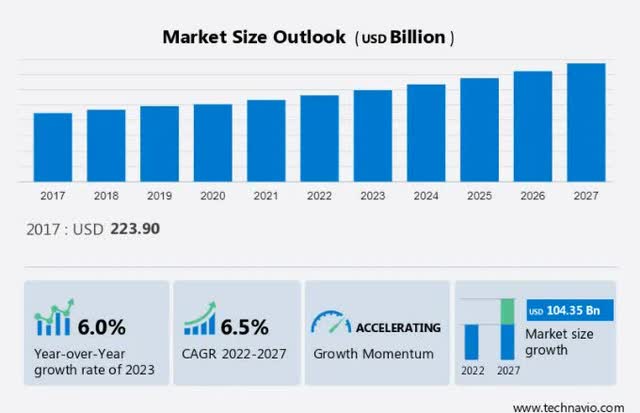

- 1% long-run growth rate as a conservative estimate to hedge 6.6% market growth against AT&T’s scale and cost base

- 3% revenue growth through 2027, pacing behind the overall telecom market at 6.5% due to AT&T’s scale. 3% revenue growth is assumed to be achieved primarily with fiber, bundling, and pricing offsetting declining copper services

- 3% growth in expenses based on US inflation forecast at 2.40% for 2025 balanced against union considerations

This DCF analysis yields a price target of $25.90, 19% upside from today’s pricing.

T DCF Analysis (Data: SA; Analysis: Mike Dion)

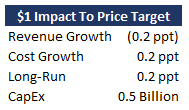

Looking at the sensitivity of my assumptions, I believe there is a wide margin of safety with four dollars of room and all assumptions leaning conservative.

DCF Sensitivity (Mike Dion)

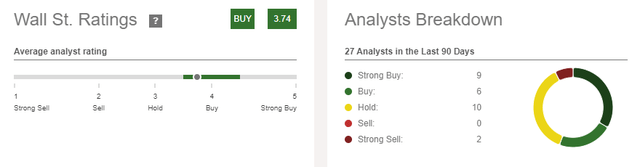

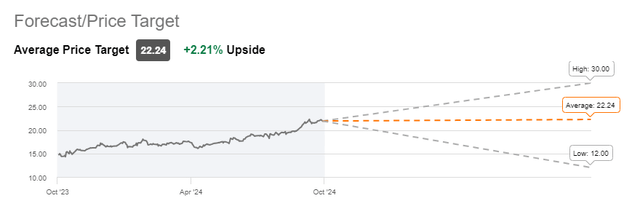

Wall Street analysts are heavily split across strong buy, buy, and hold. The combined price target is essentially in line with today’s pricing. My target sits comfortably on the low end of average-high relative to other analysts.

Wall Street Rating (Seeking Alpha)

Wall Street Rating (Seeking Alpha)

DirectTV Deal Is A Win For Shareholders

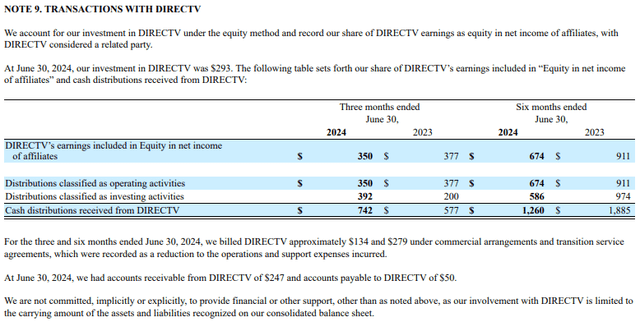

On September 30th, AT&T announced that they would sell their 70% share in DirectTV to TPG for $7.6 billion in cash payments in addition to still receiving a 2025 distribution of $1.6 billion from DirectTV.

I feel this is a huge win for AT&T shareholders.

DirectTV’s contribution to the P&L (recorded under equity in net income of affiliates) is rapidly declining as the satellite industry falters. This is in addition to a large debt balance and weak bond rating.

In fact, if valued as a declining perpetuity at AT&Ts cost of capital, AT&Ts share of the business is worth only $6 to $7 billion and AT&T is actually coming out ahead

DirectTV Financials (T Investor Relations)

In my eyes, the deal has been a continuous disappointment and has not enabled rate capture or bundling on AT&Ts part.

Aside from the balance sheet benefit of accelerating cash flow and deleveraging, this continues to play into AT&T’s strategy of dropping distractions and focusing on the core business. This focus, especially with aggressive fiber growth plans, is the key to shareholder value.

Ready To Accelerate Bundling

A couple of interesting things are happening in the industry that provide upside for AT&T. First, the growth in what has always been considered a mature industry is accelerating as telcos offer more premium services like 5G and Fiber.

US Telecom CAGR (Technavio)

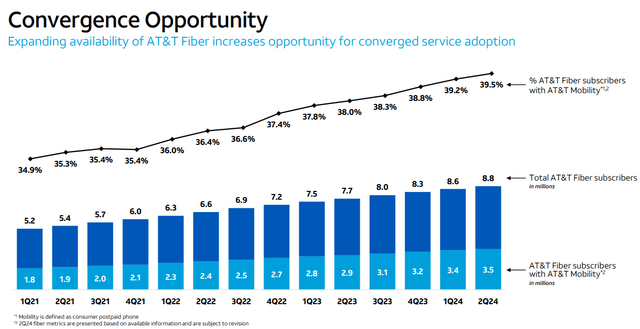

The other trend that benefits AT&T is bundling. Both Mobile and Fixed as well as Fixed and OTT. As telecos look to slow churn and stop trading market share every few quarters, bundling has become a key part of the strategy.

AT&T has been steadily increasing the number of fiber subscribers as well as the number of fiber subscribers with wireless services. Still, 60.5% of fiber subscribers don’t have AT&T wireless and AT&T still has thousands of miles of fiber to deploy.

Neither T-Mobile not Verizon can match AT&Ts overlap of fiber and wireless which provides a competitive moat and future growth opportunities.

AT&T Bundling Opportunity (T Investor Relations)

This strategy is playing out as AT&T announced major rate increases across the network, which can of course be offset by bundling.

Downside Risk

AT&T faces two primary risks (outside of a price war which is ever present in telcos).

The first risk is that AT&T can’t generate a sufficient return on its fiber investment. With $20 billion in annual capital spend, this could quickly weigh down results and profitability. I feel this is well mitigated by convergence and bundling but still something to keep a close eye on.

The second risk is related in that competitors encroach on, and compete with, AT&Ts fiber service using 5G Home Internet. From my previous research, I do not believe 5G fixed access is competitive with fiber so this is somewhat mitigated. However, it is still something to keep an eye on.

Verdict

AT&T continues to play out a strategy that I have called focused, disciplined value creation. While competitors chase M&A deals, AT&T is shedding distractions and focusing on driving as much value out of their core wireless and wireline businesses as possible. This strategy is very clear in the recent DirectTV announcement as well as continued success in driving consumers to bundle.

I rate AT&T a buy at a price target of $25.90, 19% upside from today’s pricing.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.